Step into the time machine, my friend! Let’s take a journey to the world of minimum payments and discover the hidden costs that await you.

Brace yourself for a wild ride as we unravel the truth behind those seemingly innocent numbers.

It’s time to break free from the chains of debt and unlock the secrets to financial success.

Get ready to dive deep into the realm of credit scores, snowballs, and avalanches.

Trust me, mastering this knowledge will be well worth your while.

Key Takeaways

- Minimum payments may seem like a great deal, but they have hidden costs.

- Making only the minimum payment leads to paying more in the long run.

- The balance on your credit card may not decrease much, or it may even increase due to interest charges.

- Minimum payments can keep you in debt by creating a snowball effect.

The Hidden Price of Minimum Payments

The hidden price of minimum payments isn’t always obvious at first glance. Sure, it may seem like a great deal to only have to pay the minimum amount due on your credit card bill each month. But beware! There are hidden costs lurking beneath the surface, ready to trap you in a cycle of debt.

You see, when you make only the minimum payment on your credit card balance, you’re actually paying more in the long run. The interest charges keep piling up, and before you know it, you’re stuck with a growing balance that seems impossible to pay off.

It’s like being caught in a never-ending maze. You make your minimum payment one month, thinking everything is under control. But then, the next month rolls around and your balance hasn’t budged much. In fact, it might have even increased due to interest charges.

And so begins the snowball effect: how minimum payments can keep you in debt. The more time passes without fully paying off your balance, the harder it becomes to escape this vicious cycle.

The Snowball Effect: How Minimum Payments Can Keep You in Debt

Get trapped in a cycle of debt by only making minimum payments. It’s like being caught in a never-ending snowstorm, where the more you try to dig yourself out, the deeper you sink.

Picture this: you’ve got multiple credit cards with balances that seem to never decrease. You diligently make the minimum payments each month, thinking you’re doing your part. But little do you know, those minimum payments are just keeping you stuck in a vicious cycle.

You see, when you only pay the minimum amount due on your credit card bills, it may feel like progress, but it’s actually a trap. The interest keeps piling up and before you know it, your debt has grown larger than that giant snowball rolling down a hill.

To break free from this icy grip of debt, you need some strategic moves up your sleeve. Debt payoff strategies are your secret weapons to defeat those sneaky minimum payment traps.

Start by prioritizing your debts – focus on paying off high-interest ones first while still making minimum payments on others.

Next comes the ‘snowball effect.’ As soon as one debt is paid off, take that extra money and apply it towards the next one. Watch how each payment builds momentum and speeds up your journey to financial freedom.

Breaking Down the Numbers: Understanding the True Cost of Minimum Payments

Hey there, savvy spender! Ready to dive into the nitty-gritty of minimum payments?

Well, buckle up because we’re about to unveil some hidden secrets. Get ready to discover how those sneaky interest charges can sneakily accumulate long-term debt and even impact your precious credit score.

Trust us, this discussion will leave you feeling like a financial detective!

Hidden Interest Charges

Make sure you’re aware of the hidden interest charges when you only pay the minimum amount. It’s like that sneaky squirrel stashing away acorns for winter – those interest charges can accumulate without you even noticing!

You see, credit card companies love it when you only make the minimum payment because they get to charge you more and more in interest. It’s their little secret way of increasing their profits while keeping a smile on your face.

But don’t be fooled by their tricks! Those hidden costs can add up faster than rabbits multiply, leaving you with a hefty balance and a sinking feeling in your stomach.

Long-Term Debt Accumulation

Long-term debt can become overwhelming if you don’t take proactive steps to manage it. But fear not, brave soul! There are plenty of debt payoff strategies out there to help you conquer that mountain of financial stress and reduce it to a mere molehill.

Picture this: you’re armed with a sword (okay, maybe just a calculator) and ready to slay that debt dragon. First, consider the snowball method – start by paying off your smallest balances first, then move on to larger ones. It’s like building momentum in a game of Jenga!

Another option is the avalanche method – tackle high-interest debts first, like an experienced mountaineer scaling the highest peaks. Whichever strategy you choose, remember that every payment brings you closer to freedom from debt.

Impact on Credit Score

Paying off your debts on time can greatly improve your credit score. Let’s be honest, who doesn’t want a good credit score? It’s like having the golden ticket to financial freedom!

But here’s the kicker – if you don’t pay those debts on time, your credit score could take a nosedive faster than a roller coaster ride. Imagine being stuck in line for hours while everyone else is enjoying the thrill of their lives.

