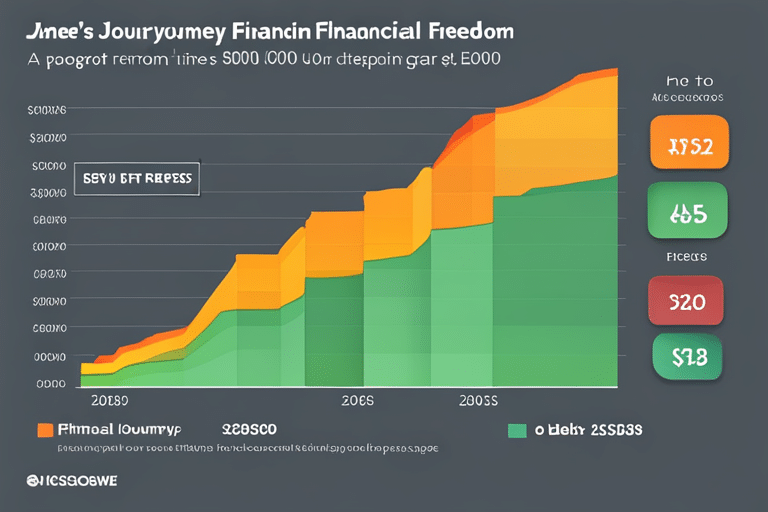

Imagine this: You, yes you, buried under a mountain of $50,000 worth of debt. It seems insurmountable, doesn’t it?

Well, get ready to be inspired because Jane did the impossible. In just 2 years, she clawed her way out of that financial hole and emerged victorious.

How did she do it? Through sheer determination and strategic planning. This case study will take you on Jane’s journey as she tackles her debt head-on and shows you how you too can conquer your own financial challenges.

Get ready for a tale of grit, resilience, and ultimate triumph.

Key Takeaways

- Debt consolidation can be an effective strategy to simplify monthly payments and save money on interest charges.

- Negotiating with creditors can lead to better repayment terms, such as reduced interest rates or extended repayment periods.

- Making significant lifestyle changes, such as cutting back on expenses and increasing income, is crucial in successfully paying off debt.

- Jane’s story serves as an inspiration and highlights the importance of assessing one’s financial situation, exploring available debt relief options, and persevering with careful planning.

Jane’s Financial Situation

Jane’s financial situation was dire, with a whopping $50,000 debt that she managed to pay off in just 2 years. Assessing the financial stress she was under, Jane knew that finding debt relief options was her only way out. She couldn’t afford to let this burden continue weighing her down.

With determination in her heart and a creative mindset, Jane began exploring different strategies to tackle her debt head-on. She researched various debt relief programs and sought advice from financial experts who specialized in helping individuals overcome similar situations. Armed with knowledge and support, Jane felt empowered to take control of her finances.

One option she considered was debt consolidation. This involved combining all of her debts into a single loan with a lower interest rate. By doing so, Jane could simplify her monthly payments and potentially save money on interest charges.

Another option Jane explored was negotiating with creditors for better repayment terms. She reached out to each of her creditors, explaining her situation honestly and requesting possible adjustments to the payment plans. Surprisingly, some creditors were willing to work with Jane and agreed to reduce interest rates or extend the repayment period.

Additionally, Jane made significant lifestyle changes during this time period. She cut back on unnecessary expenses, created a strict budget for herself, and even took on freelance work to increase her income. These sacrifices allowed her to allocate more money towards paying off her debts.

In the end, it was not an easy journey for Jane, but through perseverance and careful planning, she successfully managed to eliminate $50,000 worth of debt within just two years. Her story serves as an inspiration for anyone facing similar financial hardships – there is always hope if you are willing to assess your situation honestly and explore available options for debt relief.

Assessing the Debt

So, you’ve finally decided to tackle your debt head-on, huh? Well, let’s get started by discussing some key points that will help you assess your debt situation.

First off, we’ll explore some effective strategies for assessing your debt and understanding the factors that contribute to it.

Then, we’ll dive into identifying those pesky triggers that lead you down the path of accumulating more debt than you can handle.

And finally, we’ll discuss some tried-and-true methods for effectively reducing your debt and getting back on track towards financial freedom.

Sound good? Let’s do this!

Debt Assessment Strategies

To assess your debt effectively, you should start by creating a budget and identifying your monthly expenses. Think of it as a roadmap to financial freedom.

