Are you ready to dive into the world of credit cards, but feeling a little overwhelmed? Don’t worry, we’ve got your back!

In this ultimate checklist for new credit card applicants, we’ll walk you through everything you need to know.

From researching the best options and understanding those tricky terms and conditions, to assessing your credit score and determining your goals – we’ve got it all covered.

So sit back, relax, and get ready to master the art of credit cards like a pro!

Key Takeaways

- Research and compare credit card options, considering interest rates, fees, rewards, and benefits.

- Understand credit card terms and conditions, including hidden fees, annual fees, and payment options.

- Assess your credit score and history before applying for a new card, focusing on creditworthiness and responsible financial habits.

- Determine your credit card needs and goals, considering rewards programs, additional perks, potential savings, and interest rates.

Researching Credit Card Options

When researching credit card options, it’s important to consider the interest rates and fees associated with each card. But hey, don’t fret! We’re here to guide you through the maze of plastic choices so that you can make an informed decision.

Let’s start by talking about credit card rewards and benefits.

Nowadays, credit cards are more than just a convenient way to pay for things; they come with some pretty sweet perks too. From cash back on your purchases to airline miles that can whisk you away on your dream vacation, credit card rewards can really add up. Imagine earning points every time you swipe your card and then redeeming those points for awesome goodies like gift cards or gadgets. It’s like getting free stuff just for using your credit card!

But wait, there’s more! Credit cards also offer a wide range of benefits that can make your life easier and more enjoyable. Need travel insurance? Many cards have got you covered. Want extended warranty protection on that shiny new gadget? Yep, some cards offer that too. And let’s not forget about those amazing shopping discounts and exclusive access to events – all thanks to your trusty piece of plastic.

Understanding Credit Card Terms and Conditions

So, you’ve finally found the perfect credit card that matches your style and spending habits. But hold on a minute, before you start swiping away, let’s talk about those hidden fees lurking in the fine print.

Don’t worry, we’re here to explain it all in plain English and save you from any surprises. Plus, we’ll dive into the nitty-gritty of interest rates and how they can impact your wallet.

Hidden Fees Explained

Before you apply for a new credit card, make sure you understand the hidden fees involved. It’s like going on an adventure – you wouldn’t want any surprises along the way, right? To help you navigate the treacherous waters of credit card fees, here’s a handy table that breaks down some common charges and how to avoid them:

| Fee | What it is | How to avoid it |

|---|---|---|

| Annual Fee | A yearly charge for using the card | Look for cards with no annual fee |

| Late Payment Fee | Charged when you miss a payment deadline | Set up automatic payments |

| Balance Transfer Fee | Applies when you move debt from one card | Opt for cards with 0% transfer fee |

Understanding these hidden charges will save your hard-earned money. So remember, read the fine print and choose wisely to keep unnecessary fees at bay! Happy hunting!

Interest Rate Implications

To fully understand the implications of interest rates, it’s important for you to compare different credit card options and choose one with a low APR. Let’s dive into the world of credit cards and explore how interest rates can affect your financial journey.

Picture this: You’re on a quest for the perfect credit card, armed with knowledge and determination. As you navigate through the sea of options, keep an eye out for those sweet credit card rewards that can make your spending feel like a game of collecting points.

And don’t forget about balance transfer options! They can be a lifesaver when you want to move debt from one card to another with lower interest rates.

Assessing Your Credit Score and History

You’ll want to check your credit score and history before applying for a new credit card. Assessing your creditworthiness is crucial because it determines whether you’ll be approved for the card and what interest rate you’ll receive. Plus, understanding your credit history can help you identify areas for improvement in order to boost your credit score.

To help you assess your creditworthiness, take a look at this handy table:

| Credit Score Range | Credit Rating |

|---|---|

| 300-579 | Poor |

| 580-669 | Fair |

| 670-739 | Good |

| 740-850 | Excellent |

Now that you know where you stand, let’s talk about how to improve your credit score. One of the most important factors is paying your bills on time. Late payments can negatively impact your score, so set up automatic payments or reminders to ensure you’re always on track.

