Are you ready to take a journey into the mysterious world of credit scores? Brace yourself, because in this article, we’re going to delve deep into the impact of debt on your precious credit score.

Yes, that little number that has so much power over your financial life. But fear not, for armed with knowledge and a sprinkle of wit, you’ll learn how different types of debt can affect your score and discover strategies to improve it.

So buckle up and get ready for some credit score mastery!

Key Takeaways

- Credit score is influenced by factors such as payment history, debt owed, credit history, new credit accounts, and types of credit.

- Different types of debt can have a positive or negative impact on credit score.

- Managing debt effectively through strategies like debt consolidation and credit counseling can help improve credit score.

- Maintaining a healthy credit utilization and debt-to-income ratio is crucial for financial well-being and a good credit score.

The Definition of Credit Score and Its Importance

You need to understand what a credit score is and why it’s important for you. I mean, come on, who doesn’t want to impress the financial gods and goddesses with their impeccable creditworthiness? Your credit score is like your financial report card, telling lenders how responsible (or reckless) you are when it comes to borrowing money. It’s a three-digit number that ranges from 300 to 850, with the higher end being more desirable than Harry Styles in his prime.

But what factors determine this magical number? Well, pay attention now because this stuff is crucial. Your credit score takes into account things like your payment history (have you been naughty or nice?), the amount of debt you owe (please don’t max out all your credit cards), the length of your credit history (shorter isn’t always sweeter), new credit accounts (don’t go on a shopping spree right before applying for a loan), and the types of credit you have (it’s all about diversity, baby!).

How Debt Affects Your Credit Score

So, you’ve racked up some debt and now you’re wondering how it’s going to affect your precious credit score, huh? Well, buckle up because we’re about to dive deep into the wild world of debt and credit scores.

We’ll explore the different types of debt that can either make or break your score, and most importantly, we’ll uncover the secrets to managing your debt effectively like a boss.

Get ready for some financial enlightenment!

Debt and Credit Score

Managing your debt can have a significant impact on your credit score. But don’t worry, I’m here to make it fun and easy for you! So grab a cup of coffee, put on your thinking cap, and let’s dive into the wonderful world of debt consolidation and credit counseling.

Here are four important things you need to know:

-

Debt Consolidation: It’s like gathering all your debts in one big happy family. By combining multiple loans into a single payment, you can simplify your life and potentially lower your interest rates.

-

Credit Counseling: Think of it as therapy for your financial woes. A credit counselor will help you create a personalized plan to manage your debts and improve your credit score.

-

Budgeting is key: Get cozy with spreadsheets or use fancy budgeting apps to track every penny that goes in and out of your wallet.

-

Patience is a virtue: Rome wasn’t built in a day, and neither is a perfect credit score. Stick to the plan, be patient, and watch as those numbers climb higher than Mount Everest!

Types of Debt

There are various types of debt that individuals may have, such as student loans, mortgages, and credit card debt. Let’s break it down for you in a snazzy little table:

| Types of Debt | Description |

|---|---|

| Student Loans | The gift that keeps on giving. Thanks, higher education! |

| Mortgages | You too can own a tiny piece of land…and pay for it forever! |

| Credit Card Debt | Ahh, the joys of impulsive shopping and high interest rates. |

Now, let’s talk about debt consolidation. It’s like trying to juggle flaming swords while riding a unicycle – challenging but potentially rewarding. Debt consolidation involves combining all your debts into one big happy family with a single monthly payment. This can help simplify your life and maybe even save some money on interest rates.

But here’s the catch: student loans are not always eligible for debt consolidation programs. So before you start dreaming about financial freedom, make sure to check if your student loans can hop aboard the consolidation train.

Stay tuned for more thrilling adventures in the wild world of credit scores and debt management!

Managing Debt Effectively

Consolidating your debts can be a helpful strategy to simplify your monthly payments and potentially save money on interest rates. Let’s face it, managing debt can feel like trying to juggle flaming potato sacks while riding a unicycle – challenging, to say the least. But fear not, brave master of finances! Here are some budgeting tips to help you manage your debts effectively:

-

Create a realistic budget: It’s time to embrace spreadsheets and become best friends with numbers.

