Imagine a journey through life, where you navigate the twists and turns that come with each passing year. As you grow from a young adult to a wise senior citizen, your needs change, and so does your approach to life insurance.

In this whimsical article, we will explore the different stages of life and how they shape your insurance requirements. From starting a family to planning for retirement, join us on this insightful adventure as we uncover the secrets to mastering your changing life insurance needs.

Key Takeaways

- Life insurance needs change at different life stages, from students to young adults, newlyweds, and empty nesters.

- Regularly reviewing and adjusting life insurance coverage is important to ensure it aligns with current circumstances and responsibilities.

- Life insurance can play a role in retirement planning, providing financial protection and helping to cover outstanding debts or mortgages.

- Understanding and utilizing policy riders, living benefits, and cash value options can enhance coverage and provide added flexibility.

Life Insurance Options for Young Adults

Young adults have a variety of life insurance options to choose from. Life insurance for students is one option that can provide financial protection in case the unthinkable happens. Picture this: you’re busy studying for exams, juggling part-time jobs, and trying to navigate through the ups and downs of college life. The last thing on your mind is life insurance, right? But hey, accidents happen, and it’s better to be prepared than caught off guard.

Now let’s fast forward a bit. You’ve graduated, found the love of your life, and tied the knot. Congratulations! As newlyweds, you’re embarking on a journey together – building a home, starting a family, and sharing dreams. With all these exciting changes happening in your life, it might be time to consider life insurance for newlyweds. It may not be as romantic as planning your honeymoon or picking out furniture for your new place, but trust me when I say that having financial protection in place can help ease any worries about what would happen if one of you were no longer around.

As you step into your 30s and 40s (which trust me – will come sooner than you think), it becomes even more important to assess your life insurance needs. Responsibilities increase – mortgages need paying off, kids need raising – and ensuring that your loved ones are taken care of becomes paramount.

Assessing Life Insurance Needs in Your 30s and 40s

In your 30s and 40s, it’s important to assess if you still need life insurance coverage. Life can be a little chaotic during this stage of life – juggling careers, raising kids, and trying to keep up with the latest TikTok dance trends. But amidst all the hustle and bustle, it’s crucial to take a moment and evaluate your financial security and retirement planning.

Here are some things to consider:

- Are you the sole breadwinner in your family? If so, life insurance can provide a safety net for your loved ones if something were to happen to you.

- Do you have outstanding debts like student loans or a mortgage? Life insurance can help cover these obligations so that they don’t fall on the shoulders of those you leave behind.

- Have you started saving for retirement? Life insurance policies like permanent or whole life insurance can offer both protection and an investment component that can help supplement your retirement income.

Now, I know what you’re thinking – ‘Do I really need more things to think about in my already jam-packed schedule?’ But assessing your financial security doesn’t have to be overwhelming. It’s simply taking stock of where you’re at and making sure you’re on track for the future.

Choosing the Right Coverage for Your Growing Family

Hey there, growing family!

As your brood expands and your little ones multiply like bunnies, it’s important to consider how this impacts your life insurance needs. Adjusting coverage as needed will ensure that you’re adequately protected in case of the unexpected.

Family Size Impact

As your family grows, so does the impact on your life insurance needs. It’s like a juggling act – the more kids you have, the more plates you need to keep spinning in the air.

Here are some ways that changing family dynamics can affect your coverage:

-

More dependents: With each new addition to the family, there are more people relying on your income. Life insurance can provide financial protection for your loved ones if anything were to happen to you.

-

Increased expenses: Kids are expensive! From diapers to college tuition, raising a family comes with a hefty price tag. Life insurance can help cover these costs and ensure that your children’s future is secure.

-

Changing priorities: As your family grows, so do your responsibilities. Your life insurance policy should reflect these evolving needs and provide adequate coverage for all stages of life.

Adjusting Coverage as Needed

Don’t forget to review your coverage regularly to ensure it aligns with your current situation and provides the protection you need.

Life is full of surprises, and as things change, so should your life insurance policy. It’s like updating your wardrobe; you wouldn’t wear bell-bottoms in today’s fashion world, right? Well, the same goes for your insurance policy.

As you navigate through different stages of life, your financial planning needs evolve too. Maybe you’ve gotten married or had kids since you last reviewed your policy. Or perhaps you’ve paid off a mortgage or started a new business venture.

These milestones call for policy updates to make sure they reflect who you are now and provide the necessary safety net for your loved ones.

Life Insurance Considerations for Empty Nesters

Empty nesters should reassess their life insurance needs to ensure they have adequate coverage for their changing circumstances. Retirement planning is a whole new ballgame, my friend! Now that the kids have flown the coop, it’s time to take a fresh look at your life insurance policy.