Another way to boost your score is by keeping a low credit utilization ratio. This means using only a small percentage of your available credit. Aim to keep it below 30% to show lenders that you’re responsible with borrowing.

Lastly, lengthening the average age of your accounts can also help improve your score over time. Avoid closing old accounts unless absolutely necessary and avoid opening too many new ones too quickly.

Determining Your Credit Card Needs and Goals

Now that we’ve covered assessing and improving your credit score, let’s discuss determining your credit card needs and goals. Choosing the right credit card can be a bit overwhelming, but fear not! We’ve got you covered with this ultimate checklist.

Here are some things to consider when determining your credit card needs and goals:

-

Rewards Galore: Do you love earning rewards for every dollar you spend? Look for a credit card that offers enticing rewards programs. Whether it’s cash back, travel miles, or points towards merchandise, pick a rewards program that aligns with your spending habits and lifestyle.

-

Beneficial Benefits: What additional perks are important to you? Some cards offer benefits like travel insurance, extended warranties on purchases, or access to exclusive events. Think about what benefits would be most valuable to you and select a card that delivers.

-

Fees vs Savings: Consider the annual fees associated with different credit cards. While some may charge an annual fee, they may also offer more generous rewards or benefits. Calculate whether the potential savings from these features outweigh the cost of the fee.

-

Interest Rates Matter: If you plan on carrying a balance on your credit card from month to month, pay close attention to interest rates. Look for low APR (Annual Percentage Rate) options to minimize interest charges over time.

-

Credit Card Suitability: Finally, think about how this new credit card will fit into your overall financial picture. Will it complement your existing cards or serve as a standalone option? Consider factors like acceptance at merchants you frequent and compatibility with any other banking products you use.

By keeping these factors in mind when choosing a credit card, you’ll be well on your way to finding one that suits your needs and goals perfectly.

Happy hunting!

Comparing Credit Card Fees and Interest Rates

When comparing credit cards, it’s important to consider the fees and interest rates associated with each option. Sure, credit card rewards and benefits might seem enticing, but let’s not forget about the nitty-gritty details that could potentially cost you a pretty penny.

First things first, let’s talk about fees. Every credit card comes with its fair share of charges – annual fees, late payment fees, balance transfer fees – the list goes on. It’s crucial to weigh these fees against the potential benefits you’ll receive from the card. After all, what good is a shiny rewards program if it ends up costing you an arm and a leg?

Next up: interest rates. These sneaky little numbers determine how much extra you’ll have to pay back when carrying a balance on your card. Low interest rates can save you big bucks in the long run, while high ones can quickly turn into a never-ending cycle of debt. So be sure to look for cards that offer competitive rates and try your best to pay off your balance in full every month.

Now, don’t get me wrong – credit card rewards and benefits are awesome! Who doesn’t love earning cash back or airline miles? But remember to keep them in perspective when making your decision. A flashy rewards program won’t mean much if you’re drowning in debt because of high fees and sky-high interest rates.

Applying for a Credit Card Online or In Person

So, you’re thinking about getting a credit card, huh? Well, let’s talk about whether you should apply online or in person.

There are pros and cons to both methods, like the convenience of online applications versus the personal touch of talking to someone face-to-face. Plus, there are some differences in the application process itself that you might want to consider.

Let’s dive into it!

Online Vs. In-Person

There’s a clear advantage to applying for a credit card online rather than in-person. Not only is it more convenient, but it also offers greater accessibility. Here are five reasons why going digital is the way to go:

- No need to leave your cozy couch or battle traffic to visit a bank branch.

- Online applications can be completed at any time, even in your pajamas at 2 am.

- Instant approval notifications mean no waiting around for weeks on end.

- Easy comparison shopping allows you to find the best deals and rewards programs.

- Secure online platforms ensure that your personal information stays safe.

So, why bother with long lines and paper forms when you can have all the benefits of applying for a credit card right from the comfort of your own home?

