Are you tired of feeling weighed down by a low credit score? It’s time to take control and boost your financial standing.

Picture this: you’re soaring through life with the wind at your back, effortlessly gliding towards the future you’ve always dreamed of. Well, my friend, improving your credit score is like spreading wings and taking flight.

In this article, we’ll reveal 10 proven tips that will help you soar to new heights of financial success. Get ready to conquer the world of credit!

Key Takeaways

- Payment history and credit utilization are two key factors that have a high impact on your credit score.

- Budgeting and managing your finances effectively can help improve your credit score by avoiding unnecessary debt and paying bills on time.

- Strategies for debt reduction, such as making consistent payments and reducing overall balances, can also contribute to improving your credit score.

- Proper credit card management, including maximizing rewards, maintaining healthy credit limits, and avoiding overspending, can positively impact your credit score.

The Importance of Credit Scores

Your credit score is a key factor in determining your financial health. It’s like the report card of your money management skills, giving potential lenders a glimpse into how responsible you are with borrowing and repaying. But what exactly goes into calculating this all-important number? Let’s dive into the world of credit score factors.

The first thing to understand is that there isn’t just one type of credit score. Different models use different scoring systems, but most commonly, your score will fall within a range of 300 to 850. The higher the number, the better your creditworthiness.

Several factors contribute to your credit score. One major component is payment history, which accounts for about 35% of your overall score. This means paying bills on time and in full can significantly boost your creditworthiness.

Another important factor is amounts owed or utilization ratio, making up approximately 30% of your score. Keeping balances low on your credit cards and other revolving accounts shows lenders that you’re not relying heavily on borrowed money.

Credit history length also plays a role, accounting for roughly 15% of your total score. Lenders want to see a long track record of responsible borrowing behavior, so it’s generally beneficial to keep old accounts open (as long as they’re in good standing).

Other factors include new credit applications (10%) and types of credit used (10%). While these percentages may vary slightly depending on the scoring model used, understanding these general guidelines can help you focus on improving specific areas if needed.

Understanding Your Current Credit Score

It’s important to understand your current credit score in order to make informed decisions about managing your finances. Your credit score is a three-digit number that reflects your creditworthiness and plays a crucial role in determining whether you will be approved for loans, credit cards, or even rental applications. By analyzing your credit report, which contains information about your borrowing history and payment habits, you can identify the factors that are affecting your current credit score.

To give you a clear picture of how different factors can impact your credit score, let’s take a look at the following table:

| Factors | Impact | Description |

|---|---|---|

| Payment History | High | Paying bills on time consistently |

| Credit Utilization | High | Keeping balances low on revolving accounts |

| Length of Credit | Medium | Having a longer credit history |

| New Credit Inquiries | Low | Limiting new credit applications |

Analyzing this table allows you to see where you stand in terms of these key factors and how they contribute to your overall credit score. For example, if you have missed payments or carry high balances on your credit cards, it may negatively impact your score. On the other hand, if you have been responsible with paying off debts and maintaining low utilization rates, it could positively affect your score.

Creating a Budget and Sticking to It

So, you’ve finally decided to get serious about your finances and take control of your money. Well, buckle up because we’re about to dive into the world of effective budgeting techniques and long-term financial discipline.

Forget about the days of mindlessly swiping your credit card or wondering where all your hard-earned cash went – it’s time to create a budget that actually works for you and stick to it like a pro.

Get ready to unleash your inner financial guru!

Effective Budgeting Techniques

One effective way to improve your credit score is by using budgeting techniques. Budgeting allows you to have control over your finances, helping you make smart spending decisions and effectively manage your money. It’s like having a personal finance superhero guiding you towards financial mastery!

With budgeting, you can allocate funds for different expenses, track your spending habits, and avoid unnecessary debt. It’s all about finding the right balance between saving and splurging – because let’s face it, we all deserve a little treat now and then!

Long-Term Financial Discipline

To maintain long-term financial discipline, you must consistently practice smart spending habits and track your expenses. Think of it as a dance between your wallet and your dreams.

Take a step back and evaluate your budgeting strategies – are they keeping you on track? It’s like having a personal trainer for your money!

By setting realistic goals, prioritizing needs over wants, and making conscious decisions about where each dollar goes, you’ll be well on your way to financial success.

Remember, every swipe of the credit card affects your credit score. So be mindful of those credit score factors that lenders consider – payment history, credit utilization ratio, length of credit history – because they can make or break your financial future.

