Are you lost in a maze of student loan repayment options, desperately seeking the light at the end of the tunnel? Look no further!

In this ultimate guide, we’ll be your trusty navigator, guiding you through the labyrinth of student loan repayment assistance programs.

From eligibility criteria to pros and cons, we’ve got it all covered.

So grab your compass and let’s embark on this journey together towards financial freedom!

Key Takeaways

- There are various types of student loan repayment assistance programs, including loan forgiveness programs, income-based repayment plans, public service loan forgiveness, teacher loan forgiveness, and military loan repayment programs.

- Eligibility criteria for these programs typically involve demonstrating financial need, completing an application process, and meeting specific requirements based on income, employment, or profession.

- Student loan repayment assistance programs offer benefits such as financial literacy resources, loan forgiveness options, peace of mind, and potential long-term benefits.

- To apply for these programs, gather necessary documents, review eligibility requirements, complete the application accurately, double-check for errors, and wait for the application to be reviewed by program administrators.

Different Types of Student Loan Repayment Assistance Programs

There are various types of student loan repayment assistance programs available to help borrowers. It’s like a magical realm with options galore!

First, we have the Loan Forgiveness Programs, where you can bid farewell to a portion or even all of your debt. It’s like waving a wand and making those loans disappear!

Then there are the Income Based Repayment Plans, where your monthly payments are based on how much you earn. It’s like having a money genie who adjusts your payments to fit your income!

These programs offer hope and relief for those burdened by student loans. Now that you know about these enchanting options, let’s dive into the eligibility criteria for student loan repayment assistance programs.

Get ready to unlock the secrets and claim your well-deserved freedom from debt!

Eligibility Criteria for Student Loan Repayment Assistance Programs

To qualify for student loan repayment assistance programs, you need to meet certain eligibility criteria. Don’t worry, it’s not as complicated as it sounds! Let’s break it down for you in a fun and whimsical way.

First things first, let’s talk about financial eligibility. This basically means that you need to demonstrate a certain level of financial need to qualify for these programs. Each program has its own specific requirements, so make sure to do your research and find one that fits your situation.

Now, let’s move on to the application process. It usually involves filling out some forms and providing documentation of your income and expenses. Think of it like solving a puzzle – just gather all the pieces and put them together!

To make things even easier for you, here’s a handy table summarizing the eligibility criteria for different types of student loan repayment assistance programs:

| Program | Financial Eligibility | Application Process |

|---|---|---|

| Program A | Must have low income | Fill out online application form |

| Program B | Must work in public service | Submit proof of employment |

| Program C | Must be enrolled in specific profession | Provide documentation of education |

Pros and Cons of Student Loan Repayment Assistance Programs

Are student loans weighing you down like a backpack full of bricks? Well, fear not, because there’s a glimmer of hope on the horizon!

In this discussion, we’ll delve into the magical world of Student Loan Repayment Assistance Programs (SLRAPs) that promise to lighten your financial load and bring some much-needed relief.

We’ll explore how these programs can alleviate the burden of your student loans while also offering potential long-term benefits that will have you skipping through life like a carefree unicorn.

Financial Burden Alleviation

One way students can alleviate their financial burden is by exploring loan repayment assistance programs. These programs can provide much-needed relief and help you manage your student loans more effectively.

Here are some benefits of these programs:

-

Financial Literacy: Loan repayment assistance programs often offer resources and guidance on financial literacy, helping you understand your loans better and make informed decisions.

-

Loan Forgiveness Options: Some programs may offer loan forgiveness options based on certain criteria, such as working in public service or qualifying for income-driven repayment plans. This can significantly reduce the amount of debt you have to repay.

-

Peace of Mind: By participating in a loan repayment assistance program, you can gain peace of mind knowing that there are options available to help you navigate the challenges of repaying your student loans.

Potential Long-Term Benefits

By exploring loan repayment assistance programs, you can gain valuable financial literacy skills and potentially qualify for loan forgiveness options, providing long-term benefits. It’s like finding a secret treasure chest full of gold coins!

These programs not only help ease the burden of student loans but also equip you with the knowledge to navigate the complex world of personal finance. Plus, if you meet the eligibility criteria, there’s even a chance that your loans could be forgiven altogether! Talk about a weight lifted off your shoulders!

