Attention graduates!

Have you been drowning in student loan debt since tossing your cap in the air? Well, fear not, because we have some good news for you.

Imagine a world where your loans could be forgiven, like magic poof! In this article, we will explore the wonderful realm of loan forgiveness programs.

From federal options to state-specific programs, and even special programs for teachers and nurses – there’s something here for everyone.

So grab a cup of coffee and get ready to embark on a journey towards financial freedom!

Key Takeaways

- Loan forgiveness programs offer grants, scholarships, and income-driven repayment plans to help graduates pay off their loans.

- Federal loan forgiveness programs provide benefits such as debt elimination and a fresh start, with a relatively straightforward application process.

- State-specific loan forgiveness programs are designed to alleviate student loan burden for public service workers and offer diverse options across the country.

- Loan forgiveness programs are available for specific professions, such as teachers, doctors, social workers, and engineers, providing relief from student debt while pursuing career goals.

Overview of Loan Forgiveness Programs

You’ll be pleased to know that there are various loan forgiveness programs available for graduates. It’s like a magical realm where your student loans disappear into thin air!

So, let’s dive into the enchanting world of loan forgiveness. First, let’s talk about funding options. Some programs offer grants or scholarships to help you pay off your loans. It’s like receiving a golden ticket to debt freedom!

Now, onto repayment plans. There are income-driven plans that adjust your monthly payments based on your salary, making it more manageable and stress-free. It’s like having a fairy godmother who waves her wand and poof! Your payments become affordable!

Federal Loan Forgiveness Programs

There’s a variety of federal programs that can help eligible individuals get their student loans forgiven. Isn’t that amazing? It’s like waving a magic wand and poof! – your debt disappears. Well, maybe not exactly like that, but close enough.

These programs offer some incredible benefits, my friend. Imagine being able to kiss those loan payments goodbye and start fresh without the burden of monthly bills hanging over you.

Now, let’s talk about the application process. It may seem daunting at first, but fear not! The government has made it relatively straightforward for you to apply for federal loan forgiveness. Just gather all your necessary documents, fill out the forms with care (crossing those t’s and dotting those i’s), and submit everything on time. Remember, attention to detail is key here.

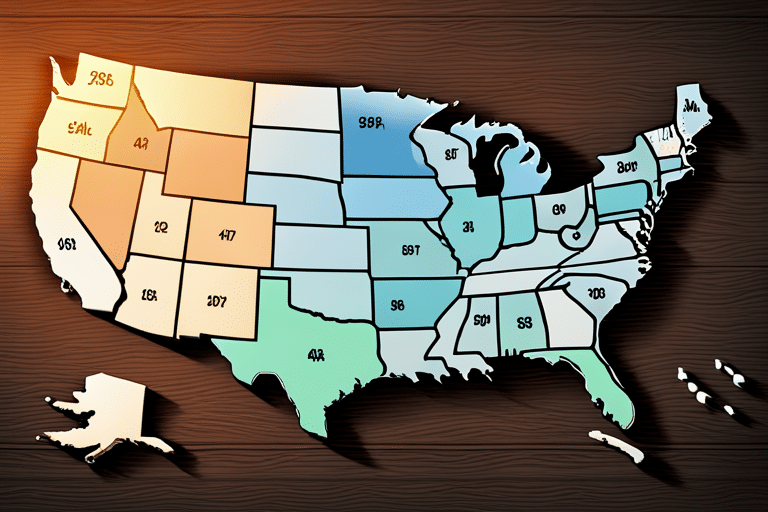

State-Specific Loan Forgiveness Programs

If you’re a resident of a specific state, don’t miss out on the opportunity to take advantage of their unique loan forgiveness programs. These state-specific programs are designed to help alleviate the burden of student loans for public service workers like yourself.

Here’s why you should consider these programs:

-

They provide targeted support: State-specific loan forgiveness programs are tailored to meet the specific needs of residents in each state. This means that you can benefit from a program that is well-suited to your circumstances.

-

They offer additional incentives: Some states go above and beyond by offering additional incentives such as grants or scholarships. These extra perks can make a significant difference in reducing your overall debt.

