Hey there, savvy consumer! Ever feel like you need a secret decoder ring just to understand those credit card offers? Well, fear not! In this article, we’ve got your back and we’re here to help you crack the code.

Whether it’s deciphering the terms and conditions or finding the perfect card for your needs, we’ll guide you through it all. So sit back, relax, and get ready to become a master of credit cards in no time.

Let’s dive in!

Key Takeaways

- Read the terms and conditions carefully before applying for a credit card.

- Avoid credit cards with high fees or no rewards.

- Consider your spending habits and financial goals when choosing a credit card.

- Understanding interest rates and APR is crucial when selecting a credit card.

Understanding Credit Card Terms and Conditions

You should read the terms and conditions carefully before applying for a credit card. I know, I know, reading through those long documents can be as fun as watching paint dry. But trust me, it’s worth it! You don’t want to end up with a credit card that charges you an arm and a leg in fees or doesn’t offer any rewards at all.

Let’s start with credit card rewards programs. These little gems are like a pot of gold at the end of the rainbow. Some credit cards offer cash back on purchases, while others give you points that you can redeem for travel or merchandise. Imagine getting rewarded just for buying things you would have bought anyway! It’s like having your cake and eating it too.

Now, let’s talk about understanding credit card fees. Nobody likes fees, but unfortunately, they’re a part of life when it comes to credit cards. Make sure you know what you’re getting into before signing up. Look out for annual fees, late payment fees, balance transfer fees – the list goes on! By knowing what these fees are upfront, you can avoid any surprises down the road.

So now that we’ve covered understanding credit card rewards programs and fees, let’s move on to the next exciting topic: types of credit cards available.

See how easy that was? Now grab yourself a cup of coffee (or tea if that’s your jam) and get ready for more fascinating insights into the world of plastic money!

Types of Credit Cards Available

There’s a wide range of credit cards available to choose from. It can be overwhelming trying to navigate through all the options and find the right one for you. But fear not, dear credit card seeker! I’m here to break it down for you in a fun and easy way.

Let’s start by comparing different types of rewards programs and see which one suits your fancy. Take a look at this handy-dandy table:

| Rewards Program | Description |

|---|---|

| Cash Back | Earn cash back on every purchase, usually a percentage of what you spend. Who doesn’t love free money? |

| Travel Rewards | Earn points or miles that can be redeemed for flights, hotels, or other travel-related expenses. Bon voyage! |

| Points | Earn points that can be used for various rewards like gift cards, merchandise, or even experiences like concert tickets. Party time! |

| Gas Rewards | Earn extra rewards when you fill up at the pump. Say goodbye to those pesky gas prices! |

| Dining Rewards | Earn extra rewards when you dine out at participating restaurants. Treat yourself to some delicious meals! |

Now that we’ve covered rewards programs, let’s talk about comparing credit card fees. Nobody likes fees, but they’re sometimes unavoidable when it comes to credit cards. Here are some common ones:

- Annual Fee: This is an annual charge just for having the card.

- Late Payment Fee: If you miss a payment deadline, brace yourself for this fee.

- Balance Transfer Fee: Moving your balance from one card to another? Be prepared for this fee.

- Foreign Transaction Fee: Planning on using your card overseas? Watch out for this fee.

- Overlimit Fee: If you exceed your credit limit, get ready for this unpleasant surprise.

How to Choose the Right Credit Card for You

When choosing the right credit card for you, it’s important to consider your spending habits and financial goals. With so many options out there, it can be overwhelming to figure out which one is the best fit. But fear not, my friend! I’m here to help you navigate through the maze of credit card offers and find the perfect plastic companion for your wallet.

-

Comparing credit card benefits: Take a look at what each credit card has to offer in terms of rewards and perks. Do you love traveling? Look for a card that offers airline miles or hotel points. Are you a shopaholic? Find a card with cash back or discounts at your favorite stores. Don’t forget to consider any special promotions or sign-up bonuses too!

