So, you think your credit score doesn’t matter? Oh, how wrong you are! Your credit score holds the key to financial opportunities and success.

It’s time to dive into the world of credit scores and learn how to use it wisely. In this article, we’ll explore the importance of a good credit score and uncover the factors that affect it.

Get ready to take control of your credit history and discover smart strategies for managing debt responsibly. Let’s unlock the secrets of mastering your credit score!

Key Takeaways

- A good credit score leads to better interest rates and loan terms.

- Regularly monitoring your credit report and disputing any errors is important for maintaining a healthy credit score.

- Paying bills on time and keeping credit utilization below 30% are key factors in improving and maintaining a good credit score.

- Closing old accounts may lower your credit score instead of boosting it, so it’s best to keep them open.

The Importance of a Good Credit Score

Your credit score is crucial when it comes to your financial well-being. It’s like the magical number that determines whether you’re a responsible borrower or a risky one. And let me tell you, having a high credit score comes with some serious perks!

First off, let’s talk about the benefits of a high credit score. Picture this: you walk into a bank or mortgage lender’s office, and they take one look at your credit score. If it’s high, they’ll be falling over themselves to offer you the best interest rates and loan terms on the market. They see you as a trustworthy individual who pays their bills on time and manages their finances responsibly.

But what if your credit score isn’t so great? Don’t worry! There are ways to improve it and boost those numbers up. The first step is to make sure all your payments are made on time. Late payments can seriously damage your credit score, so set up automatic payments or reminders if necessary.

Another way to improve your credit score is by keeping your credit utilization ratio low. This means using only a small percentage of your available credit limit. So resist the urge to max out those shiny new credit cards!

Lastly, keep an eye on your credit report for any errors or discrepancies that could be dragging down your score unfairly. You have the right to dispute any inaccurate information and have it removed from your report.

Understanding the Factors That Affect Your Credit Score

Hey there, credit connoisseur!

Ready to dive deeper into the factors that shape your credit score?

Well, get ready to be blown away by the impact of your payment history and credit utilization ratio.

These two powerhouses can either make or break your creditworthiness, so buckle up and let’s unravel their secrets together!

Payment History Impact

Making consistent on-time payments is crucial for maintaining a good credit score and avoiding negative impacts. Your payment history plays a significant role in determining your creditworthiness. Here are some key points to keep in mind:

-

Credit Score Calculation: Your payment history accounts for about 35% of your overall credit score calculation. This means that even one late or missed payment can have a significant impact on your score.

-

Credit Score Range: Credit scores typically range from 300 to 850, with higher scores indicating better creditworthiness. By consistently making on-time payments, you can improve your score and move towards the higher end of this range.

-

Negative Impacts: Late or missed payments can lead to penalties, increased interest rates, and even collection efforts by creditors.

Credit Utilization Ratio

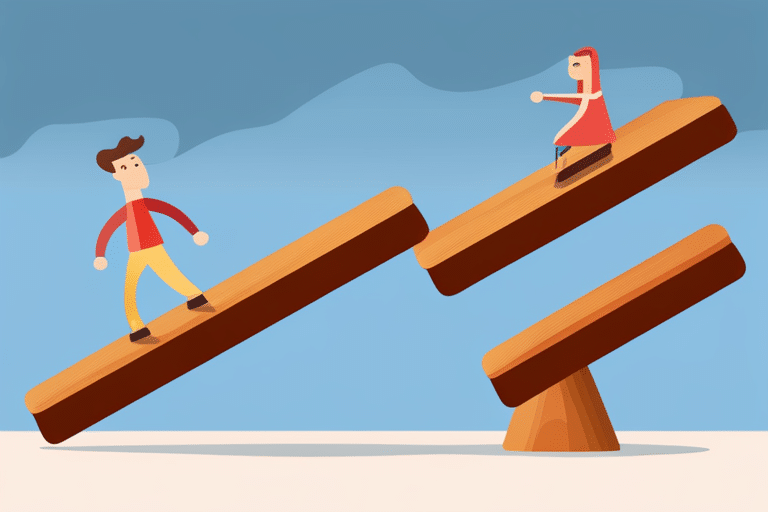

Understanding the impact of credit utilization ratio is crucial for managing your overall creditworthiness. It’s like finding the perfect balance between eating a whole cake and not having any dessert at all. You want to maximize your credit but also reduce your debt, so it’s important to keep an eye on this ratio.

