Did you know that 69% of Americans have never checked their credit score? Don’t be one of them! Knowing your credit score is essential for financial success.

In this article, we’ll show you how to check your credit score for free in a simple and easy way. You’ll learn about reliable credit score providers, how to navigate their websites, and even discover areas where you can improve your score.

Get ready to take control of your financial future!

Key Takeaways

- Credit score is crucial for managing finances and unlocking opportunities.

- Trusted sources for credit scores include Credit Karma and Experian.

- Free options provide a good estimate of credit standing.

- Credit monitoring helps protect financial well-being.

Understand the Importance of Your Credit Score

Understanding the importance of your credit score is crucial when it comes to managing your finances. It’s like having a secret financial superpower, allowing you to unlock opportunities and navigate the world of loans, mortgages, and credit cards with ease.

Your credit score is a reflection of your credit history, which includes information about your past borrowing and repayment habits. This magical number ranges from 300 to 850, with higher scores indicating better creditworthiness.

Think of your credit history as a storybook that tells lenders how responsible you’ve been with borrowed money in the past. Have you always paid on time? Did you have any late payments or defaults? The characters in this story include your previous lenders and creditors, who report this information to credit bureaus like Experian, Equifax, and TransUnion. These bureaus then use their own secret formulas to calculate your credit score based on this data.

Having good credit can open doors for you – imagine yourself walking into a bank confidently while wearing a superhero cape! With an excellent score in hand, you’ll be able to secure lower interest rates on loans and credit cards. You might even qualify for higher spending limits or exclusive rewards programs! On the other hand, if your score is not so impressive, it’s like trying to fly without wings; you may encounter difficulties getting approved for loans or be stuck with higher interest rates.

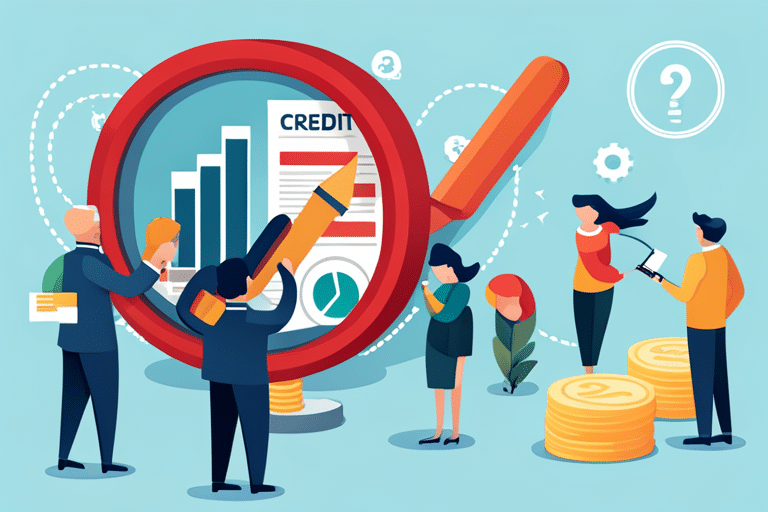

Choose a Reliable Credit Score Provider

So you’re ready to dive into the world of credit scores and find a reliable source for checking your score. Well, fear not! We’ve got you covered with trusted credit score sources that will give you peace of mind.

Plus, we’ll let you in on a little secret – some of these sources even offer their services for free! Isn’t that just music to your ears?

Trusted Credit Score Sources

To find trusted sources for your credit score, you can use websites like Credit Karma or Experian. These platforms provide a wealth of information and resources to help you monitor and understand your credit health. With just a few clicks, you can compare credit score providers and choose the one that suits your needs best.

Credit Karma offers personalized recommendations based on your financial profile, while Experian gives you access to detailed credit reports and scores from all three major bureaus. Both options are user-friendly and have robust security measures in place to protect your sensitive information.

So why wait? Take control of your financial future by checking your credit score with these trusted sources.

Now that you know where to find reliable credit score information, let’s dive into the exciting world of free score availability!