-

Prioritize your debts: Attack those high-interest ones first like they’re the last slice of pizza at a party.

-

Consider debt consolidation: Think of it as gathering all your debts into one big happy debt family.

-

Control spending habits: Remember that time you bought 37 pairs of socks? Yeah, let’s avoid that.

Now that you’ve mastered these budgeting tips and conquered the art of debt management, let’s dive deeper into the different types of debt and their impact on your credit score.

The Different Types of Debt and Their Impact on Your Credit Score

Understanding the different types of debt and how they affect your credit score is crucial for financial success. But don’t worry, I’m here to break it down for you in a way that won’t make your head spin faster than a merry-go-round on steroids.

First up, we have good old credit card debt. Ah, the classic plastic money trap. This type of debt can have a big impact on your credit score if you’re not careful. Rack up those balances and watch your score plummet faster than a lead balloon at a helium party.

Next, we have student loans. Ah yes, the gift that keeps on giving…and giving…and giving some more. These bad boys can also affect your credit score, so make sure you stay on top of those payments or risk being haunted by Sallie Mae’s ghost forever.

And let’s not forget about everyone’s favorite – mortgage debt! Buying a home is exciting and all, but it can also have an impact on your credit score if you fall behind on those monthly payments. So keep that roof over your head and pay up!

Now that you’re familiar with the different types of debt and their potential impact on your credit score, let’s dive into understanding credit utilization and debt-to-income ratio in the next section. Because who doesn’t love more financial jargon to decipher?

Understanding Credit Utilization and Debt-to-Income Ratio

So, you’ve got some credit card balances, huh? Well, managing debt wisely is like navigating a treacherous jungle filled with hidden fees and tempting impulse buys.

But fear not! With a little discipline and a dash of financial savvy, you can tame those wild balances and conquer the debt monster like the financial warrior you were born to be.

Credit Card Balances

If you’re carrying high credit card balances, it can negatively affect your credit score. And let’s face it, nobody wants that! So, here are four things to keep in mind when it comes to those pesky credit card balances:

-

Credit Card Utilization: This fancy term simply means how much of your available credit you’re actually using. Aim to keep your utilization below 30%. Think of it like trying to fit into skinny jeans after a buffet – not easy!

-

Minimum Payments: Sure, paying the minimum may seem tempting, but it’s like trying to blow out a forest fire with a single breath – ineffective! Paying more than the minimum helps reduce those balances faster and shows lenders you’re responsible.

-

Balance Transfers: Consider transferring high-interest balances to a card with lower rates. It’s like getting a coupon for free nachos – who can resist?

-

Paying Off High Balances First: Attack those big bad balances first! It’s like defeating the final boss in a video game – exhilarating!

Now that you know the ins and outs of credit card balances, let’s dive into managing debt wisely and conquer this financial adventure together!

Managing Debt Wisely

Let’s start by exploring some smart strategies for managing your debts effectively.

Debt management can be as tricky as trying to untangle a slinky, but fear not! With the right approach, you’ll be mastering your debts like a pro in no time.

First things first, it’s essential to create a budget that would make even Scrooge McDuck proud. Take a close look at your income and expenses, and find areas where you can cut back. Maybe skip that daily latte or resist the urge to buy every cute puppy calendar you see.

Next up, tackle those high-interest debts like they’re an all-you-can-eat buffet. Start by paying off the ones with the highest interest rates first, while making minimum payments on others. It’s like playing whack-a-mole with debt!

And finally, don’t forget about negotiation skills worthy of a seasoned lawyer. Reach out to lenders and creditors for potential lower interest rates or payment plans that are more manageable.

