Are you ready to unlock the hidden potential of your credit card?

Get ready to dive into the world of cashback rewards with our guide on how to navigate cashback credit cards.

With these insider tips and tricks, you’ll learn how to earn while you spend, turning everyday purchases into cold hard cash.

So buckle up and get ready for a wild ride as we show you the secrets to maximizing your cashback rewards.

Let’s embark on this journey together towards financial mastery!

Key Takeaways

- Choosing the right cashback credit card depends on your spending habits and preferences.

- Cashback rewards allow cardholders to earn money back on their purchases.

- Factors to consider when choosing a cashback credit card include redemption options, annual fees, and sign-up bonuses.

- To maximize cashback rewards, choose a card that aligns with your spending habits, strategize your purchases, and use your card for everyday expenses.

Different Types of Cashback Credit Cards

There are various types of cashback credit cards available in the market. When it comes to earning rewards on your everyday purchases, these little plastic wonders can be a real game-changer. But with so many options out there, how do you choose the right one for you?

Let’s dive into the world of cashback credit cards and explore the different cashback structures!

First up, we have the flat-rate cashback cards. These cards offer a consistent percentage back on every purchase you make, regardless of where or what you buy. It’s like getting a little bonus every time you swipe your card! This type of card is great if you want simplicity and don’t want to bother with tracking spending categories.

Next, we have the tiered cashback cards. These cards offer different percentages of cashback depending on the category of your purchase. For example, you might earn 3% back on groceries and gas, but only 1% back on everything else. If you spend most of your money in specific categories like dining out or travel, this type of card can maximize your rewards.

Then there are rotating category cashback cards. These gems change their bonus categories every few months to keep things interesting. You might earn extra cashback at supermarkets one quarter and then at department stores the next quarter. It’s like a surprise party for your wallet!

Lastly, we have the sign-up bonus cards. These bad boys give you a hefty amount of cashback just for signing up and meeting certain spending requirements within a specified timeframe. They’re perfect if you have some big-ticket purchases coming up or if you’re planning a major expense.

Now that we’ve explored these different types of cashback structures, it’s time to compare them side by side and see which one fits best with your spending habits and lifestyle! Happy hunting for that perfect cashback credit card!

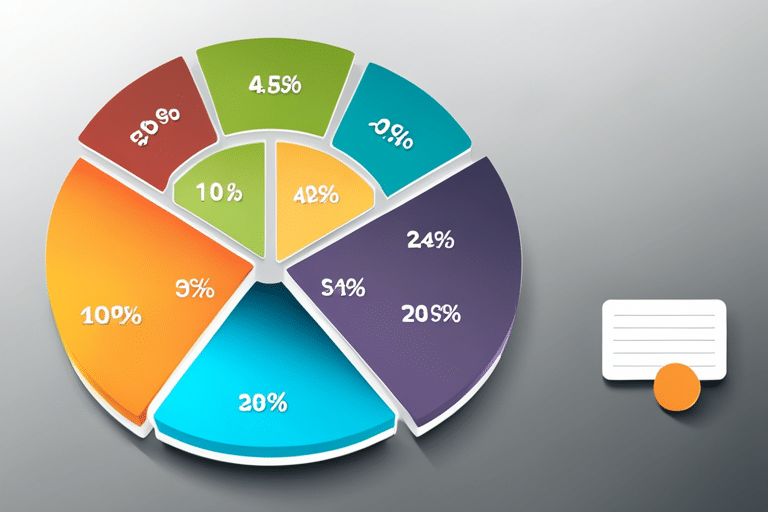

How Cashback Rewards Work

To understand how cashback rewards work, it’s important to know that they are a way for cardholders to earn money back on their purchases. It’s like getting a little bonus for being a smart shopper! Let’s break it down so you can fully grasp the earning potential of these rewards.

Imagine you have a cashback credit card with different categories that offer varying percentages of cashback. Here’s a handy table to help paint the picture:

| Category | Cashback Percentage |

|---|---|

| Groceries | 3% |

| Gas | 2% |

| Dining | 1% |

| Travel | 2.5% |

| Online Shopping | 5% |

So, let’s say you spend $100 on groceries in a month. With your cashback credit card, you’ll earn $3 back as cash rewards! And if you’re someone who spends quite a bit on online shopping, those purchases could earn you $5 back for every hundred dollars spent.

