Imagine you’re a phoenix, rising from the ashes of financial hardship. Your credit score may have taken a hit, but fear not! This article is your guide to rebuilding and reclaiming your financial glory.

We’ll explore practical tips and tricks that will help you soar above the wreckage of your past mistakes. From budgeting like a pro to negotiating with creditors like a smooth-talking diplomat, we’ve got you covered.

So strap on your wings, my friend, it’s time to take flight and rebuild that credit score!

Key Takeaways

- Financial hardship can negatively affect your credit score.

- Implementing effective rebuilding strategies can help recover your credit score.

- Creating a budget and sticking to it can regain control over your finances.

- Prioritize paying off outstanding debts and make consistent payments.

Understanding the Impact of Financial Hardship on Your Credit Score

You might be wondering how financial hardship can affect your credit score. Well, my friend, let me shed some light on this for you.

When life throws you a curveball and you find yourself facing tough times financially, it’s not just your bank account that takes a hit – your credit score can also suffer the consequences. But fret not! There are ways to bounce back and rebuild that precious three-digit number.

Let’s dive into the nitty-gritty of it all. When faced with financial hardship, such as job loss or overwhelming debt, it becomes challenging to keep up with your bills and payments. Late payments or defaulting on loans can send shockwaves through your credit report, causing your score to plummet faster than a rollercoaster ride. It’s like getting stuck in quicksand – the more you struggle, the deeper you sink.

But fear not! There is hope for credit score recovery even after experiencing financial hardships. The key lies in implementing effective rebuilding strategies. First things first: create a budget and stick to it religiously. This will help you regain control over your finances and ensure that all future payments are made on time.

Next up, tackle any outstanding debts head-on by negotiating with creditors or seeking professional help from a credit counseling agency. They can assist in developing repayment plans that work for both parties involved.

Remember, rebuilding your credit score won’t happen overnight; it requires patience and persistence. Stay committed to responsible financial habits and gradually watch as those numbers climb back up again.

Assessing the Damage: Determining Your Current Credit Score

So, you’ve assessed the damage and now it’s time to understand what factors affect your credit score and how you can develop a recovery plan.

Let’s dive in and uncover the secrets behind your credit score! Don’t worry, we’ll make this process as painless as possible and before you know it, you’ll be on your way to rebuilding your credit like a champ.

Understanding Credit Score Factors

To improve your credit score after financial hardship, it’s important to understand the factors that affect it. Your credit score is calculated based on a variety of factors, and one of the most important ones is your credit utilization ratio. Here are four key things to know about how these factors impact your score:

-

Credit Score Calculation: Your credit score is determined by various factors such as payment history, length of credit history, types of accounts, and new credit applications.

-

Credit Utilization Ratio: This refers to the percentage of available credit you’re using. Keeping this ratio low can positively impact your credit score.

-

Payment History: Paying bills on time shows responsible financial behavior and can boost your score.

-

Length of Credit History: The longer you have a positive credit history, the better it reflects on your score.

Understanding these factors will help you make smarter decisions when rebuilding your credit after hardship. Now let’s dive into developing a recovery plan that suits your needs and goals.

Developing a Recovery Plan

Now let’s explore how to create a plan for recovering from your financial setbacks.

Rebuilding credit may seem daunting, but fear not! With a little determination and savvy strategy, you can bounce back stronger than ever.

First things first, take a deep breath and assess the damage. Look at your credit report to identify any errors or discrepancies that may be dragging down your score.

Next, prioritize paying off outstanding debts and make consistent payments going forward. Consider consolidating your debt or negotiating with creditors to reduce interest rates or settle for lower amounts.

Finally, establish healthy financial habits by keeping your balances low, paying bills on time, and resisting the urge to open unnecessary accounts.

Creating a Budget: Managing Your Finances Effectively

Managing your finances effectively starts with creating a budget that reflects your income and expenses. It’s like being the CEO of your own financial empire! Don’t worry, you don’t need a fancy suit or a corner office for this job – just a pen, paper, and a dash of determination.

Here are four essential steps to help you master the art of managing your expenses and saving strategies:

-

Track Your Spending: Start by keeping track of every penny you spend. That daily coffee run may seem harmless, but those small purchases can add up quickly. By tracking your spending, you’ll become more aware of where your money is going and identify areas where you can cut back.