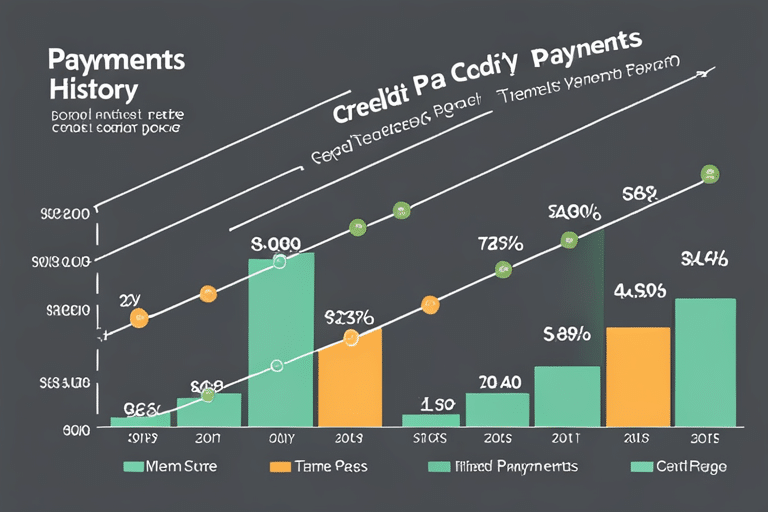

The Role of Payment History in Your Credit Score

Make sure you always pay your bills on time to maintain a good payment history and improve your credit score. Your payment history plays a vital role in determining your creditworthiness, so it’s important not to let those bills pile up like dirty laundry. Missed payments can have a disastrous impact on your credit score, leaving you with a financial hangover that’s harder to shake off than the worst tequila shots.

Here are four reasons why paying your bills on time is essential for maintaining good credit:

-

Creditors love punctuality: Just like showing up late for a date can ruin your chances of a second one, missing payments signals to creditors that you’re unreliable and not worthy of their trust (or money). Don’t be that person who keeps getting stood up by lenders.

-

Late fees are no fun: When you miss payments, not only do you get hit with late fees that make your bank account cry, but these charges also show up on your credit report like an embarrassing pimple on prom night. Trust me; nobody wants to see that.

-

Your credit score takes a hit: Missing payments can cause significant damage to your credit score, making it harder for you to borrow money in the future or secure favorable interest rates. It’s like trying to win at Monopoly while being stuck in jail – not exactly ideal.

-

It takes time to recover: Repairing the damage caused by missed payments isn’t as easy as waving a magic wand or finding the perfect filter for an Instagram photo. It requires consistent effort over time to rebuild trust with creditors and improve your creditworthiness.

The Effects of Late Payments and Defaults on Your Credit Score

Late payments and defaults can severely damage your chances of obtaining future loans or favorable interest rates. So, let’s talk about the effects of these financial mishaps on your credit score. Picture this: you’re at a fancy dinner party, surrounded by lenders and creditors who hold the key to your financial dreams. On one side, we have Late Payment Larry, notorious for his inability to pay bills on time. And on the other side, we have Default Donna, who has a knack for ignoring her debts altogether.

| Effects of Late Payments | Consequences of Defaults |

|---|---|

| Lowered credit score | Devastating credit score |

| Higher interest rates | Debt collectors knocking |

| Limited borrowing options | Financial reputation tarnished |

Let’s start with Late Payment Larry. When he misses a payment or makes one late, his credit score takes a hit like a boxer in the ring. His once respectable 750 is now struggling in the 600s club. As if that wasn’t bad enough, Larry gets slapped with higher interest rates when he does manage to secure a loan.

Now onto Default Donna – she’s got bigger problems than just a lowered credit score. Defaults are like grenades thrown into her financial life; they explode with consequences! Debt collectors come knocking at her door like pesky salespeople trying to sell their latest gadget.

