Are you tired of drowning in a sea of insurance policies, desperately searching for the life raft that fits your needs? Fear not, dear reader! In this article, we will equip you with the skills to navigate the treacherous waters of online insurance shopping.

From researching different coverage options to comparing providers and deciphering the fine print, you’ll become a master of insurance mastery.

So grab your virtual shopping cart and prepare to conquer the world of online insurance policies!

Key Takeaways

- Research insurance providers for reviews, ratings, and customer experiences.

- Compare insurance premiums to find the best value for your money.

- Look beyond flashy advertisements and focus on the coverage each policy offers.

- Read the terms and conditions of each policy to ensure all potential risks are covered.

Understanding the Importance of Shopping and Comparing Insurance Policies Online

Understanding the importance of shopping and comparing insurance policies online can save you time and money. Let’s face it, insurance is like that annoying mosquito buzzing around your head – you’d rather swat it away and forget about it. But hey, we’re here to help you navigate this jungle of policies and premiums with a little bit of humor and a whole lot of creativity.

First things first, researching insurance providers is key. You don’t want to end up with an insurer who thinks ‘customer service’ means putting you on hold for hours while listening to elevator music. So hop onto your trusty computer and start Googling away! Look for reviews, ratings, and any horror stories (cue dramatic music) that may have popped up in the search results.

Now that you’ve narrowed down your options, it’s time to compare insurance premiums. Think of this as going on a shopping spree without breaking the bank (a win-win situation!). Don’t be lured in by flashy advertisements or catchy jingles; instead, focus on those numbers. Compare what each provider offers for the price they’re asking – after all, you wouldn’t buy a pair of designer shoes without checking if they actually fit!

But wait, there’s more! While comparing premiums is important, don’t forget to dig deeper into what each policy covers. Sure, one insurer might offer lower rates than others, but does that mean they’ll leave you stranded when disaster strikes? Read through their terms and conditions like Sherlock Holmes solving a case; make sure everything from accidents to acts of nature are covered.

Researching Different Types of Insurance Coverage

So, you’re ready to dive into the exciting world of insurance coverage options. Don’t worry, we promise to explain everything simply and without all those mind-numbing jargon-filled terms.

Plus, we’ll give you the lowdown on the key factors you need to consider when comparing different policies.

Get ready for a rollercoaster ride through the wild world of insurance!

Coverage Options Explained Simply

When shopping for insurance online, it’s important to have coverage options explained simply. Because let’s face it, insurance can be as confusing as trying to solve a Rubik’s Cube blindfolded while riding a unicycle on a tightrope. But fear not! We’re here to guide you through the treacherous labyrinth of policy comparisons and help you find the perfect coverage that suits your needs like a tailored suit made from unicorn hair.

First things first, let’s talk about coverage options. Think of them as delicious toppings on your insurance pizza. You’ve got liability, collision, comprehensive, personal injury protection – the list goes on! Each option adds its own flavor and protects you from different calamities life throws at you.

Now comes the fun part – policy comparisons! It’s like going shopping for shoes but instead of trying them on your feet, you’re trying them on your life. Look for policies with similar coverage options and compare their prices like a seasoned deal hunter.

Key Factors When Comparing

Remember, the key factors to consider when comparing coverage options are your specific needs and budget. So, if you want to find insurance that doesn’t break the bank but still covers your hairy situations, look no further! Here are three tips to help you navigate through the treacherous waters of coverage comparison and premium affordability:

-

Think about your needs like a chameleon. Are you a daredevil or a cautious cat? Assess your risk-taking tendencies and choose coverage accordingly.

-

Don’t be fooled by flashy ads or fancy jargon. Take the time to read the fine print, just like deciphering hieroglyphics. The devil is in those details!

-

Shop around like a bargain hunter on Black Friday. Demand quotes from multiple providers, compare them side-by-side, and let them fight for your business.

With these tricks up your sleeve, you’ll be able to sail smoothly towards an insurance policy that fits both your needs and wallet!