So if you’re looking for ways to ease the financial strain of student loans while making a difference in your community, be sure to explore these state-specific loan forgiveness programs.

And speaking of making a difference, let’s now delve into the exciting world of loan forgiveness programs for teachers…

Loan Forgiveness Programs for Teachers

Are you a passionate teacher burdened by student loan debt? Well, fret not! Let’s dive into the world of loan forgiveness programs designed exclusively for teachers.

In this discussion, we’ll explore the eligibility criteria that make you an ideal candidate, uncover the enticing benefits awaiting you, and walk you through the straightforward application process.

Eligibility Criteria for Teachers

Teachers who meet the eligibility criteria may qualify for loan forgiveness programs. It’s like having a magic wand that makes your student loans disappear! Check out these exciting benefits:

-

Financial Freedom: Imagine being able to focus on your passion for teaching without the constant worry of debt hanging over your head. With loan forgiveness, you can finally breathe easy and enjoy the rewards of your hard work.

-

Dream Home: Say goodbye to cramped apartments and hello to homeownership! With the burden of student loans lifted, you can start saving up for that cozy little house in the suburbs or a charming cottage by the beach.

-

Travel Adventures: Explore new horizons during summers and breaks! Loan forgiveness allows you to indulge in wanderlust without breaking the bank. From backpacking across Europe to relaxing on tropical islands, the world becomes your classroom.

Benefits of Loan Forgiveness

Now that you know if you’re eligible for loan forgiveness as a teacher, let’s dive into the exciting part – the benefits of loan forgiveness! Imagine the weight lifted off your shoulders when those student loans no longer haunt your dreams. With loan forgiveness, you can enjoy financial freedom and focus on what truly matters: shaping young minds.

To give you a clearer picture, here’s a handy table showcasing the impact and benefits of loan forgiveness for teachers:

| Impact | Benefits |

|---|---|

| Reduced Financial Burden | Say goodbye to hefty monthly payments |

| Career Flexibility | Explore different teaching opportunities |

| Motivation and Job Satisfaction | Feel valued for your dedication to education |

| Long-Term Financial Stability | Save more money for other important life goals |

These benefits not only have a positive impact on your personal finances but also on your overall well-being. Now that we’ve explored the benefits of loan forgiveness, let’s move on to the application process for teachers.

Application Process for Teachers

To begin the application process for loan forgiveness as a teacher, you’ll need to gather all necessary documentation. It may seem like a daunting task, but fret not! Follow these simple steps to make the process a breeze:

-

First, gather your employment certification form from each school where you taught. This is crucial evidence of your qualifying teaching service.

-

Next, collect your loan information, including details about the type of loan and its current status. You’ll want to have this handy when filling out the application.

-

Remember to include any supporting documents that showcase your dedication as an educator. This could be letters of recommendation or awards you’ve received.

Completing the teacher loan forgiveness application doesn’t have to be overwhelming! By staying organized and providing clear evidence of your teaching service, you’re one step closer to achieving financial freedom. Good luck!

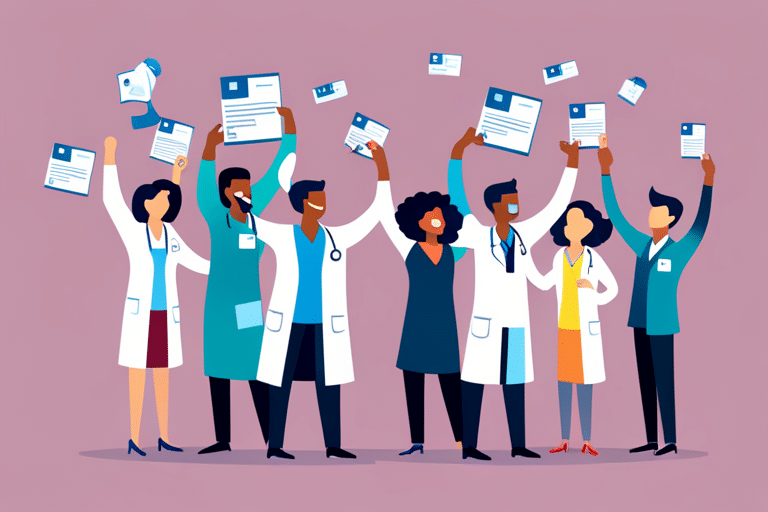

Loan Forgiveness Programs for Nurses

So you’ve chosen to dive into the world of loan forgiveness programs for nurses.