Free Score Availability

You can easily access your credit score for no cost. Yes, you read that right – absolutely free! There are several options available to check your credit score without spending a single penny.

But wait, before you jump into the excitement, let’s talk about accuracy. It’s important to note that while these free score options provide a good estimate of your credit standing, they might not be as accurate as the scores provided by paid services or lenders themselves. Nevertheless, they still give you a decent idea of where you stand financially.

So go ahead and explore these free options to get an idea of your credit health.

Now that you have an idea of where your credit stands, it’s time to take things up a notch. Transitioning into the next section, why not sign up for a free credit monitoring service?

Sign Up for a Free Credit Monitoring Service

Are you curious about the benefits of credit monitoring? Well, get ready to be amazed by how it can help protect your financial well-being!

In this discussion, we’ll explore the best free services out there and show you how easy it is to sign up.

Benefits of Monitoring

Monitoring your credit score can provide valuable insights into your financial health and help you make informed decisions. It’s like having a personal financial assistant, guiding you towards the best money moves.

Here are some benefits of credit monitoring:

-

Early detection: Credit monitoring tools keep a close eye on any changes to your credit report, alerting you to potential fraud or errors before they become big problems.

-

Improved financial habits: By regularly checking your credit score, you become more aware of how your financial choices impact your creditworthiness. This can motivate you to make smarter spending and payment decisions.

-

Opportunity for improvement: Monitoring allows you to track the progress of your credit score over time. Seeing positive changes can boost your confidence and encourage responsible financial behavior.

With these amazing benefits at your fingertips, why not start using credit monitoring tools today? Your future self will thank you!

Best Free Services

Take advantage of the top-rated credit monitoring services available for no cost to help you stay on top of your financial well-being. With so many options out there, it can be overwhelming to choose the best credit score apps. But fear not! We’re here to debunk some credit score myths and guide you towards the cream of the crop.

First up, we have Credit Karma. This app is like a superhero cape for your credit score, giving you access to free credit reports and scores from TransUnion and Equifax. Plus, they offer personalized recommendations based on your financial goals.

Next in line is Mint Credit Monitor. It’s like having a personal finance guru in your pocket, constantly keeping an eye on your credit report for any suspicious activity or errors.

And last but certainly not least, we have Experian CreditWorks Basic. This app puts the power back in your hands by providing unlimited access to your Experian credit report and FICO Score 8.

How to Sign up

To get started, simply download one of these fantastic credit monitoring apps and follow the easy sign-up process. It’s as simple as a few taps on your phone to gain access to your credit score in no time!

Here’s how to sign up:

- First, open the app and click on ‘Create Account.’

- Next, enter your personal information like name, email address, and password.

- Once you’ve filled in the details, hit the ‘Submit’ button and voila! You’re almost there!

But wait, there’s one more step – account verification. Don’t worry; it’s just to ensure that you’re the rightful owner of this fabulous credit-seeking persona. Simply check your email for a verification link or enter a code sent via SMS.

And that’s it! With just a few steps and some account verification magic, you’ll be on your way to mastering your credit journey.

Happy exploring!

Gather the Necessary Information

First, you’ll need to collect the necessary information to check your credit score for free. Picture yourself as a master detective, on a mission to unravel the mysteries of your creditworthiness. Grab a pen and paper because it’s time to gather some intel!

To begin, make sure you have your personal details handy. Jot down your full name, address, and social security number. These are top-secret pieces of information that will unlock the door to your credit history.

Next up is identifying any outstanding debts you may have lurking in the shadows. Grab those bills from under the couch cushions or dig out that forgotten folder labeled ‘Important Documents.’ You want to be aware of any loans, credit cards, or other financial obligations that may be impacting your credit score.

Now it’s time for a trip down memory lane – well, sort of. Retrieve at least six months’ worth of bank statements and payment records. This will help paint a clear picture of how responsible you’ve been with managing your money.

Last but not least, gather any documentation related to previous bankruptcies or legal judgments against you. While we’re all about positivity here, understanding these aspects can provide valuable insight into your overall credit health.