Identifying Your Insurance Needs and Budget

To effectively shop and compare insurance policies online, you should start by identifying your insurance needs and budget. Let’s face it, insurance can be a real pain in the you-know-what. But fear not, my friend! With a little bit of know-how and some witty banter (because who doesn’t love a good laugh?), you’ll be well on your way to finding the perfect policy at the perfect price.

First things first, grab yourself a cup of coffee (or tea if that’s more your jam) and sit down with a pen and paper. It’s time to do some serious self-reflection. Take a moment to assess your current coverage and identify any gaps that need filling. Are you protected against unexpected accidents? Do you have enough coverage for that shiny new car of yours? Write it all down in our handy-dandy table below:

| Coverage Needed | Budget |

|---|---|

| Accidental Damage | $200/month |

| Comprehensive Car Insurance | $150/month |

| Home Contents Insurance | $100/month |

Now that you’ve got a clear picture of what you need, it’s time to evaluate those insurance providers. Remember, not all insurers are created equal. Some are as reliable as your uncle’s homemade fireworks display on New Year’s Eve (you know the one), while others are about as trustworthy as a cat wearing sunglasses.

In the next section, we’ll dive into evaluating insurance providers and their reputation. So buckle up (safety first!) because this shopping adventure is just getting started!

Evaluating Insurance Providers and Their Reputation

So, you’re ready to dive into the world of insurance providers and their reputation, huh? Well, buckle up because this is where things get interesting.

Trustworthy insurance providers are like unicorns – rare and magical creatures that you can’t help but admire. But here’s the thing: reputation affects credibility, so make sure to do your research before hopping on any insurance bandwagon.

After all, you don’t want to end up with a provider whose reputation is as trustworthy as a used car salesman selling ‘totally not haunted’ houses.

Trustworthy Insurance Providers

Finding trustworthy insurance providers can be challenging when shopping for policies online. It’s like trying to find a needle in a haystack, except the haystack is filled with sneaky insurance salesmen trying to sell you policies that cover only half of what you actually need.

But fear not! Here are three tips to help you navigate the treacherous waters of online insurance shopping:

-

Look for customer reviews: Don’t just rely on what the insurance company tells you about their own services. Find out what real customers have to say. If they’re happy and satisfied, chances are you will be too.

-

Check financial ratings: You don’t want your insurance provider going bankrupt when it’s time for them to pay up. Make sure they have strong financial ratings from reputable organizations.

-

Compare policy coverage: Take the time to carefully compare the coverage offered by different providers. Don’t just look at the price tag, but also consider what is actually included in each policy.

By following these tips, you’ll be able to weed out the shady characters and find yourself a trustworthy insurance provider that has your back when things go wrong.

Happy shopping!

Reputation Affects Credibility

When you’re researching insurance providers, it’s important to consider their reputation as it directly impacts their credibility. After all, would you trust an insurance company that has more negative reviews than a dental visit?

Reputation management is crucial in the world of insurance because online credibility can make or break a company. Think about it: if an insurer has a track record of denying claims faster than Usain Bolt running the 100-meter dash, chances are they won’t be your knight in shining armor when you need them most.

Comparing Policy Coverage and Exclusions

It’s important to carefully review policy coverage and exclusions when comparing insurance policies online. After all, you don’t want to end up with an insurance policy that covers as much as a wet paper towel or excludes more than your ex on Valentine’s Day.

So, before you dive headfirst into the world of insurance policies, here are three things you should keep in mind:

-

Coverage Limits: Think of coverage limits like the boundaries of a playground. You want to make sure they’re big enough to handle all the falls, scrapes, and monkey bar adventures life throws at you. So, check if the policy offers sufficient coverage for your needs and consider any potential gaps that could leave you swinging from one financial disaster to another.

-

Policy Inclusions: Imagine ordering a pizza with ‘everything’ on it only to find out that ‘everything’ means just cheese and crust (no offense to cheese lovers). When comparing insurance policies online, pay close attention to what’s included in each one. Does it cover your car getting stolen by a pack of squirrels? Does it protect against alien invasions? Make sure the inclusions match your wildest dreams (or worst nightmares).

