Imagine you are a skilled tightrope walker, gracefully balancing your way across the sky. But what if your safety net was frayed and weak? That’s where understanding your debt-to-income ratio comes in.

It’s like having a sturdy safety net beneath you, ensuring financial stability and success. In this article, we’ll explore why knowing your debt-to-income ratio is crucial for mastering your finances.

So let’s dive in and discover how this simple yet powerful concept can transform your financial journey.

Key Takeaways

- Debt-to-income ratio is a measure of debt compared to income and is calculated using monthly debts and gross monthly income.

- Understanding and managing your debt-to-income ratio is crucial for mortgage eligibility, reducing financial burden, and achieving financial goals.

- Maintaining a low debt-to-income ratio provides flexibility for unexpected expenses and helps avoid financial instability and bankruptcy.

- A high debt-to-income ratio can negatively impact creditworthiness, making it more challenging to qualify for loans, leading to higher interest rates, limited access to credit, and reduced purchasing power.

The Definition of Debt-To-Income Ratio

The debt-to-income ratio is a measure of how much debt you have compared to your income. It’s like a little creature that crawls into your financial life and takes a peek at how much money you owe versus how much money you make. Think of it as your very own personal finance detective, investigating the balance between what goes out and what comes in.

Calculating DTI is not rocket science, but it does require some math skills. You take all your monthly debts – credit card payments, student loans, car loans, and any other obligations – and divide them by your gross monthly income. The result is expressed as a percentage, which tells lenders just how balanced or imbalanced your financial situation is.

Now, why does this little creature matter? Well, let me tell you! Lenders use the debt-to-income ratio as an important factor in loan applications because it helps them assess whether or not you can handle additional debt. If your DTI is too high, it may be a red flag for lenders that you are already stretched thin financially and may struggle to meet future payment obligations.

Why Debt-To-Income Ratio Matters

Knowing why your debt-to-income ratio is important can help you make smarter financial decisions. It’s like having a magical compass that guides you through the treacherous waters of debt. Here are four reasons why understanding your debt-to-income ratio matters:

-

Sailing towards mortgage eligibility: Your debt-to-income ratio plays a crucial role in determining whether you qualify for a mortgage or not. Lenders use this ratio to assess your ability to repay the loan, so keeping it in check is essential if you want to unlock the door to homeownership.

-

Weight off your shoulders: High levels of debt can weigh heavily on your mind and hinder your financial freedom. By understanding and reducing your debt-to-income ratio, you can lighten that burden and sail towards a more secure future.

-

Smooth sailing towards financial goals: A low debt-to-income ratio allows for more flexibility with your finances. It means you have more disposable income to save, invest, or pursue other life goals like starting a business or traveling the world.

-

Avoiding stormy seas: Reducing debt is essential because high levels of debt can lead to financial instability, missed payments, and even bankruptcy. By keeping an eye on your debt-to-income ratio, you can steer clear of these rocky waters and set sail towards a brighter financial horizon.

Understanding the importance of reducing debt and its impact on mortgage eligibility will empower you to navigate the choppy seas of personal finance with confidence and finesse. So grab hold of that magic compass called the debt-to-income ratio and set sail towards financial mastery!

How to Calculate Your Debt-To-Income Ratio

Calculating your debt-to-income ratio is a straightforward process that can provide valuable insights into your financial health. It’s like peering into a crystal ball that reveals the delicate balance between what you owe and what you earn. So, grab your calculator and embark on this whimsical journey of numerical mastery!

To calculate your debt-to-income ratio accurately, start by adding up all your monthly debts. This includes everything from credit card payments to student loans and even that gym membership you never use (oops!).

Next, determine your monthly income – the sweet fruits of your labor! Be sure to include all sources of income, such as wages, bonuses, and any side hustles you’ve got going on.

Now comes the moment of truth: divide your total monthly debts by your total monthly income. Multiply the result by 100 to get a percentage. Voila! You have calculated your debt-to-income ratio with accuracy fit for a master mathematician!

But beware! Common mistakes can lurk in the shadows of these calculations. One slip-up could throw off the entire equation. So double-check those numbers, watch out for missing debts or income sources, and resist the temptation to fudge the figures (we’re watching you!).