Remember: knowledge is power! By collecting this information and having a deep dive into your financial past, you’ll gain a better understanding of how lenders view you as a borrower.

Navigate to the Credit Score Check Website

So, you want to check your credit score? Well, lucky for you, it’s easier than ever! In just a few simple steps, you’ll have all the information you need to keep track of your financial health.

Plus, did I mention it’s completely free? Now that’s what I call a win-win!

Easy Steps for Checking

You can easily check your credit score for free by following these simple steps.

First, gather all the necessary information such as your social security number and date of birth.

Then, find a reputable credit score checking website that offers this service for free.

Once you’ve found the perfect site, navigate to their homepage and locate the ‘Check Your Credit Score’ button – it’s usually hard to miss!

Click on it and enter your personal details when prompted.

Voila! Your credit score will be calculated in no time.

Remember, checking your credit score is an essential part of maintaining financial health.

By understanding where you stand financially, you can make informed decisions about loans, mortgages, or even renting a new apartment.

Free Credit Score Options

There are various websites that offer the option to check your credit score for no cost. It’s like a magical land where numbers and financial knowledge collide! These free credit score websites give you access to valuable information about your creditworthiness without breaking the bank. You can keep track of your credit score and monitor any changes, all while sipping on a virtual cup of tea. Picture this: a table awaiting you, filled with rows and columns of credit score goodness. Here it is, just for you:

| Website | Features |

|---|---|

| Credit Karma | Free credit scores and reports |

| Experian | Access to FICO® scores |

| Credit Sesame | Personalized recommendations |

| NerdWallet | Detailed financial analysis |

| Mint | Budgeting tools and advice |

Create an Account or Log In

To access your credit score, simply create an account or log in using your personal information. It’s as easy as pie! Just follow these steps to get started on your credit score journey:

-

Step 1: Sign up Process

Creating an account is a breeze. Just enter your name, email address, and choose a secure password. We’ll ask you for some additional details like your date of birth and social security number to verify your identity. Don’t worry, we take account security seriously! -

Step 2: Account Security

We understand that the safety of your personal information is paramount. That’s why our platform employs state-of-the-art encryption technology to safeguard all data transmissions. Rest assured, only you will have access to your credit score. -

Step 3: Dive Into Your Credit Score

Once you’ve created an account or logged in, it’s time to explore the world of credit scores! Discover where you stand financially and gain insights into how lenders perceive you. With this knowledge at hand, you can make informed decisions about loans, mortgages, and even applying for that dream job.

Verify Your Identity

So, you want to make sure your identity is secure, protect yourself against those sneaky fraudsters, and have an easy peasy online authentication process? Well, my friend, you’ve come to the right place!

In this discussion, we’ll dive into the world of secure identity verification. We’ll show you how to protect yourself against fraud like a pro. And we’ll reveal some nifty tricks for breezy online authentication.

Get ready to safeguard your digital life with style!

Secure Identity Verification

Make sure you have your personal identification documents ready when checking your credit score for free. This step is crucial to ensure the security of your data and maintain online safety.

Here are a few tips to help you securely verify your identity:

- Keep your identification documents, such as your driver’s license or passport, in a safe place.

- When entering personal information online, make sure the website is encrypted (look for the padlock icon).

- Be cautious of phishing emails or calls asking for sensitive information – always double-check with trusted sources.

Securing your identity verification process not only protects your data but also ensures that you can confidently access and monitor your credit score without any worries.