-

Exclusions: Insurance companies can be trickier than trying to untangle headphone wires in the dark. That’s why it’s crucial to read through the exclusions section with laser focus. Look out for sneaky clauses that exclude certain events or conditions from coverage—like finding out your policy won’t protect you if your house is eaten by termites because they’re considered ‘pests’ but not covered under ‘natural disasters.’

Now that you’ve got an idea of what coverage limits and policy inclusions mean, let’s move on to analyzing insurance premiums and deductibles so you can become an expert insurance shopper faster than a cheetah chasing its prey!

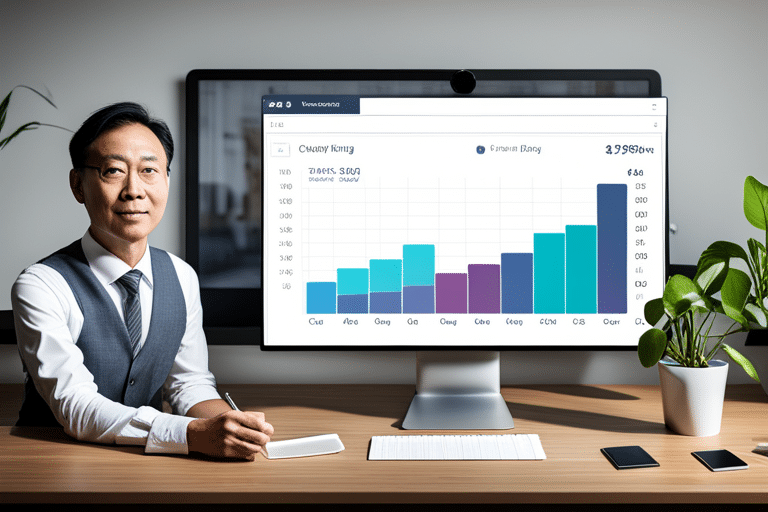

Analyzing Insurance Premiums and Deductibles

Analyzing insurance premiums and deductibles can help you determine the overall cost of your policy and how much you’ll need to pay out-of-pocket before coverage kicks in. But let’s be real here, insurance lingo can be as confusing as trying to untangle a ball of yarn after your cat has had a field day with it. Lucky for you, I’m here to break it down in a way that even your grandma would understand.

So, picture this: you’re sitting at your computer, ready to dive into the world of insurance. You open up a website and bam! There it is, a table staring back at you like an eager Labrador retriever waiting for its treat. Allow me to introduce you to the magical world of premium and deductible analysis:

| Insurance Provider | Premium (per month) |

|---|---|

| ABC Insurance | $100 |

| XYZ Insurance | $150 |

| 123 Insurance | $120 |

| QWE Insurance | $90 |

| OMG Insurance | $200 |

Now, before you start panicking about why OMG Insurance wants to charge you an arm and a leg (and maybe even your firstborn child), take a deep breath. Analyzing these numbers will give you an idea of what each provider is offering and how much they expect from your oh-so-deep pockets.

Once you’ve picked yourself up off the floor from laughing at OMG’s outrageous price tag, it’s time to evaluate their deductibles. This is the amount of money YOU have to pay out-of-pocket before your insurance kicks in like Superman coming to save the day.

But don’t worry, not all providers are created equal when it comes to deductibles either. Some may have higher deductibles but lower premiums (hello ABC Insurance!), while others may have lower deductibles but higher premiums (looking at you OMG Insurance). It’s all about finding the right balance that suits your needs and budget.

Now that you’ve analyzed insurance premiums and deductibles like a pro, it’s time to move on to the next step: examining policy limits and additional benefits. Trust me, it only gets more exciting from here!

Examining Policy Limits and Additional Benefits

Now that you’ve got a handle on insurance premiums and deductibles, let’s take a closer look at policy limits and the additional benefits different providers offer.

Insurance policies can be as confusing as trying to fold a fitted sheet, but fear not! We’re here to break it down for you in a way that won’t make your head spin faster than a hamster wheel.

First things first, policy limits. These are like the guardrails of your insurance coverage. They determine how much your provider will pay out for different types of claims. It’s important to examine these limits carefully because, let’s face it, no one wants to end up with less coverage than an umbrella made from Swiss cheese.