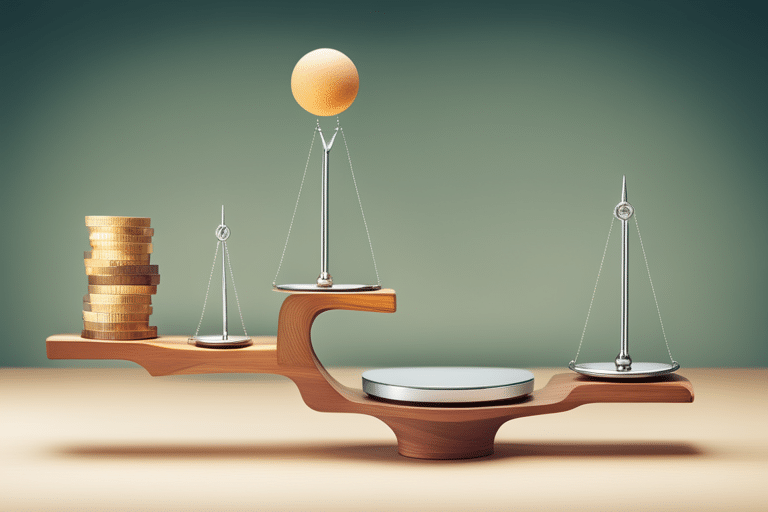

The Ideal Debt-To-Income Ratio

To achieve an ideal debt-to-income ratio, you should aim for a balance between what you owe and what you earn. Maintaining a low debt-to-income ratio is crucial for your financial stability. Imagine yourself walking on a tightrope, with debts on one side and your income on the other. The key is to find that sweet spot where the two are perfectly balanced.

Here’s why it’s important:

- A low debt-to-income ratio means less financial stress and more peace of mind. It allows you to have more disposable income, which can be used for savings or investments.

- Lenders view a low debt-to-income ratio favorably, making it easier for you to access credit when needed.

- It provides flexibility in case of unexpected expenses or emergencies.

On the other hand, having a high debt-to-income ratio can throw off your balance and lead to financial instability. Imagine being overloaded with debts while trying to juggle your limited income. It’s like carrying a heavy backpack uphill without any relief in sight.

Red Flags: High Debt-To-Income Ratios

If you have a high debt-to-income ratio, it’s important to be aware of the potential red flags that can arise. Picture this: you’re standing on a tightrope, trying to maintain balance between your income and your debts. Suddenly, you see red flags waving in the wind, signaling danger ahead. These red flags symbolize financial instability and can have detrimental effects on your overall well-being.

One of the most prominent red flags is struggling to make ends meet each month. If a large portion of your income goes towards paying off debts, leaving little left for necessities or savings, it’s a clear indication that your debt-to-income ratio is out of balance.

Another red flag to watch out for is being denied credit or loans due to your high ratio. Lenders use this metric as an indicator of risk, and if yours is too high, they may view you as a risky borrower.

These red flags not only highlight the need for immediate action but also serve as warnings about the potential impacts on your creditworthiness. Understanding how high debt-to-income ratios affect creditworthiness will help you navigate through financial challenges more effectively and secure a brighter future. So let’s dive deeper into the effects that this ratio can have on your ability to obtain credit and maintain financial stability.

[Transition sentence into subsequent section about ‘the effects of debt-to-income ratio on creditworthiness’]

The Effects of Debt-To-Income Ratio on Creditworthiness

When it comes to your creditworthiness, having a high debt-to-income ratio can greatly impact your ability to obtain loans or credit cards. Understanding the effects of this ratio on your financial situation is crucial for maintaining a healthy credit score and ensuring eligibility for future loans.

Here are four whimsical ways in which a high debt-to-income ratio can affect your creditworthiness:

-

Credit Score Plunge: Just like a rollercoaster ride, a high debt-to-income ratio can cause your credit score to plummet. Lenders view this as a sign of potential risk, resulting in lower scores that may hinder your chances of securing favorable loan terms.

-

Loan Eligibility Roadblock: Imagine trying to navigate through an obstacle course made of red tape and paperwork. That’s what it feels like when lenders see a high debt-to-income ratio. It becomes harder to qualify for loans since they worry about your ability to repay them.

-

Interest Rate Spike: Picture yourself stuck in quicksand while interest rates skyrocket around you. A high debt-to-income ratio often leads to higher interest rates on loans and credit cards, making it more expensive for you to borrow money.

-

Limited Financial Freedom: Visualize being trapped inside a birdcage with limited room to spread your wings and fly freely. A high debt-to-income ratio restricts your financial freedom by limiting the amount of available credit and reducing your purchasing power.

Understanding these whimsical effects will help you take control of your finances and work towards improving your debt-to-income ratio for better creditworthiness and increased loan eligibility.

Strategies for Improving Your Debt-To-Income Ratio

Congratulations on reaching the current subtopic, where we will explore some whimsical strategies for reducing debt and managing monthly expenses. Let’s dive right in and uncover some creative ways to improve your debt-to-income ratio!

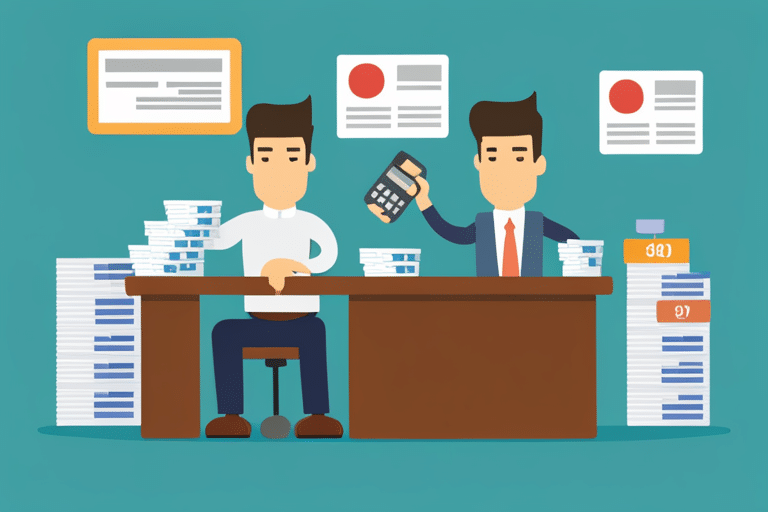

| Strategy | Description | Benefits |

|---|---|---|

| Create a Budget | Develop a detailed budget that tracks your income and expenses. This will help you identify areas where you can cut back and allocate more funds towards debt repayment. | Gain control over your finances, prioritize debt payments, and reduce unnecessary spending. |