Now, let’s delve into some debt assessment techniques that can help you on this journey.

Firstly, take advantage of debt assessment tools available online. These nifty resources allow you to input your debts and income, giving you a clear picture of where you stand financially. They analyze your data and provide insightful reports that can guide your decision-making process.

Secondly, track your spending habits diligently. Keep a record of every penny you spend – from that morning coffee to those impulsive online purchases. By doing so, you’ll be able to identify any unnecessary expenditures and make adjustments accordingly.

Lastly, consider seeking professional advice if needed. Financial advisors have the expertise to assess your situation comprehensively and suggest tailored strategies to tackle your debt efficiently.

Identifying Debt Triggers

Identifying your debt triggers is crucial in understanding the underlying reasons behind your financial challenges and finding effective solutions. To help you on this journey, here are four strategies for avoiding debt triggers:

-

Recognize emotional triggers: Take time to reflect on the emotions that lead you towards making impulsive purchases or overspending. Are you seeking comfort or relief? Identifying these emotional triggers will allow you to develop healthier coping mechanisms.

-

Create a budget: Establishing a detailed budget can help you stay mindful of your spending habits. Set limits for different categories and prioritize essential expenses over non-essential ones.

-

Build an emergency fund: Having savings set aside for unexpected expenses can prevent you from relying on credit cards or loans when faced with emergencies, reducing the risk of falling into debt.

-

Seek support and accountability: Surround yourself with individuals who understand your goals and can provide encouragement and guidance along the way. Joining support groups or seeking professional advice can greatly improve your chances of avoiding debt triggers.

Effective Debt Reduction

If you want to effectively reduce your debt, it’s important to develop a repayment plan that fits your financial situation and goals.

But before diving into the nitty-gritty of numbers and calculations, you need to cultivate a debt-free mindset. Picture yourself living without the burden of debt weighing you down. Imagine the freedom and peace that comes with financial stability. This mindset shift will fuel your motivation and keep you focused on your goal.

To truly conquer debt, arm yourself with knowledge. Seek out resources for financial education – books, podcasts, online courses – that can help you understand how money works and equip you with practical strategies for managing it wisely. The more informed you are about personal finance, the better equipped you’ll be to make smart decisions and avoid falling back into debt.

Now that you have the right mindset and knowledge in place, it’s time to create a solid debt repayment plan. Transitioning from dreaming about being debt-free to taking concrete steps requires careful planning and discipline.

In the next section, we’ll explore how Jane devised her own personalized plan to tackle her $50,000 debt head-on and emerged victorious after just two years of hard work.

Creating a Debt Repayment Plan

You can start by listing all your debts and creating a repayment plan. This is the first step towards getting out of debt and achieving financial freedom. Here are four handy tips to help you create an effective debt repayment plan:

-

Analyze Your Debts: Take a close look at all your outstanding debts, including credit cards, loans, and any other forms of borrowing. Note down the total amount owed for each debt, their interest rates, and minimum monthly payments.

-

Prioritize Your Debts: Use the debt snowball method to prioritize your debts. Start by paying off the smallest balance first while making minimum payments on other debts. Once the smallest balance is paid off, move on to the next smallest one until all debts are cleared.

-

Set Realistic Goals: Define a timeline for paying off each debt based on your current income and expenses. Set realistic goals that are achievable within your budgetary constraints.

-

Cut Expenses & Increase Income: Look for ways to cut unnecessary expenses in order to free up more money for debt repayments. Additionally, consider taking on side gigs or finding ways to increase your income temporarily.

Cutting Expenses and Increasing Income

So you’re ready to take control of your financial situation and start making progress towards your goals? That’s awesome!

In this discussion, we’ll dive into three key points that will help you on your journey: budgeting for success, side hustle strategies, and debt payoff strategies.

By mastering these areas, you’ll have the tools and knowledge to not only manage your money effectively but also increase your income and tackle any debt that may be holding you back.

Let’s get started!

Budgeting for Success

Jane’s success in getting out of $50,000 debt in 2 years was largely due to her effective budgeting skills. Here are four budgeting techniques that helped her achieve financial freedom:

-

Track Every Penny: Jane meticulously recorded every expense, no matter how small. This allowed her to identify areas where she was overspending and make necessary adjustments.

-

Set Realistic Goals: Jane set monthly and yearly goals for saving and debt repayment. By breaking down her larger financial objectives into smaller, attainable targets, she stayed motivated and on track.