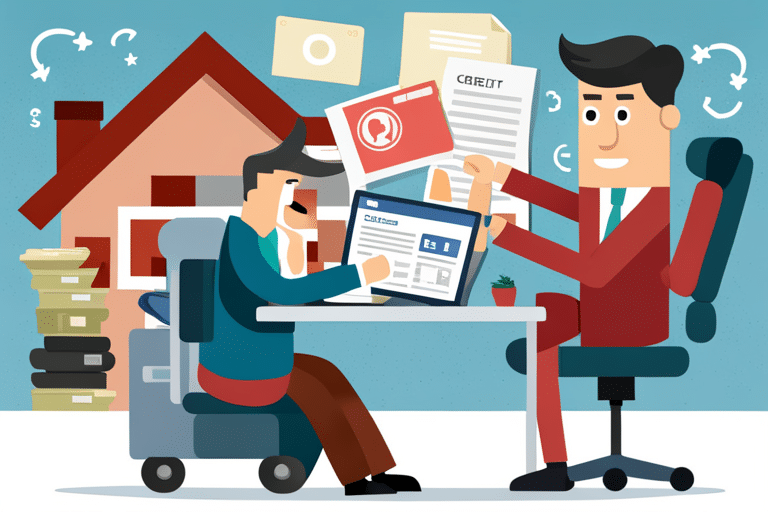

How Debt Settlement and Bankruptcy Impact Your Credit Score

Debt settlement and bankruptcy can have significant effects on how lenders view your financial history. It’s like the ultimate game of ‘Truth or Dare’ that lenders play when they see these debt relief options on your record. Will they trust you again, or will they run for the hills? Here’s what you need to know:

-

Bankruptcy: When you declare bankruptcy, it’s like shouting from the rooftops, ‘I’m financially screwed!’ Lenders take note of this and may see you as a risky bet. Your credit score takes a major hit, and it feels like getting a punch in the gut.

-

Debt Settlement: This option is like playing hardball with your creditors. You negotiate to pay less than what you owe, but here’s the catch – it leaves a scar on your credit report for years to come. Lenders raise an eyebrow when they see this and wonder if you’re trustworthy.

-

Credit Score Recovery: Both debt settlement and bankruptcy make it harder for you to recover your credit score. It’s like trying to climb Mount Everest with one arm tied behind your back! But fear not, there are ways to rebuild your credit slowly but surely.

-

Patience and Persistence: Rebuilding your credit after debt settlement or bankruptcy requires time and effort. Paying bills on time, keeping low balances on credit cards, and avoiding new debts are all part of the recovery process.

The Importance of Keeping a Low Credit Card Balance

Keeping a low credit card balance can help improve your overall financial health and increase your chances of being approved for future loans. It’s like going to the gym for your wallet, except you don’t have to break a sweat or wear spandex. Plus, it’s way more fun than doing sit-ups.

Imagine this: you’re at a dinner party and someone asks you about your credit card balance. Instead of mumbling something about ‘I’ll check my statement later,’ you confidently respond, ‘Oh, I keep my credit utilization low because I understand the impact it has on my financial well-being.’ Boom! Instant cool points.

But there’s more to it than just impressing people at parties. Keeping a low credit card balance can also save you money in the long run. When your credit utilization is high, lenders see you as a riskier borrower and may charge higher interest rates. That’s like paying extra for guacamole every time you buy tacos – unnecessary and painful.

So how do you keep that balance in check? Well, one option is to seek out the benefits of credit counseling. These experts can help guide you through the world of personal finance and give you tips on managing your debt responsibly.

Strategies for Paying Off Debt and Improving Your Credit Score

Imagine this: you’ve decided to take control of your financial future and are determined to pay off your debts and improve your credit score. Good for you! Now, let’s dive into some strategies that will help you conquer those pesky debts and build a solid credit history.

-

Prioritize and strategize: Start by listing all your debts from highest interest rate to lowest. Attack the high-interest ones first, while making minimum payments on the others. It’s like playing a game of Whack-a-Mole with debt!

-

Cut back on unnecessary expenses: Say goodbye to that daily latte or weekly fancy dinner out. By trimming down unnecessary expenses, you’ll have more money to put towards paying off your debts faster.

