Imagine this: you’re standing at the checkout counter, about to make a purchase with your credit card. But wait! Before you swipe that plastic, have you ever stopped to think about all the perks and extra features your card offers? Don’t worry, we’ve got your back.

In this article, we’ll teach you how to evaluate those hidden gems so you can maximize the benefits and become a true credit card connoisseur. Get ready to unlock a world of rewards and start mastering the art of credit cards!

Key Takeaways

- Understand the rewards programs and redemption process of different credit cards

- Evaluate the perks and benefits of credit cards based on your interests and spending habits

- Consider the impact of annual fees and compare rewards and cash back offers from different cards

- Look for credit cards with no foreign transaction fees and travel benefits that enhance your travel experience

Rewards Programs

You should consider the rewards programs offered by different credit cards. After all, who doesn’t love getting rewarded for simply using their card? It’s like a little pat on the back every time you swipe.

So, let’s dive into the world of rewards redemption and points systems.

When evaluating credit card perks, it’s important to understand how the rewards redemption process works. Some cards offer straightforward cashback options, where you earn a certain percentage of your purchases back as cash. Others may have more complex points systems, where you accumulate points that can be redeemed for various goodies like travel vouchers or merchandise.

Now, here comes the fun part: finding creative ways to maximize your rewards! Think outside the box and explore different strategies to make those points work for you. Maybe you’ll discover a hidden gem in the fine print – an opportunity to earn bonus points through partner offers or by taking advantage of limited-time promotions.

To truly master this game, it’s crucial to stay organized. Keep track of your reward balances and expiration dates so that none of those hard-earned points go to waste. And don’t forget to read up on any restrictions or limitations that may apply when redeeming your rewards – after all, knowledge is power!

Sign-Up Bonuses

So, you’ve finally signed up for that rewards program and now you’re wondering if it’s actually worth the effort. Well, fear not my friend, because I’m here to tell you all about the redemption options available to make sure you get the most bang for your buck!

From cash back to travel perks and everything in between, there are plenty of ways to redeem those hard-earned points and make them work for you.

Worth the Effort

It’s important to determine if the perks and extra features of a credit card are worth the effort.

Let’s be real, who doesn’t love free stuff? But before jumping on the credit card bandwagon, you need to ask yourself: are you maximizing rewards or just piling up unnecessary stress?

Take a step back and evaluate those perks like a pro. Don’t settle for anything less than what you deserve. Look for cards that align with your interests – maybe one that gives you points for your online shopping addiction or cashback on your food delivery splurges.

Redemption Options Available?

Take a look at the various options available for redeeming your rewards.

Now, I know what you’re thinking – ‘Redemption process? Rewards value? Sounds like a snooze fest!’ But fear not, my friend, because this is where things get interesting.

When it comes to redeeming those hard-earned rewards, you’ve got choices aplenty. Think of it as your own personal buffet of perks and goodies.

You can go for the classic option of cash back – cold hard moolah in your pocket. Or perhaps you fancy treating yourself with some fancy flights or luxurious hotel stays.

And let’s not forget about the ever-popular gift cards – perfect for spoiling yourself or someone special.

Annual Fees

When considering credit card perks and extra features, you should evaluate the annual fees associated with each card. Annual fees can vary greatly from one credit card to another, and it’s important to weigh the benefits against the cost. To help you make an informed decision, here is a comparison of rewards and cash back offers from different cards:

| Credit Card | Annual Fee | Rewards Program | Cash Back Offer |

|---|---|---|---|

| Card A | $0 | Points | 1% |

| Card B | $99 | Miles | 2% |

| Card C | $49 | Cash Back | 1.5% |

As you can see, there are various options available when it comes to credit card perks. While some cards offer no annual fee, others may charge a higher fee but provide more lucrative rewards or cash back offers.

Card A has no annual fee and offers a points-based rewards program. This could be a good choice if you prefer accumulating points for travel or merchandise.

Card B has an annual fee of $99 but provides miles as part of its rewards program. If you frequently travel and value airline miles, this card might be worth considering.

Card C charges an annual fee of $49 but offers a cash back program with a higher percentage of 1.5%. If maximizing your cash back is your priority, this card could be the right fit for you.

Remember that while these numbers give you an idea of what each card offers, it’s essential to consider your own spending habits and preferences before making a decision.