-

Set Realistic Goals: Saving money doesn’t mean living like a hermit or depriving yourself of all the fun things in life. Instead, set realistic goals that align with your financial situation. Whether it’s saving for a dream vacation or building an emergency fund, having clear goals will motivate you to stick to your budget.

-

Prioritize Your Expenses: Not all expenses are created equal – some are necessary while others are discretionary. When creating your budget, make sure to prioritize essential expenses like rent/mortgage payments, utilities, groceries, and debt repayments before allocating funds for entertainment or non-essential items.

-

Automate Your Savings: We all know how tempting it can be to spend money when it’s readily available in our bank accounts. So why not automate your savings? Set up automatic transfers from your checking account to a separate savings account each month. This way, you won’t even have time to miss the money before it’s safely tucked away for future use.

Paying Off Existing Debts: Prioritizing Your Payments

So, you’ve made the brave decision to tackle your existing debts head-on. Good for you!

Now, let’s dive into the exciting world of debt prioritization strategies. You’ll learn how to juggle multiple obligations like a pro and discover the magic of making timely payments that can have a surprisingly positive impact on your financial situation.

Get ready to become the master of your debts!

Debt Prioritization Strategies

To start rebuilding your credit score after financial hardship, you’ll want to prioritize your debts strategically. Here are some debt prioritization strategies to help you get started:

-

Consider Debt Consolidation Options: Consolidating your debts can simplify your payments and potentially lower your interest rates. Look into options like personal loans or balance transfer credit cards to streamline your repayment process.

-

Negotiate Lower Interest Rates: Reach out to your creditors and see if they’re willing to negotiate lower interest rates on your outstanding balances. This can help reduce the amount of interest you’ll have to pay over time.

-

Focus on High-Interest Debts First: Start by tackling the debts with the highest interest rates since they cost you more in the long run. By paying them off first, you’ll save money on interest and make progress towards improving your credit score.

-

Create a Budget and Stick to It: Establishing a realistic budget will help you allocate funds towards debt repayment while still covering essential expenses.

By implementing these strategies, you’ll be well on your way towards rebuilding your credit score after financial hardship.

Now let’s explore how timely payments can further impact your journey back to financial health.

Impact of Timely Payments

Making timely payments on your debts is crucial for improving your financial health and increasing your chances of qualifying for better loan terms in the future. By establishing positive payment patterns, you prove to lenders that you are responsible and trustworthy. Not only will this boost your credit score, but it will also open doors to more favorable interest rates and loan options down the road.

Think of timely payments as a secret weapon in your quest for financial mastery. It’s like hitting the bullseye every time you throw darts at a target. Each successful payment builds momentum, showing lenders that you’re serious about repaying what you owe.

But the benefits don’t stop there! Making timely payments can also save you money in the long run. With better loan terms, you’ll be paying less interest over time, which means more money in your pocket.

Balancing Multiple Obligations

You’ve learned the importance of making timely payments to rebuild your credit score. Now it’s time to tackle another challenge: balancing multiple financial obligations.

Managing financial stress can be overwhelming, but with the right strategies, you can juggle your responsibilities like a pro. Here are four tips to help you stay on top of your finances:

-

Prioritize Your Payments: Make a list of your financial obligations and prioritize them based on urgency and importance.

-

Create a Budget: Set aside specific amounts for each expense category and stick to it religiously.

-

Automate Your Payments: Take advantage of technology by setting up automatic bill payments to avoid missing due dates.

-

Seek Professional Help if Needed: If you’re feeling overwhelmed, don’t hesitate to seek advice from a financial counselor who can provide guidance tailored to your situation.

Negotiating With Creditors: Exploring Options for Debt Settlement

If you’re struggling with debt, it’s important to explore options for debt settlement by negotiating with creditors. Don’t worry, you’re not alone in this financial maze! Let’s dive into the world of debt negotiation strategies and alternative debt relief options together.

First things first, let’s understand what exactly is on the table when it comes to negotiating with your creditors. Picture a three-column table:

| Debt Negotiation Strategies | Alternative Debt Relief Options |

|---|---|

| Direct Communication | Debt Consolidation |

| Payment Plans | Debt Management Programs |

| Settlement Offers | Bankruptcy as a Last Resort |

Now that we have our roadmap, let’s start exploring those strategies! When it comes to direct communication, don’t be afraid to pick up the phone and talk to your creditors. Explain your situation honestly and see if they are willing to work out a payment plan or even accept a reduced settlement offer. Remember, they want their money back too!