-

Get creative with extra income: Consider taking up a side hustle or selling unused items online. Every little bit helps, and who knows? You might discover hidden talents along the way!

-

Negotiate like a boss: Reach out to your creditors and negotiate lower interest rates or even settlement offers if possible. Remember, it never hurts to ask!

How Your Credit Score Is Used by Lenders and Creditors

When lenders and creditors evaluate your creditworthiness, they take into account various factors such as payment history, income, and employment stability. It’s like being under a microscope with a team of judgmental scientists examining every detail of your financial life. They scrutinize how promptly you pay your bills, how much money you make, and whether you can hold down a job without falling into the nearest water cooler.

But wait! There’s more! These meticulous scholars also consider other elements that affect your credit score calculation. Things like the length of your credit history – it’s like measuring the age of fine wine or cheese; the older, the better. They even examine how much debt you have compared to your available credit limits – it’s like trying to balance on a tightrope while juggling flaming torches.

And let’s not forget about those sneaky little inquiries when you apply for new credit. The more times you inquire about obtaining additional funds, the more suspicious these financial detectives become. It’s like they’re saying: ‘Hey buddy, why are all these people suddenly interested in lending you money? What do they know that we don’t?’

The Long-Term Effects of Debt on Your Creditworthiness

So, you’ve learned about how your credit score is used by lenders and creditors. Now let’s dive into the long-term effects of debt on your creditworthiness. Brace yourself, because this is where things get real.

-

The Debt Avalanche: Picture a snowball rolling down a hill, gaining momentum and size with each passing moment. Well, that’s what happens when you accumulate long-term debt without paying it off. Your creditworthiness starts to crumble like a poorly built snowman in spring.

-

The Credit Score Sinkhole: Long-term debt consequences are no joke. They can drag your credit score down faster than a sinking ship in quicksand. That shiny credit card you maxed out during that online shopping spree? Yeah, that will haunt you for years to come.

-

The Lender’s Suspicion Dance: When lenders see a history of unpaid debts or high levels of long-term debt, they start doing their dance of suspicion. They question whether you’re capable of handling more debt responsibly, causing them to hesitate when considering extending credit to you.

-

The Financial Scarlet Letter: Accumulating excessive long-term debt can feel like wearing an invisible scarlet letter on your financial chest – everyone knows about it (especially potential lenders), and it affects how they perceive your trustworthiness with money.

Frequently Asked Questions

Are There Any Exceptions to the Impact of Debt on Your Credit Score?

Exceptions to the impact of debt on your credit score? Well, let me tell you, my friend. Even for low income individuals, debt still packs a punch. So keep those balances low and pay on time!

How Does Having Multiple Types of Debt Affect Your Credit Score?

Ever wonder how juggling different types of debt affects your credit score? Like a magician with too many balls in the air, your credit utilization may suffer if you’re not careful.

Can Paying off Debt Completely Erase Its Impact on Your Credit Score?

Paying off debt completely won’t magically erase its impact on your credit score, but it can definitely help improve it. By reducing your debt, you lower your credit utilization ratio, which is a good thing for your score.

What Is the Maximum Debt-To-Income Ratio That Is Considered Acceptable by Lenders?

When it comes to the maximum debt-to-income ratio that lenders find acceptable, there are some exceptions. But remember, high debt can still have a big impact on your credit score. So tread carefully!

How Long Does It Take for Negative Marks Like Late Payments or Defaults to Be Removed From Your Credit Score?

Late payments and defaults can hang around on your credit score for what feels like an eternity. But fear not, my friend! Debt consolidation can have a positive impact, while the amount of debt affects removal time. Keep those negative marks at bay!

Conclusion

So there you have it, dear reader! The impact of debt on your credit score is no joke. It’s like having a giant boulder tied around your ankle while trying to swim upstream.

But fear not, for with the right strategies and determination, you can break free from the shackles of debt and watch your credit score soar like a majestic eagle in the sky.

So go forth, my friend, conquer that debt and let your creditworthiness shine bright like a diamond!