Are you ready to unlock the secret code that holds the key to your financial well-being?

It’s time to dive into the fascinating world of credit scores. They may seem like just numbers, but they have a profound impact on your financial health.

By understanding how your credit score works and taking steps to improve it, you can open doors to better loan rates, higher credit limits, and a brighter financial future.

So let’s embark on this journey together and discover the hidden connection between your credit score and your overall financial success.

Key Takeaways

- A good credit score directly impacts loan approvals and interest rates

- Job prospects can be influenced by credit scores

- Insurance rates are affected by credit scores

- Credit score impacts overall financial health and opportunities

The Importance of a Good Credit Score

Having a good credit score is important because it directly impacts your ability to secure loans and favorable interest rates. But let’s not get too serious here, my friend! Today, we’re going to delve into the magical world of credit scores and explore why they are so crucial for your financial stability.

Picture this: you’re sitting on a cloud, basking in the warm glow of financial security. You have a shining credit score that opens doors to countless benefits. With a good credit score, lenders will flock to you like seagulls to a bag of popcorn at the beach. They’ll trust you with their precious money because they know you’re responsible and reliable.

Imagine walking into a bank, wearing sunglasses as if you were some kind of secret agent. The loan officer looks at your credit score and says, ‘My oh my! Your impeccable credit score has granted you access to our exclusive club.’ And just like that, you receive lower interest rates on loans and mortgages.

A good credit score is like having an invisible knight guarding your financial castle. It protects you from high-interest rates that can drain your pockets faster than a leaky faucet. It allows you to borrow money when needed without breaking into a cold sweat about getting approved.

Understanding Credit Score Factors

Hey there, credit connoisseur!

Let’s dive into the magical world of credit scores and explore the key factors that make them tick.

We’ll unravel how these factors can have a profound impact on your financial health, but fret not – we’ll also uncover some nifty strategies to help you improve your creditworthiness along the way.

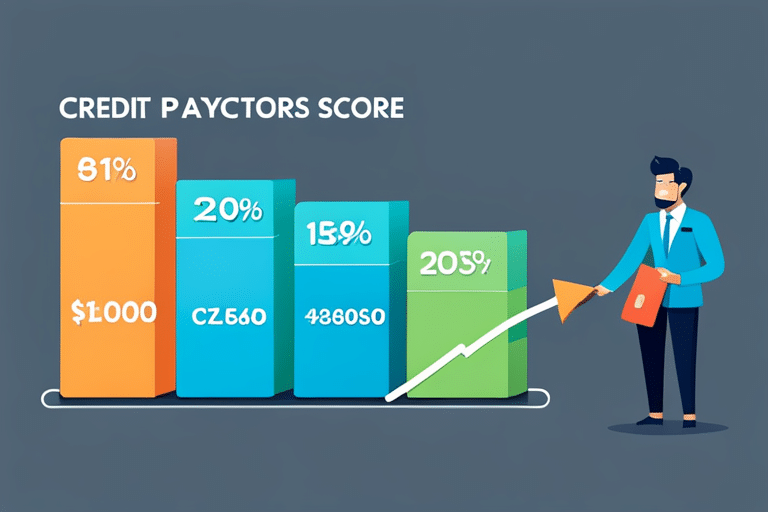

Key Credit Score Factors

Understanding the key factors that impact your credit score is essential for maintaining good financial health. It’s like putting together a puzzle made of numbers, where the higher the score, the better your financial future looks. So, let’s dive into these credit score factors and unravel the mystery!

� Payment History: Think of this as your credit report card. Paying your bills on time is like acing every test, while late payments can be a red mark against your record.

� Credit Utilization: Picture a seesaw balancing act. Keeping your credit card balances low compared to their limits shows lenders you’re responsible with borrowing.

� Credit Mix: Imagine a colorful buffet table offering different types of credit—credit cards, loans, mortgages. Having a diverse mix adds flavor to your creditworthiness.

� Length of Credit History: Consider this as building trust with lenders over time. The longer you’ve had accounts open and managed them well, the more reliable you appear.

Impact on Financial Health

To maintain good financial health, you’ll need to consider how these key factors impact your overall financial well-being. Your credit score doesn’t just affect your ability to get a loan or a credit card, it can also impact other areas of your life. Let’s take a closer look at two important aspects: job prospects and insurance rates.

