Are you drowning in a sea of credit card debt? Fear not, for the Debt Snowball Method is here to save the day!

Picture this: you, triumphant and debt-free, basking in the glow of financial freedom. With a little bit of organization and a dash of determination, you can conquer your credit card debt one snowball at a time.

In this article, we will guide you through the process step by step, helping you master the art of using the Debt Snowball Method to pay off your debts.

Get ready to unleash your inner debt-slaying warrior!

Key Takeaways

- The debt snowball method involves focusing on small debts first and paying them off one by one.

- Assessing your credit card debt is crucial for creating an effective payment plan.

- Debt consolidation and debt settlement are options to consider for repaying your debt.

- Assessing your debt burden helps you understand the overall scope of your debt and take control of your financial journey.

Understanding the Debt Snowball Method

The debt snowball method is like building a snowman, but instead of rolling up snow, you’re rolling up small credit card balances. It’s a clever strategy that helps you tackle your debt in a manageable and satisfying way. Start by focusing on those little debts first, paying them off one by one. As you knock out each balance, the momentum builds, just like when you roll that tiny snowball into a massive winter wonderland sculpture.

Now, some may question the effectiveness of the debt snowball method. They say it’s not as efficient as other methods that prioritize interest rates. But here’s the thing – personal finance isn’t always about numbers and spreadsheets; it’s about behavior and motivation too. And let me tell you, seeing those small balances disappear feels amazing! It gives you the confidence to keep going until all your credit card debts are gone.

Of course, there are alternatives to the debt snowball method. You could try prioritizing higher interest rate debts first or even consolidating your debt with a personal loan. But remember, finding what works for you is key. So assess your credit card debt carefully, considering factors like interest rates and psychological motivation before deciding which strategy to embrace.

And now that we’ve covered understanding the debt snowball method, let’s move on to assessing your credit card debt in more detail…

Assessing Your Credit Card Debt

So, you’ve learned about the debt snowball method and how it can help you conquer your credit card debt. Now it’s time to dive into the next step: assessing your credit card debt.

This discussion will cover essential topics like different strategies for repaying your debt, evaluating various repayment options, and utilizing effective techniques for assessing the overall scope of your debt.

Get ready to take control of your financial journey and say goodbye to those pesky credit card balances!

Debt Repayment Strategies

Start by making a list of all your credit card debts and their corresponding interest rates. This step is crucial in assessing your debt burden and creating an effective payment plan.

Picture yourself sitting down at a cozy café with a cup of steaming hot coffee, armed with a notebook and pen. As you jot down each debt, feel the weight lift off your shoulders, knowing that soon enough you’ll be free from this financial burden.

Now that you have your list, it’s time to get creative with your repayment strategy. Imagine yourself as a fearless captain navigating through stormy waters. The debt snowball method comes to the rescue! Start by paying off the smallest balance first while making minimum payments on the rest. As you conquer each small debt, celebrate your victories like fireworks lighting up the night sky.

Remember, mastery requires discipline and determination. Stay focused on your goal as if you were an athlete training for an Olympic event. With every payment made, imagine yourself getting closer to financial freedom – where worries are replaced with peace of mind and opportunities abound.

Ready to take charge? Let’s sail towards a debt-free future!

Evaluating Debt Repayment Options

Now that you have evaluated your options, it’s time to decide which repayment strategy will work best for you.

Debt can be overwhelming, but don’t worry, there are ways to tackle it head-on.

One option to consider is debt consolidation. This involves combining multiple debts into one loan with a lower interest rate, making it easier to manage and potentially saving you money in the long run. However, keep in mind that while it may simplify your payments, it doesn’t actually reduce the amount of debt you owe.

Another alternative is debt settlement. This involves negotiating with your creditors to pay off a portion of what you owe in exchange for forgiving the rest of the debt. It can provide some relief by reducing your overall debt burden, but it may also negatively impact your credit score.

As you weigh these options, consider what matters most to you: simplicity or reducing your debt amount? Both have their pros and cons, so choose wisely based on what aligns with your financial goals and priorities.

With a clearer understanding of different repayment strategies at hand, let’s now explore some techniques for assessing your current debt situation.