Let’s start by discussing the eligibility criteria that nurses must meet in order to qualify for these fantastic benefits.

Once we’ve got that covered, we can explore all the amazing perks and advantages of loan forgiveness, because who doesn’t love a little financial relief?

Eligibility Criteria for Nurses

Nurses can qualify for loan forgiveness programs if they meet the eligibility criteria. So, let’s dive into what it takes to be eligible and reap the benefits of loan forgiveness!

Eligibility Criteria for Healthcare Professionals:

– Graduating from an accredited nursing program.

– Working full-time in a designated high-need area or facility.

Benefits of Loan Forgiveness for Nurses:

– Lighten your financial burden and focus on helping others.

– Gain valuable experience while serving underserved communities.

Imagine being able to pursue your passion and have your student loans forgiven at the same time! By meeting these eligibility criteria, you not only get relief from the weight of student debt but also get to make a difference in people’s lives. It’s a win-win situation that allows you to excel in your career while giving back to those who need it most.

Benefits of Loan Forgiveness

Imagine the relief you would feel knowing that your student loans could be forgiven, allowing you to focus on making a difference in people’s lives.

The benefits of loan forgiveness are immense and have a significant impact on your future. Not only would it alleviate the financial burden, but it would also open up doors for you to pursue your passion without being tied down by debt.

Picture yourself working as a nurse in an underserved community, providing care to those who need it most, all while knowing that your loans will be forgiven after a certain period of service. This kind of freedom and peace of mind can truly make a difference in how you approach your career and life overall.

Loan Forgiveness Programs for Public Service Workers

Public service workers may be eligible for loan forgiveness programs that can help alleviate the burden of student debt. Imagine a world where your dedication to serving others not only makes a difference in people’s lives but also lightens your financial load. With loan forgiveness programs, this dream can become a reality! Check out these exciting benefits:

-

Financial Freedom: By participating in these programs, you can wave goodbye to those hefty monthly loan payments and enjoy more disposable income.

-

Rewarding Career: Knowing that your hard work as a public service worker is valued and acknowledged by society can bring immense job satisfaction.

Now, let’s dive into specific loan forgiveness programs designed for our healthcare heroes:

-

Federal Public Service Loan Forgiveness (PSLF): Healthcare professionals working full-time at qualifying public service organizations may have their remaining student loans forgiven after making 120 qualifying payments.

-

National Health Service Corps (NHSC) Loan Repayment Program: This program offers up to $50,000 in tax-free loan repayment assistance to primary care medical, dental, and mental/behavioral health providers who serve communities with limited access to healthcare.

Loan Forgiveness Programs for Veterans

Veterans, listen up! You have access to loan forgiveness programs that can work wonders for your student debt. Yes, you read that right – financial relief is within reach. These programs are like superheroes swooping in to save the day, making your burdens lighter and your pockets fuller.

Imagine the benefits of having those loans forgiven – no more sleepless nights worrying about payments or drowning in a sea of bills. It’s time to breathe easy and focus on building the life you deserve after serving our country with honor.

But wait, there’s more! Loan forgiveness programs aren’t just for veterans; lawyers can also tap into these amazing opportunities. So buckle up, because we’re about to dive into the world of loan forgiveness programs for lawyers and explore how they can help you conquer that mountain of debt too.

Loan Forgiveness Programs for Lawyers

Hey, lawyer! Are you drowning in student loan debt? Well, good news is here to save the day!

Let’s talk about loan forgiveness programs for lawyers and how they can help alleviate your financial burden.

First up, we’ll dive into the eligibility criteria for lawyers, followed by all the juicy benefits of loan forgiveness.