Let’s dive in and explore some considerations for empty nesters like yourself:

-

Peace of mind: As an empty nester, you may no longer need as much coverage as before. Take this opportunity to evaluate your financial situation and determine how much life insurance you actually need to provide peace of mind for your loved ones.

-

Debt repayment: With the kids out of the house, you might find yourself with fewer financial responsibilities. Consider using your life insurance policy as a tool to help pay off any outstanding debts or mortgages, ensuring a smooth transition into retirement.

-

Legacy planning: Now that raising children is no longer your main focus, it’s time to think about leaving a lasting legacy. Life insurance can be used as an inheritance tool, allowing you to leave behind a financial gift for future generations or support causes close to your heart.

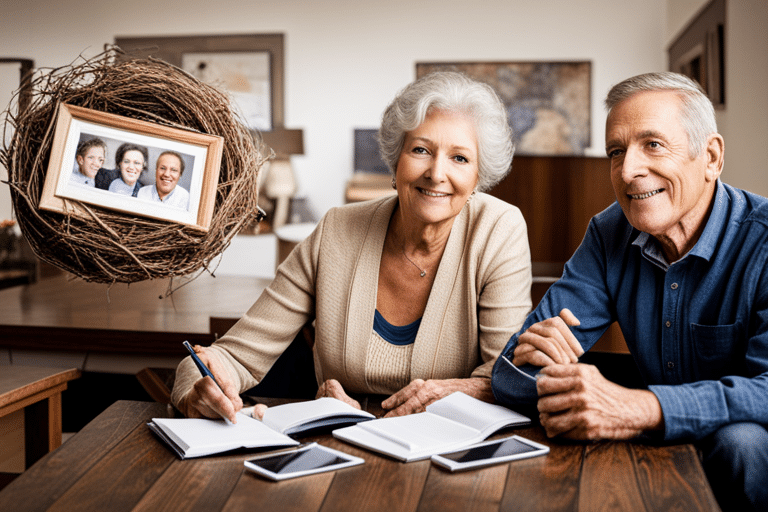

Planning for Retirement With Life Insurance

Congratulations, empty nester! You’ve survived the chaos of raising kids and now it’s time to start thinking about your golden years. Yes, retirement is just around the corner, and while you may be dreaming of sipping margaritas on a beach somewhere, it’s important to consider your financial security during this stage of life.

Planning for retirement with life insurance might not sound like the most exciting topic, but trust me, it’s crucial. Life insurance can provide an extra layer of protection for you and your loved ones as you transition into this new phase. It ensures that even if something were to happen to you before or during retirement, your family will still be taken care of financially.

Now, I know what you’re thinking – ‘But I’m almost retired! Do I really need life insurance?’ Well my friend, it depends on your individual circumstances. If you have dependents who rely on your income or if there are outstanding debts that would burden your loved ones in case of untimely demise, then having life insurance can bring peace of mind.

As part of planning for retirement, take some time to evaluate your current life insurance policy. Does it still align with your needs? Maybe you no longer need as much coverage because the kids are grown and financially independent. Or perhaps you want to increase coverage to ensure a comfortable inheritance for future generations.

In the next section, we’ll dive deeper into evaluating your life insurance policy as you approach retirement. So grab another cup of coffee (or maybe that margarita) and let’s get started!

Evaluating Your Life Insurance Policy as You Approach Retirement

So, you’re getting closer to retirement and starting to think about your life insurance policy. Well, good for you!

It’s important to make sure your coverage is still adequate after you retire. You might also want to consider adjusting your premiums and benefits to better suit your new lifestyle.

Let’s dive into these topics together and find out what works best for you!

Coverage Adequacy After Retirement

To ensure your coverage adequately meets your needs after retirement, it’s essential to review and adjust your life insurance policy accordingly. Life is full of surprises, and you don’t want any unexpected gaps in your coverage as you enter the golden years.

Here are a few things to consider:

-

Coverage adequacy in early retirement: As you transition from working life to retirement, your financial obligations may change. It’s important to reassess whether your current policy provides enough coverage for this new phase.

-

Potential gaps in coverage in later life: As you grow older, certain expenses like healthcare and long-term care might become more significant. Make sure your policy takes these potential costs into account.

-

Planning for legacy: If leaving a financial legacy for loved ones is important to you, review if the death benefit of your policy still aligns with those goals.

Now that we’ve covered the importance of assessing coverage adequacy after retirement, let’s move on to adjusting premiums and benefits to fit your evolving needs…

Adjusting Premiums and Benefits

Adjusting your premiums and benefits is a crucial step in ensuring that your life insurance policy continues to meet your evolving needs.

Life is full of surprises, like finding out you have a hidden talent for juggling or discovering that you can fit into those jeans from high school. Just as we adapt to these changes, our life insurance should too!