Now onto the fun part – additional benefits! Think of these as those fancy little add-ons you can get with your fast food meal. Except instead of extra fries or an upgraded drink size, you’ll find perks like roadside assistance, rental car reimbursement, or even pet injury coverage (because who wouldn’t want their furry friend protected?).

Here are three additional benefits to keep an eye out for when comparing insurance policies:

-

Accident forgiveness: This gem allows you to maintain your good driver status even if you have a little fender bender. It’s like having a magical eraser for your driving record.

-

New car replacement: Say goodbye to heartache if your shiny new wheels get totaled in the first year. With this benefit, your provider will replace it with another brand spanking new car.

-

Identity theft protection: In today’s digital world, protecting yourself from identity theft is more important than ever. Look for policies that offer this added layer of security so you can sleep soundly knowing someone else isn’t running around pretending to be you.

So remember, when comparing insurance policies online, don’t forget about examining those policy limits and keeping an eye out for those extra special additional benefits. You never know when they might come in handy, like a superhero cape for your insurance coverage.

Happy shopping!

Assessing the Financial Stability of Insurance Companies

When assessing the financial stability of insurance companies, you’ll want to take a close look at their credit ratings and financial strength. But let’s be honest here, my friend. Who wants to spend their precious time diving into dusty financial reports? Not me! So, let me give you a little secret: evaluating the reputation of an insurance company can be just as revealing.

Now, I know what you’re thinking. ‘Reputation? What does that have to do with financial stability?’ Well, my curious friend, a good reputation is like a solid foundation for any business. It shows that people trust them enough to keep giving them their hard-earned money. And if people are willing to trust them with their cash, chances are they’ve got some pretty strong finances backing them up.

So how do you assess an insurance company’s reputation? Glad you asked! Start by checking out customer reviews and ratings online. Are people raving about their excellent customer service and quick claim settlements? Or are they complaining about unanswered calls and delays in payouts? Dig deeper by looking for any news articles or consumer complaints against the company. Remember, it’s all about getting the full picture!

But wait, there’s more! Don’t forget to consider industry awards and rankings too. If an insurance company consistently receives accolades from experts in the field, it’s a sign that they’re doing something right.

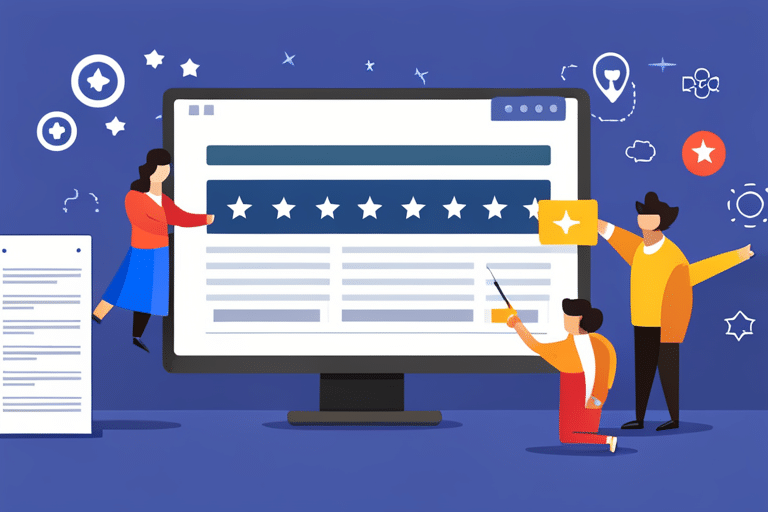

Reviewing Customer Reviews and Ratings

Don’t forget to check out customer reviews and ratings to get a sense of an insurance company’s reputation. Sure, you could just blindly choose the first policy that pops up on your screen, but where’s the fun in that? Plus, you don’t want to end up with an insurance company that’s as reliable as a rubber duck in a rainstorm.

So, put on your detective hat and start analyzing customer feedback like Sherlock Holmes on the case. Here are some tips to help you separate the wheat from the chaff:

- Look for patterns: Are customers consistently praising or complaining about certain aspects of the insurance company? Pay attention to common themes and consider if those factors align with what matters most to you.

