Imagine you’re holding a key to your dream home. But wait! There’s a catch – that key is tied to your credit score.

Yes, friend, your credit score has the power to make or break your mortgage application. In this article, we’ll unravel the mysterious connection between that three-digit number and your homeownership dreams.

So buckle up and get ready to dive into the whimsical world of credit scores and mortgages. It’s time to master the art of securing that sweet loan for your dream castle!

Key Takeaways

- Good credit scores unlock benefits for mortgage applicants, such as lower interest rates and better loan terms.

- Lenders examine credit scores to determine creditworthiness, considering factors like payment history and credit utilization.

- Higher credit scores lead to lower interest rates on mortgages, while lower credit scores may result in higher rates or additional documentation requirements.

- It is crucial for prospective homebuyers to match their credit scores with the right interest rate to increase their chances of loan approval.

The Importance of a Good Credit Score

Having a good credit score is crucial when applying for a mortgage. It’s like having a secret weapon in your pocket that can unlock all sorts of benefits for you. Imagine being able to stroll into the bank with confidence, knowing that your credit score is working in your favor. Well, my friend, that’s exactly what happens when you have a stellar credit score.

One of the biggest benefits of having a good credit score is the impact it has on your interest rates. You see, lenders love borrowers with high credit scores because they are seen as less risky. They believe that if you’ve been responsible with your finances in the past, you’ll most likely be responsible with your mortgage payments too.

So, when you apply for a mortgage with an excellent credit score, lenders will reward you by offering lower interest rates. And let me tell you, lower interest rates can save you big bucks over the life of your loan! Think about all the things you could do with that extra money – take vacations, buy fancy gadgets, or even start saving for retirement earlier than planned.

But wait, there’s more! A good credit score also opens up opportunities for better loan terms and higher borrowing limits. Lenders will be more willing to work with you and offer flexible repayment options because they trust that you’ll honor your commitments.

Understanding Credit Score and Mortgage Rates

Understanding how credit scores impact mortgage rates is essential for prospective homebuyers. It’s like trying to solve a puzzle, but instead of matching colorful pieces, you’re matching your credit score with the right interest rate. So, let’s dive into this whimsical world of credit score factors and their magical impact on interest rates!

Picture this: You walk into a bank with your shiny credit score in hand, feeling like a superhero ready to conquer homeownership. As you sit down with the loan officer, they start examining your credit history like an archaeologist on a treasure hunt. They look at things like payment history, amounts owed, length of credit history, new accounts opened…it’s like they have X-ray vision! These factors are the key ingredients that determine your creditworthiness.

Now comes the fun part: how these factors dance together to create your mortgage rate. The higher your credit score – ta-da! – the lower your interest rate will be. It’s like getting VIP access to the best roller coaster in town while others wait in long lines. On the other hand, if your credit score is not as impressive as you hoped, don’t worry! There are still options available for you; it just might mean paying a higher interest rate or providing more documentation.

How Your Credit Score Impacts Loan Approval

Imagine walking into a lender’s office, confident in your financial track record, only to discover that your credit score determines whether you get approved for a loan or not. It’s like finding out that the key to your dreams lies in a three-digit number. But fear not! Your credit score doesn’t have to be an insurmountable obstacle. With some strategic moves, you can improve it and increase your chances of loan approval.

Let’s take a lighthearted and whimsical approach to understanding the importance of credit scores and exploring strategies for improvement. Picture yourself on stage with two columns and three rows forming a table. On one side, we have ‘Credit Score Importance’ filled with gloomy words like ‘denial,’ ‘higher interest rates,’ and ‘missed opportunities.’ On the other side, we have ‘Strategies for Improvement’ with words like ‘responsibility,’ ‘timely payments,’ and ‘budgeting wizardry.’ Now, let the battle between these two columns begin!

In the first row, denial stares fiercely at responsibility. But wait! Responsibility whips out its secret weapon: timely payments! Bam! Denial stumbles back as lenders start noticing your improved payment history.

In the second row, higher interest rates tries to intimidate budgeting wizardry. But budgeting wizardry is prepared; it slashes unnecessary expenses left and right! Pow! Higher interest rates are no match for your frugal skills.