-

Create a Zero-Based Budget: With this technique, Jane assigned every dollar a specific purpose at the beginning of each month. This ensured that all income was accounted for and eliminated wasteful spending.

-

Prioritize Debt Repayment: Jane made paying off debt her top priority by allocating the majority of her income towards it. She cut back on non-essential expenses to accelerate the process.

By implementing these budgeting techniques and having a solid financial plan in place, Jane successfully eliminated her debt within two years.

Now let’s explore some side hustle strategies to further boost your income!

Side Hustle Strategies

If you’re looking to increase your income, exploring side hustle strategies can be a smart move. Especially for stay-at-home parents, finding side hustles that fit into your schedule can provide extra financial stability while still allowing you to prioritize your family.

There are countless success stories of stay-at-home parents who have turned their side hustles into thriving businesses. From selling handmade crafts on Etsy to becoming virtual assistants or freelance writers, the options are endless.

Imagine being able to earn money from the comfort of your own home, all while taking care of your kids and doing what you love. It’s not just a dream – it’s a reality for many stay-at-home parents who have found side hustle success.

Debt Payoff Strategies

So, you’ve learned some great side hustle strategies to help increase your income and pay off your debt. Now, let’s dive into some debt payoff strategies that will help you stay motivated and focused on reaching your financial goals.

Here are four key elements of a debt payoff mindset that can lead to success:

-

Positive visualization: Imagine yourself being debt-free and how it will feel. Visualize the sense of freedom and relief that comes with paying off your debts.

-

Goal-setting: Set specific, measurable goals for paying off your debts. Break them down into smaller milestones so you can track your progress along the way.

-

Budgeting: Create a budget that allows you to allocate a portion of your income towards debt repayment each month. Stick to this budget religiously to ensure consistent progress.

-

Celebrating milestones: Celebrate each milestone achieved on your journey towards becoming debt-free. Reward yourself in small ways as a reminder of the progress you’re making.

By adopting these strategies, you’ll develop a mindset that is focused on achieving debt payoff success stories like Jane’s incredible journey out of $50,000 in just 2 years.

Now, let’s move on to the next section where we’ll discuss prioritizing debt payments and maximizing their impact on reducing overall debt burden.

Prioritizing Debt Payments

To prioritize your debt payments, start by identifying which debts have the highest interest rates. This is a crucial step in your journey towards becoming debt-free. Debt prioritization allows you to focus your limited resources on tackling the most expensive debts first, ultimately saving you money in the long run.

Picture this: You’re standing at the top of a mountain, surrounded by an array of debts. Each one represents a different financial burden weighing you down. But fear not! Armed with knowledge and determination, you can conquer them all.

Take a moment to assess each debt’s interest rate. Is it sky-high or relatively low? The higher the interest rate, the more damage it inflicts on your finances over time. These high-interest debts should be at the forefront of your repayment strategy.

Imagine yourself as a skilled archer aiming for bullseyes. Your target is now set on those pesky high-interest debts. Draw back your bowstring and release – make extra payments towards these debts until they are vanquished!

Utilizing Debt Consolidation Strategies

Imagine how much easier it’d be to manage your debts if you consolidated them into a single monthly payment. Debt consolidation can provide you with numerous benefits and help you regain control over your financial situation.

Here are four reasons why debt consolidation might be the right strategy for you:

-

Simplified Payments: By consolidating your debts, you can combine multiple payments into one, making it easier to keep track of and manage your finances.

-

Lower Interest Rates: One of the main advantages of debt consolidation is the potential for lower interest rates. This means that more of your monthly payment goes towards reducing the principal balance rather than paying off interest charges.

-

Improved Credit Score: Consistently making on-time payments through a debt consolidation program can have a positive impact on your credit score, allowing you to rebuild your creditworthiness over time.

-

Reduced Stress: Dealing with multiple creditors and due dates can be overwhelming and stressful. Debt consolidation simplifies this process, giving you peace of mind knowing that all your debts are being handled in one place.

While there are many benefits to debt consolidation, it’s important to understand the risks involved as well. It may extend the length of time needed to pay off your debts or result in additional fees or charges if not managed properly.

Consolidating your debts is just one step towards achieving financial freedom; next, let’s explore how negotiating with creditors can further assist in resolving your outstanding balances.

Negotiating With Creditors

So, you’ve found yourself drowning in debt and feeling overwhelmed. But don’t worry, there are effective negotiation strategies that can help you successfully settle your debts.