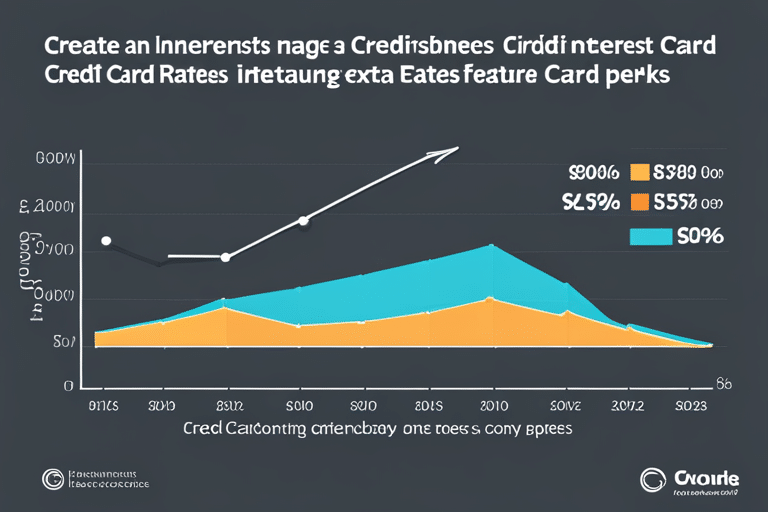

Interest Rates

Ah, interest rates. The topic that makes your eyes glaze over and your brain go into hibernation mode. But fear not, dear credit card aficionado, for I am here to make this seemingly dull subject as exciting as a roller coaster ride.

You see, interest rates are the bane of our existence when it comes to credit cards. They can make or break our financial dreams faster than you can say ‘compound interest’. So let’s dive right in and uncover the mysteries of these little numbers:

-

Watch out for introductory rates: Ah, those sneaky little devils! Credit card companies love to lure you in with low introductory rates that skyrocket after a few months. Don’t fall for their tricks – read the fine print before committing!

-

Utilization matters: Did you know that your credit utilization plays a role in determining your interest rate? Yep, it’s true! The higher your credit utilization (i.e., how much of your available credit you’re using), the more likely you’ll be slapped with a higher interest rate. Keep those balances low to keep those rates down!

-

Shop around for better deals: Just like finding the perfect pair of shoes requires some serious browsing, finding the best interest rate on a credit card takes time and effort too! Don’t settle for just any old offer – compare different options and find one that suits your needs.

Foreign Transaction Fees

Don’t let those foreign transaction fees sneak up on you – they can quickly add up and put a damper on your travel budget. We all know that feeling of excitement when planning a trip abroad, but the last thing you want is to be hit with unexpected fees every time you swipe your credit card.

So, how can you avoid these pesky charges? Well, my friend, it’s time to do some credit card research.

When it comes to foreign transaction fees, not all cards are created equal. Some cards charge a hefty fee for every purchase made outside of your home country, while others offer no foreign transaction fees at all. That’s right, zero! So before embarking on your next adventure, make sure to look for a credit card that doesn’t penalize you for exploring new lands.

But wait, there’s more! As if avoiding foreign transaction fees wasn’t enough of a perk, many credit cards also offer balance transfer offers. These nifty deals allow you to transfer existing balances from higher interest rate cards onto a new card with lower or even 0% interest for an introductory period. It’s like giving your finances a much-needed breath of fresh air!

Now that we’ve tackled those sneaky foreign transaction fees and enticing balance transfer offers, let’s move on to the exciting world of travel benefits. After all, why settle for just saving money when you can also enjoy exclusive perks like airport lounge access and complimentary travel insurance? Buckle up and get ready to discover the amazing rewards waiting for you in the next section!

Travel Benefits

So, you’ve finally decided to embark on a grand adventure and explore the world. Well, my friend, let me tell you about the best travel credit cards and their hidden perks that will make your journey even more incredible!

These little gems not only offer fantastic rewards for your spending but also come with secret goodies like airport lounge access and travel insurance.

Get ready to unlock a world of possibilities with these amazing travel companions!

Best Travel Credit Cards

If you’re looking for the best travel credit cards, you’ll want to consider their bonus points, airline partnerships, and travel insurance coverage. But don’t worry, we’ve got your back! Here are three top-notch options that will make your wanderlust heart sing:

-

The Wanderer Card: With its generous sign-up bonus and flexible redemption options, this card is perfect for students itching to explore the world without breaking the bank.