That’s what happens when your creditworthiness takes a hit. Lenders start questioning whether you’re reliable or not, and that can have serious consequences.

The Illusion of Progress: Why Minimum Payments Won’t Set You Free

Don’t fall for the illusion that minimum payments will give you financial freedom. It’s like trying to build a sandcastle with a teaspoon – sure, it may look like progress at first, but deep down, you know it won’t lead to anything substantial.

The minimum payment mindset is a sneaky trap that keeps you stuck in a cycle of debt and delays your journey towards true financial mastery.

You see, when you only make the minimum payment on your credit card or loan each month, it may feel like you’re making some kind of progress. After all, you’re meeting your obligation and avoiding late fees. But here’s the thing: while those small payments may appease your creditors temporarily, they do little to chip away at the actual balance.

It’s as if you’re running on a hamster wheel – lots of movement but no real forward motion. And all the while, interest is piling up, devouring any illusionary progress you thought you were making.

So why settle for this mediocre dance? Break free from the minimum payment mindset and take control of your financial destiny. Make larger payments whenever possible and watch as your debt shrinks before your eyes.

The Long Road: How Minimum Payments Extend the Life of Your Debt

Hey there, debt wrangler! Ready to dive into the world of minimum payments and the sneaky ways they extend the lifespan of your debt?

Well, buckle up because we’re about to uncover all the drawbacks of those pesky minimum payments while also exploring how paying more can actually benefit you in the long run.

Debt Lifespan Extension

If you only make the minimum payments, your debt will continue to linger for much longer. But fear not, my dear friend! I have some whimsical and creative debt repayment strategies for you that will help speed up your journey towards financial freedom. So grab your wizard hat and let’s dive in!

-

Snowball method: Start by paying off your smallest debts first while making minimum payments on the rest. As each small debt is conquered, roll that payment into the next one, creating a snowball effect of motivation and progress.

-

Avalanche method: This strategy focuses on high-interest debts first. Attack those pesky credit card balances or loans with sky-high interest rates. By eliminating these costly debts early on, you’ll save money in the long run.

-

Get a side hustle: Channel your inner entrepreneur and find ways to earn extra income outside of your regular job. Whether it’s freelancing, dog walking, or selling homemade crafts online, every dollar counts towards paying down that debt faster.

Minimum Payment Drawbacks

To truly tackle your debt, it’s important to be aware of the drawbacks that come with making only minimum payments.

Sure, it may feel good in the moment to pay just a small portion of what you owe each month, but let me tell you, my friend, there are hidden costs lurking beneath the surface.

You see, when you only make minimum payments, you’re essentially signing up for an extended stay in Debtville. Interest rates will continue to pile up like dirty laundry in your hamper – and trust me, that stinks!

By employing minimum payment strategies, you’re waving goodbye to financial freedom and saying hello to a lifetime subscription of servitude to your debts.

Paying More Benefits

By increasing your monthly payment, you’ll be able to save more money in interest and pay off your debt faster. It’s time to embrace the power of paying more!

Let’s dive into the benefits that await you:

-

Freedom from the chains of debt: Imagine the weight lifting off your shoulders as you see your balance decrease at lightning speed. Paying more allows you to break free from the clutches of debt and reclaim control over your financial future.

-

A financial security mindset: By prioritizing larger payments, you’re cultivating a mindset of financial security. You’re taking proactive steps towards building a solid foundation for yourself, paving the way for a brighter and more stable future.

-

The joy of progress: Each increased payment brings you closer to being debt-free. Celebrate every milestone along the way and revel in the satisfaction of knowing that with each passing month, you’re chipping away at your debt mountain.

The Interest Trap: How Minimum Payments Contribute to Higher Interest Charges

When you only make minimum payments on your credit card, you’re falling into the interest trap and allowing higher interest charges to accumulate. It’s like getting caught in a spider’s web, where each tiny thread represents those hidden costs that slowly entangle you. You may think you’re being smart by paying just the minimum, but in reality, you’re dancing with the devil.

Picture this: every month, your credit card balance grows like a pesky weed in your garden. The interest charges creep up silently, just waiting for the perfect moment to pounce on your hard-earned money. And while it may seem like a small amount at first glance, over time it adds up faster than rabbits multiplying.

But fear not! There is a way out of this tangled mess. By paying more than just the minimum amount due each month, you can break free from the clutches of those high-interest rates. It’s like untangling yourself from a complicated knot – once you start making larger payments, those hidden costs unravel before your eyes.