If direct communication doesn’t do the trick, consider proposing a payment plan that fits your budget. This shows good faith and commitment towards repaying your debts.

But wait, there’s more! Alternative debt relief options like debt consolidation or management programs can also help streamline multiple payments into one manageable monthly amount.

Lastly, bankruptcy should always be considered as an absolute last resort due to its long-lasting impact on your credit score.

Exploring Credit Building Options: Secured Credit Cards and Loans

So you’re ready to take the next step in building your credit and exploring the world of secured credit cards and loans?

Well, buckle up because we’re about to dive into the pros of secured credit, how you can build credit with loans, and the differences between secured and unsecured credit.

Get ready to become a credit-building expert in no time!

Pros of Secured Credit

Secured credit can be beneficial because it allows you to establish or rebuild your credit history. Here are some advantages of secured credit:

-

Easy approval: Secured credit cards and loans are often easier to get approved for, even if you have a low credit score or no credit history at all. This makes them a great option for those looking to build their credit from scratch.

-

Credit limit flexibility: With secured credit, you have the ability to choose your own credit limit by making a deposit that serves as collateral. This means you can start small and gradually increase your limit as your financial situation improves.

-

Credit history reporting: Secured credit accounts are reported to the major credit bureaus, helping you establish or rebuild your positive payment history. As long as you make timely payments, this will reflect positively on your overall credit score.

-

Opportunity for unsecured options: Successfully using secured credit can open doors to unsecured financing options in the future, such as unsecured personal loans or traditional credit cards.

Building Credit With Loans

Building credit with loans can be a smart strategy for improving your financial situation. But, hey, did you know that there are other ways to rebuild your credit without taking out loans? Yes, it’s true! Sometimes the thought of adding more debt can be overwhelming. So, why not consider building credit through credit cards instead?

Credit cards can be your secret weapon in the quest to rebuild your credit score. They offer flexibility and convenience while allowing you to demonstrate responsible borrowing habits. Start by obtaining a secured credit card or a starter credit card designed for individuals with limited or poor credit history.

The key here is to use your credit card wisely. Make small purchases and pay off the balance in full each month to avoid accumulating interest charges. This shows lenders that you are capable of managing debt responsibly.

Secured Vs Unsecured Credit

Using credit cards can be a helpful way to demonstrate responsible borrowing habits and improve your financial situation. But when it comes to choosing the right type of credit, you need to consider the options carefully.

Here are four reasons why secured credit might benefit individuals with low credit scores:

-

Collateral: Secured credit requires collateral, such as a deposit or property, which reduces the risk for lenders and allows them to offer better terms.

-

Easier Approval: With secured credit, approval is often easier because lenders have something to fall back on if you default on your payments.

-

Credit Building: By making timely payments on a secured credit card or loan, you can gradually build up your credit score over time.

-

Lower Interest Rates: Secured loans typically come with lower interest rates compared to unsecured options.

On the other hand, here are two risks associated with unsecured credit for individuals facing financial hardship:

-

Higher Interest Rates: Unsecured loans usually have higher interest rates since there’s no collateral involved.

-

Potential Debt Trap: Without proper financial management, unsecured credit can lead to accumulating debt that becomes difficult to repay.

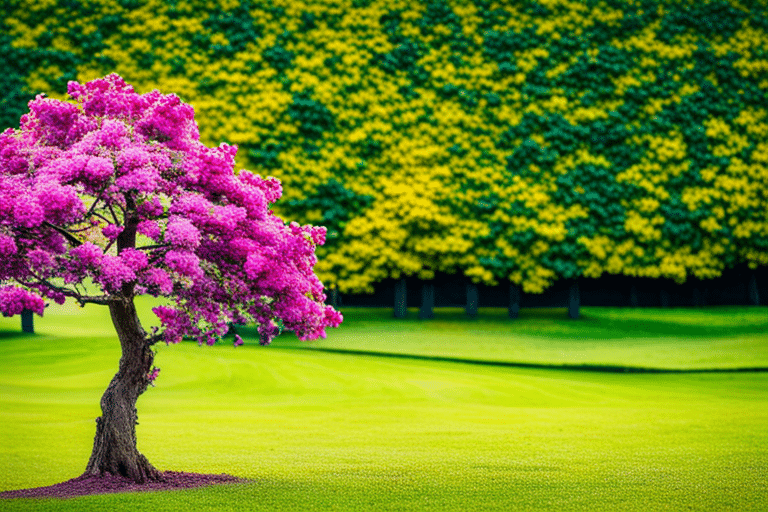

Establishing Positive Payment Patterns: Timely Payments and Autopay

Making timely payments and setting up autopay are effective strategies for establishing positive payment patterns to rebuild your credit score after financial hardship.