Finally, in the third row, missed opportunities taunts responsibility once more. But responsibility takes a deep breath and shows off its ultimate move: keeping credit utilization low while still using credit wisely. Kaboom! Missed opportunities crumble as lenders see that you can handle credit responsibly.

Credit Score Requirements for Different Mortgage Types

When applying for different mortgage types, it’s important to be aware of the specific credit score requirements. Your credit score is like a magical number that can open doors to your dream home or leave you stuck in a house-less purgatory.

So, let’s dive into the enchanting world of credit score minimums and ranges!

For some mortgage types, like conventional loans, you may need a credit score minimum of 620. But don’t fret if your score falls below this range! There are other mortgage options available for those with lower scores, such as FHA loans with a minimum requirement of 580. It’s like having a little fairy godmother who swoops in to save the day!

Now, let me sprinkle some knowledge about credit score ranges on you. Credit scores typically range from 300 to 850, with higher numbers being better. If your credit score is above 720, you’re in the land of unicorns and rainbows – lenders will see you as low-risk and offer you their best loan terms.

But even if your credit score isn’t quite there yet, don’t lose hope! You can still qualify for mortgages with scores between 580 and 719. It might not be as magical as getting the best rates and terms, but hey, at least you’re still on the path to homeownership.

Tips for Improving Your Credit Score Before Applying for a Mortgage

So, you’re thinking about applying for a mortgage, huh?

Well, let me tell you, your credit score is gonna be pretty important in that process.

But don’t worry! I’ve got some super fun and creative strategies to help you improve that score and increase your chances of getting approved.

Trust me, it’s gonna be a breeze!

Credit Score Importance

To understand the importance of your credit score when applying for a mortgage, you must first consider how it affects your interest rate and loan approval.

Think of it like this: your creditworthiness is the secret ingredient that lenders use to determine if you’re worthy of their trust (and money). Your credit score is like a magical number that reflects your financial responsibility and reliability.

It’s like a shiny golden ticket that can open doors to better loan terms and lower interest rates. With a high credit score, you become the belle of the mortgage ball, attracting lenders who are eager to offer you favorable terms.

But beware! A low credit score can turn you into Cinderella at midnight, facing higher interest rates and potentially even getting denied for a loan altogether.

Strategies for Improvement

If you want to improve your creditworthiness and increase your chances of getting a better mortgage deal, consider implementing these strategies.

Building credit doesn’t have to be dull and dreary; it can actually be quite fun! First, pay your bills on time, like clockwork. Think of it as a challenge to beat deadlines and show off your responsible side.

Second, keep your credit card balances low. It’s like playing a game where the goal is to have more available credit than debt.

Third, don’t close old accounts; they add character to your credit history.

Finally, mix it up – having different types of credit shows that you can handle various financial responsibilities with ease.

Factors That Can Negatively Affect Your Credit Score

Avoid maxing out your credit cards as it can negatively affect your credit score. You know, that three-digit number that holds the key to your financial future? Yeah, that one. So, let’s talk about some factors that can bring down your credit score faster than a rollercoaster ride.

-

Late payments: Oops! Paying bills late not only racks up those pesky late fees but also sends a red flag to lenders.

-

High credit utilization: Picture this: you’re at an all-you-can-eat buffet, and you pile your plate so high it’s practically touching the ceiling. Well, doing the same with your credit card balances isn’t such a good idea. Keep those balances low!

-

Closing old accounts: Don’t be too quick to say goodbye! Closing old accounts can shorten your credit history and lower your overall available credit.

-

Applying for new credit too often: Slow down there, Speedy Gonzalez! Applying for multiple lines of credit within a short period of time can make lenders think you’re desperate for money (even if you’re not).

-

Collections and bankruptcies: Yikes! These are like big red warning signs on your credit report. Avoid them like the plague if you want to keep that shiny credit score intact.

Remember, maintaining a good credit score is like taking care of a pet unicorn – it requires attention, responsibility, and the occasional sprinkle of magic dust. So be mindful of these factors and watch as your credit score soars higher than Peter Pan on his way to Neverland!

Now go forth and conquer those financial goals with confidence because you’ve got this whole mastery thing in the bag!