-

The Guardian Card: Safety first! This card not only offers amazing rewards but also comes with robust credit card fraud prevention measures to keep your hard-earned money secure during your travels.

-

The Jetsetter Card: If you’re a frequent flyer, this card’s airline partnerships will have you jetting off in no time. Plus, it offers comprehensive travel insurance coverage for those unexpected hiccups along the way.

Now that you know which cards pack a punch in terms of benefits and security measures, let’s dive into some hidden travel perks that could take your adventures to the next level.

Hidden Travel Perks

Let’s explore some lesser-known travel perks that can enhance your adventures.

Choosing the right perks for your journey can make all the difference in creating a truly memorable experience. And hey, who doesn’t love a little extra something when they’re globe-trotting?

First up, we have hidden travel perks. These are the secret gems that lurk beneath the surface, waiting to be discovered by savvy travelers like you. Think free airport lounge access, complimentary hotel upgrades, or even exclusive discounts on activities and attractions. It’s like finding buried treasure!

But how do you know which perks to choose? Well, it all comes down to what floats your boat. Are you a foodie? Look for credit cards with dining rewards and culinary experiences as part of their perk package. Adventure junkie? Seek out cards that offer travel insurance for those adrenaline-fueled excursions.

So go ahead, dig deep and uncover those hidden travel perks that will take your adventures to new heights!

Happy exploring!

Purchase Protection

When you’re evaluating credit card perks and extra features, don’t forget to consider the purchase protection offered. It may not sound as exciting as free flights or cashback rewards, but trust me, it can save your bacon when things go wrong.

Here are three reasons why purchase protection is worth your attention:

-

Extended Warranty: Imagine this: you finally splurge on that brand-new gadget you’ve been eyeing for months. But then, disaster strikes and it stops working just a few weeks after the manufacturer’s warranty expires. Cue the tears and frustration. Thankfully, some credit cards offer extended warranties that extend the coverage period for eligible purchases, providing you with peace of mind and potentially saving you from costly repairs or replacements.

-

Price Protection: Ah, the joy of finding a better deal on something you just bought! With price protection, certain credit cards will refund you the difference if an item goes on sale within a specific time frame after your purchase. It’s like having a personal shopping assistant who ensures that you always get the best price.

-

Damage and Theft Protection: Accidents happen, whether it’s dropping your phone in a puddle or having your bag stolen while traveling abroad (talk about bad luck!). Luckily, many credit cards offer coverage against damage or theft for eligible purchases made with their card. So even if life throws unexpected curveballs at you, at least your credit card has got your back.

Now that we’ve covered purchase protection basics let’s dive into another important feature: extended warranty…

Extended Warranty

So you’ve splurged on that shiny new gadget, but what happens if it suddenly stops working?

Well, fear not, my friend! Today we’re diving into the world of extended warranties.

We’ll uncover the coverage and limitations, explore the nitty-gritty of the claim process details, and reveal both the glorious benefits and sneaky exclusions.

Get ready to become an expert in protecting your prized possessions!

Coverage and Limitations

The coverage and limitations of credit card perks should be carefully evaluated before making a decision. You don’t want to get caught up in the excitement of flashy perks only to find out they come with more strings attached than a marionette show. So, let’s break it down for you:

-

Coverage Limits: Before you start planning your extravagant vacation using those travel rewards, make sure you understand the coverage limits. Some cards may have restrictions on destinations or require minimum purchases to activate the benefits.

-

Claim Process: Picture this – your brand new phone gets stolen while you’re on a trip. A credit card perk promises to cover it, but what’s the claim process like? Is it as easy as snapping your fingers or more complicated than solving a Rubik’s Cube blindfolded?

-

Fine Print: Ah, yes, the notorious fine print! Take a magnifying glass and read every single word of it (or at least skim through). Look for exclusions, deductibles, and any hidden surprises that might pop up when you least expect them.

Claim Process Details

Before you decide to take advantage of the claim process for credit card perks, make sure to understand how it works and what steps are involved.

So, you’ve scored some sweet credit card perks and now it’s time to cash in on all those amazing benefits. But wait! Before you start dreaming about that free vacation or fancy gadget, let’s talk about the claim process. It may not be the most exciting topic, but trust me, it’s important.

First things first, familiarize yourself with the coverage details. Each perk comes with its own set of rules and limitations, so read the fine print carefully. Once you’re armed with this knowledge, it’s time to jump into the claim process. Don’t worry, it’s not as complicated as quantum physics – just a few simple steps to follow.

