Are you ready to embark on the journey of crafting your dream retirement?

Imagine this: like a skilled architect, you hold the power to design a future filled with financial security and endless possibilities.

In this step-by-step planning guide, we will show you how to assess your current situation, set clear goals, and create a realistic budget.

With our help, you’ll explore retirement savings options, maximize social security benefits, and diversify your investment portfolio.

Get ready to master the art of retirement planning!

Key Takeaways

- Assess your current financial situation and set realistic retirement goals.

- Create a realistic retirement budget by identifying essential expenses and exploring lifestyle adjustments.

- Explore different retirement savings options and maximize Social Security benefits.

- Implement diversification strategies to protect against market volatility and maximize investment returns.

Assessing Your Current Financial Situation

You need to take a close look at your current financial situation and determine where you stand before planning for your dream retirement. It’s time to assess how ready you are for this exciting chapter of your life.

Picture yourself sitting in a cozy armchair, sipping on a cup of tea, and pondering the possibilities that lie ahead. But before you can fully immerse yourself in this retirement bliss, it’s essential to evaluate your future income streams.

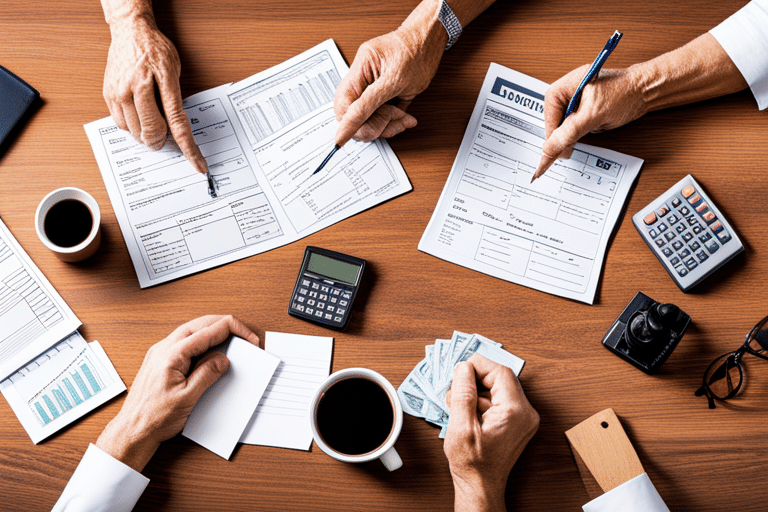

Assessing retirement readiness means taking stock of all the financial resources at your disposal. Start by examining your savings accounts, investments, and any other assets you may have accumulated over the years. Don’t forget to factor in any outstanding debts or mortgages that need to be considered as well.

Next, consider evaluating future income streams. This includes looking into sources such as pensions, Social Security benefits, and potential part-time employment opportunities during retirement. Think about what kind of lifestyle you envision for yourself – do you plan on traveling extensively or enjoying a quieter existence closer to home? Determining how much income you’ll need will help guide your decision-making process.

As you embark on this assessment journey, remember that mastery comes from understanding every aspect of your financial standing. Take the time to thoroughly review statements and consult with financial advisors if necessary. By doing so, not only will you gain clarity about where you currently stand financially but also set yourself up for a more secure and fulfilling retirement ahead.

Setting Clear Retirement Goals

So, you’ve assessed your current financial situation and now it’s time to dive into the nitty-gritty of setting clear retirement goals.

First up, let’s talk about defining your dream retirement lifestyle – picture yourself lounging on a tropical beach or exploring bustling cities.

Next, we’ll delve into establishing financial targets and milestones to ensure you’re on track for that dream getaway.

And last but certainly not least, we’ll emphasize the importance of prioritizing your health and wellness so you can fully enjoy all those golden years have to offer.

Ready to make your retirement dreams a reality? Let’s get started!

Defining Retirement Lifestyle

Take a moment to envision what your ideal retirement lifestyle looks like, and consider the activities and experiences that would bring you the most joy and fulfillment.

Picture yourself waking up with a smile on your face, knowing that the day ahead is filled with endless possibilities. Maybe you see yourself hiking through breathtaking landscapes, or perhaps you imagine sipping margaritas on a pristine beach.

Whatever it is, defining your retirement goals and creating a clear vision for your future can help guide you towards living the life of your dreams.

Imagine indulging in hobbies you never had time for before, spending quality time with loved ones, or even starting a new adventure. Retirement is not just about financial planning; it’s about crafting a fulfilling lifestyle that brings happiness every single day.