But before you make up your mind completely, let’s explore the pros and cons of both options.

Pros and Cons

So, you’ve decided to apply for a new credit card! Exciting times ahead. Now that we’ve discussed the online vs. in-person options, let’s dive into the pros and cons of each method.

When it comes to applying online, one major benefit is convenience. You can do it from the comfort of your own home, in your pajamas if you so desire. Plus, the application process tends to be quicker and more streamlined.

On the other hand, going in-person has its own set of benefits. You can ask questions directly to a bank representative and get immediate answers. It also allows for a more personal touch and may make you feel more confident about your decision.

However, there are drawbacks too. Online applications might lack that human touch, leaving you with unanswered questions or concerns. In-person applications could be time-consuming if there’s a long queue or wait time at the branch.

Alrighty then! Now that we’ve weighed the pros and cons of each method, let’s move on to exploring some differences in the application process itself…

Application Process Differences

When applying online, you’ll typically be required to fill out a digital form with your personal information. It’s important to pay attention to the application requirements and eligibility criteria before you start filling out that form. Here are some things to keep in mind:

- Make sure you meet the minimum age requirement for the credit card.

- Check if there are any income requirements or employment criteria.

- Gather all necessary documents like proof of identification and address.

- Be prepared to provide details about your financial history, such as existing debts or loans.

- Double-check if there are any specific qualifications related to credit score.

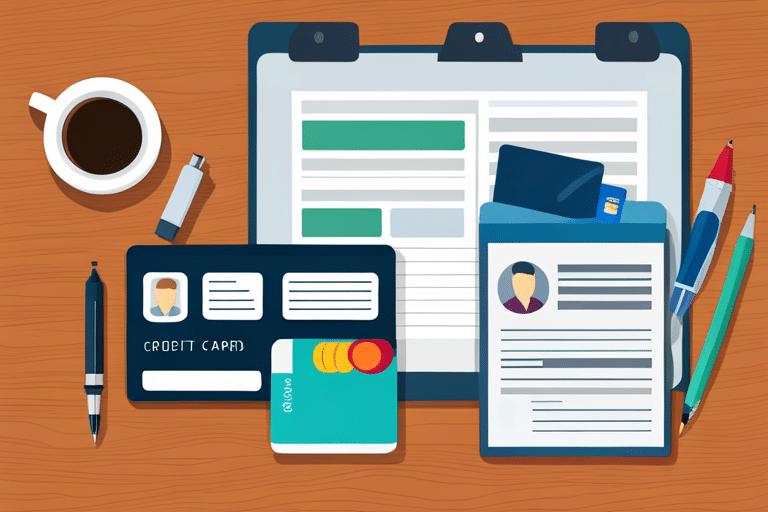

Providing Required Documentation and Information

To provide the required documentation and information for your credit card application, you’ll need to gather your proof of income, identification, and address. Don’t worry, it’s not as daunting as it sounds! Let’s break it down step by step.

First things first: providing income verification. Now, I know talking about money can sometimes make you feel like you’re in a never-ending episode of ‘Survivor,’ but trust me when I say this is important. You want the credit card company to know that you have enough moolah to handle those bills like a pro. So grab your recent pay stubs or tax returns (if you’re feeling extra fancy) and let them do the talking for you.

Next up, verifying identity. We all know how important it is to prove who we are in this crazy world. After all, no one wants an imposter running around pretending to be them! To avoid any mix-ups with your credit card application, dust off that driver’s license or passport and show ’em who’s boss.

Last but certainly not least: address verification. They just want to make sure they can send those shiny new cards right to your doorstep without any hiccups along the way. So jot down your current address on a piece of paper or snap a picture of that utility bill with your name on it – whatever floats your boat!

And there you have it – the ultimate checklist for providing all the necessary documents and information for your credit card application. Just remember to keep calm and gather those documents like a seasoned detective on a mission! You’ve got this!

Understanding the Approval Process and Timelines

Understanding the approval process and timelines can help you manage your expectations while waiting for a decision on your credit card application. It’s like waiting for a package to arrive – checking the tracking updates every hour won’t make it come any faster! So, take a deep breath and let me guide you through this credit card approval journey.

