Hey there, student loan warrior! Ever feel like your student loan statement is written in a foreign language? Well, fear not, because we’ve got your back.

In this article, we’re going to break down the complicated jargon and confusing numbers on your statement so you can finally understand what it all means. Think of us as your personal translation service for the world of student loans.

So grab a cup of coffee, kick up your feet, and let’s dive into the magical realm of deciphering your student loan statement together!

Key Takeaways

- Understanding the terminology and numbers on your student loan statement is crucial to effectively managing your student loan debt.

- There are various repayment options and strategies available, such as standard repayment, income-driven repayment, graduated repayment, and extended repayment. It is important to choose the best option based on your income level and future goals.

- Analyzing the payment breakdown and managing your loan effectively involves understanding how payments are allocated to principal, interest, and fees.

- Tips for spotting errors and discrepancies on your student loan statement include scrutinizing the statement, verifying interest rates, checking payment history, confirming the outstanding balance reflects payments made, and taking action to correct any errors or discrepancies.

Understanding the Terminology on Your Student Loan Statement

It’s important to familiarize yourself with the terminology on your student loan statement. Let’s face it, understanding all those fancy words can be as confusing as trying to solve a Rubik’s cube blindfolded. But fear not, my friend! I’m here to help you unravel this linguistic labyrinth and make sense of it all.

When it comes to loan repayment, there are certain terms you need to know. Take ‘principal,’ for example. It’s not the head honcho of your school, but rather the original amount you borrowed. And then we have ‘interest,’ which is like that annoying friend who always wants a piece of your pizza. It’s basically what you pay extra for borrowing money.

Now that we’ve dipped our toes into these waters of financial jargon, let’s dive deeper and decode the numbers: making sense of your loan balance and interest rates…

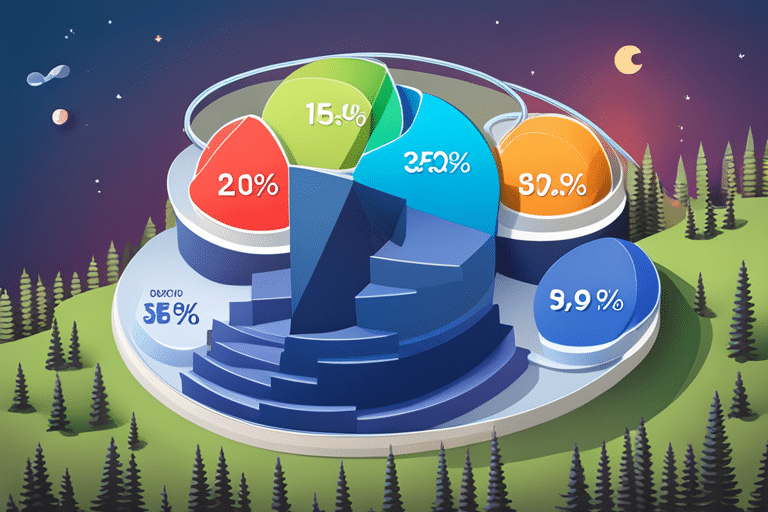

Decoding the Numbers: Making Sense of Your Loan Balance and Interest Rates

Understanding the numbers on your loan balance and interest rates is crucial when decoding your student loan statement. It’s like unraveling a mysterious code, but fear not! With a little bit of knowledge, you can conquer this financial puzzle with ease. So let’s dive in and break it down for you:

-

Loan Balance: This is the amount of money you still owe on your student loans. Keep an eye on this number as it will decrease over time as you make payments.

-

Interest Rates: These are the additional charges applied to your loan balance over time. The higher the interest rate, the more you’ll end up paying in the long run.

-

Loan Forgiveness: Ah, sweet relief! If you qualify for loan forgiveness, a portion or even all of your student debt may be wiped away. Stay informed about eligibility requirements and take advantage of this opportunity if available to you.

Now that we’ve deciphered these important numbers, let’s move on to unraveling repayment options: how to navigate your student loan statement…

Unraveling Repayment Options: How to Navigate Your Student Loan Statement

Navigating your student loan statement can be a bit overwhelming, but don’t worry, we’ll guide you through the repayment options. When it comes to managing your student loans, understanding the different repayment strategies is key. Let’s take a look at some common options:

| Repayment Strategy | Description |

|---|---|

| Standard Repayment | Pay off your loan in equal monthly installments over a set period of time. |

| Income-Driven Repayment | Adjust your payments based on your income and family size. |

| Graduated Repayment | Start with lower payments that gradually increase over time. |

| Extended Repayment | Extend the repayment term beyond the standard 10 years for smaller monthly payments. |

Now that you have an idea of the various repayment strategies, let’s move on to managing loan forgiveness and analyzing your payment breakdown: principal, interest, and fees in the next section.