Now, it’s important to note the difference between cashback and other types of rewards. While rewards may come in the form of points or miles, which can be redeemed for specific items or experiences, cashback gives you actual money back in your pocket. It’s like winning a mini lottery every time you make a purchase!

As we’ve seen, understanding how cashback rewards work opens up exciting possibilities to earn while you spend. But before diving headfirst into the world of cashback credit cards, there are some factors to consider when choosing one that suits your needs and preferences…

[Transition sentence: Now that we’ve covered how cashback rewards work, let’s explore some factors to consider when choosing a cashback credit card.]

Factors to Consider When Choosing a Cashback Credit Card

Now that we’ve covered how cashback rewards work, let’s delve into what factors you should consider when choosing a cashback credit card.

I know it can be overwhelming with all the different options out there, but fear not! I’m here to guide you through this wonderful world of cashback credit card benefits.

First and foremost, think about your spending habits. Are you someone who loves to shop online? Or do you prefer swiping your card at your favorite local coffee shop? Different cards offer varying percentages of cashback on different categories of purchases. So, if you’re a frequent online shopper, look for a card that offers higher rewards for online purchases. If eating out is more your thing, find a card that gives extra cash back on dining expenses.

Another factor to consider is the redemption process. Some cards offer statement credits or direct deposits into your bank account as redemption options, while others may provide gift cards or merchandise. Make sure you choose a card with a redemption method that suits your preferences.

Don’t forget to check if there are any annual fees associated with the card! While some cards have no annual fee at all, others may charge an amount which could eat into your overall rewards earnings.

Lastly, keep an eye out for sign-up bonuses. Many cashback credit cards offer enticing sign-up bonuses in the form of additional cash back or bonus points after reaching a certain spending threshold within the first few months.

So there you have it – some key factors to consider when choosing a cashback credit card: aligning benefits with your spending habits, understanding the redemption process, checking for annual fees, and taking advantage of sign-up bonuses.

Now go forth and earn while you spend!

Tips for Maximizing Cashback Rewards

So, you’ve got yourself a shiny new cashback credit card and you’re ready to start earning those sweet rewards. But hold on a minute, my friend, because there’s more to it than just swiping your card willy-nilly.

In this discussion, we’ll delve into the art of choosing the right card for your spending habits, strategizing your purchases to maximize rewards, and most importantly, how to cash in on that hard-earned cashback effectively.

Get ready to become a master of the cashback game!

Choosing the Right Card

When choosing the right cashback credit card, it’s important to consider your spending habits and rewards structure. Here are four things to keep in mind:

-

Cashback Credit Card Benefits: Look for a card that offers benefits tailored to your lifestyle. Are you a frequent traveler? Look for cards with travel perks like airline miles and hotel discounts. Love dining out? Find a card that gives extra cashback on restaurant purchases. It’s all about maximizing the rewards that align with your spending habits.

-

Comparing Cashback Rates: Not all cards offer the same cashback rates, so make sure to compare and find one that gives you the best bang for your buck. Some cards may offer higher percentages of cashback on specific categories like groceries or gas stations, while others have a flat rate across all purchases.

-

Annual Fees: Consider whether the benefits and rewards outweigh any annual fees associated with the card. If you’re not earning enough in cashback to offset those fees, it might not be worth it.

-

Redemption Options: Look into how you can redeem your earned cashback – is it in the form of statement credits, gift cards, or direct deposits? Choose a card that offers flexible redemption options that fit your needs.

Spending Strategically for Rewards

To maximize your rewards, it’s important to strategically plan how you spend with your cashback credit card. By understanding your spending habits and taking advantage of cashback programs, you can earn some serious perks while buying the things you love. So, let’s get strategic!

First, take a look at the table below to see how different spending categories can affect your rewards:

| Category | Cashback Percentage |

|---|---|

| Groceries | 3% |

| Dining out | 2% |

| Gas | 1% |

Now that you know where you can earn more, adjust your spending habits accordingly. If you’re planning a big grocery haul, use your cashback card for maximum returns. Craving a dinner date? Opt for a restaurant that gives you cash back.

Redeeming Cashback Effectively

If you want to make the most of your rewards, don’t forget to check the expiration dates on your cashback. Nothing is worse than realizing your hard-earned cashback has gone stale like an old bag of chips.