Picture this: you’re standing on the edge of a beautiful garden, filled with blooming flowers and lush greenery. This garden represents your credit score, and it’s time to plant the seeds of success.

By making timely payments, you ensure that your creditors see you as a responsible borrower who can be trusted with credit again. One of the key benefits of timely payments is that they show lenders that you’re serious about repaying your debts. It demonstrates your commitment to financial responsibility and builds trust in your ability to manage future credit accounts. Think of it as watering those plants regularly – it keeps them healthy and thriving.

But wait, there’s more! Autopay comes into play like a magical sprinkler system for your credit score garden. By setting up autopay, you can ensure that your bills are paid on time without even lifting a finger. This not only saves you from the stress of remembering due dates but also prevents any late payment penalties or negative marks on your credit report.

The advantages of autopay are twofold: convenience and consistency. With just a few clicks, you can set up automatic payments for all your bills, including loans, utilities, and even credit card balances. This way, you never have to worry about missing a payment again. Plus, consistent payments over time will help rebuild your credit history and improve your overall creditworthiness.

Monitoring Your Credit Report: Identifying Errors and Disputing Them

Take a moment to check your credit report regularly for any errors or discrepancies that may be negatively impacting your financial profile. It’s like giving your credit score a little check-up – just to make sure everything is in tip-top shape.

Here are four things you should know about identifying and disputing errors on your credit report:

-

Look for inaccuracies: When reviewing your credit report, keep an eye out for any incorrect information such as late payments that you actually made on time or accounts that don’t belong to you. These mistakes can drag down your score, so it’s important to spot them.

-

Gather evidence: If you do find an error, gather all the necessary documentation to prove that it’s incorrect. This could include bank statements, payment receipts, or anything else that supports your case.

-

File a dispute: Reach out to the credit reporting agency and provide them with the evidence of the mistake. They are legally obligated to investigate and correct any errors within 30 days.

-

Stay vigilant: After disputing an error, closely monitor your credit report to ensure it has been corrected as promised. Mistakes can sometimes resurface, so it’s crucial to stay on top of things.

Building a Emergency Fund: Preparing for Future Financial Hardships

So, you’ve tackled the task of rebuilding your credit score after financial hardship. Great job!

Now let’s shift gears and talk about building an emergency fund to prepare for future financial bumps in the road.

We’ll cover the importance of savings, share some strategies to help you build that cushion, and throw in a few tips on how to stay financially resilient.

Trust me, you’ll feel like a money-saving superhero by the end of this discussion!

Importance of Savings

Having an emergency fund is crucial for rebuilding your credit score after financial hardship. It acts as a safety net, providing you with the necessary funds to cover unexpected expenses and avoid falling into debt.

But why is having savings so important? Let’s break it down:

-

Peace of mind: Knowing you have money set aside for emergencies can relieve stress and help you sleep better at night.

-

Financial security: Having savings allows you to handle unexpected expenses without relying on credit cards or loans, protecting your credit score in the process.

-

Flexibility: With an emergency fund, you have the freedom to make choices based on what’s best for your financial situation, rather than being forced into debt.

-

Opportunity for growth: Building savings sets the foundation for future financial success and opens doors to investment opportunities.

Now that you understand the importance of having savings, let’s dive into some strategies to help you build your emergency fund and strengthen your financial well-being.

Emergency Fund Strategies

Now that you understand the importance of having savings, let’s explore some strategies to help you build your emergency fund and strengthen your financial well-being. Building an emergency fund is like giving yourself a safety net for unexpected expenses or emergencies. It’s important to have a plan in place so that you can feel secure and confident in your financial situation. Here are three effective strategies to consider:

| Strategy | Description | Benefits |

|---|---|---|

| Automate Savings | Set up automatic transfers to a separate account every payday. | Helps you save consistently without thinking about it. |

| Cut Expenses | Identify unnecessary spending and reduce costs wherever possible. | Allows you to allocate more money towards your emergency fund. |

| Increase Income | Look for ways to earn extra money, such as freelancing or taking on a side job. | Provides additional funds for saving purposes. |

Financial Resilience Tips

One important aspect of building financial resilience is to create a budget and stick to it consistently. By following these strategies, you can start building financial stability and bounce back from any setbacks:

-

Track your expenses: Keep an eye on where your money is going by logging all your expenses. This will help you identify areas where you can cut back and save.