Stay disciplined and watch as your dreams become a reality.

Paying Bills on Time

Hey there, time-conscious money whiz! Let’s dive into the importance of paying your bills on time and how it can impact your credit score.

Picture this: you’re a superhero with the power to zap those pesky bills before they even have a chance to reach their due date. Well, my friend, by being a bill-paying champion, you not only avoid late fees but also boost your credit score like a boss.

Timely Bill Payments

Paying your bills on time is crucial to improving your credit score. It’s like hitting the bullseye in darts or scoring a touchdown in football – it’s a small victory that leads to big rewards!

By managing your expenses wisely and making timely bill payments, you’re showing lenders that you’re responsible and trustworthy. Plus, it’s a great way to avoid those pesky late fees.

Remember, your credit score is influenced by several factors, and one of them is payment history. So, take charge of your financial journey and set up automatic payments or use handy reminders to ensure you never miss a due date.

With each on-time payment, you’ll be one step closer to achieving credit mastery and unlocking better financial opportunities!

Credit Score Impact

Managing your expenses wisely and making timely bill payments can have a significant impact on your credit score. Your credit score is influenced by various factors, which are taken into account during the credit score calculation process. Here are four key factors that can affect your credit score:

-

Payment history: Consistently paying your bills on time shows lenders that you are responsible and trustworthy.

-

Credit utilization: Keeping your credit card balances low relative to your available credit limit demonstrates good financial management.

-

Length of credit history: Having a longer credit history indicates stability and reliability in managing debt.

-

Credit mix: Maintaining a diverse portfolio of different types of credits, such as loans and credit cards, can positively impact your score.

Reducing Credit Card Debt

To lower your credit card debt, you should focus on making consistent payments and reducing your overall balance. It’s time to take control of your financial situation and put those negotiation tactics to good use. Don’t worry, it’s not as daunting as it sounds. Let’s dive in!

First things first, consider debt consolidation as a way to simplify your payments and potentially reduce interest rates. By combining multiple debts into one, you can streamline the repayment process and make it more manageable. Plus, negotiating with lenders for better terms is an option worth exploring.

When negotiating with creditors, keep in mind that they want to get their money back too. Be polite but firm when discussing potential solutions such as lowering interest rates or setting up a payment plan that works for both parties. Remember, being open and honest about your financial situation can go a long way in finding common ground.

Now let’s talk about making consistent payments. This is crucial because missed or late payments can negatively impact your credit score. Set up automatic payments if possible or create reminders to ensure you never miss a due date again.

Lastly, work on reducing your overall balance by paying more than the minimum amount due each month whenever possible. This will not only help decrease the debt but also save you money on interest charges over time.

Avoiding New Credit Applications

Hey there, credit connoisseur!

Let’s dive into the fascinating world of minimizing credit card applications and its impact on your financial well-being.

We’ll uncover the secrets behind how new credit can shake up your credit score and what it means for you in the long run.

Minimizing Credit Card Applications

You can reduce the number of credit card applications to improve your credit score. Here are four reasons why minimizing credit card applications is beneficial for your financial well-being:

-

Preserving Credit Card Rewards: By avoiding unnecessary applications, you’ll be able to focus on maximizing the rewards from your existing credit cards.

-

Maintaining Healthy Credit Card Limits: Frequent applications can lead to lower credit limits, which may negatively impact your credit utilization ratio, a key factor in calculating your credit score.

-

Reducing Inquiries: Every time you apply for a new card, it triggers a hard inquiry on your credit report. Multiple inquiries within a short period raise red flags to lenders and can lower your score.

-

Avoiding Temptation: Fewer applications mean less temptation to overspend or accumulate debt with multiple cards.

By minimizing credit card applications, you’ll be taking proactive steps towards improving your financial standing and boosting your credit score.

Now let’s explore the impact of new credits on your overall score…

Impact of New Credit

Reducing the number of credit card applications can have an impact on your overall score when it comes to new credits. It’s important to understand how new credit affects your credit score. When you apply for multiple credit cards within a short period, lenders may view it as a sign of financial instability. This can negatively impact your credit score because one of the factors that determine your score is the number of new accounts opened. Additionally, each application results in a hard inquiry on your credit report, which can also lower your score temporarily. To give you a better understanding, here’s a table showing the different factors that influence your credit score:

| Credit Score Factors | Weightage |

|---|---|

| Payment History | 35% |

| Credit Utilization | 30% |

| Length of Credit | 15% |

Understanding these factors will help you make informed decisions about applying for new credits and managing your existing ones effectively.