Debt Assessment Techniques

To assess your current debt situation, take a close look at your monthly income and expenses to determine how much money you have available to allocate towards paying off your debts. It’s like going on a financial scavenger hunt! Grab a pen and paper, or if you’re feeling fancy, open up a spreadsheet. Now, let’s create a table to organize all those numbers:

| Monthly Income | Monthly Expenses |

|---|---|

| $3000 | $2000 |

Now that we have our table set up, it’s time to do some math magic. Subtract your monthly expenses from your monthly income to see how much extra cash is left over for debt reduction strategies. In this case, you have $1000 bucks ready to tackle those debts!

But wait! Before we dive into the exciting world of debt consolidation options, let’s first organize your debts in the next section. Trust me, it’ll make everything easier.

Organizing Your Debts

Hey there! So, you’ve tackled the daunting task of assessing your credit card debt and now it’s time to get organized. Don’t worry, we’ve got your back!

In this discussion, we’ll explore three key points: prioritizing your debt payments, tracking your payment progress, and setting achievable goals.

Trust us, with a little organization and a dash of determination, you’ll be well on your way to financial freedom in no time!

Prioritize Debt Payments

It’s important to prioritize your debt payments when using the debt snowball method to pay off credit card debt. By focusing on paying off your debts in a specific order, you can gain momentum and motivation as you see your progress grow.

When prioritizing your debt payments, consider the following:

-

Assess interest: Start by identifying which of your debts have the highest interest rates. These are the ones that are costing you the most money over time.

-

Debt consolidation strategies: Explore options like consolidating high-interest debts into a lower-interest loan or transferring balances to a credit card with a 0% introductory APR.

Track Payment Progress

Keep tabs on how much you’ve paid off each month to track your progress towards becoming debt-free. Payment tracking is like playing a game where you get closer to victory with every move.

It’s like keeping score in a race, except instead of running, you’re paying off your debts! Imagine a giant scoreboard hanging on the wall, displaying all the amounts you’ve conquered. Each payment made is a step forward, bringing you closer to financial freedom.

You can see the numbers decreasing and your progress growing. It’s motivating and exciting to witness your debt shrinking before your eyes. Monitoring your progress not only helps you stay focused but also gives you a sense of accomplishment as you watch those balances dwindle away.

Set Achievable Goals

Start by creating realistic and achievable goals that will guide you on your journey towards financial freedom. Setting achievable goals is like giving yourself a map to follow. It keeps you focused and motivated along the way.

Here are two key ways to set achievable goals:

-

Break it down: Divide your larger goal into smaller, manageable tasks. This makes them less overwhelming and easier to tackle.

-

Celebrate milestones: Acknowledge and reward yourself when you achieve each milestone. This will keep you motivated throughout the process.

Remember, staying motivated is crucial when paying off credit card debt using the debt snowball method. By setting achievable goals and celebrating your progress, you’ll stay inspired to keep pushing forward towards financial freedom!

Creating a Budget and Setting Financial Goals

To create a budget and set financial goals, you should first analyze your monthly income and expenses. Think of it as playing detective with your money! Grab a magnifying glass (or just open up that spreadsheet) and start examining where your hard-earned cash is going. Are you spending too much on takeout or those cute little trinkets that catch your eye?

Once you have a clear picture of your spending habits, it’s time to create a budget that works for you. Set realistic financial goals that excite you, like saving up for that dream vacation or finally paying off your student loans. Remember, this is about taking control of your finances and making them work in YOUR favor. So go ahead, get creative with your budgeting strategies and watch those financial goals become reality!

Now that you’ve got an awesome budget in place, let’s talk about prioritizing your debts…

Prioritizing Your Debts

Now that you’ve got your budget in place and your financial goals set, it’s time to tackle those pesky debts. But where do you start? Well, my friend, let me introduce you to two popular methods: the debt snowball and the debt avalanche.

With the debt snowball method, you’ll prioritize your debts based on their balance. You start by paying off the smallest balance first while making minimum payments on the others. Once that smallest debt is paid off, you take that payment and add it to the next smallest balance. It’s like a little snowball rolling down a hill, gaining momentum as it goes!

On the other hand, with the debt avalanche method, you prioritize your debts based on their interest rates. You tackle the highest interest rate first while making minimum payments on the rest. Once that high-interest debt is gone, you move onto the next one.

Now, let’s dive into some options for consolidating your debts! Here are two popular choices:

-

Debt consolidation loan: This involves taking out a new loan to pay off all your existing debts. By doing so, you’ll have just one monthly payment at (hopefully) a lower interest rate.

