Imagine this: you’re on a roller coaster, riding the twists and turns of your financial journey. As you navigate this thrilling ride, your credit score stands as the ultimate barometer of success.

But do you know how it’s calculated? Buckle up for a step-by-step guide that will demystify the process and empower you to take control of your credit destiny.

From understanding the importance of credit scores to analyzing report data, we’ll show you how to master this exhilarating ride towards financial freedom.

Key Takeaways

- Credit scores play a crucial role in determining financial health and lenders use them to measure trustworthiness and ability to repay loans.

- Factors such as credit utilization and payment history significantly affect credit scores.

- Analyzing credit report data, including identifying negative factors and addressing errors, can lead to improved financial health.

- Understanding credit report statuses and sections is important for assessing financial standing, detecting potential red flags, and uncovering unfamiliar accounts or incorrect personal information.

The Importance of Credit Scores

You should know that your credit score plays a crucial role in determining your financial health. It’s like the report card of your financial life, but instead of grades, you get a three-digit number. This magical number can have a significant impact on whether you get approved for loans or not.

When it comes to loan approvals, lenders take your credit score seriously. They use it as a measure of your trustworthiness and ability to repay borrowed money. A higher credit score gives them confidence in lending you money, while a lower one might make them hesitate.

But don’t fret! There are ways to improve your credit score and boost your chances of getting that loan approved. First things first, pay all your bills on time. Late payments can negatively affect your credit score faster than melting ice cream on a sunny day.

Next up, keep an eye on those credit card balances. Ideally, you should aim to use less than 30% of the available credit limit on each card. It shows that you’re responsible with managing debt and not maxing out every plastic friend in sight.

Lastly, don’t be afraid to ask for help if needed. Credit counseling services exist for a reason – they can guide you through the maze of improving your credit score and provide useful strategies tailored to your specific situation.

Understanding the Credit Score Range

To understand the credit score range, it’s important to know what factors contribute to it. Your credit score is like your financial report card, telling lenders how responsible you are with money. So, let’s dive into this magical world of numbers and symbols!

Here are four key things you need to know about credit score categories and their interpretation:

-

Excellent Credit: Ahh, the holy grail of credit scores! If you’re in this category (which ranges from 800 to 850), lenders will see you as a financial wizard who pays bills on time and manages debt responsibly. You’ll have access to the best interest rates and loan options. Bragging rights included!

-

Good Credit: Don’t worry if you’re not quite at ‘excellent’ status yet. With a good credit score ranging from 670 to 799, you’re still in solid territory. Lenders will trust that you’ll pay them back, but maybe not with sparkles and glitter like those excellent folks.

-

Fair Credit: Oopsie-doodle! In the fair credit category (580 to 669), lenders might raise an eyebrow or two when considering your loan application. They may offer less favorable terms or higher interest rates because they see some red flags in your financial past.

-

Poor Credit: Oh no! This is where things get tricky. A poor credit score (300 to 579) can really put a damper on your financial goals. Lenders may be hesitant to lend you money or charge sky-high interest rates because they think there’s a chance they won’t see that moolah again.

Factors That Affect Your Credit Score

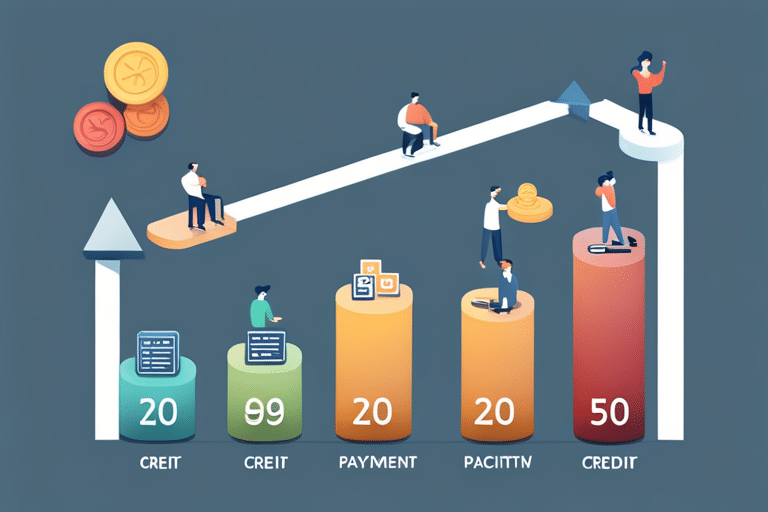

Understanding the factors that impact your credit score can help you make informed decisions about your financial health. Your credit score is like a magical number that lenders use to decide whether or not they want to lend you money. So, let’s dive into the world of credit scores and discover what makes them tick!

There are two main factors that play a significant role in determining your credit score: credit utilization and payment history. Think of these factors as the dynamic duo, working together to either boost or hinder your credit score.