Escaping the Minimum Payment Cycle: Strategies for Paying More

Are you tired of being stuck in the never-ending cycle of minimum payments?

Well, it’s time to break free and take control of your debt!

In this discussion, we’ll explore some creative strategies that will help you pay off your debts faster than ever before.

From snowballing payments to cutting back on unnecessary expenses, get ready to say goodbye to those pesky interest charges and hello to financial freedom!

Breaking the Cycle

Breaking the cycle of minimum payments is crucial if you want to avoid long-term debt. It’s time to shift your mindset and overcome the belief that minimum payments are enough. Here are 3 reasons why breaking this cycle is essential:

-

Freedom: Imagine being free from the burden of debt hanging over your head. By paying more than the minimum, you can accelerate your journey towards financial freedom and enjoy a stress-free life.

-

Savings: Paying only the minimum means you’ll end up paying more in interest over time. By breaking the cycle, you can save a significant amount of money that could be better spent on achieving your dreams or future investments.

-

Empowerment: Taking control of your finances and overcoming the mindset of just scraping by gives you a sense of empowerment. You become the master of your own destiny, making smart choices that will lead to a brighter financial future.

Paying off Debt Faster

To pay off your debt faster, it’s important to implement strategies that will help you make progress towards becoming debt-free. So, let’s dive into some whimsical and creative ways to tackle that pesky debt monster!

First up, the ‘Extra Dollar Dance.’ Every time you find spare change lying around, put it towards your debt. It may not seem like much, but those pennies add up over time.

Next, try the ‘Payment Shuffle.’ Instead of making one big payment each month, break it up into smaller payments throughout the month. This not only helps you stay on top of things but also reduces interest charges.

Lastly, unleash your inner bargain hunter with the ‘Coupon Crusade.’ Use coupons and discounts whenever possible to save money and put those savings towards paying off your debt faster.

With these playful strategies in your arsenal, you’ll be well on your way to conquering that mountain of debt!

The Power of Compound Interest: Why Paying More Can Save You Money

Paying more on your credit card each month can save you a significant amount of money due to the power of compound interest. It might not sound exciting, but trust us, compound interest is like a magical money-growing potion! Here are three reasons why paying more can be your secret weapon against debt:

-

Snowball effect: When you make larger payments, it reduces your outstanding balance faster. And guess what? That means less money for those sneaky interest charges to devour. Before you know it, your debts will start shrinking like magic!

-

Faster payoff: By paying more than the minimum, you’ll be able to tackle your debt at warp speed. Imagine that satisfying feeling when you see those balances dropping quicker than a magician’s disappearing act.

-

More moolah in your pocket: The best part about paying off your debt faster? You’ll save bundles of cash in interest charges over time! Think about all the amazing things you could do with that extra dough – take a dream vacation or treat yourself to something special.

The Psychology of Minimum Payments: Overcoming the Mindset of “Good Enough

So, you’ve been making those minimum payments on your credit cards, huh? Well, let’s talk about breaking that payment cycle and unleashing yourself from the clutches of debt.

We’ll delve into the long-term consequences of carrying this burden and explore how adopting a financial freedom mindset can set you on the path to a brighter future.

Are you ready to break free and embrace a life where your money works for you instead of the other way around? Let’s dive in!

Breaking Payment Cycle

Breaking the payment cycle can help you avoid accumulating more debt in the long run. It’s time to take control of your finances and implement some strategies for success. Here are three whimsical ways to break free from the cycle:

-

The Snowball Method: Start by paying off your smallest debts first, then work your way up to the larger ones. As you see those small victories pile up, it will give you the motivation to keep going.

-

The 50/30/20 Rule: Allocate 50% of your income to necessities, 30% to wants, and 20% towards debt repayment and savings. This balanced approach ensures you’re making progress while still enjoying a little fun along the way.

-

The Accountability Buddy: Find a friend or family member who can hold you accountable for sticking to your debt repayment plan. Having someone cheering you on makes the journey much more enjoyable.

Long-Term Debt Consequences

If you ignore the long-term debt consequences, you might find yourself in a financial hole that’s difficult to climb out of. Sure, making only the minimum payment on your credit card may seem like an easy way out, but it can have serious repercussions down the line. Let me break it down for you:

| Minimum Payment | Interest Rate | Time to Pay Off |

|---|---|---|

| $50 | 20% | 10 years |

Just look at that table! By making only the minimum payment each month, you’re extending your debt for a decade and paying a hefty amount in interest. It’s like being stuck on a never-ending hamster wheel of debt! But fear not, my friend. There is hope.