To help you redeem your rewards efficiently and avoid any expiration mishaps, here are four cashback redemption strategies that will have you feeling like a reward-redeeming pro:

-

Plan Ahead: Take note of the expiration dates for each of your cashback rewards and make a plan to use them before they expire. Set reminders or mark your calendar so you don’t miss out.

-

Optimize Redemption Options: Some credit card companies offer various ways to redeem your cashback, such as statement credits, gift cards, or even travel rewards. Explore all the options available to find the one that maximizes the value of your rewards.

-

Stack Your Rewards: Look for opportunities to combine multiple offers or promotions when redeeming your cashback. For example, if there’s a sale or special deal happening at a retailer where you can use both your cashback and a coupon code, that’s double savings right there!

-

Keep Track of Bonus Categories: Many cashback credit cards offer rotating bonus categories throughout the year where you can earn even more rewards on specific purchases. Stay informed about these categories and adjust your spending accordingly to earn extra cashback.

Now go forth and conquer those reward redemptions like a boss!

Understanding Cashback Categories and Tiers

Hey there! So, you’ve mastered the art of cashback rewards, but now it’s time to take it up a notch.

Get ready to dive into the nitty-gritty details of different cashback tiers, because not all rewards are created equal.

We’ll also explore how to choose those top categories that will give you the biggest bang for your buck and help you maximize your rewards potential.

Are you ready to level up your cashback game? Let’s go!

Different Cashback Tiers

Understanding the different cashback tiers can help you maximize your earnings on a credit card. So, let’s dive into it and see what each tier has to offer!

Here are four things you need to know about cashback tiers comparison and their benefits:

-

Higher Spending, Higher Rewards: Some credit cards offer multiple tiers based on your spending habits. The more you spend, the higher your cashback percentage becomes.

-

Introductory Promotions: Many credit cards entice new customers with attractive introductory offers. These promotions often provide higher cashback rates for a limited period or specific spending categories.

-

Tiered Categories: Some cards have different cashback percentages for different spending categories like groceries, dining, or travel. It’s essential to choose a card that aligns with your purchasing habits.

-

Caps and Limits: Keep an eye out for any caps or limits on cashback earnings within each tier. Sometimes, there may be a maximum amount you can earn in certain categories or overall.

Now that you understand the benefits of different cashback tiers, let’s move on to choosing your top categories and maximizing those rewards!

Choosing Top Categories

When choosing your top categories, it’s important to consider your spending habits and prioritize the ones that align with your needs. You want to make sure you’re maximizing rewards potential and getting the most bang for your buck.

But hey, why stop there? Let’s take it up a notch by utilizing sign-up bonuses too!

Think about where you spend the most money. Is it groceries? Maybe dining out or travel? Whatever it is, find a cashback credit card that offers higher percentages in those categories. That way, every time you swipe, you’re earning more cashback.

And don’t forget about those sign-up bonuses! Many credit cards offer sweet deals when you first open an account. It’s like getting free money just for signing up!

Maximizing Rewards Potential

To get the most out of your rewards, it’s important to choose credit cards that offer higher percentages in the categories where you spend the most. But choosing the right card is just the first step in unlocking your earning potential. If you want to truly maximize your cashback, here are a few strategies for you to consider:

-

Stack those bonuses: Look for cards that offer sign-up bonuses or introductory offers. By taking advantage of these perks, you can jumpstart your earnings right from the start.

-

Get strategic with spending: Take a closer look at your monthly expenses and identify which categories make up the bulk of your spending. Then, focus on using credit cards that offer higher cashback percentages in those specific areas.

-

Don’t forget about rotating categories: Some credit cards have rotating categories that change every quarter. Keep an eye on these updates so you can plan ahead and earn more when those categories align with your spending habits.

-

Utilize online shopping portals: Many credit card issuers have online shopping portals where you can earn extra cashback by going through their site before making a purchase. It’s like getting rewarded twice for one purchase!

With these cashback strategies in mind, you’ll be well on your way to maximizing your rewards potential and earning some serious dough while doing what you do best – spending money! So go ahead and put those credit cards to work for you!

Managing Multiple Cashback Credit Cards

Managing multiple cashback credit cards can be tricky, but it’s worth it if you want to maximize your rewards. You’re a savvy spender who knows how to make every dollar count, and having multiple cashback credit cards is like having a team of reward-earning superheroes in your wallet. But with great power comes great responsibility, and managing those limits and balancing rewards and fees requires some finesse.