And don’t worry, we’ll wrap it up with a discussion on the application process so you can start on your journey to debt-free bliss.

Eligibility Criteria for Lawyers

To be eligible for loan forgiveness as a lawyer, you’ll need to meet specific criteria set by the program. But don’t worry, it’s not as daunting as it sounds! Here are the key requirements that will make you jump for joy:

- Employment: You must be employed full-time in a qualifying public service job. Think of it as fighting crime with your legal superpowers!

- Loan Type: Only federal loans are eligible for forgiveness. So say goodbye to those private loans and hello to financial freedom!

Now, let’s dive into the emotions this news might evoke:

- Relief: Finally, some light at the end of the tunnel! Your hard work is paying off.

- Hopefulness: The thought of shedding that debt burden is like a breath of fresh air.

Keep these criteria in mind and soon enough, you’ll be on your way to reaping the benefits of lawyer loan forgiveness programs. Keep up the fantastic work!

Benefits of Loan Forgiveness

Federal loan forgiveness programs offer a range of benefits that can ease the burden of student debt for eligible individuals. Not only do these programs provide relief to borrowers, but they also have a positive impact on the economy. By reducing the financial strain on graduates, loan forgiveness allows them to allocate more funds towards other expenses or investments, stimulating economic growth. Imagine a world where recent graduates are not weighed down by mountains of debt. They would be free to pursue their passions, start businesses, and contribute to society in meaningful ways. This table illustrates just how beneficial loan forgiveness can be for borrowers and the economy:

| Benefits for Borrowers | Impact on Economy |

|---|---|

| Reduced monthly payments | Increased consumer spending |

| Loan balance forgiven after certain years | Job creation through entrepreneurship |

| Opportunity to pursue higher education | Boost in homeownership rates |

| Improved credit score | Greater economic mobility |

Application Process for Lawyers

The application process for lawyers seeking loan forgiveness can be complex, but it’s worth navigating in order to alleviate financial burdens.

Don’t let the paperwork and requirements deter you. Here’s a step-by-step guide to help you through:

-

Gather all necessary documents, such as proof of employment and income.

-

Research different loan forgiveness programs available specifically for law school graduates.

-

Discover the joy of knowing that your hard work studying law won’t just benefit society, but also provide relief from student loans.

-

Imagine the weight lifting off your shoulders as you see your debt decrease with each successful application.

Remember, perseverance is key. It may take time and effort, but the reward of being debt-free will make it all worthwhile.

Loan Forgiveness Programs for Doctors

Doctors can benefit from loan forgiveness programs that help alleviate their student debt burden. These programs are not just limited to lawyers or other professions; they exist for dentists and pharmacists too! Imagine the relief of having some of your student loans forgiven while working in your dream job. It’s like a weight lifted off your shoulders, allowing you to focus on providing excellent patient care without the constant worry of mounting debt. Check out these incredible loan forgiveness programs specifically designed for dentists and pharmacists:

| Loan Forgiveness Programs | Eligibility Criteria |

|---|---|

| Dentist Dream Program | – Graduated from an accredited dental school – Commitment to serving in underserved areas |

| Pharmacist Freedom Plan | – Completed a Doctor of Pharmacy (PharmD) degree – Employment at a qualified public health facility |

These programs offer hope and financial support, turning your dreams into reality while making a positive impact on communities in need. Don’t let student loans hold you back; explore these loan forgiveness options today!

Loan Forgiveness Programs for Social Workers

Social workers can also benefit from loan forgiveness programs, providing relief from their student debt burden while making a positive impact on underserved communities. Imagine the weight lifted off your shoulders as you receive assistance in repaying those hefty loans. With social work loan forgiveness, your dedication to helping others is rewarded in more ways than one.

Consider the following emotional benefits:

-

Sense of fulfillment: Knowing that your work directly improves the lives of individuals and families in need can bring immense satisfaction. Imagine the joy you’ll feel when you see a smile on a child’s face because of the support you provided. Picture yourself making a difference in someone’s life and feeling an overwhelming sense of purpose.

