Are you ready to peer into the crystal ball and catch a glimpse of what lies ahead for student loan debt? Brace yourself, because the future is looking both daunting and promising.

As you embark on this journey through the labyrinth of educational finance, prepare to uncover trends that will shape your financial destiny.

From skyrocketing tuition costs to innovative repayment plans, from the influence of technology to potential legislative changes – it’s time to equip yourself with the knowledge needed to master your student loan story.

Key Takeaways

- The rising cost of higher education and the student loan crisis are major issues that need to be addressed.

- Federal student loan policies have the potential to provide relief and hope for borrowers.

- Technology is revolutionizing the management and repayment of student loans, making the process more efficient and accessible.

- Income-driven repayment plans and private student loans are important considerations for managing student loan debt and securing better interest rates.

The Rising Cost of Higher Education

You’ll be surprised at how much the cost of higher education has been rising in recent years. It’s like watching a rocket launch into space, except instead of reaching for the stars, tuition fees are skyrocketing to unimaginable heights.

It’s as if colleges and universities have decided to charge you an arm and a leg just for the privilege of sitting in their classrooms. And let’s not even get started on the student loan crisis that has engulfed our nation. With tuition costs soaring, students are forced to take out loans that will haunt them well into adulthood. It’s like signing up for a lifetime subscription to debt and stress!

But fear not, my friend, because knowledge is power and together we can find ways to navigate this treacherous terrain and come out victorious.

The Impact of Federal Student Loan Policies

Be aware that federal policies regarding student loans have a significant impact on how you manage your debt. It’s like being caught in a never-ending maze of paperwork and confusion, with the occasional glimmer of hope shining through. Here are three key things to keep in mind:

-

Federal loan forgiveness: Picture this: you’ve been diligently making payments for years, and suddenly, poof! Your remaining balance disappears into thin air, as if it never existed. That’s the magic of federal loan forgiveness, a beacon of light for borrowers drowning in debt.

-

Student loan interest rates: Ah, interest rates – the bane of every borrower’s existence. But fear not! Due to federal policies, these rates can be tamed and kept at bay. With some luck and strategic planning, you’ll avoid getting trapped in an endless cycle of accumulating interest.

-

The ever-changing landscape: Federal student loan policies are like chameleons; they constantly change their colors and shapes. Stay vigilant and up-to-date on any new regulations or programs that could affect your repayment journey.

Student Loan Forgiveness Programs

Don’t miss out on the potential benefits of student loan forgiveness programs, as they could offer a glimmer of hope in your journey towards financial freedom. Imagine a world where your student loan debt magically disappears, leaving you with extra cash to spend on things like avocado toast or artisanal coffee. Well, my friend, that world might not be too far away. Student loan forgiveness programs are designed to alleviate the burden of crushing debt and give you a fresh start. But before you start daydreaming about all the money you’ll save, let’s talk about eligibility and the application process.

| Eligibility | Application Process |

|---|---|

| – Meet certain employment criteria | – Gather all necessary documents |

| – Make consistent payments | – Complete the application form |

| – Work in specific fields | – Submit your application |

Now that you know what it takes to qualify for student loan forgiveness, it’s time to take action. So grab your pen (or keyboard) and get started on that application! And remember, while student loan forgiveness programs can offer relief, technology is also playing a significant role in shaping the future of student loan debt. Let’s explore how advancements in technology are changing the way we approach this issue…

The Influence of Technology on Student Loan Debt

Imagine how technology is revolutionizing the management and repayment of student loans, providing innovative solutions to simplify the process and ease financial burdens. It’s a brave new world out there, my friend, where artificial intelligence (AI) swoops in like a superhero to save the day.

Here are some ways technology is shaking up the student loan game:

-

AI-powered chatbots: These virtual assistants answer all your burning questions faster than you can say ‘student debt.’ They’re available 24/7, never get tired or annoyed, and provide accurate information with a dash of charm.

-

Predictive analytics: Thanks to fancy algorithms, AI can analyze your spending habits, income potential, and even career prospects. Armed with this data, it can suggest personalized repayment plans that suit your financial situation like a tailored suit.

-

Blockchain magic: Imagine an unbreakable chain where every transaction is recorded securely. That’s blockchain for you! It ensures transparency and eliminates fraud by creating an immutable digital trail of your loan history.

The Role of Income-driven Repayment Plans

Get ready to breathe a sigh of relief because income-driven repayment plans can help you manage your student loan payments based on your income and family size. These plans are like little superheroes swooping in to save the day, allowing you to focus on building a future rather than drowning in debt.

With income-driven repayment plans, the role they play is crucial in providing flexibility and affordability. They take into account your financial situation and adjust your monthly payments accordingly, ensuring that you don’t have to choose between paying off loans or buying groceries.

But hold on tight, my friend! While these plans are currently a lifesaver for many, there’s always the potential for legislative changes. With new laws constantly being debated and passed, it’s important to stay informed about any updates that could impact these repayment options.

Speaking of burdensome loans, let’s dive into the subsequent section about the burden of private student loans…

The Burden of Private Student Loans

Hold tight, my friend, as we delve into the burden of private student loans and how they can impact your financial well-being.