Think of it as a seesaw – if you have a high credit utilization ratio, it can negatively affect your credit score. But if you have a low ratio, it shows lenders that you’re responsible with your credit. So, aim for around 30% or less to keep things in check.

Building and Maintaining a Healthy Credit History

Hey there, credit score superhero!

Now that you understand the factors that affect your credit score, let’s dive into the importance of building and maintaining a healthy credit history.

Your credit score impacts so many aspects of your financial life, from getting approved for loans to securing lower interest rates.

Credit Score Impact

To improve your credit score, you should consistently pay your bills on time. But why does your credit score matter? Let’s debunk some misconceptions and explore the benefits:

- Credit Score Benefits:

- Opens doors to better interest rates and loan options.

- Enhances your financial reputation and credibility.

- Provides a snapshot of your financial health.

Now, let’s clear up those misconceptions:

- ‘Closing old accounts will boost my score.’ False! It may actually lower it.

- ‘Checking my own credit hurts my score.’ Nope! It’s called a soft inquiry, and it won’t affect you.

- ‘Paying off debt instantly skyrockets my score.’ Sadly, no magic trick here; it takes time to rebuild.

Credit History Importance

Remember, it’s crucial to maintain a healthy credit history by making timely payments and managing your debt responsibly. Your credit history length plays a vital role in determining your creditworthiness. Think of it as the story of your financial journey, with each payment and debt management decision shaping the narrative. Just like a captivating book, you want your credit history to be long and filled with positive chapters.

By consistently demonstrating responsible financial behavior over time, you’ll establish a solid foundation for lenders to trust you. It shows that you’ve been able to handle various types of debts and make reliable payments. So, whether it’s that student loan or that shiny new car you financed, remember to manage them wisely.

Maintaining a good credit history doesn’t have to be daunting either! Stay organized by setting up automatic payments or creating reminders for yourself. Regularly reviewing your credit report can also help identify any errors or potential issues.

The Role of Credit Utilization in Your Score

Credit utilization plays a significant role in determining your credit score. It’s one of those mysterious factors that can either boost your score or bring it crashing down. So, let’s dive into the world of credit utilization and discover how it impacts your financial life.

Here are three things you need to know about credit utilization:

-

Role of Credit Limits: Your credit limit is like a magic wand that determines how much you can borrow from your credit card company. It’s important to understand that using too much of your available credit can be seen as risky behavior by lenders. So, it’s crucial to keep an eye on your credit limits and try not to max them out!

-

Credit Utilization Impact: The percentage of available credit you’re currently using is known as your credit utilization ratio. This ratio has a big impact on your overall credit score. A lower ratio shows that you’re responsible with borrowing, while a higher ratio suggests that you might be relying too heavily on debt.

-

Strategies for Improvement: If you find yourself with high credit utilization, don’t worry! There are ways to improve it. One strategy is paying down existing debt or increasing your available credit limits. Another option is applying for new lines of credit to spread out the balance across multiple accounts.

How Payment History Impacts Your Credit Score

Payment history is a key factor that influences your creditworthiness. It’s like a report card for your financial responsibility, and believe me, lenders pay close attention to it. Late payments can have a negative impact on your credit score, so it’s important to make sure you pay your bills on time.

Imagine your credit score as a delicate flower garden. Each payment you make on time is like watering the flowers, helping them grow strong and healthy. But if you miss a payment or pay late, it’s like forgetting to water the garden for weeks – those beautiful flowers start wilting and withering away.

Late payments can stay on your credit report for up to seven years, dragging down your score and making it harder for you to get approved for loans or credit cards in the future. Lenders see late payments as a sign of financial irresponsibility, and nobody wants that reputation hanging over their heads.

On the other hand, when you consistently make your payments on time, it shows lenders that you are reliable and trustworthy. It’s like having a green thumb when it comes to managing your finances! Your credit score will thank you by staying high and healthy.

So remember, making on-time payments is crucial for maintaining good credit health. It not only keeps those beautiful flowers blooming in your garden but also opens doors to better opportunities in the future.