| Snowball or Avalanche Method | Choose either the snowball method (paying off smallest debts first) or the avalanche method (paying off debts with highest interest rates first). Stick to one approach consistently for faster progress. | Motivation from small wins (snowball method) or saving money on interest (avalanche method) while clearing off debts efficiently. |

| Negotiate Lower Interest Rates | Contact your creditors to negotiate lower interest rates on your existing loans or credit cards. A reduced interest rate means more of your payment goes towards paying down the principal balance. | Decrease overall cost of borrowing, speed up debt repayment, and potentially save hundreds or even thousands of dollars! |

Debt-To-Income Ratio and Loan Approval

Reducing your debt-to-income ratio is essential for improving your chances of loan approval. Imagine yourself as a tightrope walker, carefully balancing between the weight of your debts and the income you earn. To successfully navigate this high wire act, here are some important points to consider:

-

Debt to Income Ratio and Mortgage Approval: Lenders use your debt-to-income ratio as a key factor in determining whether you can afford a mortgage. Aim for a lower ratio to increase your chances of approval.

-

Debt to Income Ratio and Loan Affordability: A lower debt-to-income ratio not only improves your chances of loan approval but also indicates that you have more financial room to comfortably afford monthly payments.

-

The Balancing Act: Just like a circus performer juggling multiple objects, it’s crucial to manage both sides of the equation – reducing your debts while increasing your income.

-

Strategic Debt Management: Consider paying off high-interest debts first or consolidating them into one manageable payment. This will help lower your overall debt burden and improve your ratio.

By understanding the importance of reducing your debt-to-income ratio, you can take steps towards achieving loan affordability and securing mortgage approval.

Now let’s dive deeper into long-term financial planning with debt-to-income ratios…

Long-Term Financial Planning With Debt-To-Income Ratio

To effectively plan for your financial future, it’s important to consider the long-term impact of your debt-to-income ratio. Picture this: you’re standing on a tightrope, balancing between your income and your debts. The higher the debt-to-income ratio, the more precarious your position becomes. It’s like juggling flaming swords while riding a unicycle – not exactly a recipe for financial stability.

But fear not, my friend! With the right budgeting techniques, you can find balance and navigate this high-wire act with ease. Start by analyzing your monthly income and total debts. Calculate that magical number called the debt-to-income ratio (DTI). This little gem reveals how much of your income is devoted to paying off debts.

Now, imagine yourself as a master chef in a kitchen full of ingredients – each representing an expense in your life. By carefully measuring and allocating these ingredients, you can create a delicious dish called financial stability. Allocate enough resources to cover essentials like rent, bills, and groceries. Then sprinkle liberally with savings for emergencies and future goals.

Frequently Asked Questions

Can a High Debt-To-Income Ratio Affect My Ability to Rent an Apartment or Buy a House?

A high debt-to-income ratio can make it difficult for you to rent an apartment or buy a house. Your credit score will be affected and you may struggle to qualify for a loan. To lower your ratio effectively, focus on paying off debts and increasing your income.

Are All Types of Debt Included in the Debt-To-Income Ratio Calculation?

Yes, all types of debt are included in the debt-to-income ratio calculation. This ratio affects your loan eligibility by showing lenders how much of your income goes towards paying off debts.

How Often Should I Review My Debt-To-Income Ratio?

You should review your debt-to-income ratio regularly. Factors like income changes and new debts can affect it. Keep an eye on it, like a captain navigating rough seas, to stay in control of your financial ship.

Is There a Maximum Debt-To-Income Ratio That Lenders Will Accept?

Lenders typically have a maximum debt-to-income ratio they will accept. Having a high debt-to-income ratio can negatively impact your ability to get approved for loans, as it suggests you may struggle with repayment.

Can I Improve My Debt-To-Income Ratio by Increasing My Income Alone?

You can indeed improve your debt-to-income ratio by increasing your income alone. When you bring in more money, it helps offset the amount of debt you have and improves your overall financial standing.

Conclusion

Congratulations on taking the time to understand your debt-to-income ratio! You’ve just unlocked a secret weapon that will guide you towards financial success.

Did you know that in the United States, the average debt-to-income ratio for households with credit card debt is a staggering 38%?

Imagine if all those people were aware of this crucial number and took steps to improve it. They could free themselves from the burden of excessive debt and open doors to a brighter future.

So go ahead, embrace your newfound knowledge and watch as your dreams come true!