You’ve got credit card debt, and it’s weighing you down like a backpack full of rocks. But fear not, my friend! In this article, we’re going to show you how to create a plan that will help you conquer that debt mountain with style and grace.

Get ready to:

– assess your debt

– set realistic goals

– analyze your spending habits

– create a budget that will make your wallet sing with joy.

So put on your thinking cap and let’s dive in!

Key Takeaways

- Gather all credit card statements and calculate your total debt

- Develop a repayment strategy and set achievable goals

- Analyze your spending habits and identify areas where you can save money

- Prioritize your debts based on interest rates or balances and explore options like debt consolidation or balance transfers

Assessing Your Credit Card Debt

You’ll want to start by gathering all of your credit card statements and calculating the total amount of debt you currently have. Assessing your credit card debt may feel like a daunting task, but fear not! Think of it as embarking on a grand adventure through the land of finances.

First, grab a cup of tea (or coffee if that’s more your style) and settle into a cozy nook with your trusty calculator. As you add up those numbers, take note of how this debt impacts your life. Does it make you lose sleep or prevent you from enjoying life’s little pleasures?

Once you understand its impact, it’s time to develop a repayment strategy fit for conquering this financial dragon. So put on your armor made of determination and let’s slay that debt together!

Setting Realistic Goals

Setting realistic goals is essential when trying to reduce your credit card debt. It’s like embarking on a magical journey, where you need a map to guide you through the enchanted forest of financial freedom. So grab your wand and let’s dive in!

To help you visualize your progress, imagine tracking your journey with a whimsical table:

| Goal | Realistic Timeline | Measuring Progress |

|---|---|---|

| Pay off $500 | 3 months | Weekly check-ins |

| Reduce APR | 6 months | Monthly statements |

| Eliminate fees | 1 year | Quarterly reviews |

With this fantastical table, you can set achievable goals and measure your progress along the way. Remember, magic doesn’t happen overnight! Stay committed, stay focused, and watch as each milestone brings you closer to financial liberation. You got this!

Analyzing Your Spending Habits

Analyzing your spending habits can provide valuable insights into where your money is going and help you make informed decisions about where to cut back. Think of it as embarking on a treasure hunt, but instead of hunting for gold doubloons, you’re searching for those sneaky spending triggers that are draining your wallet faster than a leaky ship.

Take a look at your bank statements and credit card bills with the precision of a detective on the trail of a notorious thief. Look out for patterns and trends that might be leading you astray. Once you’ve identified these culprits, it’s time to develop a savings plan that will put those hard-earned doubloons back in your pocket.

Whether it’s packing lunch instead of ordering takeout or resisting the urge to impulse buy that shiny new gadget, every small step counts towards building a treasure chest full of savings. So grab your magnifying glass and get ready to uncover the secret behind financial mastery!

Creating a Budget

So, you’re ready to dive into the world of budgeting? Well, buckle up and get ready for a wild ride!

In this discussion, we’ll be exploring three key points: income vs. expenses (aka the battle royale), cutting unnecessary spending (say goodbye to those impulse buys), and tracking monthly payments (because math can be fun… sometimes).

Income Vs. Expenses

To better understand your financial situation, it’s important to compare your income and expenses. Let’s take a whimsical journey into the world of assessing your financial situation and increasing your income. Here are four magical steps to help you on this adventure:

-

Create a budget: Track your income and expenses like a wizard tracking potions. This will give you a clear picture of where your money is going.

-

Cut unnecessary expenses: Wave your wand and banish those frivolous purchases that drain your bank account faster than a dragon devours its prey.

-

Find ways to increase income: Summon new opportunities by exploring side gigs or leveling up in your current job through additional training or certifications.

-

Invest wisely: Like casting a spell, make smart investments that have the potential to grow and multiply over time, helping you reach financial freedom.

Cutting Unnecessary Spending

Cutting unnecessary spending is a key step in gaining control of your finances and achieving financial freedom. It’s time to put on your detective hat and uncover those sneaky expenses that are draining your wallet.

Start by scrutinizing your discretionary spending, like that daily latte addiction or the urge to splurge on the latest gadgets. Do you really need that third pair of designer shoes? Probably not.

Look for alternative income sources too, because who doesn’t love a little extra cash? Maybe you have a hidden talent for baking delicious cookies or a knack for pet sitting. Get creative with your money-making skills!