-

Evaluating annual fees and rewards programs: Some cards may have an annual fee attached, while others don’t charge anything at all. Remember that if a card comes with an annual fee, make sure the benefits outweigh the cost. Additionally, pay attention to how rewards are earned and redeemed – some programs may have restrictions or expiration dates.

-

Understanding interest rates and fees: While we’re on the topic of fees, be sure to check out the APR (annual percentage rate) on each credit card you’re considering. This is important if you tend to carry a balance from month-to-month because higher interest rates mean more money out of your pocket in the long run.

Interest Rates and APR: What You Need to Know

Understanding interest rates and APR is essential when selecting a credit card that fits your financial needs. But don’t worry, we’ve got your back! We’ll break it down for you in the simplest terms possible. So grab a cup of coffee and let’s dive right in!

First things first, let’s talk about interest rates. Now, imagine this – you’re at a party and someone hands you a plate full of delicious snacks. You can gobble them up now or save some for later. Interest works the same way! It’s like the extra snack you have to pay when you carry a balance on your credit card.

Speaking of carrying balances, APR (Annual Percentage Rate) is the real deal here. It’s like the big brother of interest rates. APR includes not only the interest but also any additional fees or charges associated with your credit card. So when comparing credit cards, make sure to look at that shiny APR number!

Now, let’s add a twist to this story – credit card rewards! Think of it as an added bonus for being responsible with your spending. Some credit cards offer cashback on purchases or points that can be redeemed for awesome goodies like travel discounts or gift cards.

So there you have it – understanding interest rates and APR is crucial when choosing the perfect credit card for yourself. Just remember to keep an eye on those numbers and always read the fine print before signing up for anything.

Now go out there and conquer the world of credit cards like a true master! Happy swiping!

Credit Limits and Utilization: Maximizing Your Spending Power

So, you’ve got yourself a shiny new credit card and you’re ready to start swiping away. But hold on just a sec, because there’s more to it than meets the eye!

In this discussion, we’ll dive into the world of credit limits and utilization, exploring how finding that sweet spot can maximize your spending power.

We’ll also touch on the magic of increasing your credit limit and the impact it can have on your oh-so-important credit score.

Optimal Credit Utilization

To maximize your credit score, you’ll want to keep your credit utilization ratio below 30%. This means using no more than 30% of your available credit.

Why is this important? Well, a high credit utilization ratio can signal to lenders that you’re relying too heavily on borrowed funds.

So, here are three credit utilization strategies to help you optimize your score and unlock those sweet rewards:

-

Spread the love: Instead of maxing out one card, try spreading your purchases across multiple cards. This way, you’ll keep each card’s balance low and maintain a healthy utilization ratio.

-

Pay it off (almost) in full: Aim to pay off most of your balance each month. By doing so, you’ll show responsible borrowing habits and keep that utilization ratio in check.

-

Request a limit increase: If you’ve been a responsible borrower, don’t be afraid to ask for a higher credit limit. This will instantly lower your utilization ratio without any extra effort on your part.

Increasing Credit Limit

Now that you’ve learned how to optimize your credit utilization, let’s talk about increasing your credit limit. You know, that magical number that determines how much money you can charge on your card without maxing it out. Increasing your credit limit can be like getting a shiny new toy – more purchasing power! But remember, with great power comes great responsibility.

To start, call up your credit card company and ask if they’re willing to increase your limit. Make sure to mention how responsible you’ve been with your payments and how you plan on managing the increase wisely. They might just grant your wish!

But hold up! Don’t go on a spending spree just because you have a higher limit. Stick to the same principles of managing your credit utilization that we discussed earlier. Keep those balances low and pay off what you owe each month.

With an increased credit limit and smart management of your credit utilization, you’ll be wielding some serious financial superpowers!

Impact on Credit Score

Remember, keeping your credit utilization low and managing your increased credit limit responsibly can have a positive impact on your credit score. So, how exactly does it work?

Let’s break it down for you:

-

Credit Utilization: This refers to the percentage of your available credit that you’re actually using. The lower this number, the better it is for your score. Aim to keep it below 30% to show lenders that you’re responsible with your borrowing.