Of course, like anything in life, there may be potential drawbacks to consider. One such drawback is the impact on your credit score. But don’t worry – we’ll explore all these details and more as we delve into how to apply for student loan repayment assistance programs.

Get ready to unlock your financial freedom!

How to Apply for Student Loan Repayment Assistance Programs

To apply for student loan repayment assistance programs, you’ll need to gather all necessary documents. Don’t worry, it’s not as complicated as it sounds! Just follow these simple steps:

-

Get your financial information ready: Gather your tax returns, pay stubs, and any other documents that show your income and expenses.

-

Review eligibility requirements: Each program has its own set of criteria, so make sure you meet the qualifications before applying.

-

Complete the application form: Fill out all the required fields accurately and honestly. Double-check everything to avoid any errors.

Once you’ve submitted your application, sit back and relax while it gets reviewed. In the meantime, let’s dive into understanding income-driven repayment plans!

Transitioning to the next section about ‘understanding income-driven repayment plans,’ now that you’ve applied for student loan repayment assistance programs.

Understanding Income-Driven Repayment Plans

Hey, you! Ready to dive into the world of Income-Driven Repayment (IDR) plans? Well, buckle up because we’re about to explore the eligibility criteria that could make you jump for joy.

Not only will we uncover who can qualify for these magical plans, but we’ll also unveil the incredible benefits they offer.

Get ready to have your mind blown!

Eligibility Criteria for IDR

Are you wondering if you meet the eligibility criteria for IDR? Well, wonder no more! Let’s dive into the world of Income-Driven Repayment plans and see if you qualify.

Here are a few things to consider:

- Income level: IDR plans typically require that your income falls below a certain threshold.

- Loan type: Not all federal student loans are eligible for IDR, so make sure to check which ones qualify.

- ID verification: When applying for IDR, you may need to go through an ID verification process to confirm your identity.

Now that you have an idea of what it takes to be eligible for IDR, let’s move on to the next step: the application process.

Benefits of IDR Plans

Now that you know the eligibility criteria, let’s explore the benefits of IDR plans and how they can help you manage your student loan payments. IDR plans, or Income-Driven Repayment plans, are a godsend for those struggling with their loan repayments. Not only do they provide relief by adjusting your monthly payments based on your income, but they also offer the possibility of loan forgiveness after a certain period of time.

Check out this nifty table to get a better understanding of the benefits:

| Benefits | Description |

|---|---|

| Lower Payments | IDR plans calculate your monthly payments based on your income and family size, ensuring that you don’t have to break the bank every month just to pay off your loans. |

| Loan Forgiveness | After making consistent payments for a specific period (usually 20-25 years), any remaining balance on your federal student loans may be forgiven. This means being debt-free sooner than you thought possible! |

| Flexibility | If your financial situation changes, IDR plans allow you to adjust your payment amount accordingly. This flexibility ensures that you can still meet other financial obligations while managing your student loans. |

IDR plans not only make repayment more manageable but also pave the way towards eventual freedom from student loan debt through loan forgiveness. So why wait? Take advantage of these incredible benefits today!

Public Service Loan Forgiveness and Repayment Assistance Programs

The Public Service Loan Forgiveness and Repayment Assistance Programs offer financial relief to eligible individuals. These programs are like magical potions that can help you escape the clutches of student loan debt. Here’s what you need to know:

-

Loan forgiveness: Imagine waving goodbye to your student loans forever! The Public Service Loan Forgiveness Program allows you to have your remaining loan balance forgiven after making 120 qualifying payments while working full-time for a qualifying employer.

-

Income-driven repayment plans: If you’re facing financial hardship, income-driven repayment plans can be your knight in shining armor. These plans calculate your monthly payment based on your income and family size, ensuring it remains affordable even if your salary is not soaring yet.

-

Repayment assistance programs: Some states also offer their own repayment assistance programs, granting additional aid to those who qualify. It’s like finding a hidden treasure chest that helps ease the burden of loan repayments.

With these programs by your side, you can conquer the daunting world of student loans and embark on a path towards financial freedom. So don’t fret, my friend! Relief is within reach!