-

Set realistic goals: Start small and gradually increase your savings targets. This will boost your confidence as you achieve each milestone along the way.

-

Build an emergency fund: Having a safety net of at least three to six months’ worth of expenses will provide peace of mind in case unexpected expenses arise.

-

Automate savings: Make saving effortless by setting up automatic transfers from your checking account to a separate savings account.

By implementing these strategies, you’ll be well on your way to financial resilience and stability.

But if you find yourself struggling, don’t hesitate to seek professional help through credit counseling and debt management services, which we’ll discuss next.

Seeking Professional Help: Credit Counseling and Debt Management

If you’re struggling to rebuild your credit score after financial hardship, consider seeking professional help through credit counseling and debt management services. Let’s face it, dealing with money issues can be overwhelming and downright stressful. But fear not! Credit counseling is like having your own personal financial coach who can guide you towards a brighter credit future.

One of the benefits of credit counseling is that it provides you with expert advice tailored to your specific situation. These professionals have seen it all – from mounting debts to late payments – and they know the best strategies to get you back on track. They’ll work with you to create a personalized plan that fits your needs and goals.

Now, let’s talk about debt management strategies. Picture this: instead of drowning in an ocean of bills, you’ll have a clear roadmap towards paying off your debts. Debt management programs can negotiate lower interest rates and monthly payments on your behalf, making it easier for you to tackle those pesky balances.

But wait, there’s more! Credit counselors will also educate you on smart financial habits and budgeting techniques. They’ll teach you how to avoid common pitfalls that could harm your credit score in the future. Think of them as your personal cheerleaders, encouraging you every step of the way.

The Importance of Patience: Understanding the Time It Takes to Rebuild

Don’t underestimate the importance of patience when it comes to rebuilding your credit after experiencing financial difficulties. It may feel like a slow process, but understanding credit repair and rebuilding your credit history takes time. So, take a deep breath and embrace the journey towards financial freedom!

Here are four reasons why patience is key:

-

Time heals all wounds: Just like a broken bone needs time to heal, so does your credit score. It won’t happen overnight, but with consistent effort and responsible financial habits, you’ll see progress.

-

Slow and steady wins the race: Rebuilding your credit isn’t about quick fixes or magic potions. It’s about making small changes over time that will have a lasting impact on your creditworthiness.

-

Learning from past mistakes: Patience allows you to reflect on what led you down this path in the first place. By taking the time to understand how you got into financial trouble, you can make better choices moving forward.

-

Building a solid foundation: Think of rebuilding your credit as constructing a sturdy house – it requires a strong foundation. Patience allows you to establish good habits, such as paying bills on time and reducing debt, which will serve as building blocks for long-term success.

Diversifying Your Credit: Utilizing Different Types of Credit

To maximize your creditworthiness, consider utilizing different types of credit to diversify your financial portfolio. Think of it like building a diverse wardrobe – you wouldn’t want to wear the same outfit every day, right? Well, the same goes for your credit. Mixing things up can actually help improve your credit score and show lenders that you’re a responsible borrower.

One of the key credit mix strategies is to have a healthy blend of both revolving and installment accounts. Revolving accounts, like credit cards, give you flexibility in how much you borrow and repay each month. On the other hand, installment accounts, such as auto loans or mortgages, involve fixed payments over a set period of time. By having both types of accounts in good standing, you demonstrate your ability to handle different forms of debt responsibly.

Another important aspect to consider is your credit utilization techniques. This refers to how much of your available credit you actually use. It’s generally recommended to keep your overall utilization below 30%. So if you have a $10,000 limit on all your credit cards combined, try not to carry more than $3,000 in balances at any given time.

Now that doesn’t mean you should go out and open multiple lines of credit just for the sake of it. Remember quality over quantity! It’s better to have a few well-managed accounts than several maxed-out ones. So choose wisely and make sure each new account fits into your overall financial plan.