How Late Payments Can Impact Your Mortgage Application

So, you’ve learned about the factors that can negatively affect your credit score. But did you know that late payments can have a big impact on your mortgage application? Oh yes, my friend, those missed payments can come back to haunt you!

You see, when you apply for a mortgage, lenders take a close look at your credit history. And if they spot any late payments lurking in there, it’s not going to make them do cartwheels of joy. Nope, quite the opposite actually.

Late payments are like little red flags waving in the wind, signaling to lenders that you may not be the most reliable borrower. They raise concerns about your ability to make timely payments on your mortgage too. And let’s face it, nobody wants to lend money to someone who has trouble paying their bills on time.

But wait! There’s more! Late payments can also lower your credit score. Remember how we talked about that earlier? Well, it turns out that one of the consequences of a lower credit score is difficulty getting approved for a mortgage.

Lenders want borrowers with good credit scores because it shows that they’re responsible and trustworthy with their finances. So if you’ve been slacking off on those payment due dates and have accumulated some late fees along the way, it’s time to get back on track.

Don’t worry though; it’s not all doom and gloom! If you start making timely payments now and work towards improving your credit score, there’s still hope for that dream home of yours. Just remember: pay on time and watch those late payment worries fade away like yesterday’s news!

The Role of Debt-to-Income Ratio in Mortgage Approval

So, you’re dreaming of that cozy little cottage in the countryside or that sleek city apartment. But before you can start packing your bags, let’s talk about something called debt-to-income ratio.

Now, I know what you’re thinking – ‘Debt? Income? Ratios? What does this have to do with my dream home?’ Well, my friend, it turns out that this little number plays a pretty big role in whether or not you’ll be sipping tea in your new living room or stuck scrolling through online listings for another year.

Let’s dive into the importance of keeping that ratio low and how it can impact your eligibility for a loan.

Importance of Low Ratio

Having a low debt-to-income ratio is crucial when applying for a mortgage. It not only impacts your loan eligibility but also has several implications that can benefit you in the long run. Take a look at these bullet points to understand why having a low ratio is so important:

- Lower risk: Lenders see you as less risky because you have more disposable income to handle unexpected expenses.

- Higher borrowing power: With lower debts, lenders may be more willing to lend you larger amounts, allowing you to purchase your dream home.

- Better interest rates: A low ratio demonstrates financial responsibility, which can lead to better interest rates on your mortgage.

- Faster approval process: Lenders are likely to process your application faster because they perceive you as less of a financial risk.

- More financial freedom: Having a low ratio means more money in your pocket each month, giving you the flexibility for other investments or savings.

Now that we’ve explored the benefits of maintaining a low debt-to-income ratio, let’s delve into how it directly impacts your loan eligibility.

Impact on Loan Eligibility

Maintaining a low debt-to-income ratio is crucial for qualifying for a mortgage. It not only affects your eligibility but also has a significant impact on your loan terms, credit score, and down payment.

When your debt-to-income ratio is low, lenders view you as a more favorable borrower. They are more likely to offer you better terms and lower interest rates. This can save you a significant amount of money over the life of your loan.

Additionally, keeping your debts in check improves your creditworthiness. A low debt-to-income ratio boosts your credit score, making you a more attractive borrower. Lenders are more willing to lend to someone with a strong credit history.

Moreover, having a low debt-to-income ratio allows you to allocate more money toward your down payment. This means you can save more in the long run and potentially avoid costly private mortgage insurance.

Now, let’s explore how your credit utilization connects to your mortgage eligibility.

The Connection Between Credit Utilization and Mortgage Eligibility

Your credit utilization ratio can significantly impact your eligibility for a mortgage. It’s more than just a fancy term – it’s a secret number that lenders use to determine how responsible you are with your credit. So, let’s dive into the connection between your credit utilization and getting that dream home!

Picture this: you have a shiny credit card in one hand and a delicious cupcake in the other. You’re tempted to take a big bite of that sugary goodness, but wait! Before you do, remember that managing your credit is just like savoring that perfect cupcake. You want to enjoy it without going overboard.