Premium adjustments and benefit modifications allow you to mold your policy to fit your current circumstances. Maybe you’ve paid off the mortgage on your house and want to lower your premium. Or perhaps you want to increase the death benefit so that it can cover future expenses for your loved ones.

Whatever it may be, don’t be afraid to tinker with your policy – after all, life is meant to be lived flexibly!

Adjusting Coverage in Your Golden Years

As you approach your golden years, it’s important to consider adjusting your life insurance coverage. After all, you’ve worked hard and built a life worth protecting. But don’t worry, making changes doesn’t have to be daunting! Let’s explore some key tips to help you navigate this new phase of life with ease.

-

Policy Exclusions: Take a close look at your policy and make sure you understand the exclusions. Are there any specific conditions or circumstances where the policy won’t pay out? It’s crucial to know what is covered and what isn’t, especially as you age. Knowledge is power!

-

Financial Planning: Your financial needs may have changed over the years. Maybe the kids are all grown up and financially independent now (finally!). Consider how much coverage you actually need at this stage in your life. You may find that you can lower your coverage amount, saving some money in the process.

-

Reviewing Options: Don’t settle for less than what suits your current needs. Research different policies and compare their benefits and costs. Maybe there are new types of coverage available that align better with your goals now. Embrace change; it might just lead to greater peace of mind.

Understanding Long-Term Care Insurance for Seniors

Understanding long-term care insurance can provide seniors with financial protection and peace of mind as they plan for their future healthcare needs. It’s like having a magical umbrella that shields you from unexpected rain showers in your golden years. So, let’s dive into the enchanting world of long-term care insurance!

Now, imagine you’re walking through a mystical forest called ‘Long-Term Care Insurance Land.’ As you wander through the trees, you come across various policy exclusions. These are like mischievous little creatures who try to sneak into your coverage and cause trouble. But fear not! With careful planning and understanding, you can protect yourself from these sneaky exclusions.

Next, you stumble upon a whimsical village where all the long-term care providers reside. They are like friendly wizards who possess incredible powers to help take care of you when you need it most. From nursing homes to in-home care services, these providers have got your back covered (quite literally!).

As you continue your journey through this magical land, keep in mind that each insurance policy is unique and may have different rules and features. It’s important to read the fine print and ask questions to ensure that your chosen policy aligns with your specific needs.

Remember, dear adventurer, understanding long-term care insurance is crucial for securing your future health and happiness. It’s like having a secret potion that keeps worries at bay while providing financial support when needed most.

Estate Planning and Life Insurance

Ah, dear reader, it seems we’ve arrived at the fascinating world of estate planning and life insurance! Now, hold onto your hats as we delve into this important aspect of financial mastery.

Let’s explore how these two elements intertwine in the grand tapestry of your future.

Picture this: you’ve worked hard all your life, building wealth and creating a legacy for yourself. But what happens to all that when you shuffle off this mortal coil? That’s where estate planning comes in! It ensures that your assets are distributed according to your wishes after you’re gone.

And guess what? Life insurance policies play a crucial role in this process!

Here are three key ways estate planning and life insurance work together:

-

Providing for loved ones: Life insurance can provide a much-needed financial safety net for those left behind. It can help cover funeral costs, outstanding debts, or even provide an inheritance.

-

Estate taxes: Nobody likes paying taxes (except maybe accountants). Fortunately, certain life insurance policies can help offset some of the hefty estate taxes that might be levied upon your heirs.

-

Equal distribution: If you have multiple beneficiaries but want to ensure they receive equal shares of your estate, life insurance can make it simpler. By designating specific payouts to each person, you leave no room for squabbles over who gets what.

Navigating Life Insurance as a Senior Citizen

So, you’ve reached your golden years and you’re thinking about life insurance. Well, don’t worry, my friend, because I’m here to guide you through it with a sprinkle of whimsy!

Let’s talk about how to ensure your policy covers those pesky medical expenses.

Next, we’ll discuss the options for converting your policy if needed.

And finally, we’ll explore how to adjust beneficiaries and payouts so that everything is just right.

Coverage for Medical Expenses

You’ll want to consider coverage for medical expenses as your life insurance needs change from being a young adult to a senior citizen. It’s like upgrading your superhero suit to handle new challenges! When it comes to elder care and end of life expenses, here are three things you should keep in mind:

-

Hospital Bills: Life happens, and sometimes that means unexpected trips to the hospital. Make sure your insurance covers those hefty bills.

-

Long-Term Care: As we age, we might need assistance with daily activities. Ensure your policy includes provisions for long-term care options like nursing homes or in-home caregivers.