Staying on Track: Maintaining Good Financial Habits

Maintaining good financial habits is essential for staying on track with your overall financial goals and ensuring long-term financial stability. When it comes to building and improving credit, developing these habits becomes even more crucial.

So, let’s dive into some tips to help you maintain those good financial habits and set yourself up for success:

-

Pay your bills on time: This may seem obvious, but it’s worth mentioning because it’s one of the most important factors in building credit. Set reminders or automate payments to avoid any missed due dates.

-

Keep your credit utilization low: Your credit utilization ratio is the amount of credit you’re using compared to your total available credit limit. Aim to keep this ratio below 30% to show lenders that you can responsibly manage your credit.

-

Limit new applications for credit: Opening multiple new accounts within a short period can raise red flags for lenders. Be selective when applying for new credit and only take on what you truly need.

-

Regularly check your credit report: Monitoring your credit report allows you to catch errors or fraudulent activities early on. Request a free copy from each of the three major credit bureaus annually and review it carefully.

By following these tips, you’ll be well on your way to maintaining good financial habits and improving your overall credit health.

Now that we’ve covered the importance of maintaining good financial habits, let’s move on to celebrating small victories by tracking your progress and motivating yourself along the way!

Celebrating Small Victories: Tracking Your Progress and Motivating Yourself

Tracking your progress and motivating yourself along the way is an effective strategy for celebrating small victories. When it comes to rebuilding your credit score after financial hardship, every step forward is worth celebrating. So, grab a pen and paper or fire up that spreadsheet because we’re diving into the world of tracking progress and staying motivated!

First things first, create a system to track your progress. It could be as simple as making a checklist or using an app to monitor your credit score. The key here is consistency. By regularly monitoring your credit score, you’ll have a clear picture of how far you’ve come and what still needs work.

Now, let’s talk about motivation. Rebuilding your credit score can sometimes feel like climbing Mount Everest with no end in sight. That’s why it’s essential to find ways to stay motivated throughout the journey.

One technique is setting achievable goals. Rather than focusing on the end result, break down your credit rebuilding process into smaller milestones. For example, aim to pay off one credit card at a time or lower your overall debt by a certain percentage within a specific timeframe.

Remember that Rome wasn’t built in a day, and neither will your credit score be magically restored overnight. Celebrate each small victory along the way – whether it’s successfully sticking to your budget or making timely payments – these accomplishments deserve recognition.

To keep yourself motivated, consider rewarding yourself when you achieve these milestones. Treat yourself to something small but meaningful – maybe it’s enjoying dinner at your favorite restaurant or treating yourself to that new book you’ve been eyeing.

Frequently Asked Questions

Can I Rebuild My Credit Score Without Paying off All My Existing Debts?

You can rebuild your credit score without paying off all existing debts by exploring alternative strategies and credit building techniques. It’s important to find creative ways to improve your credit while managing financial hardships.

What Are the Consequences of Disputing Errors on My Credit Report?

When you dispute errors on your credit report, there can be consequences. It’s important to be aware of these consequences and understand the importance of credit monitoring to avoid any further issues.

How Long Does It Typically Take to Rebuild a Credit Score After Financial Hardship?

Rebuilding credit after financial hardship can be challenging, but don’t worry! By implementing strategies for bankruptcy and taking steps to improve your score after foreclosure, you can bounce back faster than you think.

Are There Any Downsides to Utilizing Different Types of Credit to Diversify My Credit Profile?

Utilizing different types of credit to diversify your credit profile can have advantages, such as improving your credit score. However, there may also be disadvantages, like potential fees or the temptation to overspend. Find a balance that works for you!

Can I Rebuild My Credit Score Without Seeking Professional Help or Credit Counseling?

You can definitely rebuild your credit score without professional help or credit counseling! It’s all about DIY credit repair. With a little dedication and some smart financial choices, you’ll be on your way to a better credit score in no time.

Conclusion

Congratulations! You’ve made it through the maze of financial hardship and you’re ready to rebuild your credit score.

It won’t be a walk in the park, but with determination and patience, you can turn things around.

Remember, Rome wasn’t built in a day! So buckle up and get ready to soar to new heights.

You’ve got this! Rebuilding your credit is like sprinkling magical unicorn dust on your financial future.

So go ahead and embrace the adventure, because there’s no limit to what you can achieve!