Here are five things you need to know about your credit utilization:

- Credit utilization is calculated by dividing the amount of credit you’re using by the total amount of credit available to you.

- Lenders like to see a low credit utilization ratio because it shows them that you’re not relying too heavily on borrowed funds.

- Aim for a ratio below 30% – anything higher may raise eyebrows and lower your chances of getting approved for that mortgage.

- Paying off debt or increasing your available credit can help improve your utilization ratio.

- Keep an eye on those balances and make sure they don’t creep up unexpectedly.

How Credit Inquiries Can Impact Your Mortgage Application

Hey there, curious credit seeker!

Let’s dive into the intriguing world of credit inquiries and their impact on your mortgage application.

Brace yourself for a rollercoaster ride of information as we explore how these little queries can affect not only your credit score but also your dreams of becoming a homeowner.

Impact of Credit Inquiries

If you’ve recently had multiple credit inquiries, it may affect your mortgage application. Credit inquiries happen when you apply for new credit, like a credit card or loan. These inquiries are recorded on your credit report and can have an impact on your credit score, which is a key factor in determining whether or not you qualify for a mortgage.

Here are some things to consider about the impact of credit inquiries:

- Multiple recent inquiries can lower your credit score.

- Lenders may see too many inquiries as a sign of financial instability.

- The effect of inquiries on your score may depend on other factors, such as the type of inquiry and how recent it is.

- It’s important to be mindful of how often you apply for new credit before applying for a mortgage.

- Monitoring your credit report regularly can help you stay aware of any potential negative impacts from credit inquiries.

Credit Score Implications

Having multiple recent credit inquiries can potentially lower your chances of qualifying for a mortgage. So, let’s dive into the whimsical world of credit score factors and some masterful tips to boost your score!

| Credit Score Factors | Credit Score Tips |

|---|---|

| Payment history | Pay bills on time |

| Credit utilization | Keep balances low |

| Length of credit | Keep old accounts open |

| New credit | Limit new applications |

Now, imagine you’re climbing a magical ladder towards mortgage approval. Each step represents a factor that affects your credit score. Step one is payment history! Make all your payments on time, and you’ll be soaring up the ladder.

Next, we have credit utilization! Keep those balances low to avoid falling down the ladder like a clumsy magician.

Step three is length of credit. Hold onto those old accounts like they’re precious treasures hidden in an enchanted forest.

Lastly, watch out for new credit applications! Too many can cause you to stumble off the ladder altogether.

Remember these tips and soon enough, you’ll be waving your wand in celebration as you secure that dreamy mortgage!

The Effect of Bankruptcies and Foreclosures on Your Credit Score

Bankruptcies and foreclosures can significantly impact your credit score. It’s like a roller coaster ride for your financial reputation, and nobody wants to be stuck on the downward slope. So, let’s dive into the effect of these unfortunate events on your credit score.

Here are five things you need to know about how bankruptcies and foreclosures can affect that all-important number:

-

Bankruptcy Laws: The effect of bankruptcy laws on your credit score depends on the type of bankruptcy filed. Chapter 7 bankruptcies tend to have a more severe impact than Chapter 13 bankruptcies. It’s like choosing between a whirlwind or just a gentle breeze.

-

Foreclosure Fallout: Foreclosure is like breaking up with your house – it’s messy, emotional, and leaves scars behind. Unfortunately, those scars show up as negative marks on your credit report. It’s as if your credit score gets its heart broken too.

-

Credit Score Crunch: Bankruptcies and foreclosures can cause a significant drop in your credit score. Think of it as putting a dent in your financial armor. But fear not! With time and responsible financial habits, you can bounce back stronger than ever before.

-

Long-lasting Effects: Both bankruptcies and foreclosures can remain on your credit report for several years, haunting you like that catchy song stuck in your head. However, their impact diminishes over time as long as you continue making smart choices.

-

Positively Rebuilding: Despite the initial blow to your credit score, there is hope for redemption! By establishing good payment habits and building positive lines of credit post-bankruptcy or foreclosure, you can slowly but surely rebuild that precious three-digit number.

The Importance of a Solid Credit History for Mortgage Approval

So, you’ve decided it’s time to buy a house and now you’re diving into the world of mortgages. Well, buckle up because there are two key points you need to know about: credit score impact and mortgage approval criteria.