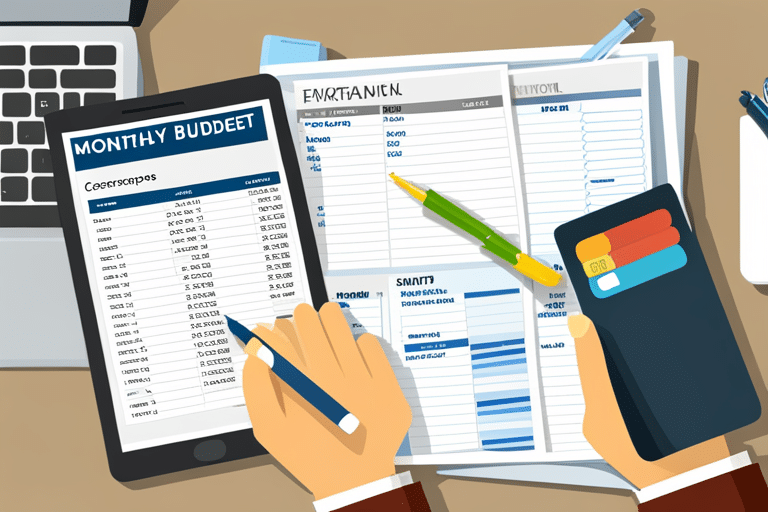

Tracking Monthly Payments

Tracking your monthly payments is an effective way to gain clarity on where your money is going and make informed financial decisions. It’s like having a magical map that shows you the secret paths your money takes, revealing hidden treasures and potential pitfalls. So grab your quill and parchment, because it’s time to embark on this whimsical journey of tracking expenses and creating a repayment timeline!

-

Gather all your invoices, receipts, and credit card statements in one enchanted folder.

-

Wave your wand (or use a spreadsheet) to categorize your expenses into groups like groceries, entertainment, or potions supplies.

-

Use colorful markers to highlight recurring payments, reminding yourself of those sneaky subscriptions that drain gold from your vault.

-

Summon the power of arithmetic to calculate how much you can allocate towards debt repayment each month.

With these mystical tools at hand, you’ll be able to navigate the labyrinth of expenses and create a clear path towards financial freedom!

Prioritizing Your Debts

When prioritizing your debts, it’s important to first identify which ones have the highest interest rates. Think of it like a game of whack-a-mole, where you tackle the moles with the biggest hats first.

Assessing priorities is key here – you want to focus on those pesky debts that are racking up interest faster than a cheetah on roller skates. Once you’ve identified these high-interest culprits, it’s time to create a payment schedule that will show them who’s boss.

Whip out your calculator and crunch those numbers like a math wizard! Allocate more funds towards those debts with higher interest rates while still making minimum payments on the others.

Cutting Back on Unnecessary Expenses

Hey, you financial wizard! Let’s dive into the magical world of cutting back on unnecessary expenses.

First things first, it’s time to prioritize your essential spending like a boss.

Then, we’ll embark on a thrilling quest to identify those sneaky non-essential purchases that are draining your gold coins.

Finally, armed with some epic cost-saving strategies, you’ll be able to slay the money-monster and bring balance back to your kingdom of finances.

Are you ready for this adventure?

Prioritizing Essential Spending

It’s important to identify and prioritize your essential spending when creating a plan to tackle credit card debt. You’re ready to take control of your finances, so let’s get started!

Here are four whimsical cost-saving strategies that will help you cut back on unnecessary expenses and focus on what really matters:

-

Dine-In Delights: Skip the fancy restaurants and embrace the art of cooking at home. With a little creativity, you can whip up gourmet meals without breaking the bank!

-

Fashion Finesse: Instead of splurging on expensive designer clothes, try thrifting or hosting clothing swaps with friends. You’ll have a unique wardrobe while saving some serious cash.

-

Energy Efficiency Extravaganza: Unplug those energy vampires lurking in your home! Turn off lights when not in use, adjust the thermostat wisely, and watch your utility bills shrink.

-

Entertainment Enlightenment: Swap pricey concert tickets for local community events or explore free activities like hiking or picnicking in beautiful parks near you.

Identifying Non-Essential Purchases

To identify non-essential purchases, take a moment to evaluate your spending habits and determine where you can cut back without sacrificing your needs.

It’s time for some detective work! Grab your magnifying glass and let’s dive into the depths of your expenses.

Start by examining those sneaky little impulse buys that somehow find their way into your shopping cart. Do you really need that shiny new gadget or that fancy latte from the coffee shop? Or could you save a few bucks by brewing your own delicious cup of joe at home?

Remember, my savvy friend, it’s all about distinguishing between wants and needs. So put on your thinking cap and get ready to eliminate those unnecessary purchases from your life.

You’re one step closer to mastering the art of financial wizardry!

Implementing Cost-Saving Strategies

Now that you’ve identified those non-essential purchases, it’s time to implement cost-saving strategies to help you save even more money. Don’t worry, my frugal friend, I’ve got a few tricks up my sleeve to make your wallet happy and your bank account grow.

Here are four whimsical cost-cutting techniques that will have you feeling like a master of frugal living:

-

Coupon Magic: Unleash the power of coupons and watch your savings soar! Clip them from newspapers or print them online—every little discount adds up.