- Consider the source: Not all reviews are created equal. Take into account both positive and negative feedback from reputable sources. Remember, Aunt Sally’s rant about her car insurance may not hold much weight compared to industry experts.

- Read between the lines: Sometimes, people can be a bit dramatic when it comes to online reviews. If someone gives a one-star rating because they didn’t win their claim dispute over a scratched fender, take it with a grain of salt.

Once you’ve done your due diligence by analyzing customer feedback and considering reputations, it’s time for some good old-fashioned price comparison. After all, you don’t want to pay more for your insurance than what Donald Trump spends on hair products.

Compare policy prices like a pro by visiting multiple websites and getting quotes from various companies. Don’t settle for the first offer that makes your heart skip a beat – shop around like you’re at an all-you-can-eat buffet trying every dish before filling up your plate.

Utilizing Online Insurance Comparison Tools

Utilize online tools to easily assess and compare different insurance options.

Let’s be honest, the world of insurance can be about as exciting as watching paint dry. But fear not, my savvy friend! With the power of technology at your fingertips, finding the perfect insurance policy has never been easier or more thrilling!

Picture this: you’re sitting in your cozy pajamas with a cup of hot cocoa in hand, ready to embark on an epic quest for maximum savings. Armed with your trusty laptop and a determination to conquer those hefty premiums, you dive into the vast sea of online insurance comparison tools.

These nifty tools are like treasure maps leading you straight to buried chests overflowing with potential savings. They allow you to compare policies from various providers side by side, giving you all the information you need in one convenient place. You can customize your search based on factors that matter most to you – whether it’s coverage limits, deductibles, or even comparing customer reviews.

Speaking of customer reviews, don’t underestimate their power! Who better to trust than fellow adventurers who have come before you? Compare customer reviews like a seasoned explorer evaluating ancient artifacts – scrutinizing every detail and uncovering hidden gems.

But remember, oh mighty warrior of savings, don’t rely solely on these tools alone. Be sure to visit each insurer’s website and get quotes directly from them too. Sometimes they might have exclusive discounts or offers that aren’t available through the comparison sites.

Understanding the Fine Print and Terms of Insurance Policies

So you’ve finally decided to delve into the exciting world of insurance policies! Congrats, you brave soul.

Now, before your head starts spinning with all the complex jargon and mind-numbing details, let’s talk about the juicy stuff: the key policy details that can make or break your coverage, those sneaky limitations that insurers conveniently forget to mention, and of course, the rarest gems of them all – the uncommon policy exclusions that will leave you scratching your head in disbelief.

Buckle up, my friend, because we’re about to embark on a wild ride through the fine print jungle!

Key Policy Details

It’s important to carefully review the key policy details when shopping for insurance online. After all, you don’t want any surprises when it comes time to file a claim. So, grab your magnifying glass and get ready to dive into the fine print!

Here are some key policy details that you should pay attention to:

-

Deductibles: Make sure you understand how much money you’ll need to fork over before your insurance kicks in. It’s like a secret membership fee that only gets activated when disaster strikes.

-

Coverage limits: Think of these as the protective force fields around your precious belongings. You want to make sure they’re strong enough to shield you from financial ruin. No one wants their priceless collection of vintage action figures left unprotected!

-

Exclusions: This is where insurance policies reveal their true colors. They tell you what they won’t cover, like spontaneous combustion or alien invasions (trust me, I’ve checked). So, if you have any unusual risks or hobbies, double-check those exclusions!

Now go forth, my insurance master! Compare coverage options with confidence and let nothing stand in the way of your insured happiness!

Coverage Limitations Explained

When exploring coverage limitations, make sure you understand the specific risks that are excluded from your insurance policy. Think of it as a game of hide and seek, but instead of seeking treasure, you’re seeking protection for your assets.

Insurance companies love to play this game with their policy restrictions, hiding behind confusing jargon and fine print. They’ll exclude things like floods, earthquakes, or even acts of war. It’s like they’re saying ‘You’re on your own if Godzilla decides to pay a visit.’