First things first, let’s talk about managing cashback limits. Each credit card has its own limit on how much cashback you can earn within a certain period of time. It’s important to keep track of these limits so you don’t miss out on any potential rewards. One way to do this is by setting up reminders or alerts on your phone or computer. That way, you’ll always know when you’re getting close to hitting the limit and can adjust your spending accordingly.

Now let’s tackle the art of balancing rewards and fees. While cashback credit cards are great for earning rewards on your everyday purchases, they often come with annual fees. It’s important to weigh the value of the rewards against the cost of the fees to make sure you’re getting the most bang for your buck. Take some time to crunch the numbers and see if the rewards outweigh the fees or if it might be more beneficial to switch to a different card.

Managing multiple cashback credit cards may require a little extra effort, but it can lead to big payoffs in terms of maximizing your rewards potential. So go ahead, embrace your inner reward-earning superhero and get ready to unlock all those sweet cashback perks! Just remember: stay organized, balance those rewards and fees wisely, and watch as those savings start piling up in no time!

Utilizing Sign-Up Bonuses and Promotional Offers

Alright, so you’ve mastered the art of managing multiple cashback credit cards and earning while you spend. Now, let’s take it up a notch and talk about how to maximize your credit card rewards like a pro.

We’ll also dive into the world of sign-up bonuses and promotional offers, because who doesn’t love getting extra perks just for signing up or taking advantage of a good deal?

Get ready to become a savvy credit card guru and make the most out of every swipe!

Maximizing Credit Card Rewards

If you want to get the most out of your credit card rewards, it’s important to understand how different cards earn cashback. So, let’s dive into the world of maximizing those sweet, sweet rewards!

Here are four tips to help you navigate the cashback game like a pro:

-

Know your spending habits: Take a good look at where your money goes each month. Do you spend more on groceries or dining out? Different cards offer higher cashback percentages in specific categories, so choose one that aligns with your spending patterns.

-

Watch out for cashback limits: Some cards have caps on how much cashback you can earn in certain categories or overall. Make sure to read the fine print and choose a card that matches your spending style without restricting your rewards potential.

-

Stack those rewards: Look for opportunities to double-dip on rewards by using coupons or shopping through online portals that offer additional cashback. It’s like getting paid extra for being a savvy shopper!

-

Pay off your balance in full: This might seem unrelated, but trust me—it matters! Paying interest on credit card balances will eat into any rewards earned, so make it a habit to pay off your bill every month and enjoy those sweet, guilt-free rewards.

Now go forth and maximize those credit card rewards like a boss! Happy spending!

Taking Advantage of Promotions

Alright, you’ve learned all about maximizing your credit card rewards, but now it’s time to take it up a notch. We’re talking about taking advantage of promotions and cashback credit card hacks!

Listen up, because this is where things get really exciting. You know those sweet discounts and deals that pop up every now and then? Well, with a little strategy and some clever thinking, you can use your cashback credit cards to make the most of them.

First things first, keep an eye out for promotional offers from your credit card company. They often partner with retailers to offer exclusive discounts or bonus cashback on certain purchases. So when you see one of these deals, jump on it like a hungry cheetah going after its prey!

And don’t forget about stacking! This is the art of combining multiple discounts or promotions to maximize your savings. For example, if you have a coupon for 20% off at a store and your cashback credit card gives you an extra 5% back on purchases there, go ahead and use both! It’s like getting paid to shop – not too shabby, right?