Financial Targets and Milestones

Set achievable financial targets and milestones to ensure a secure and comfortable retirement.

Picture this: you’re lounging on a tropical beach, sipping a piña colada, with not a care in the world. Ah, retirement bliss! But how do you get there? It all starts with smart financial planning.

Think of it as your own personal treasure map, leading you towards that golden pot of retirement savings.

First, set specific targets for your retirement nest egg. How much money will you need to live the life of luxury? Consider expenses like housing, healthcare, travel, and leisure activities. Break it down into smaller milestones along the way—a certain amount saved by age 40, another by 50—to keep yourself motivated.

Next comes the fun part: finding creative ways to save and invest. Explore different investment options like stocks, bonds, or real estate. Don’t be afraid to seek advice from experts who can guide you through the maze of financial jargon.

Prioritizing Health and Wellness

Finding ways to prioritize your health and wellness is crucial for a happy and fulfilling retirement. After years of hard work, it’s finally time to focus on yourself and ensure that you age gracefully. Healthy aging is not just about physical fitness, but also encompasses mental well-being and emotional stability. Retirement fitness should be approached with enthusiasm and creativity.

Imagine waking up in the morning, feeling energized and ready to seize the day! You could start by incorporating exercise into your daily routine – whether it’s going for a brisk walk, joining a yoga class, or trying out water aerobics. Engaging in regular physical activity will not only keep your body strong but also release those feel-good endorphins that boost your mood.

In addition to exercise, make sure you eat a balanced diet rich in fruits, vegetables, whole grains, and lean proteins. Stay hydrated by drinking plenty of water throughout the day. Don’t forget to nurture your mind as well – read books, solve puzzles, learn new skills; anything that keeps your brain sharp.

Retirement is an opportunity to explore hobbies you’ve always wanted to pursue. Whether it’s painting landscapes or playing an instrument – indulge in activities that bring you joy and stimulate your creativity.

Lastly, surround yourself with positive people who uplift you emotionally. Foster strong relationships with friends and family members who share similar interests.

Remember: healthy aging requires dedication but yields immense rewards. Prioritize your health and wellness today for a vibrant retirement tomorrow!

Creating a Realistic Retirement Budget

So, you’ve been dreaming about retirement and now it’s time to get down to the nitty-gritty of creating a realistic budget.

In this discussion, we’ll break down your essential expenses, explore the lifestyle adjustments and trade-offs you might need to make, and ultimately ensure long-term financial sustainability.

Don’t worry, we’ll guide you through this process with a dash of creativity, imagination, and maybe even a sprinkle of humor.

Let’s dive in!

Essential Expenses Breakdown

Once you’ve determined your necessary expenses, it’s important to break them down into categories. This will help you gain a clearer understanding of where your hard-earned money is going.

Here are four essential expense categories to consider when crafting your dream retirement:

-

Housing: Your mortgage or rent payment, property taxes, and home maintenance costs should be factored in here. After all, you want a cozy nest to enjoy your golden years.

-

Healthcare: As we age, healthcare becomes increasingly important. Include expenses such as insurance premiums, prescription medications, and regular check-ups with your doctor.

-

Transportation: Whether it’s car maintenance or public transportation fees, getting around is crucial for maintaining an active lifestyle during retirement.

-

Lifestyle: Don’t forget to indulge in the things that bring you joy! This category includes hobbies, travel expenses, dining out at fancy restaurants – whatever makes your heart sing!

Lifestyle Adjustments and Trade-Offs

Indulging in the things that bring you joy during retirement may require making lifestyle adjustments and trade-offs. But fear not, dear retiree, for with a little bit of creativity and imagination, you can navigate these modifications with ease. It’s all about finding the right balance between achieving your dreams and ensuring long-term financial sustainability.

Perhaps you’ve always dreamt of traveling the world, but now find yourself needing to downsize your living arrangements or cut back on other expenses. Don’t fret! This is an opportunity to declutter your life and focus on what truly matters – creating unforgettable memories.

Retirement sacrifices may feel daunting at first, but they are stepping stones towards a more fulfilling future. Remember, it’s not about giving up on your desires; it’s about finding alternative ways to achieve them while maintaining financial stability.

With this mindset, let us delve into the next section: ‘long-term financial sustainability,’ where we’ll explore strategies to ensure a secure and prosperous retirement.