Financial Freedom Mindset

To achieve financial freedom, it’s essential to adopt a mindset that prioritizes long-term stability over short-term convenience. It’s time for a financial mindset shift! Changing your spending habits can be challenging, but with the right approach, you’ll be on your way to mastering your finances.

Here are three key steps to help you make that shift:

-

Embrace delayed gratification: Instead of succumbing to impulsive purchases, learn to wait and save up for what you truly want. It may feel tough at first, but the satisfaction of achieving your goals will far outweigh any momentary desire.

-

Prioritize needs over wants: Take a closer look at your expenses and distinguish between what you need versus what you simply want. Focus on meeting your basic necessities before indulging in non-essential items.

-

Cultivate mindful spending habits: Before making any purchase, pause and ask yourself if it aligns with your long-term financial goals. Are there alternative ways to fulfill the same need without breaking the bank? By being conscious of every dollar spent, you’ll develop healthier spending habits and gain more control over your money.

The Financial Toll of Minimum Payments: How They Impact Your Overall Budget

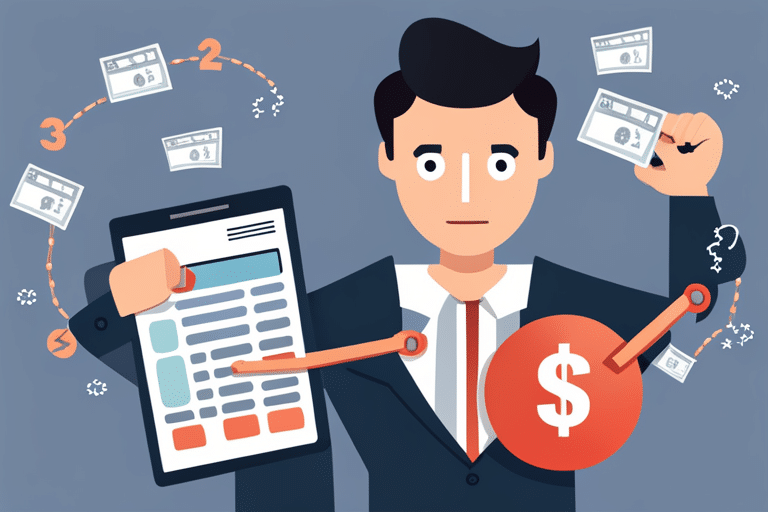

You’re probably wondering how minimum payments actually affect your overall budget. Well, let me tell you, my financially savvy friend!

Minimum payments may seem like a small drop in the ocean of your debt, but they can have some sneaky hidden costs that can really make a dent in your wallet.

First off, these minimum payments are often just enough to cover the interest charges on your outstanding balance. This means that if you only pay the minimum each month, you’ll be stuck with that debt for what feels like an eternity! And let’s not forget about those pesky late fees and penalties that can quickly add up if you miss a payment or don’t meet the minimum requirement.

But it’s not just about the extra expenses – it’s also about the impact on your overall budget. By only paying the minimum, you’re prolonging the life of your debt and tying up more of your hard-earned money in monthly payments. This leaves less room in your budget for other important things like saving for emergencies or treating yourself to a well-deserved vacation.

The Benefits of Paying More: How It Can Improve Your Credit Score

So, you’ve learned about the financial toll of minimum payments and how they can wreak havoc on your budget. But fear not! There’s a light at the end of the tunnel – it’s time to talk about the benefits of paying more and how it can improve your credit score. Get ready to boost your creditworthiness and achieve financial stability like never before!

Here are three reasons why paying more than the minimum payment is worth every penny:

-

Credit Score Superpowers: By consistently making larger payments, you show lenders that you’re responsible with your finances. Your improved creditworthiness will make them see you as a trustworthy borrower, which opens doors to better interest rates and loan opportunities.

-

Financial Flexibility: Paying more means reducing your debt faster. With every extra dollar you put towards your balance, you’ll inch closer to becoming debt-free and gain more control over your money. Imagine all the possibilities when those monthly payments no longer hang over your head!

-

Peace of Mind: Knowing that you’re actively taking steps towards improving your credit score brings a sense of peace and security. You’ll sleep better at night knowing that future financial endeavors won’t be hindered by past debts.

The Freedom of Paying Off Your Debt: Why It’s Worth the Extra Effort

Paying off your debt can bring a sense of freedom and relief, allowing you to take control of your financial future. It may require some extra effort, but the benefits are well worth it. By shifting your mindset and making a commitment to paying off your debt as quickly as possible, you can experience the true joy of being debt-free.