Gather all necessary documentation like receipts or proof of loss, fill out any required forms (online or offline), and submit your claim within the specified timeframe. That’s it! Now sit back and relax while your claim is being processed.

Before you know it, those credit card perks will be yours for the taking!

Benefits and Exclusions

Alright, you savvy credit card connoisseur, let’s dive into the world of benefits and exclusions. These perks can make your credit card experience extra special, but it’s important to evaluate them carefully. Here are three things to keep in mind:

-

Read the fine print: Don’t be fooled by flashy promises. Take a closer look at what’s actually covered and what’s excluded. You don’t want any nasty surprises down the road.

-

Assess their value: Consider how often you’ll use these perks and whether they align with your lifestyle. A free flight might sound amazing, but if you never travel, it won’t do much good.

-

Compare and contrast: Different credit cards offer different perks, so don’t settle for the first one that catches your eye. Shop around and find the card that offers the most bang for your buck.

Now that we’ve uncovered the secrets of benefits and exclusions, let’s move on to another exciting topic: price protection!

Price Protection

Price protection can be a valuable perk to consider when evaluating credit card benefits. Not only does it save you money, but it also gives you peace of mind knowing that you won’t end up paying more than necessary for your purchases. Let’s dive into the world of price protection and explore how it works and why it’s important.

Picture this: You find the perfect pair of shoes online, but before hitting that “Buy Now” button, you decide to do a quick price comparison. Lo and behold, you discover that the exact same shoes are available at a lower price on another website! With price protection, your credit card company will refund you the difference in cost.

To help illustrate this, here’s a handy table:

| Credit Card Benefit | Price Protection | Fraud Protection |

|---|---|---|

| Description | Refunds price difference if item is found cheaper elsewhere within a certain timeframe | Protects against unauthorized transactions or fraudulent activity |

| Eligibility Criteria | Varies by credit card issuer | Available on most credit cards |

| Coverage Limit | Usually limited to a specific amount per item or per year | Typically covers all eligible transactions |

| Claims Process | Submit proof of lower price within specified timeframe | Report suspicious activity immediately and work with card issuer |

| Additional Benefits | Extended warranty coverage | Identity theft resolution services |

Remember, fraud protection is another essential feature offered by credit cards. It safeguards your finances from unauthorized charges and helps resolve any issues that may arise due to identity theft.

With these perks in mind, take control of your financial journey like a true master!

Concierge Services

Hey, you! Ready to dive into the world of concierge services?

Let’s talk about the benefits that come with having your own personal assistant at your fingertips.

Then we’ll help you navigate the tricky task of choosing the right perks that suit your fancy.

And lastly, we’ll show you some sneaky tricks to maximize those card benefits and make you feel like a VIP everywhere you go.

Benefits of Concierge Services

If you’re someone who enjoys personalized assistance and access to exclusive experiences, the benefits of concierge services on credit cards can be a game-changer. These hidden gems offer much more than just booking dinner reservations or scoring tickets to your favorite concert.

Here are three reasons why concierge services are worth their weight in gold:

-

Hidden Discounts: The savvy concierge knows all the secret codes and special promotions that can save you big bucks on hotels, flights, and even shopping sprees. They’ll dig deep into their bag of tricks to find you the best deals around.

-

Personalized Assistance: Need help planning a surprise getaway? Or maybe you’re looking for recommendations on the hottest restaurants in town? The concierge is your very own personal assistant, ready to cater to your every whim.

-

Exclusive Experiences: With their connections and insider knowledge, concierges have the power to unlock doors that are usually off-limits to regular folks like us. From backstage passes at concerts to VIP treatment at luxury resorts, they’ll make sure you feel like a true rockstar.

Choosing the Right Perks

When selecting a credit card, it’s important to consider which perks align with your lifestyle and preferences. It’s like choosing the right outfit for a party – you want it to be stylish, comfortable, and make you feel like a million bucks.

So, let’s talk about rewards! These little gems can make your credit card experience even more exciting. Whether it’s cashback on groceries or travel points for your dream vacation, the right rewards can really sweeten the deal.

But don’t forget to compare benefits and drawbacks! Just like finding the perfect pair of shoes, you need to weigh the pros and cons. Maybe that 5% cashback sounds incredible, but if there are high annual fees attached, is it really worth it?