Long-Term Financial Sustainability

Now that you’ve made those necessary lifestyle adjustments and trade-offs, it’s time to dive into the world of long-term financial sustainability. Don’t worry, I’m here to guide you through this exciting process! So put on your thinking cap and let’s get started.

-

Diversify, diversify, diversify: When it comes to retirement income, don’t put all your eggs in one basket. Explore different investment options like stocks, bonds, real estate, and mutual funds to spread out your risk and maximize potential returns.

-

Get professional advice: Consider consulting with a certified financial planner who can help you create a personalized investment strategy tailored to your goals and risk tolerance. They have the expertise to navigate the complex world of finance while keeping your best interests in mind.

-

Keep an eye on fees: Make sure you’re aware of any hidden fees associated with your investments. High fees can eat away at your returns over time, so choose low-cost index funds or exchange-traded funds (ETFs) whenever possible.

-

Stay informed: Keep up-to-date with market trends and economic news that may impact your retirement portfolio. Knowledge is power when it comes to making informed investment decisions.

With these investment strategies in mind, you’ll be well on your way to achieving long-term financial sustainability for the retirement of your dreams!

Exploring Retirement Savings Options

To explore retirement savings options, you should first evaluate your financial goals and determine which investment vehicles align with your long-term plans. Retirement income is a crucial aspect of enjoying your golden years, so it’s essential to choose the right investment strategies that will provide you with a comfortable lifestyle.

So, let’s dive into the exciting world of retirement savings! Picture this: on one side of our table, we have traditional options like 401(k) plans and Individual Retirement Accounts (IRAs). These tried-and-true investments offer tax advantages and steady growth over time. On the other side, we have more adventurous choices like real estate investments or starting your own business. These alternatives can potentially bring higher returns but may come with additional risks.

In column one, we’ll list the traditional options:

| Traditional Options |

|---|

| 401(k) Plans |

| Individual Retirement Accounts (IRAs) |

And in column two, let’s jot down some adventurous choices:

| Adventurous Choices |

|---|

| Real Estate Investments |

| Starting a Business |

Now, take a moment to reflect on your financial goals. Are you looking for long-term stability or are you open to taking calculated risks? Keep in mind that diversifying your portfolio is often recommended to balance potential gains and losses.

Maximizing Social Security Benefits

Are you aware that maximizing your Social Security benefits is a key aspect of securing a stable income during your retirement years? It’s true! By implementing the right strategies, you can increase your retirement income and make the most out of what Social Security has to offer. So, let’s dive in and explore some creative ways to maximize your Social Security benefits:

-

Delay claiming: Did you know that for each year you delay claiming your benefits past full retirement age, they increase by about 8%? That’s like giving yourself a raise without lifting a finger!

-

Coordinate with your spouse: If you’re married, coordinating when and how both of you claim Social Security benefits can lead to higher payouts for both of you. It’s like teamwork but with financial rewards.

-

Take advantage of spousal benefits: Even if you never worked or earned less than your spouse, you may still be eligible for spousal benefits based on their work record. It’s like getting a bonus just for being married!

-

Optimize tax planning: Believe it or not, how and when you withdraw from other retirement accounts can impact the taxes on your Social Security benefits. By strategically managing withdrawals, you can minimize taxes and keep more money in your pocket.

Maximizing your retirement income through effective strategies for increasing Social Security benefits is not only possible but also fun! So go ahead and put these tips into practice to ensure a financially secure and enjoyable retirement journey. You’ve got this!

Diversifying Your Investment Portfolio

Did you know that diversifying your investment portfolio is a smart way to minimize risk and maximize potential returns? It’s like having a buffet of investments, where you can pick and choose different options to create a well-rounded financial plan. Think of it as the Avengers team of investments – each member brings something unique to the table, making your portfolio stronger and more resilient.

Diversification strategies are all about spreading your eggs across different baskets. By investing in a variety of assets like stocks, bonds, real estate, and even commodities, you’re not putting all your money into one single investment. This helps protect you from the ups and downs of any particular market or industry.

Risk management is at the core of diversification. Just like how Thor uses his hammer to fend off enemies, diversification acts as your shield against potential losses. When one investment may be performing poorly, another could be thriving, effectively balancing out any negative impacts.

So how do you go about implementing these strategies? Well, it starts with understanding your goals and risk tolerance. You’ll want to assess how much volatility you can handle before losing sleep at night. Then, work with a financial advisor who can help tailor an investment mix that aligns with your unique needs.