-

Increased Credit Limit: When you get a higher credit limit, it means you have more available credit at your disposal. This can help improve your credit utilization ratio, as long as you don’t go on a spending spree and max out those extra funds.

-

Positive Impact on Score: By keeping your credit utilization low and managing an increased credit limit wisely, you demonstrate financial responsibility. Lenders see this and view you as less risky, which can lead to a higher credit score over time.

Rewards Programs: Navigating the Benefits and Pitfalls

Understanding rewards programs can be tricky, but let me tell you, they offer some seriously awesome benefits for us consumers. I mean, who doesn’t want to earn free flights or cash back just by swiping their credit card? It’s like getting a little treat every time you make a purchase.

But before you dive headfirst into the world of rewards programs, there are a few things you need to know to maximize those sweet perks and avoid any sneaky fees.

First up, let’s talk about maximizing rewards. This is where the real magic happens. Different credit cards offer different types of rewards – from travel points to cash back – so it’s important to choose one that aligns with your spending habits and goals. If you’re a frequent flyer, go for a card that gives you miles for every dollar spent. And if you’re more of a homebody (like me), look for one that offers cash back on everyday purchases like groceries or gas.

Now, onto the not-so-fun part: fees. While rewards programs can save you money in the long run, some credit cards come with pesky annual fees or foreign transaction fees that can eat into your earnings. So be sure to read the fine print and choose wisely. If you’re someone who rarely travels internationally, it might not be worth paying extra for a card with foreign transaction fees.

Annual Fees: Are They Worth It

Annual fees can be a deciding factor when choosing a rewards credit card. After all, who wants to pay an annual fee just to earn some cashback rewards? But before you dismiss the idea altogether, let’s take a closer look at the pros and cons of cashback rewards and the value of evaluating annual fees.

Here are three things to consider:

-

Pros of Cashback Rewards: Let’s face it, who doesn’t love getting money back on their purchases? Cashback rewards can help offset your spending, making it feel like you’re getting a little something extra for every swipe. Whether it’s 1% or 5%, those dollars add up over time.

-

Cons of Cashback Rewards: While earning money back sounds great, it’s important to remember that not all purchases qualify for cashback rewards. Some cards may have specific categories where you can earn higher cashback percentages, while others may limit your earnings to certain merchants. Be sure to read the fine print before signing up.

-

Evaluating Annual Fee Value: When considering a credit card with an annual fee, think about how much you spend each year and calculate if the potential cashback earnings will outweigh that fee. If you’re someone who spends big on groceries or travel, a card with higher cashback percentages might make sense even with an annual fee. However, if your spending habits don’t align with the card’s reward structure or if the fee is too high, it may be best to opt for a no-fee option instead.

Introductory Offers and Promotional Rates: What to Watch Out For

Now that you’re an expert on annual fees and whether they’re worth it or not, let’s talk about something a little more exciting – introductory offers and promotional rates!

Ah yes, those seemingly irresistible deals that credit card companies dangle in front of us like juicy carrots. But be warned, my eager friend, there may be hidden fees lurking beneath the surface.

Picture this: You spot a credit card offer with a flashy headline screaming ‘0% APR for the first 12 months!’ Sounds amazing, right? Well, before you go jumping for joy and signing up faster than a cheetah chasing its prey, take a deep breath and read the fine print.

Hidden fees can be sneaky little devils. They hide behind words like ‘balance transfer fee’ or ‘annual membership fee.’ And trust me when I say they can quickly turn your dream deal into a financial nightmare. So what should you do? Arm yourself with knowledge!

First things first, always read the terms and conditions (yes, I know they’re as thrilling as watching paint dry). Look for any mention of hidden fees or charges that might rear their ugly heads once the introductory period is over. Pay close attention to any changes in interest rates too – because no one likes surprises when it comes to money!