-

Final Expenses: Nobody likes thinking about it, but planning for end-of-life costs is essential. From funeral arrangements to estate settlements, having the right coverage can ease the burden on your loved ones.

Policy Conversion Options

When it’s time to make changes to your policy, don’t forget to explore the available options for converting it. Policy conversion can be a great way to adapt your coverage as your needs change over time. Whether you’re a young adult just starting out or a seasoned senior citizen, there are conversion options that can help ensure your life insurance continues to meet your evolving needs.

Check out this handy table below to see some common policy conversion options:

| Conversion Option | Description |

|---|---|

| Term-to-Permanent | Convert your term life insurance policy into a permanent one, providing lifelong coverage and potential cash value accumulation. |

| Decreasing-to-Level | If you have a decreasing term policy, convert it into a level term policy with consistent coverage throughout the duration of the policy. |

| Whole Life Flexibility | Convert your whole life insurance policy into one that offers more flexibility in premium payments or death benefits. |

Adjusting Beneficiaries and Payouts

If you want to adjust the beneficiaries and payouts on your policy, it’s important to review your options and consult with an expert who can provide guidance based on your specific circumstances.

Life insurance is like a delicious buffet of financial security, and you want to make sure everything is just right. Here are some things to consider:

-

Adjusting Beneficiaries: Life happens, relationships change. It’s crucial to update your beneficiaries as needed so that your loved ones are taken care of when the time comes.

-

Payout Options: Do you prefer a lump sum or regular installments? Maybe you’re feeling adventurous and want a mix of both! The choice is yours, but it’s good to explore different payout options that suit your current needs.

Remember, life insurance is all about providing peace of mind for you and those you care about. So take the time to adjust those beneficiaries and explore the payout options that work best for you.

Happy planning!

Making the Most of Your Life Insurance in Later Life

As you age, it’s important to maximize the benefits of your life insurance policy. Life is full of surprises, and having a solid life insurance plan can provide peace of mind for you and your loved ones. But how do you ensure that you’re making the most of your policy in later life? Let’s dive into some tips and tricks to help you navigate this stage with ease.

First things first, let’s talk about making life insurance claims. When the time comes, it’s crucial to understand the process and requirements for filing a claim. Familiarize yourself with the necessary documents and contact information so that when the need arises, you can swiftly initiate the claim without any hassle.

Now let’s focus on maximizing your policy benefits. Whether you have a term or whole life insurance policy, there are ways to make sure you’re getting the most out of it:

| Tips | Description | Benefits |

|---|---|---|

| Regular Policy Review | Evaluate if your coverage aligns with your needs | Adjustments for better protection |

| Consider Policy Riders | Enhance coverage by adding additional features | Tailor-made protection |

| Utilize Living Benefits | Access funds while alive in case of terminal illness | Financial support when it matters most |

| Explore Cash Value Options | Understand options like loans or surrendering | Additional financial flexibility |

| Seek Professional Advice | Consult an expert for personalized guidance | Expert insights tailored to your needs |

Frequently Asked Questions

What Are the Different Types of Life Insurance Policies Available for Young Adults?

When looking for life insurance as a young adult, you have several options. Term life insurance offers affordable protection for a specific period, while whole life insurance provides lifelong coverage and cash value. Consider your needs and budget when deciding.

How Can I Determine the Appropriate Amount of Life Insurance Coverage for My Family in My 30s and 40s?

You’re in your 30s and 40s, trying to figure out how much life insurance coverage your family needs. Evaluating insurance needs can be tricky, but with a little math and some thoughtful consideration, you’ll find the right amount.

What Factors Should I Consider When Selecting a Life Insurance Policy for My Growing Family?

When choosing life insurance for your family, consider factors like affordability and coverage options. Don’t worry, it’s not as complicated as it sounds. Just think about what you can afford and what kind of protection you want for your loved ones.

How Does Life Insurance Play a Role in Estate Planning for Empty Nesters?

When it comes to estate planning, empty nesters like you need to consider the role of life insurance. It can be a valuable financial tool for seniors, providing security and peace of mind.

What Are the Advantages of Long-Term Care Insurance for Seniors and How Does It Differ From Traditional Life Insurance Policies?

Long-term care insurance for seniors has advantages like covering costs of in-home care, nursing homes, and assisted living. It differs from traditional life insurance as it focuses on providing financial support for daily activities and healthcare needs in old age.

Conclusion

Congratulations on reaching the end of this whimsical journey through changing life insurance needs! You’ve learned how to navigate the ever-changing landscape of coverage options, from your vibrant youth to your golden years.

Remember, life insurance is like a magical safety net that can protect you and your loved ones in unexpected situations. So, embrace the enchantment of planning for the future and make sure you’re making the most of your life insurance as you embark on new adventures ahead.

Happy insuring!