Now that we’ve covered how payment history affects your credit score, let’s move on to the next step: managing debt responsibly to improve your score even further.

Managing Debt Responsibly to Improve Your Score

When you consistently make on-time payments, it shows lenders that you’re financially responsible and can be trusted. This is an essential aspect of managing your debt responsibly and improving your credit score. Responsible borrowing and debt management are key factors in ensuring a healthy financial future.

Here are some fun tips to help you navigate the world of debt:

-

Create a budget: Take control of your finances by creating a budget that outlines your income and expenses. This will help you prioritize your spending and avoid accumulating unnecessary debt.

-

Pay more than the minimum: Whenever possible, try to pay more than the minimum required payment on your debts. By doing so, you’ll not only reduce your overall balance faster but also demonstrate responsible borrowing habits to lenders.

-

Avoid unnecessary debts: Before taking on new debts, ask yourself if it’s necessary. Sometimes we get caught up in the excitement of buying something new, but it’s important to consider whether it fits within our means.

By implementing these strategies for managing debt responsibly, you’ll be well on your way to improving your credit score and achieving financial success.

Now that we’ve covered responsible borrowing and debt management, let’s move on to exploring smart strategies for using credit wisely.

Smart Strategies for Using Credit Wisely

If you want to make the most of your financial opportunities, it’s important to understand how to use credit wisely. Making smart credit decisions can help you build a solid foundation for your financial future and avoid common credit pitfalls. To help you navigate the world of credit, here are some strategies that will set you on the path to success.

| Smart Credit Decisions | Avoiding Credit Pitfalls |

|---|---|

| Paying bills on time | Keeping credit utilization low |

| Monitoring your credit score regularly | Avoiding unnecessary debt |

| Using credit for necessary expenses only | Being cautious with balance transfers |

Paying bills on time is crucial for maintaining a good credit score. Late payments can negatively impact your score and lead to higher interest rates in the future. Keep track of due dates and set up reminders so you never miss a payment.

Monitoring your credit score regularly allows you to stay informed about any changes or discrepancies. By catching errors early, you can take steps to correct them and prevent potential damage to your score.

When it comes to using credit, it’s important to be selective. Use it for necessary expenses that align with your budget and avoid impulse purchases that could lead to unnecessary debt.

Lastly, be cautious when considering balance transfers. While they can be a useful tool for consolidating debt, they should be approached with caution. Make sure to read the fine print and understand all fees involved before making a decision.

Frequently Asked Questions

What Is a Credit Score and Why Is It Important?

Understanding your credit score is crucial. It determines your financial opportunities and affects major decisions. Factors like payment history, debt utilization, and credit age impact it. Learn how to improve it and avoid negative information on your reports.

How Often Does My Credit Score Change and What Factors Can Cause It to Fluctuate?

Ever wonder how often your credit score does the cha-cha? Well, it can change frequently due to factors like payment history and credit utilization. Stay on top of it by monitoring and tracking regularly!

Can I Improve My Credit Score if I Have a History of Late Payments or Defaults?

Yes, you can improve your credit score even if you have a history of late payments or defaults. By making consistent on-time payments and reducing your debt, you can positively impact your credit score.

How Long Does Negative Information, Like Late Payments or Bankruptcy, Stay on My Credit Report?

If you’ve had late payments or bankruptcy, the negative information can stay on your credit report for a while. It’s like a rainstorm that leaves puddles behind. But don’t worry, there are ways to rebuild your credit after bankruptcy and minimize the impact of missed payments on your score.

Is It Necessary to Have Multiple Credit Accounts to Have a Good Credit Score?

Having multiple credit accounts isn’t necessary for a good credit score, but it can help. Building credit with secured credit cards is a smart move. However, be careful not to have too many accounts as it may hurt your score.

Conclusion

As you embark on your financial journey, remember that your credit score is like a trusty compass guiding you through the treacherous waters of borrowing and lending.

Just as a sailor relies on their compass to navigate the vast ocean, you must rely on your credit score to steer clear of financial pitfalls.

By understanding its importance and using it wisely, you can sail towards a brighter future with ease.

So set sail, my friend, and let your credit score be the wind in your sails!