And remember, just because an offer seems too good to be true doesn’t mean it actually is. So don’t let those flashy introductory offers blind you from seeing the potential pitfalls. Trust your gut instincts and stay vigilant in decoding those credit card offers – after all, mastering them will save you from unnecessary headaches down the line!

Balance Transfers: Pros and Cons

Before you dive headfirst into a balance transfer offer, take a moment to consider the pros and cons. Sure, it may seem like the perfect way to save some money and get rid of that pesky credit card debt, but is it really worth it? Let’s break it down for you.

First off, let’s talk about the pros.

-

Save on interest: One of the biggest advantages of a balance transfer is the potential to save on interest charges. By transferring your high-interest credit card debt to a card with a lower or even zero-percent introductory rate, you can pay off your debt faster and save some dough in the process.

-

Simplify your finances: If you’re juggling multiple credit cards with different due dates and interest rates, consolidating your debts through a balance transfer can help simplify your financial life. With just one payment to worry about each month, you can focus on paying down your debt rather than keeping track of various bills.

-

Credit card rewards: Some balance transfer offers come with additional perks like credit card rewards or cashback incentives. So not only can you save on interest charges, but you might also earn some sweet rewards along the way.

Now onto the cons.

- Balance transfer fees: While many offers boast low or even zero-percent introductory rates, they often come with balance transfer fees that can eat into any potential savings. Make sure to read the fine print before jumping in – those fees could outweigh any benefits.

Cash Advances: When to Use Them Wisely

So, you’ve found yourself in a bit of a pickle and need some extra cash to get through. Don’t worry, we’ve all been there! But before you rush off to get a cash advance, let’s talk about responsible usage, avoiding those pesky high interest rates, and when it’s actually appropriate to use this emergency financial option.

Because hey, sometimes life throws us curveballs and we just need a little help getting back on track.

Responsible Cash Advance Usage

When considering a cash advance on your credit card, it’s important to understand responsible usage. Here are three tips to help you make the most of this option:

-

Evaluate your emergency funds: Before taking a cash advance, assess your emergency fund situation. If you have enough saved up to cover unexpected expenses, it may be wiser to dip into those funds instead of resorting to a cash advance.

-

Utilize cash management strategies: Managing your cash flow is crucial when using a credit card for a cash advance. Make sure you have a plan in place to pay off the borrowed amount quickly and avoid accumulating unnecessary interest charges.

-

Use it as a last resort: Cash advances should be reserved for true emergencies only. It’s tempting to use them for frivolous expenses, but remember that the high interest rates and fees can quickly add up.

Avoiding High Interest

If you want to avoid high interest charges on your cash advance, it’s essential to pay off the borrowed amount as quickly as possible. Let’s face it – nobody wants to pay more than they have to. So, here are some tips for keeping those interest charges at bay.

First and foremost, make sure you understand the terms of your credit card agreement. Look for any introductory rates or special offers that can help minimize those fees.

Secondly, try to maximize your rewards while paying off the cash advance. Some credit cards offer points or cash back on certain purchases, so take advantage of those opportunities.

Lastly, don’t forget about balance transfer options. If you have other high-interest debt, consider transferring the balance from your cash advance onto a lower interest rate card.

Emergency Cash Situations

During unexpected financial emergencies, it’s crucial to have access to emergency cash. Whether it’s a sudden car repair or an unexpected medical expense, having a safety net can save the day.

Here are three options to consider when you find yourself in need of quick funds:

-

Emergency Fund: Having a designated fund set aside for unforeseen circumstances can provide peace of mind and immediate access to cash when you need it most.

-

Credit Cards: While not ideal for long-term borrowing, credit cards can be a useful tool in emergency situations. Just remember to pay off the balance as soon as possible to avoid high interest charges.

-

Personal Loans: If your credit score is in good shape, taking out a personal loan can offer lower interest rates compared to credit cards. Shop around and compare different lenders to find the best terms for your situation.