Here are some things you need to know:

-

Credit Card Approval Criteria: Each credit card company has its own set of criteria for approving applications. They consider factors such as your credit score, income level, employment status, and existing debt. Make sure you meet these requirements before applying.

-

Processing Time: The time it takes to process an application varies from bank to bank. Some banks have a quick turnaround time of just a few days, while others may take up to two weeks or even longer. Patience is key!

-

Documentation: Ensure that you’ve submitted all the required documents accurately and in a timely manner. Missing or incorrect information can delay the approval process.

-

Common Reasons for Denial: Unfortunately, not everyone gets approved on their first try. Some common reasons for denials include low credit scores, high debt-to-income ratio, insufficient income, or negative marks on your credit report.

-

Follow Up with the Bank: If it’s been more than the estimated processing time and you haven’t received any update yet, don’t hesitate to give the bank a call. Sometimes applications get stuck in review or there might be additional information needed.

Remember that getting approved for a credit card is not guaranteed but understanding how the process works will help ease your anticipation. So sit back, relax, and keep those fingers crossed! Good luck!

Activating and Managing Your New Credit Card

Managing your new credit card is an important step after activating it. Congrats on getting that shiny piece of plastic! Now, let’s dive into the exciting world of credit card rewards and keeping your financial information safe.

First things first, let’s talk about credit card rewards. These little perks can make your spending feel like a game. It’s like being rewarded for being responsible – who doesn’t love that? Take some time to explore the different reward programs offered by your credit card issuer. From cashback to travel points, there’s something for everyone. Just remember to choose a reward system that aligns with your lifestyle and spending habits.

Now, onto credit card security – protecting yourself from those sneaky fraudsters is crucial. Keep an eye out for any suspicious activity on your account, like unexpected charges or unfamiliar transactions. If you spot anything fishy, contact your credit card company right away; they’ll have your back!

To take things up a notch in the security department, consider enabling two-factor authentication (2FA) for online purchases. This extra layer of protection ensures that only you can authorize transactions using a unique code sent to your phone or email.

Lastly, always be mindful of where and how you use your credit card online. Stick to reputable websites and be cautious when sharing sensitive information.

Frequently Asked Questions

What Steps Should I Take to Protect My Credit Card Information From Fraud or Identity Theft?

To protect your credit card info from fraud or identity theft, take steps like regularly checking your statements, using strong passwords, and avoiding suspicious websites. Stay vigilant and keep those sneaky thieves at bay!

Can I Have Multiple Credit Cards From Different Issuers at the Same Time?

Sure, you can totally have multiple credit cards from different issuers at the same time! It has its pros and cons though. Just make sure to compare offers and find the best fit for you.

How Do Credit Card Rewards Programs Work and How Can I Maximize the Benefits?

Credit card rewards programs are a great way to earn perks for your spending. To maximize the benefits, compare different programs and choose one that aligns with your lifestyle. Get creative and strategize how to make the most of those sweet rewards!

What Should I Do if I Suspect Unauthorized Transactions on My Credit Card?

If you suspect unauthorized transactions on your credit card, take action immediately! Reporting unauthorized transactions and disputing charges are crucial steps. Don’t wait – protect yourself and your hard-earned money.

How Long Does It Take for a Credit Card Payment to Reflect on My Account?

Hey there! Wondering how long it takes for a credit card payment to show up on your account? Well, it usually varies, but generally expect it to take a day or two.

Conclusion

So there you have it, the ultimate checklist for new credit card applicants!

Now, I know what you might be thinking – ‘But applying for a credit card seems like such a hassle!’

Well, fear not my friend, because with this handy guide by your side, the process will be a breeze. Just remember to do your research, understand the terms and conditions, assess your credit score, compare fees and interest rates, apply online or in person with all the necessary documents, follow the approval process patiently and voila!

You’ll soon be swiping that shiny new card like a pro.

Happy spending!