But fear not! With a little perseverance and some detective work, you can uncover these sneaky exclusions and find the right coverage for your needs. So let’s dive into the world of uncommon policy exclusions and see what surprises await us there.

Uncommon Policy Exclusions

Make sure you thoroughly review your insurance policy to understand any uncommon exclusions that may leave you unprotected in certain situations. Insurance policies can be as sneaky as a cat burglar, hiding unusual exclusions and overlooked restrictions that could surprise you when you least expect it.

To ensure you’re not caught off guard, keep an eye out for these hidden pitfalls:

-

Alien invasions: While we all hope for extraterrestrial encounters, most insurance policies won’t cover the damage caused by little green men or their laser beams.

-

Time travel mishaps: If your DeLorean accidentally crashes into a medieval castle or disrupts the space-time continuum, don’t count on your insurance company to foot the bill.

-

Zombie uprisings: Unfortunately, even if the undead take over your neighborhood, causing chaos and destruction, most policies won’t protect against zombie-related damages.

Seeking Professional Advice and Guidance

You should definitely consider seeking professional advice and guidance when shopping for insurance policies online. Insurance is like that complicated math problem you never understood in high school. It’s that confusing!

But fear not, my friend! There are professionals out there who specialize in deciphering all the jargon and fine print of insurance policies. These experts have spent years honing their skills and acquiring the knowledge to guide you through this treacherous online insurance jungle.

Sure, you may think that with all the online resources available today, you can become an insurance guru overnight. But let me tell you something – those websites may provide information, but they lack the personal touch of professional expertise. They won’t hold your hand (figuratively speaking) and walk you through the intricacies of deductibles, coverage limits, or exclusions.

Think about it this way: would you trust yourself to perform open-heart surgery after watching a few YouTube videos? Of course not! So why would anyone expect themselves to navigate the complex world of insurance without proper guidance?

So do yourself a favor and seek out those knowledgeable professionals who can help make sense of it all. They’ll save you time, money, and most importantly – your sanity! Because let’s face it – reading policy documents is about as fun as watching paint dry.

Remember: when it comes to shopping for insurance policies online, leave it to the experts. Trust me; they’ve got your back!

Making Informed Decisions and Avoiding Common Pitfalls

So, you’ve finally decided to delve into the world of insurance policies, huh? Well, buckle up because it’s about to get wild.

First things first, let’s talk about researching policy coverage – a thrilling activity that involves deciphering vague terms and navigating through endless jargon.

Oh, and don’t forget to keep your eyes peeled for those hidden costs lurking in the fine print like ninjas ready to ambush your wallet.

And last but not least, be prepared to play a game of ‘Guess What’s Excluded’ because understanding policy exclusions is like trying to solve a riddle from the Sphinx herself.

Good luck!

Researching Policy Coverage

When researching policy coverage, it’s important to thoroughly read and compare the fine print of each insurance plan. Now, I know what you’re thinking – reading fine print sounds about as exciting as watching paint dry. But fear not, my fellow insurance aficionados! I’ve got some tips to make this process a little less soul-sucking and a lot more enlightening. So grab your reading glasses and let’s dive in!

Here are three things you should keep in mind while researching policy coverage:

-

Researching Policy Limits: Don’t just rely on the flashy headlines and promises of unlimited coverage. Dig deep into those policy limits to ensure they align with your needs.

-

Comparing Policy Benefits: Insurance plans can be like snowflakes – no two are exactly alike. Compare the benefits offered by different policies to find the one that suits your unique situation.

-

Don’t Skip the Fine Print: I know it can be tempting to skim over those lengthy documents, but trust me, there’s gold hidden in those words! Take the time to read every line and understand what you’re signing up for.