Credit utilization refers to the amount of available credit you are using. It’s like having a plate of cookies and only eating half of them. The less you gobble up, the better it looks to lenders. Aim for a low percentage – around 30% or less – to keep those creditors drooling over your responsible borrowing habits.

Payment history is all about paying your bills on time, just like feeding your pet goldfish every day so it doesn’t swim away from you! Late payments can have a negative impact on your credit score because they show potential lenders that you may not be reliable when it comes to repaying debts.

Now, let’s take a look at how these factors fit into the grand scheme of things:

| Factors | Impact on Credit Score |

|---|---|

| Credit Utilization | High utilization = bad |

| Payment History | On-time payments = good |

Understanding how these factors affect your credit score will empower you to take control of your financial destiny. Armed with this knowledge, you’re ready for the next step: gathering information about your credit report.

Step 1: Gathering Credit Report Information

Now that you’ve learned about the factors that affect your credit score, it’s time to dive into Step 1: Gathering Credit Report Information.

This step is like going on a treasure hunt for all the juicy details about your credit history! So grab your magnifying glass and get ready to analyze some data.

Here’s what you need to do:

-

Request your credit report: Start by contacting the three major credit bureaus – Equifax, Experian, and TransUnion – and request a copy of your credit report from each of them. These reports will give you a comprehensive view of your financial history.

-

Review for accuracy: Now comes the fun part! Take a close look at every single detail in your credit reports. Check if all the information is accurate and up-to-date. Look out for any errors or discrepancies that could potentially harm your credit score.

-

Pay attention to account statuses: As you go through your credit reports, pay special attention to the status of each account listed. Are they marked as open, closed, or in collections? Understanding these statuses will help you see where you stand financially.

-

Identify potential red flags: Keep an eye out for any signs of fraudulent activity or identity theft. Look for unfamiliar accounts, incorrect personal information, or any other suspicious entries that could indicate someone has been messing with your finances.

Remember, analyzing credit report data is essential for maintaining good financial health. By ensuring its accuracy, you can take control of your credit score and make informed decisions moving forward.

Step 2: Analyzing Credit Report Data

Take a closer look at the information in your credit reports and analyze the data to identify any potential red flags or discrepancies. It’s time to put on your detective hat and dig deep into those credit reports. But fear not, dear reader, for this is no ordinary investigation! We are about to embark on an adventure filled with analyzing trends and identifying errors.

As you delve into the depths of your credit reports, keep an eye out for any patterns or trends that may arise. Are there any recurring late payments? Have you noticed a sudden increase in credit inquiries? These could be indicators of financial missteps or even identity theft lurking in the shadows. Stay vigilant!

But don’t let all those numbers and codes intimidate you. Remember that mastery comes from understanding, so take your time dissecting each section of your report. Look for inconsistencies like misspelled names, incorrect addresses, or unfamiliar accounts – these could signal potential errors that need correcting.

Now, armed with knowledge and a keen eye for detail, you’re ready to tackle those credit reports head-on! Embrace the whimsy of this journey as you uncover hidden gems of information tucked away within the pages. And remember, analyzing trends and identifying errors is not just about fixing mistakes but also about gaining control over your financial destiny.

Frequently Asked Questions

How Long Does It Take for a Credit Score to Improve After Paying off a Debt?

Paying off a debt can boost your credit score, but the time it takes to see improvement varies. Factors like other debts and payment history also influence how quickly your score bounces back.

Can Closing a Credit Card Account Negatively Affect Your Credit Score?

Closing a credit card account can have a negative impact on your credit score, especially if it affects your credit utilization. To rebuild your credit after closing a card, focus on paying off debts and keeping low balances.

Does Checking Your Own Credit Score Have a Negative Impact on Your Credit Score?

Checking your own credit score won’t hurt your score! In fact, it’s like giving yourself a high-five. It shows responsibility and helps you catch any errors or fraudulent activity. So go ahead, check away!

How Often Should I Check My Credit Score?

Checking your credit score regularly is like peeking at a present before it’s unwrapped. It’s important to monitor it to catch any fluctuations and stay on top of your financial game.

Can a Single Late Payment Significantly Lower Your Credit Score?

Yes, a single late payment can significantly lower your credit score. Multiple late payments have an even greater effect. Also, keeping your credit utilization low is important for maintaining a high score.

Conclusion

So, there you have it! You’ve journeyed through the mystical realm of credit scores and learned how they are calculated.

It may seem like a daunting task at first, but fear not! With a little knowledge and perseverance, you can conquer any credit score challenge that comes your way.

Remember, just like a wizard mastering their spells or a superhero honing their powers, understanding your credit score is the key to financial success.

So go forth, my friend, armed with this magical knowledge and watch as your credit score soars higher than an enchanted broomstick in the night sky!