Private student loan interest rates are like a roller coaster ride with unexpected twists and turns. One moment you’re flying high with a low rate, and the next moment you’re plummeting down into debt oblivion.

And let’s not forget about the dreaded student loan default rates. It’s like being trapped in quicksand, sinking deeper and deeper into a pit of financial despair.

But fear not! There are ways to navigate this treacherous terrain. You can refinance your loans to get a better interest rate or explore loan forgiveness options if you find yourself struggling to make payments.

The Effects of Student Loan Debt on Mental Health

Navigating the effects of student loan debt on your mental health can be a challenging journey, but remember that you are not alone.

It’s like being stuck in a never-ending game of Monopoly, where instead of passing go and collecting $200, you’re drowning in debt and accumulating stress.

The mental health implications of student loan debt are no laughing matter, but let’s face it – sometimes laughter is the best coping strategy.

So why not imagine your loans as pesky little monsters that you have to defeat? Picture yourself armed with a sword made out of determination and shielded by a suit of resilience.

As you slay each monster, visualize your stress melting away. Remember to take breaks from the battle and practice self-care.

Ultimately, with creativity and humor as your allies, you will conquer these challenges and emerge victorious!

The Connection Between Student Loan Debt and Homeownership

Imagine the sense of accomplishment and stability you’ll feel when you finally own a home, free from the burden of student loan debt. It’s a dream many millennials strive for, but is it really achievable? Well, let me tell you, dear reader, that there is indeed a connection between student loan debt and homeownership.

Don’t believe me? Let’s break it down:

- Affordability:

- Student loans can eat up a significant portion of your income, making it harder to save for a down payment.

- Higher debt-to-income ratio means higher interest rates on mortgages.

-

Homeownership becomes more challenging when you’re already drowning in monthly payments.

-

Credit score:

- Missed or late student loan payments can negatively impact your credit score.

-

A lower credit score makes it harder to qualify for a mortgage.

-

Future financial goals:

- Focusing on paying off student loans delays saving for retirement or other investments.

The Rise of Income Share Agreements (ISAs

If you’re considering alternative options to traditional student loans, you may want to explore the rise of Income Share Agreements (ISAs).

These funky little agreements are shaking up the world of education financing like a disco ball at a dance party.

With ISAs, instead of taking out a loan and drowning in debt for years to come, you make an agreement with a funding provider who will cover your tuition costs upfront.

In return, you agree to pay them a percentage of your future income once you start earning above a certain threshold. It’s like having your own personal investor cheering you on as you conquer the career world!

And the best part? If things don’t go as planned and your income doesn’t take off like a rocket ship, well guess what? You won’t be stuck with an astronomical loan balance hanging over your head.

ISAs give you flexibility and freedom to pursue your dreams without worrying about crippling debt.

The Future of Student Loan Refinancing

Refinancing student loans can provide you with an opportunity to lower your monthly payments and potentially save money over time. It’s like finding a hidden treasure chest full of gold coins under your bed, except the gold coins are actually savings on your loan repayments.

Here are three reasons why you should consider refinancing:

-

Lower interest rates: By refinancing, you may be able to secure a lower interest rate than what you currently have. It’s like getting a discount on that fancy pair of shoes you’ve been eyeing for months.

-

Consolidation: Refinancing also allows you to consolidate multiple student loans into one, making it much easier to manage and keep track of your debt. It’s like organizing your messy closet into neat little stacks.

-

Flexible repayment options: With refinancing, you can choose a repayment plan that suits your financial situation. It’s like having ice cream flavors tailored just for you – vanilla if you prefer stability or rocky road if you want some flexibility.

The Need for Financial Literacy Education

Hey there, financial whiz! Let’s dive into the importance of early education and the long-term financial consequences that come with it.

Picture this: a group of tiny tots learning about saving money while wearing superhero capes, because let’s face it, being financially responsible is pretty heroic.

Now imagine those same kids growing up to be money-savvy adults who avoid drowning in debt and instead ride off into the sunset on their fiscally responsible unicorns. Sounds like a fantasy?

Well, buckle up because we’re about to make it a reality!

Importance of Early Education

Early education is crucial for setting students up for success in managing their student loan debt in the future. It’s never too early to start teaching kids about responsible financial practices, even before they can count their pennies. Here are three reasons why early childhood development and preschool programs play a vital role in shaping future borrowers:

-

Building a strong foundation: Just like learning to tie shoelaces or reciting the alphabet, understanding money management should be a fundamental skill taught from an early age.

-

Developing good habits: Preschool programs provide opportunities for children to learn the value of saving, budgeting, and making wise financial decisions. They can practice with pretend money or set up mini-businesses, fostering a sense of responsibility and resourcefulness.

-

Nurturing financial literacy: By introducing basic concepts like earning, spending, and saving at an early stage, children develop a solid understanding of finances that will benefit them throughout their lives.

Long-Term Financial Consequences

Don’t underestimate the impact of long-term financial decisions on your overall financial well-being. Your future self will thank you for taking the time to plan ahead and make smart choices when it comes to your finances.