Your credit score can either make or break your chances of getting approved for a mortgage, so it’s important to understand how it all works. And don’t worry, we’ll guide you through this whimsical journey with a sprinkle of lightheartedness along the way!

Credit Score Impact

Your credit score can greatly influence your chances of getting approved for a mortgage. It’s like a magical number that lenders use to determine how responsible you are with money. So, if you want that dream home, it’s time to take a closer look at your credit score factors and understand its impact on interest rates.

Here are some things to consider:

-

Payment history: Did you pay all your bills on time? A solid record here is like waving a magic wand over your credit score.

-

Credit utilization: How much of your available credit are you using? Keep it low, and watch those interest rates drop!

-

Length of credit history: The longer the better! Show those lenders you’ve been responsible for ages.

-

Credit mix: Variety is the spice of life, and also good for your credit score. Mix it up with different types of accounts.

-

New credit applications: Be cautious about applying for too many new accounts. Lenders may see this as risky.

Mortgage Approval Criteria

The criteria for mortgage approval include factors such as employment history, income stability, and debt-to-income ratio.

But let’s not forget about the credit score! Your credit score factors heavily into the equation when it comes to getting approved for a mortgage. It’s like the secret ingredient that can make or break your application.

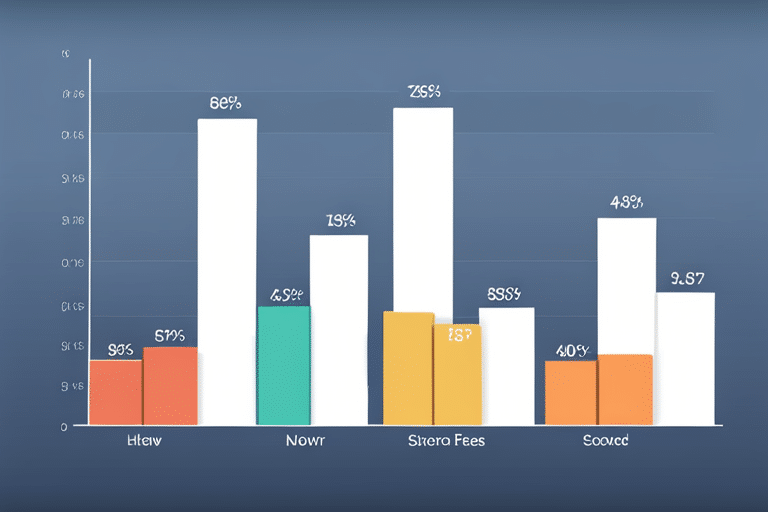

Picture this: you’re sitting at a table with four rows and two columns, and on one side you have your credit score and on the other side you have your mortgage rate. As you move up in credit score, your mortgage rate magically decreases. It’s like watching a magic show where the magician pulls lower interest rates out of his hat!

How Your Credit Score Can Affect Your Mortgage Interest Rate

A higher credit score can result in a lower interest rate on your mortgage. So, if you’re looking to save some money, it’s time to dive into the world of credit scores and how they affect your mortgage rates. Here are five key things you need to know:

-

Lenders love high credit scores: A good credit score shows that you’re responsible with your finances and are likely to make timely mortgage payments. This makes lenders more willing to offer you lower interest rates.

-

Lower risk, lower rates: Your credit score is like a report card for your financial behavior. The higher your score, the less risky you appear to lenders. And when they see less risk, they’re more inclined to give you a better deal.

-

The impact of just a few points: Even a small increase in your credit score can have a big impact on your interest rate. So, take the time to improve your credit before applying for a mortgage – it could save you thousands of dollars over the life of the loan.

-

Paying bills on time matters: Late payments can seriously damage your credit score. Make sure all of your bills are paid on time, every time, so that when it comes time to apply for a mortgage, you’ll have an impressive track record.

-

Keep those balances low: High balances on revolving accounts like credit cards can negatively impact your credit utilization ratio – which is the amount of available credit being used. Aim to keep this ratio below 30% and watch as your credit score climbs higher.