When it comes to job prospects, employers often check credit scores as part of their hiring process. A low credit score may raise red flags for potential employers, making them question your financial responsibility. On the flip side, a high credit score can give you an edge over other candidates and show that you are trustworthy and reliable.

Now let’s talk about insurance rates. Insurance companies use credit scores to determine how much they will charge you for coverage. A poor credit score could result in higher premiums because insurers view individuals with lower scores as higher risk.

But don’t worry! By maintaining a good credit score, you can improve your chances of getting better job opportunities and affordable insurance rates.

| Job Prospects | Insurance Rates |

|---|---|

| Low Credit Score: May raise concerns for employers | Low Credit Score: Higher premiums due to perceived risk |

| High Credit Score: Advantageous in the hiring process | High Credit Score: Lower premiums as insurers see you as lower risk |

Improving Creditworthiness Strategies

Improving your creditworthiness requires implementing effective strategies to enhance your financial standing. But fear not, dear reader! With a touch of whimsy and a sprinkle of creativity, you’ll be well on your way to repairing and building your credit. So put on your imaginary cape and get ready for some magical tips:

-

Become best friends with your budget: Create a budget that fits like a perfectly tailored outfit, keeping track of every penny like a savvy detective.

-

Pay those bills on time: Show the world that you’re responsible and reliable by paying your bills promptly – it’s like receiving an A+ in financial responsibility.

-

Reduce those pesky debts: Channel your inner wizard and work on reducing those debts with determination and laser-like focus.

-

Diversify thy credit portfolio: Just as variety is the spice of life, having different types of credit (like loans or credit cards) can add flavor to your credit score.

Now go forth, my friend, armed with these magical strategies, and conquer the world of credit repair and building!

How Your Credit Score Affects Loan Approval

When applying for a loan, your credit score heavily impacts the approval process. It’s like going to a fancy party where the bouncer at the door checks your invitation before letting you in. In this case, your credit score is that golden ticket, determining whether you’re allowed into the exclusive club of loan recipients or left outside in the cold.

First things first, let’s talk about understanding creditworthiness. Think of it as a popularity contest among lenders. They want to know how likely you are to repay them on time and in full. So they look at your credit history, payment patterns, and overall financial behavior to gauge your trustworthiness.

Credit score requirements vary depending on the type of loan and lender you approach. It’s like finding the perfect pair of shoes – different styles have different sizes! Some loans may require a minimum credit score of 700 or higher, while others may be more lenient with scores in the 600s. It’s important to do some research and find out what range lenders typically prefer for the specific loan you’re interested in.

Remember, having good credit opens doors (and not just those fancy ones). Lenders are more likely to approve your loan application if you have a stellar credit score because it shows them that you’re responsible and reliable with money. On the other hand, if your credit score is lower than desired, don’t lose hope! There are ways to improve it over time by making timely payments and keeping balances low.

The Link Between Credit Score and Interest Rates

Hey there, credit score enthusiast! Let’s talk about the magical connection between your credit score and interest rates.

Brace yourself for a wild ride as we explore how lower scores can lead to higher rates, leaving you feeling like you’re stuck in a never-ending loop of financial doom.

But fear not, my friend! We’ll also dive into some tips on improving your creditworthiness so you can snag those better rates and ride off into the sunset with your dream loan.

Credit Score Impact

Your credit score can have a significant impact on your overall financial health. It’s like the conductor of an orchestra, guiding your financial decisions and determining your access to opportunities.

So, let’s dive into the whimsical world of credit score factors and improvement!

Picture this:

– Your payment history dancing in perfect harmony with on-time payments and responsible borrowing.

– The utilization ratio twirling gracefully, balancing the amount you owe against your available credit.

– Length of credit history skipping along, showcasing your time-tested reliability.

– The mix of credit types singing a harmonious melody, showing that you can handle different financial responsibilities.

But fear not if your credit score isn’t hitting all the right notes just yet! In the next section, we’ll explore how lower scores can lead to higher rates and what you can do to improve. So grab your baton and get ready for some melodious knowledge!