Employer-Based Student Loan Repayment Assistance Programs

Employers can be your knight in shining armor when it comes to tackling those pesky student loans. Picture this: a magical world where bosses not only care about your work, but also your financial well-being. With employer-based student loan repayment assistance programs, this dream can become a reality.

Now, you may be wondering about the tax implications of such a program. Fear not! The IRS has sweetened the deal by allowing employers to contribute up to $5,250 per year towards your student loans without any additional taxes for you or them. It’s like finding a pot of gold at the end of the rainbow!

But wait, there’s more! These programs don’t just benefit you financially; they also have a positive impact on employee retention. By offering this support, employers show that they value their employees’ personal growth and are invested in their long-term success.

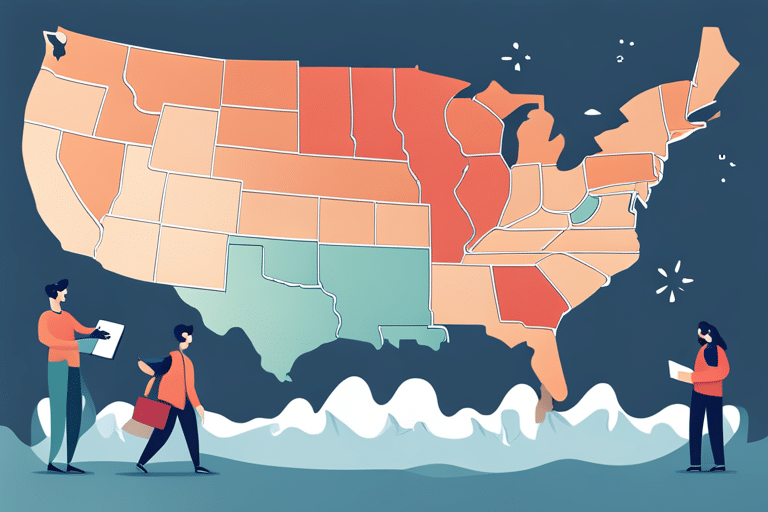

State-Specific Student Loan Repayment Assistance Programs

Hey, you! Ready to dive into state-specific student loan repayment assistance programs? Let’s talk about the nitty-gritty details, starting with eligibility criteria and requirements.

We’ll explore who can qualify for these programs and what hoops you may need to jump through. And don’t worry, we won’t forget about the important stuff – available funding options will also be on our radar.

Eligibility Criteria and Requirements

To be eligible for student loan repayment assistance programs, you’ll need to meet certain criteria and fulfill specific requirements. But don’t worry, it’s not as daunting as it sounds! Here are a few key things to keep in mind:

-

Income Limits: Most programs have income thresholds, so make sure your earnings fall within the specified range.

-

Employment Requirements: Many programs require you to work in specific fields or occupations, such as public service or healthcare.

-

Loan Types: Some programs may only assist with certain types of loans, so double-check if your loans are eligible.

Remember, these programs can provide a much-needed relief from the burden of student debt. However, it’s important to understand that enrolling in these assistance programs may impact your credit. So be sure to weigh the pros and cons before making any decisions.

Happy strategizing!

Available Funding Options

Don’t stress, my friend! There are oodles of funding options just waiting to swoop in and save the day when it comes to your student debt.

Let’s dive into the magical world of student loan refinancing options and private student loan repayment assistance.

Picture this: you’re standing at a crossroads, surrounded by towering mountains of debt. But fear not! With student loan refinancing, you can summon the power to consolidate all those pesky loans into one manageable monthly payment. It’s like using a magic wand to transform chaos into order!

Now, let’s talk about private student loan repayment assistance. These generous wizards (or rather, organizations) offer grants or scholarships specifically designed for folks with private student loans. They understand that sometimes life throws unexpected curveballs, and they want to help lighten your load.

Nonprofit Organizations Offering Student Loan Repayment Assistance

You should check out nonprofit organizations that offer student loan repayment assistance programs. These organizations are like fairy godmothers, waving their magic wands to help you slay your student loan debt dragon.

Here are three enchanting options for you:

-

Magical Money Makers: These nonprofits work tirelessly to raise funds specifically for student loan repayment assistance. They sprinkle their financial fairy dust on deserving individuals, helping them escape the clutches of debt.