Understanding how your credit score affects mortgage rates is essential if you want better terms and lower monthly payments. But there’s another important aspect of mortgages that we need to explore – how does our beloved credit score come into play when it comes down to insurance requirements? Well, let’s find out!

The Role of Credit Score in Mortgage Insurance Requirements

So, you’ve learned that your credit score can have a big impact on the interest rate you get for your mortgage. But did you know that it also plays a role in determining whether or not you’ll need to pay for mortgage insurance?

Oh yes, my friend, your credit score has some serious power!

You see, when lenders are deciding whether or not to require mortgage insurance, they take a look at several factors. And one of the most important factors is your credit score. The higher your credit score, the less risky you appear to be as a borrower. And when lenders see less risk, they’re more likely to waive the requirement for mortgage insurance.

On the flip side, if your credit score is on the lower end of the spectrum, lenders might view you as a riskier borrower and insist on having mortgage insurance. It’s their way of protecting themselves against potential losses if you were to default on your loan.

Now, let me tell you why this matters. Mortgage insurance can add up over time and really put a dent in your monthly budget. So if you’re able to avoid it altogether because of your stellar credit score, well then kudos to you! You’ll save yourself some serious cash.

Steps to Take if Your Credit Score Is Holding You Back From Getting a Mortgage

If your credit score is preventing you from getting a mortgage, there are steps you can take to improve your chances of approval. Don’t fret! You have the power to turn things around and make yourself more creditworthy.

Here’s what you can do:

-

Pay down your debts: Show those lenders that you’re serious about managing your finances by reducing your outstanding debt. It’s like giving them a high-five with your money-smart hand.

-

Pay on time, every time: Consistent and timely payments demonstrate responsibility and reliability. Be the punctual superstar in the world of creditworthiness!

-

Check for errors in your credit report: Sometimes, mistakes happen. Make sure to review your credit report regularly and dispute any errors you find. You deserve an accurate representation of your financial history.

-

Keep old accounts open: Closing old accounts may seem tempting, but keeping them open actually helps boost the length of your credit history. So hold on tight to those ancient relics!

-

Consider alternative mortgage options: If traditional mortgages aren’t within reach just yet, explore other possibilities such as FHA loans or VA loans. These alternative options might be the key to unlocking that dream home.

Remember, improving your creditworthiness takes time and effort, but it’s totally worth it in the end. So put on your cape (or maybe a snazzy suit) and take charge of your financial destiny!

The road to homeownership may have a few bumps along the way, but with determination and these steps, you’ll be well on your way to securing that mortgage and turning those dreams into reality!

Frequently Asked Questions

Can a Low Credit Score Prevent Me From Getting a Mortgage?

Having a low credit score can make it harder to secure a mortgage. But don’t worry, there are alternative financing options available. Just keep working on improving your credit and exploring different avenues!

How Does My Credit Score Affect the Interest Rate on My Mortgage?

Your credit score has a bigger impact on your mortgage interest rate than a stampede of wild elephants in your living room. But fear not! By improving factors like payment history and debt utilization, you can tame those rates into submission.

Are There Specific Credit Score Requirements for Different Types of Mortgages?

When it comes to types of mortgages, there are often specific credit score requirements. Lenders like to see a good credit score before granting you that dream loan. So keep those numbers up!

What Steps Can I Take to Improve My Credit Score Before Applying for a Mortgage?

Are you dreaming of a cozy home but worried about your credit score’s impact on your mortgage application? Fear not, my friend! I’ll share some tips to boost your creditworthiness and improve that score. Let’s make those dreams a reality!

If My Credit Score Is Holding Me Back From Getting a Mortgage, What Options Do I Have?

If your credit score is holding you back from getting a mortgage, don’t fret! There are alternative financing options available and steps you can take to improve your credit score. Keep pushing forward!

Conclusion

So, you’ve seen how important your credit score is when it comes to applying for a mortgage. It can impact everything from the interest rate you’ll get to whether or not you’re approved for a loan.

But don’t fret! There are plenty of ways to improve your credit score before diving into the mortgage application process.

So why wait? Start taking steps now to boost that credit score and open up a world of homebuying possibilities. After all, who doesn’t want their dream home?