Protect Against Fraud

Guard yourself against fraud by regularly monitoring your financial statements and reporting any suspicious activity to your bank. Credit score fraud prevention is crucial in today’s digital age. By staying vigilant and proactive, you can protect yourself from becoming a victim of identity theft or credit card fraud. One effective way to safeguard your credit score is by monitoring it regularly. This allows you to quickly detect any unauthorized changes or discrepancies, giving you the opportunity to take immediate action. Keeping an eye on your credit score not only helps prevent fraudulent activity but also provides several benefits. It enables you to identify areas for improvement, track your progress, and maintain a healthy credit profile. Take control of your financial well-being by taking advantage of credit score monitoring services today.

| Benefits of Credit Score Monitoring |

| — | — | — |

| Early detection of fraudulent activity | Improved financial awareness | Increased peace of mind |

| Protection against identity theft | Tracking progress towards financial goals | Maintenance of a healthy credit profile |

Easy Online Authentication

Stay secure online by taking advantage of easy online authentication methods like two-factor authentication and biometric verification to protect your personal information. With these simple yet effective online security measures, you can safeguard yourself against identity theft and ensure peace of mind while browsing the digital world.

Here are three ways to enhance your online security:

-

Enable two-factor authentication: This adds an extra layer of protection by requiring a second form of verification, such as a unique code sent to your phone.

-

Utilize biometric verification: Embrace the future with fingerprint or facial recognition technology that ensures only you can access your accounts.

-

Update passwords regularly: Don’t underestimate the power of a strong password. Combine uppercase and lowercase letters, numbers, and symbols for added security.

By implementing these measures, you can stay one step ahead of potential threats and keep your personal information safe from prying eyes.

Now, let’s review and confirm your personal information to complete the process securely.

Review and Confirm Your Personal Information

You can start by ensuring that all your personal information is accurate and up-to-date. Imagine a world where your credit score reflects the true you, not some outdated version from years ago. It’s like having a fresh start, a blank canvas to paint your financial masterpiece. So how do you achieve this credit nirvana?

By reviewing your information and double checking every single piece of data. Think of it as going on a treasure hunt through the vast jungle of your personal details. You grab your magnifying glass and embark on an adventure to uncover any errors or discrepancies lurking in the shadows. As you delve deeper into the labyrinth of paperwork, you feel like Sherlock Holmes solving his greatest mystery.

Piece by piece, you examine your name – spelled correctly, check! Your address – current and accurate, check! Social security number – locked away securely, check! Financial accounts – all present and accounted for, check! But wait, what about that one time when you moved houses and forgot to update your address? Or when someone misspelled your name at the doctor’s office? These little oversights could be holding you back from achieving credit greatness.

So take a moment to review each detail with care. Double check those digits, make sure everything aligns perfectly with reality. Because when it comes to building good credit health, accuracy is key.

Once you’ve confirmed that all is well in the land of personal information, it’s time to move onto the next step: exploring ways to boost your credit score without spending a dime. But that’s a story for another day…

Determine the Type of Credit Score You Want to Check

Picture this: there are different types of credit scores available for you to explore and choose from. When it comes to determining your creditworthiness, understanding the different credit score ranges is key. Here’s a breakdown of some common types of credit scores:

-

FICO Score: This is the most widely used credit score in the United States. It ranges from 300 to 850, with a higher number indicating better creditworthiness.

-

VantageScore: A newer player in the game, VantageScore also ranges from 300 to 850. It was created by the three major credit bureaus (Equifax, Experian, and TransUnion) as a competitor to FICO.

-

Credit Karma Score: Credit Karma provides its own unique scoring model that ranges from 300 to 850. While not as widely used as FICO or VantageScore, it can still give you a good idea of your overall credit health.

Now that you know about these different types of credit scores, it’s time to choose which one you want to check. Each type may have slight variations in how they calculate your score, but they all aim to assess your creditworthiness in some way.

Access Your Credit Score Report

Once you’ve determined which credit score type to access, it’s important to know how to obtain your credit score report. Don’t worry, it’s not as complicated as deciphering hieroglyphics. In fact, accessing your credit score data is easier than getting a pizza delivered to your door!

To begin the quest for your credit score report, you can start by visiting one of the many websites that offer free access to this valuable information. These websites will ask for some basic details about yourself, like your name and social security number. Don’t worry, they won’t steal your identity and run off into the sunset. They just need these details to retrieve accurate information about your financial history.