Maximizing Card Benefits

To get the most out of your credit card, you’ll want to take advantage of all the benefits it offers. So buckle up and prepare for a wild ride as we dive into the world of maximizing rewards and comparing offers!

Here are three tricks that will have you feeling like a credit card guru in no time:

-

Rack Up Those Rewards: Look for cards that offer generous cash back or travel points on everyday purchases like groceries, gas, and dining out. The more you spend, the more rewards you’ll earn!

-

Bonus Bonanza: Keep an eye out for sign-up bonuses when comparing offers. These can give your rewards balance a serious boost right from the start.

-

Perks Galore: Don’t forget to consider the extra features that come with your card, like airport lounge access or purchase protection. These perks can save you money and enhance your overall experience.

Lounge Access

Lounge access is one of the extra features that credit card holders can enjoy. And boy, oh boy, let me tell you, it’s like entering a secret club where relaxation reigns supreme. You know those fancy airport lounges? Well, with the right credit card in your pocket, you can waltz right in and experience all the benefits.

First off, picture this: plush sofas as far as the eye can see, cozy nooks for napping or reading a good book, and an endless supply of delicious snacks and drinks. Yep, that’s what awaits you when you have lounge access. No more scrambling for a seat at the crowded gate or munching on overpriced airport food. Instead, you’ll be indulging in comfort and luxury before your flight even takes off.

But hold your horses! Before you get too excited about these lounge access benefits, there are some restrictions to keep in mind. Each credit card has its own set of rules regarding lounge access. Some cards offer unlimited visits while others have limited entries per year or require a certain spending threshold to qualify for entry.

Additionally, not all airports have participating lounges for every credit card program. So make sure to check if your favorite travel destinations are covered by your chosen credit card’s lounge network.

Now that you know about the perks and restrictions of lounge access with your trusty credit card by your side, go forth and conquer those airport layovers like the master traveler that you are! Happy lounging!

Rental Car Insurance

Renting a car? Make sure to review the rental car insurance coverage provided by your credit card. You might be surprised at the perks and protections that come with using your trusty piece of plastic. So buckle up, because we’re about to take you on a wild ride through the world of rental car insurance!

-

Peace of Mind: Did you know that some credit cards offer primary rental car coverage? That means if an accident happens, you won’t have to file a claim with your personal auto insurance policy. Plus, this perk is usually free! Cha-ching!

-

Discounts Galore: Not only can you save money on the actual rental cost, but many credit cards also offer sweet discounts on extras like GPS rentals or additional drivers. Who doesn’t love a good discount?

-

Extra Protection: Some credit cards provide secondary coverage, which means they’ll pick up where your personal auto insurance leaves off. And let’s not forget about those pesky deductibles – certain cards will even cover those for you!

Now that you’ve got all this amazing knowledge about rental car coverage, it’s time to hit the road…but not before we mention one more thing: travel insurance.

Speaking of protection, did you know that many credit cards also offer travel insurance as part of their perks package? It’s true! So whether you’re jetting off to an exotic destination or just taking a weekend getaway, make sure to review what kind of travel insurance benefits are available to you through your credit card.

Travel Insurance

Don’t forget to check out the travel insurance benefits offered by your credit card before you embark on your next adventure. Sure, we all love a good adventure, but sometimes things don’t go as planned. Your luggage might get lost, your flight might get delayed, or maybe you’ll even sprain an ankle while hiking through the mountains. But fear not! Your credit card might just have your back.

Now, I know what you’re thinking. Travel insurance? Isn’t that something only fancy schmancy travelers buy? Well, my friend, let me tell you something. Many credit cards offer travel insurance as one of their perks. So before you start dishing out big bucks for a separate policy, take a look at what your trusty old credit card has to offer.

With travel insurance from your credit card, you can enjoy benefits such as trip cancellation coverage (in case life throws a curveball and forces you to cancel that dream vacation), lost baggage reimbursement (because no one wants to be stranded without their favorite Hawaiian shirt), and even emergency medical assistance (just in case that water skiing excursion goes awry).

But wait! There’s more! Some credit cards also offer purchase protection and extended warranty on purchases made with the card. So if that new camera lens gets damaged or stops working after the manufacturer’s warranty expires, you could be covered.

So before packing your bags and setting off on your next great adventure, don’t forget to check out the travel insurance benefits provided by your credit card. It could save you money and give you peace of mind knowing that someone’s got your back if things go awry.

And speaking of saving money…let’s move on to the next exciting topic: balance transfer offers!