As we move forward in planning for health care and long-term care expenses, remember that diversifying your investment portfolio is just one piece of the puzzle. By taking steps now to safeguard yourself financially through diversification strategies and risk management techniques, you’ll be better equipped to face whatever challenges lie ahead in this next phase of life.

Planning for Health Care and Long-Term Care Expenses

When considering health care and long-term care expenses, it’s important to evaluate your options and make informed decisions that align with your financial goals. Planning for healthcare savings and managing long-term care expenses may seem daunting, but with the right approach, you can ensure that you have a secure plan in place.

Here are four key steps to help you navigate this important aspect of retirement planning:

-

Start saving early: Begin setting aside funds specifically designated for healthcare expenses as soon as possible. By starting early, you give yourself more time to build up a substantial nest egg dedicated solely to covering medical costs.

-

Research insurance options: Look into different healthcare insurance plans and their coverage details. Consider factors such as premiums, deductibles, co-pays, and prescription drug coverage to find a plan that suits your needs while fitting within your budget.

-

Explore long-term care options: Long-term care can be costly but is often necessary in later stages of life. Investigate various options like home-based care, assisted living facilities, or nursing homes. Understanding the costs associated with each option can help you make an informed decision that meets both your financial requirements and personal preferences.

-

Consult professional advisors: Seek advice from financial planners who specialize in retirement planning or healthcare finance experts who can guide you through the intricacies of managing long-term care expenses. These professionals can provide valuable insights tailored to your specific situation.

Implementing a Comprehensive Estate Plan

Implementing a comprehensive estate plan involves consulting with an attorney to ensure that your assets are distributed according to your wishes after you pass away. But don’t worry, it’s not as daunting as it sounds! Think of it like creating a treasure map for your loved ones to follow when you’re no longer around. So grab your imagination and let’s dive into the world of estate planning strategies.

Firstly, you’ll want to consider legacy asset protection. This means safeguarding your hard-earned wealth for future generations. Picture this: you’ve built a castle from sand on the beach, and now you want to make sure it stands tall against the crashing waves of time. An attorney can help set up trusts or other structures that shield your assets from potential creditors or excessive taxes, ensuring they remain intact for your heirs.

But what about those sentimental items? That vintage record collection or antique pocket watch? These treasures may not have significant monetary value, but they hold great emotional worth. With proper estate planning strategies, you can designate specific beneficiaries for these items, ensuring they end up in the right hands – maybe even sparking joy in someone who will appreciate them as much as you do!

Remember, estate planning is like crafting a masterpiece; it takes time and careful consideration. A seasoned attorney will guide you through the process, helping navigate complex legal jargon and ensuring all necessary documents are in order.

Frequently Asked Questions

How Can I Determine the Best Age to Retire Based on My Financial Situation?

You can figure out the best age to retire by analyzing your financial situation. Crunch those numbers, consult with experts, and make a plan that fits your dreams and bank account.

What Are Some Creative Ways to Boost My Retirement Savings Apart From Traditional Savings Accounts and Investment Options?

Looking to boost your retirement savings? Get creative with alternative investments and side hustles. Did you know that 65% of retirees start a small business after retiring? Tap into your entrepreneurial spirit and watch your nest egg grow!

How Can I Minimize Taxes on My Retirement Income and Withdrawals?

Minimize taxes on your retirement income and withdrawals by exploring tax efficient investment strategies. Consider Roth IRA conversions as a way to potentially reduce future tax liabilities. Get creative, and dream of a tax-friendly retirement!

What Factors Should I Consider When Deciding Whether to Downsize My Home for Retirement?

Considering factors like location and cost are important when deciding whether to downsize your home for retirement. By downsizing, you can potentially simplify your life and free up funds for other adventures.

Are There Any Government Programs or Resources Available to Help Cover Long-Term Care Expenses in Retirement?

You’ll be glad to know that there are government programs available to help cover long-term care expenses in retirement. These resources can provide financial support and peace of mind for your golden years.

Conclusion

Congratulations! You’ve reached the end of this crafting journey towards your dream retirement. Like a skilled artist, you’ve painted a vivid picture of your financial future, carefully assessing where you stand and setting clear goals.

With your realistic budget as a guiding brushstroke, you explored different savings options and maximized those Social Security benefits like a master sculptor carving out the perfect form.

Your investment portfolio shines with diversity, like a dazzling kaleidoscope of colors. And with your comprehensive estate plan in place, you’ve built a sturdy foundation for lasting peace of mind.

Now sit back and admire your masterpiece – the picture-perfect retirement that awaits you!