-

Wise Wizards of Education: Some nonprofits focus on providing education and resources about alternative repayment plans. They empower you with knowledge so you can make informed decisions and navigate the complex world of student loans.

-

Charitable Champions: These generous nonprofits directly contribute towards reducing your outstanding balance. It’s like having a secret benefactor paying off chunks of your debt while you focus on building your future.

Student Loan Repayment Assistance Programs for Healthcare Professionals

If you’re a healthcare professional, listen up! There are some amazing nonprofit organizations out there just waiting to swoop in and help you with those pesky student loans.

It’s like having your very own superhero sidekick in the financial world. These organizations offer a range of resources to assist you on your loan repayment journey, including loan forgiveness options that can make your debt disappear faster than a magician’s rabbit.

With their guidance and support, you’ll have more financial freedom to focus on what really matters – saving lives and making a difference in the world.

Student Loan Repayment Assistance Programs for Teachers

Teachers, listen up! There are incredible nonprofit organizations out there ready to assist with those pesky student loans. You’ve dedicated your life to shaping young minds, and it’s time someone repaid the favor. Here are some amazing financial aid options available just for you:

-

Loan forgiveness programs: These magical programs can make a portion or even all of your student loans disappear. Just imagine the weight lifting off your shoulders!

-

Teacher loan repayment assistance: Some generous souls out there offer grants or scholarships specifically for teachers. It’s like finding a pot of gold at the end of the rainbow!

-

Income-driven repayment plans: With these plans, your monthly loan payments are based on what you actually earn. So if money is tight in the beginning, don’t worry – you won’t have to live off ramen forever!

Don’t let those student loans dictate your career choices any longer. Explore these financial aid options and watch how they impact both your bank account and your happiness as a teacher!

Strategies for Maximizing Student Loan Repayment Assistance Benefits

Now that you know all about the amazing student loan repayment assistance programs available for teachers, let’s dive into some strategies for maximizing those benefits! Budgeting and negotiating repayment terms are two key areas where you can make a big difference in your student loan journey.

To help you visualize these strategies, here’s a handy table:

| Budgeting Strategies | Negotiating Repayment Terms |

|---|---|

| Track your expenses | Explore income-driven plans |

| Cut unnecessary costs | Request lower interest rates |

| Create a savings plan | Extend the repayment period |

| Prioritize loan payments | Seek forgiveness options |

Frequently Asked Questions

Are There Any Tax Implications for Receiving Student Loan Repayment Assistance?

When you receive student loan repayment assistance, it’s important to be aware of the potential tax implications. While it can help with your debt, there may be pros and cons when it comes to taxes.

Can Student Loan Repayment Assistance Programs Be Used to Pay off Private Student Loans?

You’re curious if student loan repayment assistance can help tackle those pesky private loans. Well, eligibility for private student loan repayment assistance depends on the program, and there may be restrictions involved.

How Does Receiving Student Loan Repayment Assistance Affect My Credit Score?

Receiving student loan repayment assistance won’t ruin your credit score. In fact, it can actually help! As long as you make your payments on time, you’ll be in good shape. Low income? No problem! You can still qualify for assistance.

Will Participating in a Student Loan Repayment Assistance Program Affect My Ability to Qualify for Other Financial Assistance Programs, Such as Grants or Scholarships?

Participating in a student loan repayment assistance program may affect your eligibility for other financial assistance programs, like grants or scholarships. It could also impact your future loan applications. But don’t worry, we’ll explore all the details in our guide!

Can I Receive Student Loan Repayment Assistance if I Am Currently on a Deferment or Forbearance Plan?

Sure, you can receive student loan repayment assistance even if you’re on a deferment or forbearance plan. It won’t affect your credit score either! So go ahead and get the help you need.

Conclusion

So, dear reader, you’ve reached the end of this whimsical journey through student loan repayment assistance programs.

We’ve covered everything from eligibility criteria to nonprofit organizations offering help.

Now, armed with this knowledge, you can navigate the world of student loans with a skip in your step and a twinkle in your eye.

Remember, these programs are like little magical potions that can make your debt disappear.

So go forth, my friend, and may your student loan burdens be lifted with ease and grace!