Whether it’s negotiating lower interest rates or creating a manageable repayment plan, these strategies can make a huge difference in your journey towards financial freedom.

With some creativity and persistence, you’ll be surprised by what you can achieve through successful debt settlement.

Effective Negotiation Strategies

One of the most effective negotiation strategies Jane used was to clearly communicate her financial situation to her creditors. By openly discussing her income, expenses, and debt obligations, she was able to create a sense of transparency and trust with her creditors. This approach allowed Jane to negotiate favorable repayment terms that aligned with her budget and financial goals.

Jane’s effective negotiation strategies included:

-

Researching market salaries: Before negotiating her salary, Jane thoroughly researched the average pay for similar positions in her industry. Armed with this knowledge, she was able to confidently advocate for a fair compensation package.

-

Utilizing active listening skills: During negotiations, Jane actively listened to the other party’s concerns and needs. By understanding their perspective, she could identify common ground and propose mutually beneficial solutions.

-

Offering value-added benefits: In addition to salary negotiations, Jane also focused on bargaining for additional benefits such as flexible working hours or professional development opportunities. This allowed her to secure a comprehensive package that met both her monetary and non-monetary needs.

-

Maintaining a positive attitude: Throughout the negotiation process, Jane remained optimistic and maintained a friendly demeanor. Her positive attitude helped foster productive discussions and build strong relationships with potential employers or creditors.

Successful Debt Settlement

To successfully settle your debts, it is crucial to negotiate with your creditors and establish a repayment plan that aligns with your financial situation. Debt settlement strategies can help you take control of your finances and work towards becoming debt-free. Here are some effective strategies that can lead to successful debt settlement:

| Debt Settlement Strategies | Benefits |

|---|---|

| 1. Negotiating lower interest rates | Save money on interest payments |

| 2. Requesting a longer repayment term | Lower monthly payments |

| 3. Offering a lump sum payment in exchange for debt reduction | Potentially reduce the total amount owed |

| 4. Seeking professional assistance from a debt settlement company | Expert guidance throughout the process |

| 5. Making consistent and timely payments | Improve credit score over time |

Tracking Progress and Staying Motivated

You can stay motivated and track your progress by setting specific financial goals and regularly reviewing your budget. Here are four tips to help you stay on track:

-

Visualize your success: Imagine what it will feel like when you achieve your financial goals. Close your eyes and picture yourself debt-free, living a life of financial freedom. Use this vision as motivation to keep pushing forward.

-

Celebrate milestones: Break down your larger financial goals into smaller milestones. Each time you reach a milestone, celebrate! Treat yourself to something small that brings you joy or take a moment to reflect on how far you’ve come.

-

Find an accountability partner: Share your financial journey with someone who can hold you accountable and provide support along the way. Whether it’s a friend, family member, or even an online community, having someone by your side can make all the difference in staying motivated.

-

Overcome obstacles with resilience: Financial journeys often have bumps in the road, but don’t let them discourage you. Instead, view these obstacles as opportunities for growth and learning. Stay resilient and find creative solutions to overcome any challenges that come your way.

Overcoming Challenges and Setbacks

Now that you’ve learned about tracking your progress and staying motivated, let’s talk about overcoming challenges and setbacks on your journey to financial freedom. Trust me, setbacks are bound to happen, but it’s how you handle them that will define your success.

Picture this: You’re sailing towards your debt-free destination when suddenly a storm hits. Your car breaks down, unexpected medical bills pile up, or maybe you lose your job. It feels like the wind has been knocked out of your sails, and giving up seems tempting. But remember, setbacks are just detours on the road to success.

To overcome these obstacles, it’s essential to stay motivated and keep pushing forward. Take a look at this table for some strategies to help you navigate through difficult times:

| Overcoming Setbacks | Staying Motivated |

|---|---|

| Embrace a positive mindset | Visualize your goals |

| Seek support from loved ones | Reward yourself |

| Learn from mistakes | Break big goals into smaller ones |

By following these strategies and persevering through challenging times, you’ll come out stronger than ever before. Remember that setbacks are temporary; they don’t define who you are or what you can achieve.

Now that we’ve discussed overcoming challenges and setbacks let’s move on to the next section – celebrating milestones and small wins!

Celebrating Milestones and Small Wins

When celebrating milestones and small wins, it’s important to acknowledge and appreciate the progress you’ve made on your journey to financial freedom. It’s easy to get caught up in the daily grind and forget just how far you’ve come.