-

Meal Planning Wizardry: Plan your meals in advance and create a shopping list accordingly. This way, you’ll avoid impulse buys and reduce food waste.

-

DIY Enchantment: Tap into your inner DIY enthusiast and try making things yourself instead of buying them. From homemade cleaning products to personalized gifts, the possibilities are endless!

-

Thrifty Treasure Hunts: Explore thrift stores, yard sales, and online marketplaces for hidden gems at bargain prices. You never know what treasures await!

With these cost-cutting strategies at hand, you’ll be well on your way to mastering the art of frugal living. So go forth, embrace the magic of saving money, and watch as your financial future becomes brighter than ever before!

Exploring Debt Consolidation Options

Considering debt consolidation options can be a smart move to address credit card debt. By consolidating your debts into one single payment, you can simplify your financial life and potentially save money in interest fees. Think of it as bringing all your little ducklings together to form one big happy family.

Debt consolidation benefits include lower interest rates, reduced monthly payments, and the convenience of having only one bill to worry about. The debt consolidation process involves combining multiple debts into a single loan or transferring balances to a low-interest credit card. It’s like solving a jigsaw puzzle where all the pieces fit perfectly together.

So why not explore this option and take control of your credit card debt? After all, finding the right solution is like finding the key to unlock financial freedom.

And speaking of solutions, once you’ve explored debt consolidation options, it’s time to dive into negotiating with creditors…

Negotiating With Creditors

Hey there, savvy negotiator!

Ready to dive into the world of creditor negotiations? We’ve got some effective strategies up our sleeves that will help you navigate those tricky conversations with finesse.

And guess what? The benefits of successful negotiation go beyond just getting a better deal – you’ll also feel like a total boss when you take control of your finances and come out on top.

Effective Negotiation Strategies

One effective negotiation strategy for tackling credit card debt is to contact your creditors and propose a lower interest rate. By effectively communicating with your creditors, you have the opportunity to find win-win solutions that can help alleviate your financial burden.

Here are four whimsical steps to guide you in this negotiation journey:

-

Prepare yourself: Gather all the necessary information about your credit card debt, such as current interest rates and payment history. This will empower you during the conversation.

-

Be polite yet assertive: Approach the conversation with confidence and respect. Politely explain your situation and why you believe a lower interest rate would be beneficial for both parties.

-

Show commitment: Demonstrate that you are committed to paying off your debt by outlining a realistic repayment plan. This will increase the likelihood of them considering your proposal.

-

Explore alternatives: If they are hesitant about lowering the interest rate, discuss other potential solutions like reducing late fees or consolidating multiple cards into one manageable payment.

Benefits of Creditor Negotiation

If you negotiate with your creditors, you can potentially lower the interest rate on your credit card debt and ease your financial burden.

The benefits of creditor negotiation are like finding a hidden treasure chest in the middle of a desert! Picture this: you sit down with your creditors, armed with knowledge and confidence, ready to strike a deal that works for both parties.

As you engage in friendly banter and clever persuasion, you discover that they are willing to reduce your interest rates or even forgive some of the outstanding balance. Your heart skips a beat as you realize the weight lifted off your shoulders.

With successful negotiation tips under your belt, such as being polite yet assertive and having a clear repayment plan in mind, you can turn this dream scenario into reality.

Considering Balance Transfer Options

When considering balance transfer options, it’s important to explore different credit cards that offer low or 0% introductory APRs. This can be a great strategy to help you manage and pay off your credit card debt more effectively. Here are four things to keep in mind as you navigate the world of balance transfers:

-

Look for cards with long introductory periods: The longer the zero or low interest rate period, the more time you have to pay down your debt without accruing additional interest.

-

Pay attention to balance transfer fees: Some cards may charge a fee for transferring your balance, so make sure to factor this into your decision-making process.

-

Consider your credit limit: Make sure the new card has a high enough limit to accommodate your existing debt.

-

Plan for after the introductory period ends: Be prepared for a potentially higher interest rate once the promotional period is over.

Exploring these considerations will help you find the best balance transfer option that suits your needs and helps you take control of your credit card debt with ease and confidence!

Exploring Debt Management Programs

Exploring debt management programs can be a helpful solution for individuals struggling with their financial obligations. If you’re feeling overwhelmed by your mountain of debt, fear not! There are alternatives to help you climb out from under that heavy burden.

Debt consolidation is like a magic trick that combines all your debts into one manageable payment. It’s like turning a chaotic jigsaw puzzle into a neat and tidy crossword.

Credit counseling services are like having a wise and experienced friend who guides you through the maze of financial decisions. They’ll help you understand your options and make informed choices.

Making a Plan for Regular Payments

So, you’ve explored debt management programs and now it’s time to make a plan for regular payments! Don’t worry, I’m here to help you tackle those credit card debts like a pro. Let’s dive right in!