-

Pros:

- Simplifies multiple payments into one

-

May get a lower interest rate

-

Cons:

-

Requires discipline not to rack up more debt

-

Balance transfer credit card: This allows you to transfer all or part of your existing credit card balances onto a new card with low or 0% introductory APR for a certain period.

-

Pros:

- Can save money on interest charges

-

Gives time to pay down debt without accruing additional interest

-

Cons:

- Introductory rates may expire quickly

- Fees may apply

Starting With the Smallest Debt

By prioritizing your smallest debt, you can gain momentum and build confidence as you work towards becoming debt-free. Think of it as a little snowball rolling down a hill, picking up speed and growing larger with each turn. The same goes for your debts! Start by tackling the smallest one first, paying as much as you can afford each month. As you watch that balance shrink, it will give you an incredible feeling of accomplishment and motivate you to keep going.

The psychological benefits of this approach are enormous. It’s like a shot of adrenaline for your financial journey. You’ll feel empowered and in control, knowing that you’re making progress towards your goal. And when that first debt is completely paid off, celebrate! Treat yourself to something small but meaningful as a reward for your hard work.

Now that you’ve got the hang of it, let’s talk about making minimum payments on other debts…

Making Minimum Payments on Other Debts

Paying only the minimum amount on your other debts may seem like a temporary solution, but it can actually prolong your journey to becoming debt-free. Sure, it’s nice to have a little extra cash in your pocket each month, but by making just the minimum payments, you’re essentially treading water in a sea of debt. Instead, consider making extra payments whenever possible.

It may require some sacrifice and budgeting, but the sooner you pay off those other debts, the closer you’ll be to financial freedom.

To help illustrate this point further, here are two sub-lists that emphasize why making extra payments is crucial:

- Paying more than the minimum:

- Saves you money in interest charges

-

Shortens the overall time it takes to become debt-free

-

Debt consolidation:

- Can simplify your repayment plan by combining multiple debts into one monthly payment

- May offer lower interest rates or fees compared to individual loans

Building an Emergency Fund

Alright, listen up! We’re about to dive into the importance of savings and emergency fund strategies.

Picture this: you’re walking down the street, minding your own business, when suddenly a wild expense appears! Without an emergency fund, you’d be caught off guard like a deer in headlights.

That’s why it’s crucial to understand how to save and strategize for those unexpected curveballs life throws at us.

Importance of Savings

First things first, it’s crucial for you to understand the importance of having savings while using the debt snowball method to pay off your credit card debt. Savings strategies play a vital role in your financial journey, providing a safety net for unexpected expenses and allowing you to stay on track with your debt repayment plan.

Here are two key reasons why savings are essential:

-

Emergency Fund: An emergency fund is like a superhero cape that comes to your rescue when life throws curveballs at you. It acts as a buffer, protecting you from falling back into debt when unexpected expenses arise, such as medical bills or car repairs.

-

Start small: Begin by saving a small portion of your income each month until you reach an amount that covers three to six months’ worth of living expenses.

-

Automate savings: Set up automatic transfers from your checking account to a separate savings account, making it easier for you to consistently save without even thinking about it.

Emergency Fund Strategies

To effectively build your emergency fund, it’s essential to establish a clear savings goal and create a realistic timeline for reaching it.

Think of your emergency fund as your superhero sidekick, ready to swoop in and save the day when unexpected expenses come knocking at your door. But like any good sidekick, it needs training and preparation.

Start by setting a specific amount that you want to save, whether it’s three months’ worth of expenses or enough to cover that dream vacation you’ve been eyeing. Then break it down into bite-sized chunks and set aside a little bit each month until you reach your goal.

It may take time, but with careful planning and dedication, your emergency fund will be ready to rescue you whenever life throws a curveball your way. So suit up, master the art of emergency fund savings, and be prepared for whatever comes your way!

Increasing Your Income and Cutting Expenses

Cutting expenses and finding ways to increase your income are key strategies for implementing the debt snowball method to pay off credit card debt. Let’s dive into some fun and creative ideas to help you master these techniques:

- Reducing Expenses:

- Start by analyzing your monthly expenses and identify areas where you can cut back.

-

Consider canceling unnecessary subscriptions or negotiating better deals on bills.

-

Increasing Income:

- Explore side hustles or freelance opportunities that align with your skills and interests.

- Get creative! Offer services like dog walking, tutoring, or selling homemade crafts online.