To illustrate the benefits of paying off your debt, let’s imagine three different scenarios. In each scenario, we have someone with $10,000 in credit card debt. The table below shows how long it would take to pay off the debt and how much interest would be paid based on different payment amounts:

| Payment Amount | Time to Pay Off Debt | Total Interest Paid |

|---|---|---|

| Minimum Payment | 25 years | $14,000 |

| $200/month | 6 years | $4,400 |

| $500/month | 2 years | $1,000 |

As you can see from this whimsical table, making just the minimum payment will keep you in debt for decades and cost you an extra $4,000 in interest! But by putting in that extra effort and increasing your monthly payments to either $200 or even better—$500—you can become debt-free much quicker and save thousands of dollars in interest.

The Snowball Vs. Avalanche Method: Choosing the Right Approach to Paying off Debt

So you’ve decided to take charge of your finances and pay off your debt. That’s fantastic! In our previous subtopic, we discussed the freedom that comes with paying off your debt. Now, let’s talk about the best approach to tackle that mountain of debt: the Snowball Vs. Avalanche Method.

1) The Snowball Method: This strategy focuses on paying off your smallest debts first while making minimum payments on larger debts. As you eliminate smaller debts, you gain momentum and motivation to keep going. It’s like rolling a snowball down a hill – it starts small but grows bigger as it picks up speed!

2) The Avalanche Method: On the other hand, this method prioritizes tackling high-interest debts first. By focusing on debts with higher interest rates, you’ll save more money in the long run and reduce overall interest paid. It’s like watching an avalanche sweep away all those pesky high-interest debts!

3) Strategies for Success: Whichever method you choose, consistency is key! Create a budget, cut unnecessary expenses, and put any extra money towards your debt payments. Celebrate milestones along the way to maintain motivation and keep pushing forward.

The Long-Term Effects: How Paying More Now Can Set You Up for Financial Success

Choosing the Snowball or Avalanche Method can have long-term effects on your financial success. It’s like choosing between a snowball fight and an epic avalanche adventure. Both methods have their merits, but let’s talk about how paying more now can set you up for ultimate financial success.

Imagine you’re standing at the bottom of a snowy mountain, ready to tackle your debt. With the Snowball Method, you start by throwing small snowballs at your smallest debts, gaining momentum as you knock them out one by one. It’s like building a snowman – each small victory brings a sense of accomplishment that keeps you going.

On the other hand, the Avalanche Method is like triggering an epic avalanche to wipe out your debts. You focus on tackling high-interest debts first, which saves you money in the long run. You may not see immediate results like with the Snowball Method, but it sets you up for bigger wins down the line.

No matter which method you choose, paying more than just the minimum payments will have profound long-term effects on your financial success. By making larger payments towards your debts now, you’ll reduce interest charges and pay off your balances faster.

Frequently Asked Questions

Can Minimum Payments Keep You in Debt Indefinitely?

Sure, minimum payments may seem convenient at first. But did you know they can trap you in a never-ending cycle of debt? They have a massive impact on your financial stability and can lead to serious long-term consequences. So, pay more and break free!

How Do Minimum Payments Contribute to Higher Interest Charges?

Hey, you know those minimum payments? They may seem harmless, but they’re actually sneaky little devils that contribute to higher interest charges and keep you stuck in debt forever. Time to break free!

What Strategies Can Help Escape the Minimum Payment Cycle?

You want to escape the minimum payment cycle and pay off faster? Well, here’s a tip: make bigger payments! It may seem obvious, but it’s the key to breaking free from those pesky minimums.

How Does Paying More Improve Your Credit Score?

Paying more on minimum payments is like adding sprinkles to a cupcake. It sweetens your credit score, boosts your financial health, and opens doors to better opportunities. So go ahead, sprinkle that extra payment!

What Is the Difference Between the Snowball Method and the Avalanche Method for Paying off Debt?

When it comes to paying off debt, there are two popular methods: the snowball method and the avalanche method. The snowball method focuses on starting with small debts first, while the avalanche method tackles high-interest debts.

Conclusion

Congratulations! You’ve reached the end of this eye-opening journey into the hidden costs of minimum payments.

Now that you know the truth, it’s time to take action and break free from the shackles of debt.

Remember, paying more than the minimum may seem like a daunting task, but it’s your ticket to financial freedom.

So go ahead, choose the avalanche or snowball method and watch your debt melt away.

By investing a little extra now, you’ll set yourself up for long-term success.

It’s time to embrace the joy of being debt-free!