Once you’ve completed the necessary steps, sit back and relax while those magical algorithms work their magic. In no time at all, you’ll be staring at a three-digit number that represents your creditworthiness. It’s like unlocking a secret code that holds the key to financial freedom!

But wait! Before you dive headfirst into analyzing every digit of your credit score report, take a moment to appreciate its accuracy. These reports are compiled by professional bureaus who specialize in collecting and organizing financial data with military precision. So rest assured, the numbers on that piece of paper (or screen) are as accurate as counting sheep before bed.

Now that you have accessed your credit score report with ease and confidence in its accuracy, it’s time for the next step: reviewing it carefully and understanding what it means for your financial future. So let’s dive deeper into the world of credit scores!

Review Your Credit Score and Report

Reviewing your credit score report can provide valuable insights into your financial standing and help you make informed decisions for the future. It’s like taking a peek into a crystal ball that reveals how lenders perceive you.

So, grab a cup of coffee and get ready to dive into the fascinating world of credit scores!

Here are three things to look out for when reviewing your credit score report:

-

Accuracy: Check if all the information on your report is correct. Look for any errors, such as incorrect personal details or accounts that don’t belong to you. Remember, accuracy is key!

-

Credit Score Impact: Your credit score plays a significant role in loan applications. A high credit score opens doors to better interest rates and higher chances of loan approval. On the other hand, a low credit score may lead to limited options and higher borrowing costs.

-

Loan Applications: Take note of any recent loan applications listed on your report. Multiple applications within a short period can negatively impact your credit score. It’s important to be mindful of how often you apply for new loans or credit cards.

By reviewing these factors, you can gain a clear understanding of where you stand financially and take steps towards improving your creditworthiness.

Now that you’ve reviewed your credit score report, it’s time to analyze the factors affecting your credit score in more detail. So buckle up and let’s explore what influences this magical number!

Analyze Factors Affecting Your Credit Score

Now that you’ve reviewed your credit score and report, it’s time to dive into the nitty-gritty and analyze the factors that affect your credit score.

Buckle up, because we’re about to embark on a journey of credit utilization and the impact of late payments.

First up, let’s talk about credit utilization. This fancy term refers to how much of your available credit you actually use. It’s like a barometer for lenders to gauge how responsible you are with your borrowing habits. Ideally, you want to keep your credit utilization below 30%. So if you have a total credit limit of $10,000, try not to rack up more than $3,000 in debt.

Next on our analysis adventure is the impact of late payments. Picture this: You’re strolling through a garden of roses (representing timely payments) when suddenly, out pops a thorny weed (representing a late payment). Ouch! That little weed can really prick your credit score. Late payments can stay on your record for up to seven years and have a negative impact on your overall score.

But fear not! There are ways to keep those late payment weeds at bay. Set up automatic payments or reminders so you never miss a due date again. And if life throws an unexpected curveball your way, don’t be afraid to reach out to creditors and explain the situation – they may be able to work something out with you.

Identify Areas for Improvement

Identifying areas for improvement in your credit utilization and payment history is key to boosting your overall credit score. It’s like giving your credit score a makeover!

Imagine you’re the captain of a ship, sailing through the vast ocean of financial possibilities. Your credit score is the wind in your sails, propelling you towards success. But sometimes, there are hidden reefs beneath the surface that can slow you down.

To help you navigate these treacherous waters and improve your credit score, here are three areas for improvement to focus on:

-

Credit Utilization: This refers to how much of your available credit you’re actually using. Ideally, you want to keep this percentage low—around 30% or less—to show lenders that you’re responsible with your borrowing capacity. Think of it as not overloading your ship with too much cargo; leave some room for expansion!

-

Payment History: Ahoy matey! On-time payments are crucial for maintaining a healthy credit score. Late payments can be like stormy weather, causing waves of negativity on your credit report. Aim to make all payments by their due dates and avoid any blemishes on your financial record.

-

Credit Score Factors: Keep an eye on what factors affect your credit score. Factors such as missed payments, high balances, or too many recent inquiries can all have an impact on that magical number. By understanding these factors and taking steps to improve them, you’ll be well on your way to achieving mastery over your credit score.