So take a moment to pat yourself on the back and revel in your achievements! Here are four ways to celebrate your financial wins and stay motivated:

-

Treat Yourself: After reaching a milestone, indulge in a small splurge that brings you joy without breaking the bank. Maybe it’s a fancy dinner at your favorite restaurant or treating yourself to a new book or gadget.

-

Share Your Success: Don’t keep your achievements all to yourself! Share them with friends, family, or even online communities who will appreciate your hard work and dedication. Celebrating with others can amplify the positive energy around your accomplishments.

-

Reflect and Recharge: Take some time for self-reflection after each win. Acknowledge what worked well for you, what challenges you overcame, and how you can continue building upon this success moving forward.

-

Set New Goals: Use each milestone as an opportunity to set new goals for yourself. By constantly striving for improvement, you’ll maintain momentum on your journey towards financial freedom.

Building an Emergency Fund

If you’re looking to build an emergency fund, it’s essential to start by setting aside a portion of your income each month. An emergency fund is crucial because life is unpredictable, and unexpected expenses can arise at any time. Having a financial cushion can provide peace of mind and protect you from going into debt when faced with emergencies.

To emphasize the importance of an emergency fund, let’s take a look at this table:

| Emergency Fund Importance | Emergency Fund Savings Strategies |

|---|---|

| Provides financial security | Set a monthly savings goal |

| Protects against debt | Cut unnecessary expenses |

| Enables quick response to emergencies | Automate savings |

As you can see, building an emergency fund is not only about saving money but also about creating stability in your financial life. Setting a monthly savings goal will help you stay on track and make consistent progress. Additionally, cutting unnecessary expenses allows you to allocate more funds towards your emergency fund.

One effective strategy is automating your savings. By setting up automatic transfers from your checking account to your emergency fund, you ensure that each month, a portion of your income goes directly towards building that safety net.

Lessons Learned and Future Financial Goals

Looking back at my financial journey, I’ve learned valuable lessons and now have clear goals for the future. It hasn’t been easy, but every step has taught me something important. Here are four lessons I’ve learned along the way:

-

Live within your means: This is a fundamental lesson in long term financial planning. Avoid unnecessary debt and prioritize saving over spending. It’s crucial to create a budget that aligns with your income and stick to it.

-

Invest early: Time is your biggest ally when it comes to building wealth. Start investing as soon as possible, even if it’s a small amount. Compound interest can work wonders over the long run.

-

Diversify your investments: Putting all your eggs in one basket is risky. Spread out your investments across different asset classes such as stocks, bonds, real estate, and mutual funds to minimize risk and maximize returns.

-

Plan for retirement: Don’t neglect your future self! Start saving for retirement early so that you can enjoy financial freedom later on in life.

With these lessons in mind, my future financial goals are crystal clear: achieve financial independence by age 50, save enough for my children’s education, and build a comfortable retirement fund.

Frequently Asked Questions

How Long Did It Take Jane to Pay off Her $50,000 Debt?

It took you two years to pay off your $50,000 debt. During your journey, you stayed motivated by setting small goals and rewarding yourself along the way. You tracked your progress and stayed on budget through careful planning and using budgeting apps.

Did Jane Have to Make Any Sacrifices to Pay off Her Debt?

To get out of debt, sacrifices were made. But with clever financial strategies, Jane was able to overcome the burden. It wasn’t easy, but it’s amazing what determination and discipline can achieve.

What Were the Interest Rates on Jane’s Debts?

Interest rates on your debts can make a big difference in your debt repayment strategy. By understanding and managing those rates, you can save money and pay off your debt faster.

Did Jane Seek Professional Help or Advice to Get Out of Debt?

You didn’t mention whether Jane sought professional help or debt advice. But let me tell you, getting some guidance from the experts can be a game-changer when it comes to tackling your debts.

How Did Jane’s Debt Affect Her Credit Score?

Your credit score took a hard hit due to the debt. But Jane had strategies to improve it while paying off her debt, like making timely payments and reducing her credit utilization.

Conclusion

So there you have it, my friend.

Jane’s inspiring journey out of $50,000 debt in just 2 years is a testament to the power of determination and smart financial strategies. She faced challenges and setbacks along the way, but she never gave up.

Her story teaches us that with careful planning, discipline, and perseverance, we can overcome any obstacle.

So go ahead and take control of your finances! Remember, you’re capable of achieving great things too.