-

Community connection: By working in underserved areas, you become an integral part of these communities and forge meaningful relationships. Envision being embraced by grateful neighbors who appreciate your tireless efforts. Picture yourself becoming an advocate for change and witnessing firsthand the positive impact it has on people’s lives.

With social work loan forgiveness options available, not only will you alleviate financial stress but also experience personal growth and fulfillment along the way.

Loan Forgiveness Programs for Engineers

Imagine the relief you’ll feel when engineering loan forgiveness programs help alleviate your financial burden, allowing you to focus on your passion for innovation and problem-solving. As a software engineer or civil engineer, you possess a unique set of skills that are in high demand. With loan forgiveness programs specifically tailored for engineers like yourself, the path to financial freedom becomes clearer than ever before.

Take a look at this table below to get an idea of the possibilities that await:

| Loan Forgiveness Programs for Engineers | Eligibility Requirements | Benefits |

|---|---|---|

| Software Engineers | – Degree in computer science or related field | – Partial or full forgiveness of student loans |

| Civil Engineers | – Bachelor’s degree in civil engineering | – Loan repayment assistance |

With these programs in place, you can pursue your dreams without being weighed down by student debt. But what if you’re not an engineer? Don’t worry! There are also loan forgiveness programs available for nonprofit employees. Let’s explore those next.

Loan Forgiveness Programs for Nonprofit Employees

So, you’re interested in loan forgiveness programs for nonprofit employees? Well, let me tell you, it’s like finding a pot of gold at the end of a rainbow!

First up, let’s talk about eligibility and requirements – don’t worry, they’re not as complicated as trying to unravel a ball of yarn.

Next on our agenda are the benefits – imagine skipping through fields of daisies without the weight of student loans dragging you down.

But hey, before you get too carried away with dreams of financial freedom, we also need to discuss the limitations – because every rose has its thorns, my friend.

Eligibility and Requirements

To be eligible for loan forgiveness programs, you’ll need to meet specific requirements set by the government. But don’t worry, it’s not as complicated as it sounds! Here are a few things to keep in mind:

-

First, make sure you understand the different loan forgiveness options available to you. From Public Service Loan Forgiveness (PSLF) to Teacher Loan Forgiveness and more, there are various programs designed to help ease your burden.

-

Secondly, familiarize yourself with the repayment plans that qualify for loan forgiveness. Income-driven repayment plans like Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE) could potentially make you eligible for forgiveness after a certain number of qualifying payments.

So before diving headfirst into these programs, take the time to research and understand the eligibility criteria. This will ensure you’re on the right track towards achieving loan forgiveness and financial freedom.

Now that we’ve covered eligibility and requirements for loan forgiveness programs, let’s explore their benefits and limitations…

Benefits and Limitations

If you’re considering applying for loan forgiveness, it’s important to understand the benefits and limitations that come along with these programs. Sure, loan forgiveness may sound like a dream come true – waving goodbye to those student loans once and for all! But before you get too excited, let’s talk about the potential drawbacks.

One major limitation of loan forgiveness programs is that they often require a long-term commitment, typically in the form of working in a specific field or location for a certain number of years. This can limit your career options and flexibility. Additionally, not all types of loans are eligible for forgiveness, so if you have multiple loans, only some may qualify. It’s crucial to weigh these limitations against the potential benefits before diving into a loan forgiveness program.

And speaking of benefits… did you know that there are specialized loan forgiveness programs for STEM graduates? That’s right! If you’ve studied science, technology, engineering, or mathematics, there may be even more opportunities for your student loans to disappear into thin air. Let’s explore these programs further and see how they can help alleviate the burden of student debt for aspiring STEM professionals like yourself.

Loan Forgiveness Programs for STEM Graduates

STEM graduates may qualify for loan forgiveness programs. These programs offer incredible benefits and can help alleviate the burden of student loans.

Here are some emotions you might experience when exploring these programs:

-

Relief: Imagine the weight lifted off your shoulders as you realize that your years of hard work in STEM have paid off, not only in terms of career prospects but also financially.