By reducing expenses and increasing income, you’ll have more cash flow available to put towards paying off your credit card debt. Plus, it’ll be a great opportunity to discover new passions and talents along the way!

Now, let’s move on to the next step: snowballing the payments.

Snowballing the Payments

So, you’ve been diligently cutting expenses and increasing your income to tackle that pesky credit card debt.

But now it’s time to take it up a notch and really snowball those payments!

By focusing on paying off the smallest balance first and then rolling that payment into the next debt, you’ll be amazed at how quickly you can make progress.

And let’s not forget about the incredible motivation this method brings – seeing those debts disappear one by one will keep you fired up and ready to conquer even more!

Faster Debt Payoff

Maximize your debt payoff by focusing on the smallest credit card balance first. It may seem counterintuitive, but trust the process – it’s called the debt snowball method. By tackling your smallest balance first, you’ll gain momentum and a sense of accomplishment that will propel you towards faster debt payoff.

Here are two sub-lists to help you understand why this strategy works:

- Psychological boost:

- Paying off a smaller debt quickly gives you a sense of achievement.

-

This motivates you to continue paying off other debts with even more determination.

-

Extra cash flow:

- As each small balance is paid off, the minimum payments for those cards are eliminated.

- This frees up cash that can be used to pay down larger balances more quickly.

Motivation to Continue

Paying off the smallest balance first gives you a psychological boost, which can motivate you to continue tackling your debts.

Picture this: you’re standing at the base of a mountain of credit card debt, armed with your trusty snowball method. It’s easy to feel overwhelmed by the sheer size of it all. But fear not!

With each small victory, as you pay off those smaller balances one by one, you’ll gain momentum and confidence. It’s like conquering mini hills on your way to the summit. By focusing on these milestones, you’ll stay motivated and push through any obstacles that come your way.

So don’t lose sight of how far you’ve come – celebrate those wins and keep pushing forward towards financial freedom!

Now let’s talk about how to celebrate those milestones and stay motivated throughout your debt payoff journey…

Celebrating Milestones and Staying Motivated

When you’re trying to pay off credit card debt using the debt snowball method, it’s important to celebrate milestones and stay motivated. Remember, tackling debt can be a long journey, so it’s crucial to keep your spirits high along the way.

Here are some tips on how to stay motivated and celebrate your achievements:

-

Set small goals: Break down your total debt into smaller chunks and set achievable goals for paying them off. Each time you reach one of these mini-goals, reward yourself with something small but meaningful.

-

Share your progress: Find a friend or family member who can support and cheer you on throughout your debt repayment journey. Sharing updates and celebrating milestones together can make the process more enjoyable.

Remember, celebrating milestones is just one part of staying motivated in your journey towards financial freedom.

Now let’s explore another crucial aspect – avoiding new debt…

Avoiding New Debt

To stay on track with your debt repayment journey, it’s crucial to avoid incurring additional debts. Think of it as trying to lose weight but constantly snacking on donuts. It just doesn’t work! So, let’s develop some healthy spending habits together and steer clear of new debt.

First things first, create a budget that fits your lifestyle. This way, you can see where your money is going and ensure you’re not overspending. It might even surprise you how much those little expenses add up!

Next, resist the urge to buy things impulsively. Ask yourself if you really need that fancy gadget or trendy outfit. Remember, delayed gratification can be satisfying too!

Lastly, find free or low-cost alternatives for entertainment and hobbies. Explore parks, have picnics with friends, read books from the library – there are endless possibilities without breaking the bank.

By avoiding new debt and developing healthy spending habits, you’ll be well on your way to financial freedom!

Speaking of which… let’s now tackle the next challenge: dealing with collection agencies!

Dealing With Collection Agencies

If you’re dealing with collection agencies, it’s important to understand your rights and options. Don’t worry, you’ve got this! Here are a few things to keep in mind:

- Negotiating settlements:

- Be confident and assertive when discussing payment options.

-

Remember that you have the power to negotiate for a lower settlement amount.

-

Dealing with credit bureaus:

- Stay on top of your credit report by checking it regularly.

- If there are any errors or inaccuracies, dispute them immediately.

When talking to collection agencies, be polite but firm. Take deep breaths and remember that you’re in control. It’s all about finding a solution that works for both parties involved. You’ve got the skills and knowledge to navigate this situation like a pro!

Tracking Your Progress

Now that you’ve learned how to deal with those pesky collection agencies, it’s time to track your progress and keep yourself motivated on your debt-free journey.