Late Fees and Penalty APR: Avoiding Unnecessary Costs

To avoid unnecessary costs, you should always be aware of late fees and penalty APRs when using a credit card. Nobody wants to pay extra for something that could have been easily avoided, right? So let’s dive into the world of late fees and penalty APRs and learn how to manage them like a pro.

Late fees are those pesky charges that you incur when you don’t make your credit card payment on time. They can range from a few dollars to even up to $40 or more! Ouch! To avoid these, it’s important to stay on top of your due dates and make sure you pay your bills promptly. Set reminders on your phone, put sticky notes all over your house – do whatever it takes!

Now, let’s talk about penalty APRs. These are the interest rates that get slapped onto your balance when you miss payments consistently. They can be as high as 30% or more, which is just outrageous! Imagine paying so much extra just because life got in the way and you missed a few payments. It’s like getting penalized for being human!

To help you understand the impact of late fees and penalty APRs, here’s a handy table:

| Late Fee | Penalty APR |

|---|---|

| $25 | 29% |

| $35 | 27% |

| $40 | 25% |

As you can see, missing payments can really add up quickly. So remember: avoiding late payments is key to managing those dreaded penalty fees. Keep an eye on those due dates and stay organized with your finances. Your wallet will thank you later!

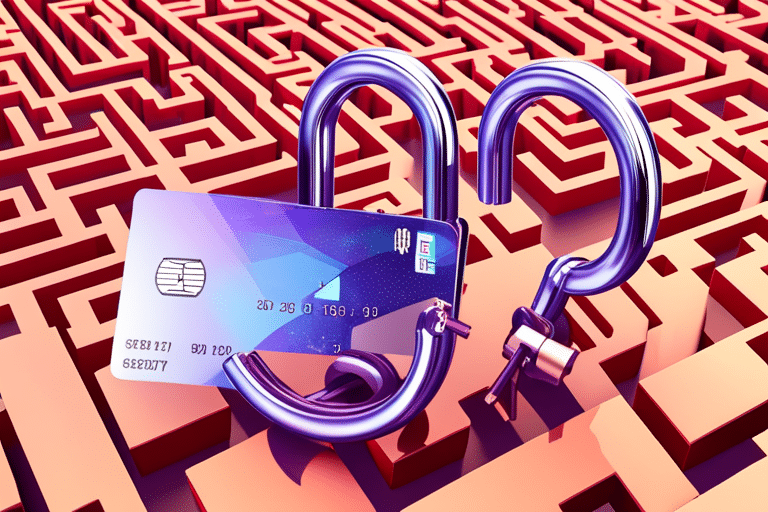

Credit Card Security: Protecting Your Personal Information

Hey there, savvy cardholder! We hope you’re enjoying our crash course on credit cards. Last time, we delved into the world of late fees and penalty APRs – those sneaky costs that can catch you off guard. But now, let’s switch gears and talk about something equally important: credit card security.

-

Keep an Eye on Your Statements: This might sound like a no-brainer, but you’d be surprised at how many people forget to check their monthly statements. By reviewing your charges regularly, you can quickly spot any suspicious activity and report it right away. Remember, prevention is key!

-

Beware of Phishing Scams: You know those emails from ‘your bank’ asking for personal information? Yeah, those are often phishing scams trying to steal your sensitive data. Never share your credit card details through email or phone calls unless you initiated the contact yourself.

-

Stay Updated on Data Breaches: Unfortunately, data breaches have become all too common these days. Stay informed about any major breaches in the news so you can take necessary precautions if your information has been compromised. And hey, don’t worry – it’s not as scary as it sounds! Just stay vigilant and informed.

Credit card fraud prevention and data breach protection are essential for keeping your personal information safe in today’s digital age. By following these simple steps and staying alert, you’ll be well-equipped to navigate the ever-evolving landscape of credit card security.

Alrighty then! Get ready for our next subtopic where we’ll dive into rewards programs – the cherry on top of this financial sundae! So grab a cuppa joe (or tea) and get ready to earn some sweet rewards with every swipe!