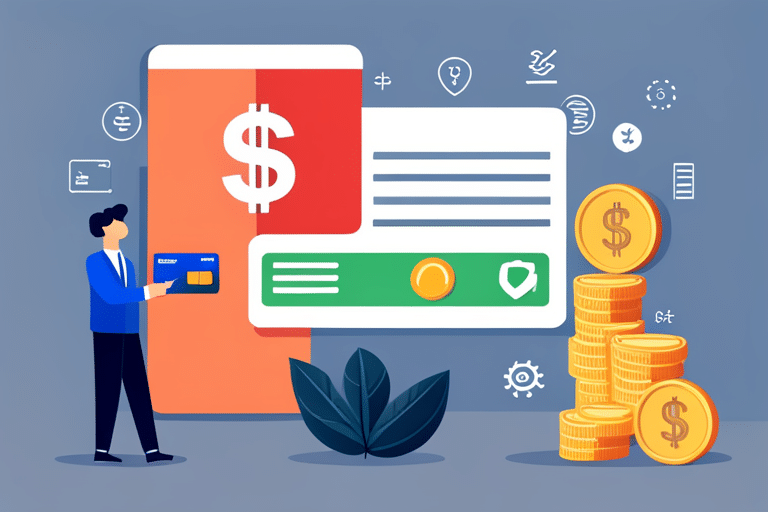

Reducing Fees and Maximizing Cashback Earnings

One way to reduce fees and maximize cashback earnings is by carefully reviewing the terms and conditions of different credit cards. Trust me, it’s not as boring as it sounds! By taking the time to compare cashback credit card options, you can find a card that suits your spending habits while minimizing those pesky annual fees.

Here are four tips to get you started on your journey to cashback mastery:

-

Look for cards with low or waived annual fees: Who wants to pay an arm and a leg just to use a credit card? Not you! When comparing different cashback credit cards, make sure to check out their annual fee policies. Some cards may even offer promotional periods with no annual fees at all. Score!

-

Pay attention to bonus categories: Different cashback credit cards offer rewards in various spending categories like groceries, dining, or travel. If you’re someone who spends a lot in one particular area, look for a card that gives extra cashback in that category. It’s like getting rewarded for doing what you already love!

-

Consider tiered earning rates: Some cards offer higher cashback rates on certain spending thresholds. For example, you might earn 1% cashback on everyday purchases but 2% on purchases above $1,000 per month. This way, the more you spend (within reason), the more you earn.

-

Don’t forget about sign-up bonuses: Many cashback credit cards entice new customers with generous sign-up bonuses. These can be in the form of statement credits or extra percentage points on your initial purchases. Snagging these bonuses can give your cashback earnings a nice boost right from the start.

By following these tips and tricks for reducing annual fees and making smart comparisons between different cashback credit cards, you’ll be well on your way to maximizing your earnings potential while keeping those pesky fees at bay.

And speaking of maximizing potential, let’s move on to the exciting world of navigating cashback redemption options!

Navigating Cashback Redemption Options

Now that you’ve mastered the art of reducing fees and maximizing your cashback earnings, it’s time to delve into the exciting world of cashback redemption options. Trust me, this is where things get really interesting!

When it comes to cashback redemption strategies, timing is everything. You want to make sure you’re getting the most bang for your buck (or should I say, cashback for your spending?). One popular strategy is to accumulate a certain amount of cashback before redeeming it. This way, you can enjoy a larger sum at once instead of small increments here and there. It’s like hitting the jackpot in one go!

Another smart tactic is to take advantage of special promotions or offers that credit card companies often run. Keep an eye out for bonus redemption opportunities where you can get even more value for your hard-earned cashback. These promotions may include discounted gift cards or limited-time deals on merchandise – talk about sweetening the deal!

Remember, every credit card has its own set of rules and regulations when it comes to redeeming your cashback rewards. Some may require you to reach a minimum threshold before you can start redeeming, while others let you redeem as little as $1 (talk about instant gratification!). Make sure to read the fine print so you know exactly what hoops you need to jump through.

Strategies for Responsible Credit Card Use

To ensure responsible credit card use, it’s important to monitor your spending habits and pay off your balance in full each month. We get it, credit cards can be a slippery slope to overspending. But fear not! With a little self-control and some savvy strategies, you can enjoy the perks of credit card rewards without falling into debt.

Here are four tips to help you navigate the world of responsible credit card use:

-

Set a budget: Take control of your spending by setting a monthly budget. Knowing how much you can afford to spend will prevent you from going overboard and racking up unnecessary debt.

-

Track your expenses: Keep tabs on every penny you spend using your credit card. This will allow you to see where your money is going and identify any areas where you may be overspending.

-

Pay in full, on time: Make it a habit to pay off your credit card balance in full each month. By doing so, you’ll avoid interest charges and keep yourself on track financially.

-

Maximize those perks: Credit cards often come with enticing perks like cashback rewards or travel points. Take advantage of these benefits by using your card for everyday purchases and then paying off the balance right away.