Understand the Impact of Credit Inquiries

Understanding the impact of credit inquiries is essential when it comes to managing your overall credit health. Imagine your credit score as a delicate house of cards, carefully balanced and maintained. Each time you apply for new credit, it’s like adding another card to the structure. Too many inquiries can cause that delicate balance to wobble and ultimately collapse.

Credit inquiries have an impact on your credit score because they reflect how often you’re seeking new credit. Lenders view frequent applications for credit as a sign of financial instability or desperation. So, when you apply for a loan or open a new line of credit, the lender will likely check your credit history with one or more of the major credit bureaus. This action is called a ‘hard inquiry.’

Now, let’s talk about the impact of these inquiries on your score. Hard inquiries usually stay on your report for two years and can lower your score by a few points each time they occur. However, the effect diminishes over time as long as you continue to demonstrate responsible borrowing habits.

It’s important to note that not all inquiries are treated equally in terms of their impact on your score. For example, if you’re shopping around for an auto loan or mortgage within a specific timeframe (usually 14-45 days), multiple inquiries made during that period may be counted as only one inquiry.

Take Action to Improve Your Credit Score

To improve your credit score, take action by paying your bills on time and reducing your overall debt. It’s time to embark on a journey towards improving your creditworthiness and boosting that credit score of yours! Don’t worry, it’s not as daunting as it may seem. With a little effort and some smart financial moves, you’ll be well on your way to better credit.

Here are three key steps you can take to start improving your credit score:

-

Pay Your Bills on Time: This may seem like an obvious one, but it’s crucial to make sure you’re paying all of your bills by their due dates. Late payments can have a negative impact on your credit score, so set up reminders or automatic payments to help you stay on track.

-

Reduce Your Overall Debt: High levels of debt can weigh down your credit score. So, take a deep breath and start chipping away at those balances. Consider creating a budget, cutting back on unnecessary expenses, or even exploring options for consolidating or refinancing existing debts.

-

Monitor Your Credit Score Factors: Familiarize yourself with the factors that influence your credit score so you know where to focus your efforts. These factors include payment history, amounts owed, length of credit history, new accounts opened, and types of credit used.

Remember that improving your creditworthiness takes time and patience. But with determination and these helpful steps in mind, you’ll be well-equipped to make positive changes and see improvements in no time! So go ahead – take the leap towards better financial health!

Frequently Asked Questions

How Often Should I Check My Credit Score?

You should check your credit score regularly to stay on top of your financial game. By monitoring it frequently, you’ll be aware of any changes and the importance of keeping a good score.

What Are the Different Types of Credit Scores Available?

Different credit score models exist, each with its own calculation methods. Factors that impact credit scores include payment history, credit utilization, length of credit history, types of credit used, and recent applications for new credit.

How Long Does It Take to See Improvements in My Credit Score?

Improving your credit score can take time, but there are factors that affect how quickly you’ll see improvements. Payment history, credit utilization, and length of credit history all play a role in boosting your score.

Can I Dispute Any Errors or Inaccuracies in My Credit Report?

You can definitely dispute errors or inaccuracies in your credit report. The dispute process allows you to challenge any discrepancies and have them corrected. It’s important to review your report regularly for accuracy.

How Do I Prevent Identity Theft and Fraud From Affecting My Credit Score?

To prevent identity theft and fraud from hurting your credit score, take preventative measures like monitoring your accounts regularly and shredding important documents. Watch out for signs of identity theft, such as unauthorized charges or new accounts in your name.

Conclusion

So, there you have it! Congratulations on successfully checking your credit score for free.

Now that you have all the information, it’s time to embark on a journey towards financial empowerment. Picture yourself as a credit superhero, armed with knowledge and ready to conquer any obstacles that come your way.

With this newfound understanding, you can make informed decisions and take actions to improve your credit score. Remember, every step counts in this whimsical adventure of creditworthiness.

Good luck on your quest!