Lower Scores, Higher Rates

If your credit score is lower, you may end up paying higher interest rates. Oh, the joys of having a not-so-stellar creditworthiness! It’s like being stuck in quicksand while everyone else is floating on fluffy clouds.

But fear not, my dear friend, for there is hope! By improving your creditworthiness, you can escape the clutches of those pesky high interest rates and bask in the glory of lower ones.

Now, I know what you’re thinking – ‘How do I improve my creditworthiness?’ Well, fret not! There are simple steps you can take to boost your score. Start by making timely payments on all your debts and keeping your utilization rate low. Don’t forget to regularly check your credit report for any errors or discrepancies that could be dragging down your score.

Improving Creditworthiness for Better Rates

Ready to take charge of your creditworthiness and unlock better interest rates? It’s time to dive into the wonderful world of credit score improvement and discover the secrets to boosting your financial prowess.

Picture yourself on a grand adventure, armed with knowledge and determination, as you embark on a journey towards creditworthiness excellence. Here are four magical tools that will help you along the way:

-

The Credit Fairy: This mystical creature sprinkles good credit habits wherever it goes, helping you build a solid foundation for financial success.

-

The Score Wizard: With a wave of its wand, this enchanting being reveals the secrets behind credit scores and guides you towards reaching new heights.

-

The Budget Genie: Granting wishes for responsible spending, this genie helps you create a budget that will keep your finances in check.

-

The Debt Dragon Slayer: Armed with bravery and wit, this valiant hero helps you slay debt monsters and improve your creditworthiness.

Now that you’ve met these extraordinary allies, let’s move on to the strategies for improving your credit score.

Strategies for Improving Your Credit Score

One effective way to improve your credit score is by consistently making on-time payments. Think of it as a magical potion that boosts your creditworthiness and keeps the credit score monsters at bay. Each month, when the payment deadline approaches, grab your wand (or pen) and cast a spell of timely payment. It’s like feeding a friendly fire-breathing dragon – it keeps them happy and prevents them from scorching your credit score.

But wait, there’s more! Just like brushing your teeth twice a day keeps the dentist away, maintaining your credit score requires regular care. Besides paying on time, you can also sprinkle some extra magic by keeping your credit card balances low. This trick demonstrates responsible spending and showcases that you have mastered the art of borrowing wisely.

Another strategy to enchant those lenders is to diversify your credit mix. Don’t just rely on one type of loan or debt; instead, dance with different types like mortgages, car loans, or even student loans if you’re feeling adventurous. This shows that you can handle various financial obligations without turning into a pumpkin.

Now that you’ve mastered these strategies for improving your credit score, let’s journey into the realm of common mistakes that hurt this delicate number.

Common Mistakes That Hurt Your Credit Score

To avoid damaging your credit score, be cautious about applying for multiple lines of credit within a short period of time. It may seem tempting to take advantage of all those enticing offers and sign up for every credit card that comes your way, but trust me, it’s like running through a field of daisies only to trip and fall face-first into a pile of mud. Not exactly the graceful move you were aiming for.

Here are a few things to keep in mind:

-

Timing is everything: Just like you wouldn’t want to schedule two important meetings at the same time, you shouldn’t apply for multiple lines of credit simultaneously. Your credit score takes into account how many inquiries you have made within a certain timeframe, so spacing out your applications can save you from unnecessary damage.

-

Quality over quantity: It’s not about how many lines of credit you have, but rather how responsibly you manage them. Having too many accounts can actually make it harder for lenders to assess your risk, leading to potential problems down the road.

-

Credit score myths busting: Don’t believe everything you hear about credit scores. There are plenty of myths floating around that can lead people astray. For example, closing old accounts won’t magically improve your score overnight or keeping a balance on your cards won’t necessarily boost it either.

-

Double-check those calculations: Mistakes happen, even in the world of numbers. Make sure to regularly review your credit report for any errors or discrepancies that could be dragging down your score. And if there is an error, don’t hesitate to reach out and get it fixed.

The Role of Credit Utilization in Your Score

Credit utilization, or the amount of credit you use compared to your available credit, plays a significant role in determining your overall creditworthiness. Think of it like this: imagine you have a magical wallet that can hold up to 100 gold coins. Now, let’s say you borrow 50 gold coins from your friend and only spend 10. That means your credit utilization is at a lowly 10%, right? Well done!