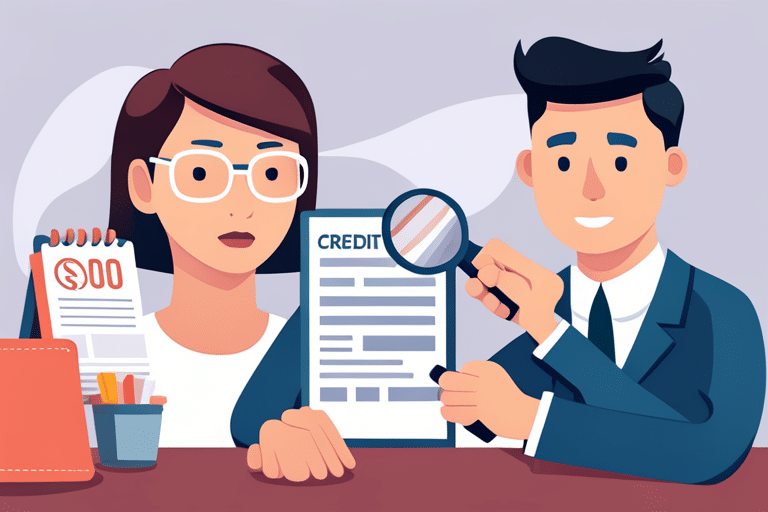

Building and Improving Your Credit Score With Credit Cards

Make sure you’re making timely payments on your credit card to build and improve your credit score. Building a strong credit history is essential for financial success, and one of the most effective ways to do this is by using credit cards responsibly.

But how exactly does it work? Let’s dive into the world of building credit with credit cards!

To understand how credit cards can help you build your credit, let’s take a look at two key factors: building credit history and managing your credit utilization ratio.

Building Credit History:

Creditors want to see a track record of responsible borrowing before they lend you money. By consistently making on-time payments on your credit card, you show them that you are reliable and trustworthy. This builds a positive credit history over time, which can open doors for better loan terms in the future.

Managing Credit Utilization Ratio:

Your credit utilization ratio is the amount of available credit you’re using compared to your total available credit limit. It’s important to keep this ratio low because it shows lenders that you’re not maxing out your cards and are managing your debt responsibly. Aim to keep it below 30% for optimal results.

By incorporating these practices into your financial routine, you’ll be well on your way to building an impressive credit score. Remember, Rome wasn’t built in a day! It takes time and consistency but rest assured that every small step counts towards achieving mastery over your finances.

Now go forth, conquer those timely payments, and watch as that shiny new car or dream home becomes closer within reach! Happy building!

Credit Card Disputes: Resolving Billing Errors and Fraudulent Charges

So, you’ve noticed some suspicious charges on your credit card statement, huh? Don’t panic!

In this discussion, we’ll dive into the world of credit card disputes and how to tackle those pesky unauthorized transactions.

We’ll also explore how to navigate billing error disputes and protect yourself against fraudulent charges.

Let’s get ready to fight for our hard-earned money!

Unauthorized Transactions Resolution

If you notice any unauthorized transactions on your credit card statement, you should immediately contact your credit card issuer. Nobody wants mysterious charges popping up on their bill like uninvited guests at a party. So, don’t panic! Your credit card issuer has got your back and is ready to assist you in resolving this issue.

Here’s what you need to do:

-

Call the hotline: Pick up that phone and give your credit card issuer a ring. They’ll guide you through the process of reporting the unauthorized transaction and launching an investigation.

-

Provide necessary information: Be prepared to share details about the transaction, such as the date, amount, and merchant involved. The more information you provide, the easier it will be for them to resolve the dispute.

-

Stay vigilant: While your credit card company investigates, keep a close eye on your account for any further unauthorized activity.

Billing Error Disputes

Now that we’ve resolved unauthorized transactions, let’s tackle the next issue: billing error disputes.

Ah, the dreaded moment when you open your credit card statement and see charges that make no sense. It’s like trying to decipher hieroglyphics! But fear not, my friend, because disputing charges and resolving billing errors is simpler than it seems.