Now that you know how new credits can impact your overall score, let’s dive into the implications it has on other aspects of your creditworthiness.

Credit Score Implications

Understanding the implications of new credit on your credit score can help you make informed decisions about managing your overall creditworthiness. Here are four important factors to consider when it comes to your credit score:

-

Payment history: Your payment history plays a significant role in determining your credit score. Make sure to pay your bills on time and in full every month.

-

Credit utilization: The amount of available credit you use affects your score. Aim to keep your credit utilization ratio below 30% by managing your spending wisely.

-

Length of credit history: The longer you have a positive track record of managing credit, the better it reflects on your score. Avoid closing old accounts unnecessarily.

-

New inquiries and accounts: Opening multiple new accounts or applying for too much new credit within a short period can negatively impact your score.

Checking Your Credit Report Regularly

Checking your credit report regularly is important for monitoring any changes or errors. It’s like giving your credit score a check-up to ensure it’s in tip-top shape. Think of it as taking care of your financial health, just like you would with your physical health. You want to catch any potential issues early on and take the necessary steps to resolve them.

Credit report monitoring is like having a watchful eye over your credit history. By keeping tabs on your report, you can spot any suspicious activity or inaccuracies that may be affecting your credit score. It’s like being Sherlock Holmes, but instead of solving crimes, you’re uncovering any discrepancies that could be holding you back from achieving the best credit score possible.

Accuracy is key when it comes to your credit report. Just one small error can have a big impact on your overall financial standing. So, by checking your report regularly, you can ensure that everything is up-to-date and correct. It’s like being an editor for the story of your financial life – making sure all the facts are accurate and there are no spelling mistakes.

So how often should you check? Well, experts recommend reviewing your credit report at least once a year. But if you’re really serious about mastering your credit game, consider checking every few months or even monthly. The more frequently you monitor, the more control you have over maintaining an accurate and healthy credit profile.

Disputing Errors on Your Credit Report

When it comes to disputing errors on your credit report, knowing the proper steps to take can help you rectify any inaccuracies and protect your financial well-being. Don’t let a mistake on your credit report bring you down! Follow these simple steps to ensure the accuracy of your credit report:

-

Review your credit report thoroughly: Take the time to carefully go through each section of your credit report, highlighting any discrepancies or errors that you come across. Pay attention to details such as incorrect personal information, unfamiliar accounts, or inaccurate payment history.

-

Gather supporting documentation: Once you’ve identified an error, gather all the necessary paperwork that supports your claim. This could be bank statements, canceled checks, or any other relevant documents that prove the inaccuracy.

-

Draft a dispute letter: Write a concise and clear dispute letter explaining the error and providing evidence to support your claim. Be sure to include copies of the supporting documentation you gathered earlier.

-

Send it via certified mail: To ensure that your dispute is properly received and documented, send your dispute letter via certified mail with a return receipt requested.

By following these steps, you’ll be taking control of your credit report accuracy and ensuring that potential errors are resolved promptly.

Now let’s move on to another important aspect of improving your credit score – utilizing the credit utilization ratio.

Transitioning into ‘Utilizing Credit Utilization Ratio’: Now that you’ve taken the necessary steps to dispute errors on your credit report…