But what if you borrowed the same amount but spent all 50 coins? Uh-oh! Your credit utilization just shot up to 50%. Not so impressive anymore, huh?

So, why does this matter? Well, when lenders look at your credit report, they want to see responsible borrowing behavior. They want to know that you’re able to manage your debts without maxing out every shiny piece of plastic that comes your way. By keeping your credit utilization low (preferably below 30%), you show them that you’re not relying too heavily on borrowed funds and are more likely to repay whatever money they lend you.

Now, I bet you’re wondering how on earth do I keep my credit utilization in check? Fear not! Here are some handy dandy tips for mastering the art of managing it:

- Keep track of those balances: Regularly monitor how much of your available credit you’re using.

- Pay off those debts: Aim to pay off as much as possible each month instead of just making minimum payments.

- Increase that limit: If possible, ask for a higher credit limit without increasing spending habits.

Monitoring and Managing Your Credit Score

Hey, you credit connoisseur! Are you ready to dive into the wonderful world of monitoring and managing your credit score?

In this discussion, we’ll explore the importance of keeping an eye on your credit and how it can affect your financial well-being.

Plus, we’ll uncover some sneaky strategies to help boost that magical number and improve your overall score.

Importance of Credit Monitoring

Make sure you’re regularly checking your credit score to stay on top of any changes and ensure the health of your finances. Credit monitoring has a whole slew of benefits that can help you navigate the puzzling world of credit. Here are a few reasons why it’s so important:

-

Protection: Credit monitoring services act as your personal superhero, keeping an eye out for any suspicious activity like identity theft or unauthorized charges.

-

Early Detection: Imagine being able to catch a financial hiccup before it becomes a full-blown catastrophe. With credit monitoring, you’ll get alerts whenever there’s a change in your credit profile.

-

Improvement: Monitoring your credit allows you to see how small changes impact your score and helps you make smarter financial decisions.

-

Peace of Mind: Knowing that someone (or something) is watching over your credit brings a sense of security and peace, freeing up mental space for more exciting things like planning that dream vacation.

Strategies for Score Improvement

To improve your credit score, it’s crucial to develop effective strategies that focus on managing your debt and establishing a solid payment history. But fear not, dear friend, for I am here to guide you through this whimsical journey of rebuilding your credit history! Picture yourself standing at the crossroads of financial success, with two paths before you – one filled with pitfalls and despair, the other paved with strategies for credit repair. Let us explore these strategies together in a delightful table:

| Strategies for Credit Repair | Rebuilding Credit History |

|---|---|

| Paying bills on time | Reducing credit card debt |

| Keeping credit utilization low | Diversifying types of credit |

| Disputing errors on your credit report | Building a positive payment history |

| Limiting new credit applications | Seeking professional guidance |

The Impact of Late Payments on Your Credit

If you consistently make late payments, it can significantly impact your credit score and overall financial health. Late payments—oh, the consequences! Let’s take a whimsical journey into the world of credit scores and discover how these tardy little slips can affect your future opportunities.

Imagine a majestic castle, standing tall and proud—the symbol of excellent credit. But alas! Your late payments have summoned a dark cloud that hangs over this fortress, causing it to crumble bit by bit. As the castle deteriorates, so does your credit score. It’s like watching a beautiful painting slowly fade away.

Now let’s embark on an adventure through the enchanted forest of missed payment repercussions:

- Lost opportunities flutter away like elusive fairies in the night.

- The doors to favorable interest rates slam shut with a thunderous boom!

- Magical rewards and perks vanish into thin air.

- Those glittering keys to financial freedom? They slip right out of your grasp.

But fear not! With determination and knowledge, you can turn this tale around. By making timely payments, you’ll mend those crumbling walls and restore your credit score to its former glory.

As we bid farewell to our crumbling castle, we venture forth into the land of credit reports—a mysterious realm where numbers reign supreme. But wait…what’s that up ahead? Ah yes, a new chapter awaits us: ‘credit score vs. credit report: what’s the difference.’ Join me as we unravel this captivating mystery together!

Credit Score Vs. Credit Report: What’s the Difference

Let’s delve into the mysterious realm of credit reports and uncover the difference between a credit score and a credit report. Ah, credit scores and credit reports – they sound so similar, don’t they? But fear not, my curious friend! I shall guide you through this perplexing maze with ease.