Balance Transfer Offers

Before jumping into a balance transfer offer, it’s important to understand the terms and conditions. Let’s dive in and explore the wonderful world of balance transfers! Here are three reasons why you should consider taking advantage of this perk:

-

Escape the clutches of high interest rates: Are you tired of paying sky-high interest rates on your credit card debt? A balance transfer can be your knight in shining armor! With a balance transfer, you can move your existing debt to a new credit card with a lower interest rate. Say goodbye to those pesky interest charges that keep piling up!

-

Simplify your financial life: Managing multiple credit cards can be overwhelming. But fear not, my friend! A balance transfer allows you to consolidate all your debts onto one shiny new card. No more juggling due dates or keeping track of various interest rates – just one simple payment each month.

-

Save some hard-earned cash: Comparing interest rates is like hunting for hidden treasure. By transferring your balance to a card with a lower rate, you’ll save money in the long run. That means more moolah in your pocket for things that truly bring you joy – like indulging in extra guac at Chipotle!

Cash Back Programs

Ready to reap the rewards? Cash back programs offer you the opportunity to earn money back on your credit card purchases. It’s like getting paid to shop! With so many credit cards offering cash back rewards, it can be overwhelming to choose the right one for you. But don’t worry, we’ve got you covered. Let’s dive into the world of cash back perks and find the best fit for your spending habits.

To help you navigate through the sea of options, here’s a handy table outlining some popular cash back credit cards:

| Credit Card | Cash Back Rate | Annual Fee |

|---|---|---|

| Awesome Rewards Card | 2% on all purchases | $0 |

| Super Saver Card | 5% on groceries, 3% on gas, 1% on everything else | $50 |

| Ultimate Cashback Card | 1.5% on all purchases with no cap | $99 |

As you can see, each card has its own unique perks and annual fees. The Awesome Rewards Card offers a flat rate of 2% cash back with no annual fee – perfect if you want simplicity and flexibility. If you spend a lot on groceries and gas, the Super Saver Card might be more appealing with higher rewards in those categories. However, keep in mind that it does come with an annual fee of $50.

For those who want maximum cash back potential without any category restrictions, the Ultimate Cashback Card could be your go-to choice. Although it has an annual fee of $99, its unlimited 1.5% cash back rate makes up for it if you’re a big spender.

Remember to evaluate your spending habits before making a decision. Choose a card that aligns with your lifestyle and offers rewards where you spend most frequently. Happy earning!

Frequently Asked Questions

Are There Any Limitations on Redeeming Rewards Points Earned Through the Credit Card’s Rewards Program?

When it comes to maximizing credit card rewards, you may encounter limitations on redeeming rewards points. But fear not! With careful planning and savvy strategies, you can make the most of those hard-earned points!

Can I Earn Sign-Up Bonuses on Multiple Credit Cards From the Same Bank?

Looking to score sign-up bonuses on multiple credit cards from the same bank? Check if the bank’s policy allows it. Don’t miss out on those sweet rewards, my friend! Time to stack up those bonuses!

Are There Any Hidden Fees Associated With the Credit Card’s Annual Fee?

Hidden fees can sneak up on you like a ninja in the night. When comparing perks, don’t forget to check if there are any lurking charges tied to that annual fee. Stay vigilant, my friend!

How Does the Credit Card Determine the Interest Rate for Each Customer?

Determining your credit card interest rates can feel like a mystical process. Factors like your credit score, payment history, and the card’s terms all come into play. It’s like a secret formula only the credit card gods know!

Are Foreign Transaction Fees Automatically Waived for All Credit Card Users or Only for Specific Types of Transactions?

You, savvy traveler, may wonder if foreign transaction fees are universally waived. Fear not! Some credit cards do waive these pesky fees, saving you dinero. Compare cards to find the best perk for your globetrotting adventures.

Conclusion

Congratulations! You’ve just unlocked the treasure chest of credit card perks and extra features. By evaluating rewards programs, sign-up bonuses, annual fees, interest rates, and foreign transaction fees, you’ve become a master navigator in the sea of credit cards.

Not only that, but you’ve also discovered the hidden treasures of rental car insurance, travel insurance, balance transfer offers, and cash back programs. Just like a savvy pirate discovering hidden gems on a deserted island, you now know how to uncover the hidden treasures that credit cards have to offer.

So set sail with confidence and let your new credit card be your trusty first mate on all your financial adventures!