Navigating through your student loan journey can feel like sailing through uncharted waters. But fear not! We’re here to help you navigate these treacherous seas with ease. So grab a life jacket (metaphorically speaking) as we dive into unraveling those complex terms and conditions that come with repaying your student loans.

Understanding different repayment options is crucial when it comes to finding what works best for you. There are several strategies available such as Standard Repayment, Income-Driven Repayment, Graduated Repayment, and Extended Repayment. Each has its own advantages depending on factors like income level and future goals.

But wait! There’s more! Managing loan forgiveness is another aspect of repaying your student loans that might pique your curiosity. Loan forgiveness programs provide relief by forgiving part or all of your remaining balance after meeting certain criteria such as working in public service or making consistent payments for a specific period.

Now that we’ve explored these repayment strategies and managing loan forgiveness, it’s time to dive deeper into analyzing your payment breakdown: principal, interest, and fees. Let’s unravel the mystery behind these numbers and gain a clearer understanding of where your hard-earned money is going.

Analyzing Your Payment Breakdown: Principal, Interest, and Fees

To get a clearer picture of where your money is going, let’s dive into the breakdown of your payments: principal, interest, and fees. Understanding how these components are allocated can help you master the art of managing your student loan. So, grab your snorkel and let’s explore!

-

Principal: This is the original amount you borrowed. Each payment chips away at this balance, slowly but surely.

-

Interest: Ah, the sneaky villain that accrues while you’re not looking! Interest is what lenders charge for lending you money. It’s like a little tax on top of your loan balance.

-

Fees: These pesky creatures can sneak up on you too! Fees are additional charges for processing and servicing your loan. Watch out for them!

Tips for Spotting Errors and Discrepancies on Your Student Loan Statement

Keep an eye out for any errors or discrepancies on your statement, as they can impact your student loan balance. Spotting inaccuracies is like playing a game of hide and seek with numbers.

Grab your magnifying glass, Sherlock! Look closely at the details—interest rates, payment amounts, due dates—and make sure they match what you remember. If something seems fishy, don’t be afraid to dispute those discrepancies!

Be the hero of your own financial story and fight for accuracy. Contact your loan servicer and provide them with all the evidence you’ve gathered. They’ll investigate faster than a cheetah chasing its prey!

Frequently Asked Questions

What Are the Consequences of Missing a Student Loan Payment?

Missing a student loan payment can have serious repercussions. It may negatively impact your credit score, making it harder to borrow money in the future. Stay on top of your payments to avoid these consequences!

How Can I Apply for a Student Loan Deferment or Forbearance?

Don’t freak out, but applying for student loan deferment or forbearance can be a lifesaver. It’s like hitting the pause button on your payments when life gets crazy. Just remember to understand the terms and conditions!

Can I Change My Repayment Plan After I Graduate?

Sure, you can totally change your repayment plan after graduation! There are various refinancing options available, but be sure to check the eligibility requirements. It’s time to take charge of your student loan journey!

What Happens if I Want to Pay off My Student Loan Early?

So you’ve decided to be a student loan ninja and pay off your student loan early, huh? Well, good news! There are usually no prepayment penalties, meaning you can save money on interest. Keep slaying those loans!

How Can I Lower My Monthly Student Loan Payments?

You want to lower your monthly student loan payments? Well, my friend, you’re in luck! By exploring options like income-driven repayment plans and negotiating lower interest rates, you’ll be on your way to financial freedom in no time.

Conclusion

So, there you have it! You’ve successfully deciphered the perplexing world of your student loan statement. It may have seemed like a daunting task at first, but by understanding the terminology, decoding those numbers, unraveling repayment options, and analyzing your payment breakdown, you’re well on your way to financial freedom.

Remember, Rome wasn’t built in a day (or paid off in one), so be patient with yourself as you navigate this labyrinth of loans. And always keep an eye out for any sneaky errors or discrepancies that may try to creep into your statement – after all, no one likes surprise fees!

Keep up the great work and continue being proactive about managing your student loans. Before you know it, you’ll be grabbing that metaphorical bull by its horns and conquering those loans like a boss!