Setting reminders can be a great way to stay on top of your payments and ensure that you don’t miss any deadlines. Whether it’s a calendar alert or a sticky note on your fridge, find a method that works best for you.

In addition to setting reminders, consider using debt tracking apps to help you visualize your progress. These apps allow you to input all of your debts and track their balances as you make payments. Watching those numbers go down can be incredibly satisfying and give you the motivation to keep going.

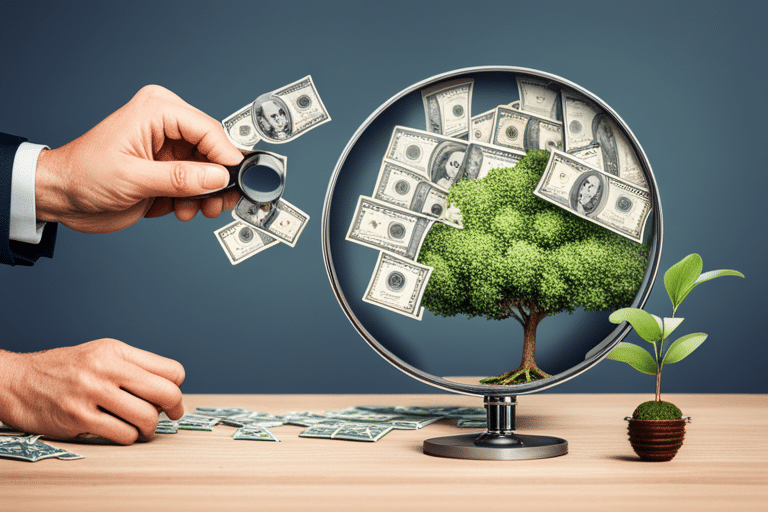

Reaping the Benefits of a Debt-Free Life

Once you’ve achieved a debt-free life, you’ll experience the incredible benefits of financial freedom and peace of mind. It’s like stepping into a whole new world where your money works for you instead of against you. No more sleepless nights worrying about bills or drowning in credit card statements. You are finally in control.

Reaching financial freedom is not just about paying off debt; it’s also about changing your spending habits. Here are two key ways that reaching financial freedom can transform your life:

- Freedom to pursue your dreams: With no debt holding you back, you have the freedom to chase after your passions and pursue the things that truly matter to you.

- Start that business you’ve always dreamed of

-

Travel the world and explore new cultures

-

Peace of mind: Being debt-free brings an unimaginable sense of peace and security.

- Sleep soundly at night without worrying about looming bills

- Build an emergency fund to handle unexpected expenses

Frequently Asked Questions

How Long Does It Typically Take to Pay off Credit Card Debt Using the Debt Snowball Method?

On average, it takes a while to pay off credit card debt using the debt snowball method. But don’t fret! The benefits of this approach are worth it, despite the drawbacks. Keep chipping away and you’ll conquer that debt mountain!

Can the Debt Snowball Method Be Used to Pay off Other Types of Debt, Such as Student Loans or a Mortgage?

Yes, the debt snowball method can be used to pay off other types of debt like student loans and car loans. By applying the same strategy, you can tackle your debts one by one and gain financial freedom.

Does Using the Debt Snowball Method Affect Your Credit Score?

Using the debt snowball method won’t directly impact your credit score, but it can help you pay off debts faster. Consider alternatives like the debt avalanche method or seeking professional guidance for a personalized plan.

What Happens if I Can’t Make the Minimum Payments on My Other Debts While Focusing on the Smallest Debt?

If you can’t make the minimum payments on your other debts while focusing on the smallest debt, don’t panic! There are alternative debt repayment strategies to explore. Consider seeking professional financial advice for guidance.

Can I Still Use the Debt Snowball Method if I Have a Low Income or Irregular Income?

If you have a low or irregular income, don’t worry! The debt snowball method can still work for you. Just adapt it to fit your situation. It’s like a personalized money snowstorm!

Conclusion

Congratulations! You’ve successfully reached the end of this article, and now you’re equipped with the knowledge to tackle your credit card debt using the debt snowball method.

So go forth and conquer those debts like a fearless warrior wielding a mighty snowball! Remember, with determination and discipline, you can crush those debts one by one until you’re finally free from their icy grip.

So buckle up, stay focused, and let the snowball roll towards your debt-free future!