Avoiding Common Pitfalls With Cashback Credit Cards

Avoiding common pitfalls with cashback credit cards is essential for maximizing the benefits and minimizing potential financial setbacks. Let’s face it, we all love earning some extra cash while swiping our credit cards. But if you’re not careful, those rewards can quickly disappear into thin air. So, buckle up and get ready to learn how to avoid overspending and keep track of your cashback earnings like a pro.

First things first, don’t let the temptation of earning more cashback lead you down a dangerous path of overspending. It’s easy to get carried away when you see those rewards piling up in your account. But remember, every purchase adds up, and before you know it, you might find yourself drowning in debt instead of swimming in rewards. So set a budget and stick to it!

Now that we’ve got the spending under control, let’s talk about tracking those precious cashback earnings. It’s like hunting for hidden treasure – except this treasure is real money! Keep an eye on your statements or use mobile apps that help you monitor your transactions and calculate your cashback earnings automatically.

As the saying goes, ‘With great power comes great responsibility.’ Cashback credit cards have the power to boost your finances if used wisely. So make sure you’re avoiding overspending and tracking your earnings like a boss.

And speaking of boosting finances, now that you’ve mastered the art of avoiding pitfalls with cashback credit cards, it’s time to move on to planning for the long-term: using those hard-earned rewards to meet your financial goals. But more on that later; first things first – let’s dive into maximizing rewards!

Planning for the Long-Term: Using Cashback Rewards to Meet Financial Goals

Once you’ve mastered the art of managing your cashback rewards, it’s time to strategically plan how to use them to achieve your long-term financial goals. After all, what good is earning those sweet rewards if you’re not using them wisely? So, buckle up and get ready for some serious cashback strategizing!

Here are four ways you can make the most of your hard-earned rewards:

-

Planning for retirement: One smart move is to funnel your cashback rewards into a retirement account. Whether it’s a 401(k), an IRA, or a Roth IRA, every little bit helps when it comes to building that nest egg for your golden years.

-

Investing surplus cash: If you find yourself with extra cash from your cashback rewards, why not put it to work? Consider investing in stocks, bonds, or even real estate. With a little research and guidance from financial experts, you could turn those rewards into substantial long-term investments.

-

Paying off debt: Don’t let those pesky credit card balances linger around like unwanted guests at a party. Use your cashback rewards as an opportunity to pay down high-interest debt and free up more money for future financial endeavors.

-

Saving for big-ticket items: Are you dreaming of that dream vacation or shiny new car? Well, guess what? Your cashback rewards can help make those dreams a reality! Instead of splurging on small purchases here and there, save up those rewards over time until you have enough for that big-ticket item you’ve been eyeing.

Frequently Asked Questions

Can I Earn Cashback Rewards on All Types of Purchases?

Sure, you can earn cashback rewards on all types of purchases! The earning potential is limitless. Just make sure to choose a credit card that maximizes your rewards and watch those savings stack up!

Are There Any Restrictions on Redeeming Cashback Rewards?

When it comes to redeeming your cashback rewards, there are a few things to keep in mind. The process varies by credit card, so check the terms and conditions. Also, be aware of any expiration dates for your hard-earned cashback.

Can I Earn Cashback Rewards on Balance Transfers or Cash Advances?

Sure, you can earn cashback rewards on balance transfers or cash advances. However, there are some pros and cons to consider. Balance transfers can be a smart move, but watch out for high fees. To maximize cashback on cash advances, pay them off quickly to avoid interest charges.

Is There a Limit to How Much Cashback I Can Earn?

You’re probably wondering if there’s a limit to how much cashback you can earn. Well, let me tell you, the sky’s the limit! With some savvy strategies, you can maximize your cashback earning potential and reap the rewards.

How Long Do Cashback Rewards Typically Take to Be Credited to My Account?

Alright, so let’s talk about how long those sweet cashback rewards take to hit your account. Typically, it takes a few billing cycles for them to show up. But don’t worry, they’re worth the wait! Now, let’s dive into some strategies for maximizing and earning that cashback even faster.

Conclusion

Congratulations! You’ve now become a master of navigating cashback credit cards. With your newfound knowledge, you’ll be earning rewards left and right while still spending on the things you love.

Remember, just like sailing through uncharted waters, it’s important to stay vigilant and avoid common pitfalls along the way. By planning for the long-term and using your cashback rewards wisely, you can set sail towards your financial goals with confidence.

So go ahead, grab that compass and steer yourself towards a brighter future!