-

Freedom: Picture yourself finally being able to pursue your dreams without the constant worry of student loan debt hanging over your head.

-

Excitement: Feel the rush of excitement as you envision all the possibilities that open up to you when you no longer have to prioritize financial stability over passion.

With these loan forgiveness programs, STEM graduates can enjoy a brighter future filled with endless opportunities and peace of mind. Don’t let student loans hold you back from achieving greatness – explore these options today!

Loan Forgiveness Programs for Business Graduates

Congratulations on making it through the STEM subtopic! Now let’s dive into a whole new world of loan forgiveness programs for business graduates like yourself.

Whether you majored in marketing or international business, there are exciting opportunities awaiting.

For marketing graduates, some loan forgiveness programs focus specifically on working in underserved communities or non-profit organizations. Imagine using your skills to make a positive impact while also getting your loans forgiven—it’s a win-win!

If you pursued international business, you might be interested in loan forgiveness programs that promote global development or support work in emerging markets. Picture yourself jetting off to different countries, building connections and contributing to economic growth, all while chipping away at those student loans.

Remember, these programs can vary depending on factors like location and employer requirements. So do your research and find the perfect fit for your career aspirations.

The world is yours for the taking, business grad!

Loan Forgiveness Programs for Education Graduates

For education majors, there are numerous loan forgiveness programs available that aim to support teachers in underserved communities. These programs not only alleviate the burden of student loans but also provide an opportunity for you to make a meaningful impact on the lives of students. Imagine being able to pursue your passion for teaching while having your loans forgiven!

Here are two loan forgiveness programs specifically designed for music and art graduates:

-

Loan Forgiveness Program for Music Graduates: This program recognizes the importance of music education and offers loan forgiveness to music graduates who teach in low-income schools or underserved areas. By participating in this program, you can inspire young minds through the power of music while receiving financial support.

-

Loan Forgiveness Program for Art Graduates: If you have a passion for art and want to share your creativity with students, this program is perfect for you. It provides loan forgiveness opportunities for art graduates who teach in schools that lack access to arts education. Through this program, you can nurture budding artists and help them discover their own artistic potential.

With these loan forgiveness programs, pursuing a career in education becomes even more rewarding as you contribute to society while achieving financial freedom.

Frequently Asked Questions

Are There Any Loan Forgiveness Programs Specifically for Graduates in the Field of Arts or Humanities?

Looking to explore loan forgiveness programs? Graduates in arts or humanities might find potential options. Discover the benefits and limitations of these programs designed specifically for you and your creative journey.

Do Loan Forgiveness Programs Have Any Income Restrictions or Eligibility Criteria?

Are you wondering about income restrictions or eligibility criteria for loan forgiveness programs? Well, the good news is that some programs do have them, but don’t worry, there are options out there for everyone.

Are There Any Loan Forgiveness Programs That Apply to Private Student Loans?

Looking to shed your private student loan burden? Explore alternative loan forgiveness options. While not as common as for federal loans, some programs exist that may help alleviate your debt.

Can Loan Forgiveness Programs Be Combined or Stacked With Other Forms of Financial Aid or Scholarships?

When considering loan forgiveness programs, it’s important to understand the financial implications. Combining them with other forms of aid or scholarships can have an impact on future loan applications. Take this into account when exploring your options!

Are There Any Loan Forgiveness Programs That Offer Partial Forgiveness or Reduced Loan Repayment Options?

Looking for loan forgiveness? Good news! There are programs that offer reduced repayment options and even partial forgiveness. Imagine the weight lifted off your shoulders as you pay off your loans. It’s possible!

Conclusion

Congratulations on completing your exploration of loan forgiveness programs for graduates! You’ve delved into the world of federal and state-specific programs, as well as those tailored to teachers, nurses, nonprofit employees, STEM and business graduates, and education professionals.

By uncovering the truth behind these programs, you have gained valuable insights into potential avenues for loan forgiveness. Remember that with a little creativity and imagination, you can lighten the burden of student loans and pave the way towards a brighter financial future.

Keep exploring and pursuing your dreams!