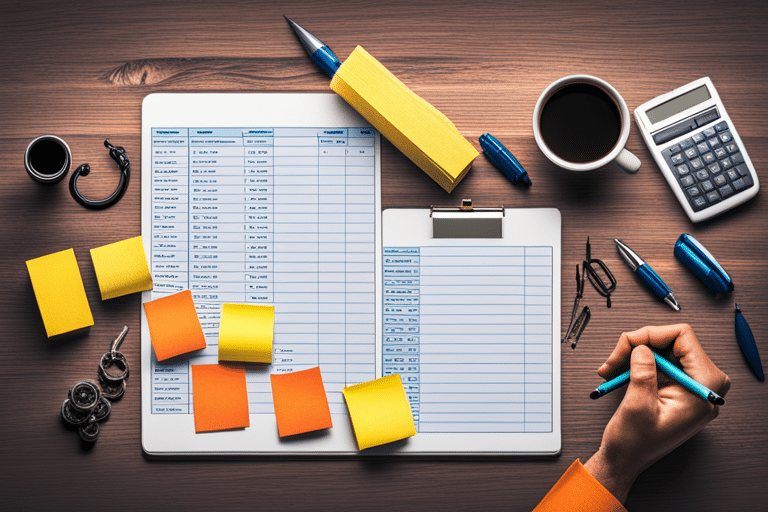

Utilizing Credit Utilization Ratio

Now that you’ve taken care of disputing errors on your credit report, it’s time to focus on how effectively you’re utilizing your available credit. Your credit utilization ratio plays a significant role in determining your credit score. It measures the amount of credit you’re using compared to your total available credit limit. To help you master the art of managing your credit card balances, here are some creative and energetic strategies:

| Credit Utilization Strategies | Description | Benefits |

|---|---|---|

| Pay off balances in full each month | By paying off your balances in full every month, you keep your utilization ratio low and demonstrate responsible credit management. | Improves your credit score and saves money on interest charges |

| Spread out expenses across multiple cards | Instead of maxing out one card, try spreading out your expenses across multiple cards to keep individual utilization ratios low. | Helps maintain a healthy overall utilization ratio |

| Request a higher credit limit | Asking for a higher credit limit can increase the amount of available credit at your disposal, lowering your overall utilization ratio. Just be sure not to use this as an excuse to spend more! | Improves your utilization ratio and gives you more financial flexibility |

By implementing these strategies into your financial routine, you’ll become a master at managing and optimizing your available credit. Remember, improving your credit score takes patience and persistence.

In the next section, we’ll dive deeper into the importance of patience and persistence when it comes to improving your overall credit score. So buckle up and get ready for some valuable insights!

Patience and Persistence in Credit Score Improvement

Don’t give up on your journey to improving your credit score – it takes time and persistence to see significant changes. Building a strong credit history is like climbing a mountain, but with the right tools and mindset, you can reach the summit. So keep going, keep pushing forward, because the view from the top is worth it!

Here are four important factors to consider when working towards improving your credit score:

-

Payment History: Consistently making on-time payments shows lenders that you are responsible and reliable. It’s like having a sturdy foundation for your credit building project.

-

Credit Utilization: Keeping your credit card balances low compared to their limits demonstrates good financial management skills. Think of it as using just the right amount of ingredient in a recipe – too much or too little could spoil the dish.

-

Length of Credit History: The longer you have been responsibly using credit, the more trustworthy you appear to potential lenders. It’s like having years of experience under your belt in any field – people trust seasoned professionals.

-

Types of Credit: Having a diverse portfolio of loans and lines of credit shows that you can handle different types of financial responsibilities. It’s like being versatile in various sports – showing off multiple skills makes you an asset.

Frequently Asked Questions

Can Having a High Credit Score Guarantee Approval for Any Type of Loan or Credit Card?

Having a high credit score doesn’t guarantee approval for any loan or credit card. However, it does offer benefits like lower interest rates and better terms. Learn how to maintain a high credit score to increase your chances of approval!

What Are Some Common Factors That Can Lead to a Decrease in Credit Score?

To decrease your credit score, factors like late payments, high credit utilization, and maxing out credit cards can have a negative impact. Did you know that 30% of your credit score is based on your credit utilization?

Is It Possible to Improve Your Credit Score Within a Short Period of Time?

You want to improve your credit score quickly. Well, with the right strategies for rapid credit score improvement, it is definitely possible to see positive changes in a short period of time.

How Long Do Negative Marks Such as Late Payments or Collections Stay on Your Credit Report?

Having late payments or collections can impact your credit score. It’s important to know how long these negative marks stay on your report. Find out the effect of credit utilization and bankruptcy on your score.

Are There Any Specific Actions That Could Cause My Credit Score to Drop Significantly, Even if I Have Been Managing My Credit Responsibly?

Sometimes, even if you’ve been responsible with your credit, certain actions can still cause a significant drop in your score. It’s important to understand the factors that affect your credit score and avoid those detrimental actions.

Conclusion

In conclusion, improving your credit score is a journey that requires patience and persistence. By following the proven tips mentioned in this article, you can take control of your financial future and boost your creditworthiness.

Did you know that according to Experian, individuals with a credit score above 800 have an average of seven open accounts? Imagine the possibilities!

So don’t give up, stay committed to managing your finances wisely, and watch as your credit score climbs higher and higher. You’ve got this!