Long-term financial planning is like planting a money tree – it takes time, patience, and careful nurturing. But once it starts to grow, oh boy, does it bear fruit!

Not only will you have a solid foundation for your future, but you’ll also see the positive effects on your credit score. A good credit score opens doors and unlocks opportunities that can lead to lower interest rates on loans, better insurance premiums, and even better job prospects.

The Role of Employers in Managing Student Loan Debt

If you’re struggling with student loan debt, employers can play a crucial role in helping you manage it. They understand that your financial burdens can take a toll on your overall well-being, so they have started offering some pretty sweet incentives to ease the pain. Check out these amazing perks:

-

Loan Repayment Assistance: Some companies are now offering to contribute towards your student loan payments. It’s like having a secret benefactor who swoops in and saves the day (and your bank account)!

-

Flexible Work Arrangements: Need some extra cash to tackle those monthly payments? Employers are getting creative with flexible work schedules and remote options, allowing you to take on side gigs and earn some extra dough.

-

Financial Education Programs: You may think you’re a master at managing money, but there’s always room for improvement. Many employers now offer workshops and resources to help you become a financial guru.

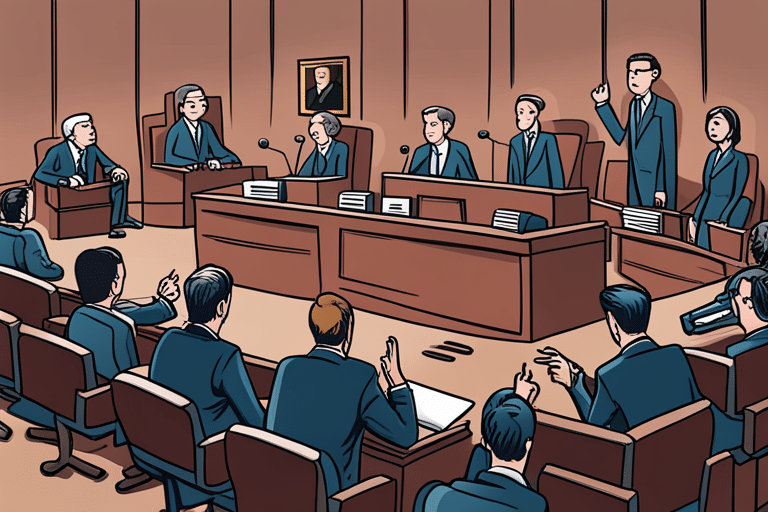

The Potential for Legislative Changes in Student Loan Policies

Legislative changes in student loan policies could have a significant impact on your financial well-being, dear borrower. Picture this: you’re sitting at your kitchen table, drowning in a sea of paperwork, trying to make sense of the complex web that is student loan debt. But fear not! The government is here to save the day with some much-needed legislative reform and government intervention.

To give you a glimpse of what could be on the horizon, let me present to you an emotional rollercoaster in the form of a table:

| Legislative Reform | Government Intervention | Impact |

|---|---|---|

| Loan Forgiveness | Lower Interest Rates | Relief |

| Increased Repayment Options | Enhanced Loan Counseling | Empowerment |

| Income-driven Plans | Streamlined Application Process | Hope |

Can you feel it? The excitement, the anticipation? It’s like riding a unicorn through a field of cotton candy while eating ice cream that never melts. So hold on tight, dear borrower, because change may be just around the corner.

Frequently Asked Questions

What Are Some Potential Solutions for Reducing the Burden of Private Student Loans?

Are you drowning in private student loan debt? Don’t fret! There are potential solutions to lighten the load. Debt forgiveness programs and refinancing options could be your saving grace. Hang in there!

How Does Student Loan Debt Impact Mental Health and What Resources Are Available for Students Struggling With This Issue?

Feeling the weight of student loan debt? It’s not just your wallet that suffers. Mental health takes a hit too. Luckily, resources like counseling services and support groups can help you find relief. Keep calm and conquer!

Are Income-Driven Repayment Plans Effective in Reducing Student Loan Debt and How Do They Work?

Income-driven repayment plans can be a lifesaver when it comes to reducing student loan debt. They work by adjusting your payments based on your income, so you don’t have to live off ramen noodles forever.

What Are Income Share Agreements (Isas) and How Do They Differ From Traditional Student Loans?

Income share agreements (ISAs) are an alternative to traditional student loans. Instead of borrowing money, you agree to pay a percentage of your income for a set period. It’s like having a financial fairy godmother!

How Can Employers Play a Role in Helping Employees Manage Their Student Loan Debt?

Employers can be your knight in shining armor when it comes to managing student loan debt. With enticing incentives and loan forgiveness programs, they’re like the fairy godmothers of financial freedom.

Conclusion

Congratulations, my friend! You’ve reached the end of this enlightening journey into the future of student loan debt.

As you bid adieu to these words, remember that your dreams aren’t bound by the chains of debt. Like a phoenix rising from the ashes, you have the power to soar above financial burdens and conquer the world.

So spread those wings, embrace your potential, and let nothing stand in your way.

Fly high and write your own destiny!