First things first, let me break it down for you. A credit score is like a grade that reflects your financial responsibility. It’s a numerical representation of how well you manage your debts and pay your bills on time. Think of it as your financial report card!

On the other hand, a credit report is like an in-depth dossier about your financial history. It contains detailed information about your past and current loans, payment history, outstanding debts, bankruptcies (if any), and even those pesky collections accounts that refuse to disappear.

Now, to make things more interesting (because why not?), let’s take a look at this handy-dandy table that highlights the key differences between a credit score and a credit report:

| Credit Score | Credit Report |

|---|---|

| Numerical representation | Detailed record |

| Reflects financial responsibility | Provides comprehensive history |

| Ranges from 300-850 | Contains personal information |

| Calculated by scoring models | Compiled by credit bureaus |

See? They’re quite different beasts! While your credit score paints an overall picture of your financial health at any given moment, your credit report provides all the juicy details behind that number.

Understanding the distinction between these two entities is crucial because both play significant roles in determining whether creditors will trust you with their precious money or not. So hold onto this knowledge tight as we venture forth into exploring the long-term effects of having a poor credit score…

Long-Term Effects of a Poor Credit Score

Ah, the long-term consequences of a poor credit score. It’s like stepping on a banana peel and sliding down a never-ending hill of financial woes. But fear not, my friend! There is hope for credit score repair and a brighter future ahead.

Picture this:

– You’re stranded on an island with nothing but your bad credit score. The sun beats down relentlessly as you desperately search for someone to lend you a hand, or better yet, some money.

-

Your credit score is like a stubborn stain on your favorite shirt. No matter how many times you try to wash it away, it lingers there, reminding you of past mistakes.

-

Imagine your financial health as a beautiful garden. A poor credit score is like a pesky weed that refuses to leave. It chokes out the beautiful flowers of opportunity and growth.

-

Your credit score is the wind beneath your wings…or lack thereof. Without good credit, you’ll find yourself grounded while others soar above.

But fret not! With determination and perseverance, you can repair your credit score and break free from these long-term consequences:

1) Access to loans at favorable interest rates will become as abundant as ice cream flavors at an ice cream parlor.

2) Landlords will greet you with open arms instead of skeptical eyes when searching for that perfect apartment.

3) Employers will see your improved credit score as a sign of responsibility and trustworthiness, opening doors to better job opportunities.

4) And lastly, peace of mind will be yours once again knowing that your financial health is in tip-top shape.

Frequently Asked Questions

How Often Should I Check My Credit Score?

You should check your credit score regularly. It’s like giving your financial health a checkup. By monitoring it, you can learn how to maintain a good score and understand how credit utilization affects it. So keep an eye on it!

Can My Credit Score Affect My Ability to Rent an Apartment?

Having a low credit score may feel like wearing a “rental kryptonite” cape. It can affect your ability to rent an apartment, get loan approvals, and even impact job prospects. Take care of your credit!

What Are the Potential Consequences of Having a Low Credit Score?

Having a low credit score can lead to a variety of consequences. It may result in higher interest rates on loans, making it more expensive to borrow money. So, keep that credit score up!

How Long Does It Take to Improve a Poor Credit Score?

Improving a poor credit score takes time and effort. It’s like growing a beautiful garden – you need to water it regularly by paying bills on time, reducing debts, and being responsible with credit.

Can My Credit Score Be Negatively Impacted by Someone Else’s Actions?

Can someone else’s actions negatively impact your credit score? Unfortunately, yes. If you have joint accounts with that person and they miss payments or accumulate debt, it can hurt your score and future loan applications. Be cautious!

Conclusion

So, you’ve reached the end of this enlightening journey through the world of credit scores and financial health. Congrats, my friend!

Now that you understand the importance of a good credit score and how it affects your loan approval and interest rates, it’s time to get proactive. Don’t fret if your score needs a little TLC – there are plenty of strategies for improvement.

Remember to monitor and manage your credit score like a boss, avoiding any tardy payments along the way. And hey, don’t forget to keep an eye on that credit report too!

It’s been an absolute pleasure taking this whimsical adventure with you. Stay financially fabulous!