First things first, carefully go through your statement and circle any suspicious charges with a bright red pen (or just mentally mark them if you prefer). Then, reach out to your credit card issuer immediately. They’ll guide you through the process of filing a dispute and may even offer temporary credit while they investigate.

Remember, mastering this skill will protect your hard-earned money from slipping away due to pesky billing errors.

Now that you’re an expert at resolving billing errors, let’s move on to the next exciting topic: fraudulent charge protection.

Fraudulent Charge Protection

Resolving billing errors is important, but another vital topic to address is how to protect yourself from fraudulent charges. We all love the convenience of using credit cards, but it’s crucial to stay vigilant and safeguard your hard-earned money. Here are three essential tips to help you stay one step ahead of fraudsters:

-

Monitor your transactions: Keep a close eye on your credit card statements and online banking activity. Report any suspicious charges immediately.

-

Enable alerts: Take advantage of the notification features offered by your credit card company or bank. Get instant updates whenever there’s a transaction on your account.

-

Understand the chargeback process: Familiarize yourself with how chargebacks work so that you can dispute unauthorized charges effectively if they occur.

Responsible Credit Card Use: Tips for Managing Your Finances Effectively

Managing your finances effectively is crucial when it comes to responsible credit card use. It’s all about being mindful of your spending and making sure you have a plan in place to repay any debts responsibly. To help you on your journey to financial mastery, here are some tips for managing your finances effectively:

First and foremost, create a budget specifically for your credit card expenses. This will ensure that you’re not overspending and can afford to make timely payments. By allocating a certain amount each month towards your credit card bills, you’ll be able to keep track of how much you owe and avoid any surprises.

To give you an idea of what this could look like, check out the table below:

| Category | Monthly Budget |

|---|---|

| Groceries | $200 |

| Dining Out | $100 |

| Entertainment | $50 |

| Transportation | $150 |

| Miscellaneous | $75 |

By setting aside these amounts each month, you’ll have a clear understanding of how much money is available for each category. This way, you won’t find yourself swiping away without considering the consequences.

Another important aspect of responsible credit card use is making timely repayments. Missing payments can lead to late fees and negatively impact your credit score. So always make sure to pay at least the minimum amount due by the due date. If possible, aim to pay off the full balance every month to avoid accumulating interest charges.

Frequently Asked Questions

Are There Any Legal Protections for Consumers in Case of Credit Card Fraud?

If you’re worried about credit card fraud, don’t fret! You’ve got legal remedies to protect your consumer rights. So relax and shop till you drop, knowing you’re covered if anything goes wrong!

Can I Use My Credit Card to Withdraw Cash From an Atm?

Sure, you can use your credit card to withdraw cash from an ATM. But watch out for those sneaky ATM withdrawal fees! Be smart and check your credit card terms before making a cash advance.

How Can I Dispute a Billing Error or Fraudulent Charge on My Credit Card?

To dispute a billing error or fraudulent charge on your credit card, start by investigating the truth of the matter. Then, follow the dispute process provided by your credit card company and promptly report any fraud. Happy detective work!

What Are the Consequences of Making Late Payments on My Credit Card?

Late payments on your credit card can have serious consequences. Your credit score will take a hit, and you may be charged hefty late fees. So pay on time and avoid the stress!

Are There Any Tips for Effectively Managing My Credit Card Expenses and Avoiding Debt?

Want to avoid drowning in credit card debt? Follow these tips: create a budget, track your expenses, and resist impulse buys. Build good credit by paying off balances each month. You got this!

Conclusion

Well, congratulations! You’ve made it to the end of this credit card decoding adventure. Now that you’re armed with all this knowledge about credit card offers, terms, and security, you can confidently navigate the financial waters like a pro.

Remember, nothing says fun quite like understanding interest rates and APRs! So go forth and conquer those credit limits, protect your personal info like a secret agent, and build that oh-so-coveted credit score.

Just remember to use those cards responsibly – because what’s life without a little irony?

Happy swiping!