-

Making extra payments: One of the best ways to pay off your credit card debt faster is by making extra payments whenever possible. It’s like giving your debt a little nudge towards freedom!

-

Snowball method: This method involves paying off your smallest debt first while making minimum payments on the rest. Once that small debt is gone, you can roll that payment into the next smallest one, creating a snowball effect that gathers momentum as it goes.

-

Prioritize high-interest debts: Take a look at all your credit card debts and prioritize them based on interest rates. Start by paying off the cards with the highest interest rates first to save money in the long run.

-

Stay consistent: Consistency is key when tackling credit card debt. Stick to your plan, make regular payments, and resist any temptations to stray from your path of financial freedom.

With these strategies in mind, you’ll be well on your way to conquering those credit card debts once and for all! Keep going, you’ve got this!

Tracking Your Progress

You can easily monitor how you’re doing by regularly checking your progress towards becoming debt-free. It’s like playing a game, but instead of collecting points, you’re tracking your financial success. Think of it as a journey towards a debt-free paradise! To make it even more fun and engaging, let’s create a progress tracker table where you can measure your success along the way.

| Milestone | Target Amount | Current Amount |

|---|---|---|

| Pay off Card 1 | $500 | $250 |

| Pay off Card 2 | $1000 | $800 |

| Pay off Card 3 | $1500 | $1200 |

As you start making payments and reducing your debt, update the current amount column to see how close you are to reaching each milestone. Celebrate every step forward because remember, every small victory counts!

Keep track of your progress regularly and watch as those numbers decrease. Before you know it, that debt will be nothing more than a distant memory. Happy tracking!

Staying Motivated

As you track your progress towards becoming debt-free, it’s important to stay motivated throughout the journey. It can be challenging at times, but with the right mindset and a sprinkle of whimsy, you’ll be able to overcome any obstacles that come your way.

Here are four tips to help you stay motivated on your debt-free adventure:

-

Celebrate small victories: Every time you make a payment or reach a milestone, treat yourself to something special. It could be as simple as enjoying a scoop of your favorite ice cream or taking a relaxing bubble bath.

-

Surround yourself with positivity: Fill your space with motivational quotes, uplifting music, and inspiring books. Create an environment that energizes and encourages you to keep going.

-

Visualize your goal: Picture yourself being debt-free and imagine how amazing it will feel. Visualizing success can help keep you motivated when times get tough.

-

Find support: Connect with others who are on a similar journey or join online communities where you can share stories, seek advice, and find encouragement from like-minded individuals.

Seeking Professional Help if Needed

If the weight of your debt becomes overwhelming, don’t hesitate to seek professional help. Sometimes, you just need a little guidance from the experts to get back on track.

Imagine having a credit counseling superhero by your side, swooping in to save the day! They’ll assess your financial situation and develop a customized plan that suits your needs. With their magical powers of knowledge and experience, they’ll help you understand how to manage your debts better and create a budget that works for you.

Together, you’ll embark on a journey towards financial freedom – like two adventurers conquering Mount Debt! So, if you’re feeling stuck or unsure about what steps to take next, remember that professional guidance is just a phone call away. Let them be your sidekick in this mission to conquer your credit card debt!

Frequently Asked Questions

How Do I Choose the Best Debt Consolidation Option for My Credit Card Debt?

You want to tackle your credit card debt? Well, first things first – choosing the best debt consolidation option is key. Explore those options and find one that fits your needs like a glove!

Is It Possible to Negotiate With Creditors to Lower My Interest Rate or Waive Late Fees?

You can totally charm those creditors into lowering your interest rate and waving late fees! It’s like persuading a stubborn cat to give up its favorite toy – just be patient and persistent.

What Are the Potential Risks and Benefits of Balance Transfer Options for Credit Card Debt?

When it comes to balance transfer options for credit card debt, you need to weigh the risks and benefits. It’s like deciding between a tightrope walk or a hammock nap. Choose wisely!

How Do Debt Management Programs Work and Are They a Good Option for Tackling Credit Card Debt?

Are you wondering if debt management programs are the way to go for tackling credit card debt? Well, let’s dive in! These programs can help you by consolidating your payments and negotiating lower interest rates. But remember, there are alternatives too!

When Should I Consider Seeking Professional Help for My Credit Card Debt?

When it feels like your credit card debt is giving you a never-ending headache, that’s when professional help might be worth considering. Credit counseling and debt settlement options can offer relief and guidance.

Conclusion

Congratulations! You’ve made it to the end of this enlightening guide on tackling your credit card debt.

Now that you’re armed with a plan, there’s nothing stopping you from conquering those pesky balances. Remember, it’s all about taking small steps and staying focused.

So go forth and slay those debts like the fearless financial warrior that you are! And don’t forget, if things get tough, there are always professionals ready to swoop in and save the day.

Happy debt-busting!