Identifying Hidden Costs

Identifying hidden costs requires careful examination of the policy terms and conditions to uncover any additional fees or charges. Insurance companies are notorious for hiding these sneaky little surprises behind pages of legal jargon. But fear not, intrepid shopper! With a keen eye and a sense of adventure, you can navigate through the treacherous waters of insurance policies and emerge unscathed. To help you in your quest, I present to you an illuminating table that will shed light on those pesky hidden costs. Compare prices across different policies so you don’t end up paying more than necessary. Remember, knowledge is power, and with this information at your fingertips, you’ll be armed with everything you need to make an informed decision.

| Hidden Costs | Policy A | Policy B | Policy C |

|---|---|---|---|

| Monthly Fee | $10 | $15 | $12 |

| Renewal Fee | $25 | N/A | $20 |

| Processing Fee | N/A | $5 | N/A |

| Late Payment Penalty | $20 | N/A | N/A |

| Cancellation Fee | N/A | $50 | N/A |

Understanding Policy Exclusions

To fully understand your insurance policy, it’s important to be aware of the exclusions that may limit or deny coverage for certain events or circumstances. It’s like finding out you’re not invited to a party after buying a fancy outfit and practicing your dance moves.

So, here are three sneaky exclusions that might make you want to cancel your insurance policy faster than a magician pulling a rabbit out of a hat:

-

‘Acts of Godzilla’ clause: Sorry, but if Godzilla decides to stomp on your house, there’s no coverage for that. Apparently, giant lizard attacks aren’t covered.

-

‘Alien abductions don’t count’ rule: If little green men whisk you away in their spaceship and probe you with strange instruments, don’t expect any reimbursement from your insurance company. They consider it an ‘out-of-this-world event.’

-

‘Dancing unicorns only’ provision: Sure, everyone loves dancing unicorns. But if they accidentally trample all over your car during their choreographed routine, well… good luck getting any compensation.

Now that you know about these coverage limitations and hidden costs (like dealing with alien invasions), let’s move on to taking action and purchasing the right insurance policy.

Taking Action and Purchasing the Right Insurance Policy

Once you’ve narrowed down your options, it’s time to purchase the insurance policy that best suits your needs. Congrats on taking action! You’re about to become a proud owner of an insurance policy.

Now, I know what you’re thinking: ‘How can I make this process even better?’ Well, my friend, let me tell you about finding discounts.

Nowadays, everyone loves a good deal. And guess what? Insurance companies are no different! They want your business just as much as you want their coverage. So why not take advantage of that? Start by doing some research and see if there are any discounts available for the type of policy you’re looking to buy.

You might be surprised at what you find. Some companies offer discounts for things like being a safe driver or having multiple policies with them. Others give discounts for bundling your home and auto insurance together. Hey, who doesn’t love killing two birds with one stone?

But wait, there’s more! Don’t forget to check out online comparison websites that can help you find the best deals in town. These handy little sites do all the legwork for you – comparing prices and coverage options from various insurers so that you don’t have to spend hours on end scrolling through endless pages of policy details.

Frequently Asked Questions

Can I Trust the Customer Reviews and Ratings Found Online?

Can you trust those online customer reviews and ratings? Well, let’s just say it’s like trying to find a needle in a haystack. Validity can be as rare as finding a unicorn.

How Do I Know if an Insurance Company Is Financially Stable?

To know if an insurance company is financially stable, evaluate their financial health. Look at their credit ratings, assets, and profits. Don’t just trust a catchy jingle or a talking lizard. Dig deeper for peace of mind.

What Are Some Common Pitfalls to Avoid When Shopping for Insurance Policies Online?

When shopping for insurance online, be cautious of common pitfalls. Beware of online insurance scams that promise too-good-to-be-true deals. Watch out for hidden fees and charges that may sneak up on you. Stay informed and shop wisely!

Is It Necessary to Seek Professional Advice When Comparing Insurance Policies?

Seeking professional guidance when comparing insurance policies is crucial. It’s like trying to navigate a labyrinth blindfolded. However, don’t forget the importance of research too! You want to make informed decisions, not rely solely on someone else’s opinion.

What Steps Should I Take After Purchasing an Insurance Policy to Ensure It Meets My Needs?

So, you’ve just purchased an insurance policy. Now what? How do you make sure it meets your needs? Take a step back and evaluate. Assess the coverage, see if it’s the perfect match for you.

Conclusion

Congratulations, savvy shopper! You’ve conquered the virtual world of insurance policies like a fearless explorer. Armed with your digital armor and a trusty search engine sword, you’ve navigated the treacherous terrain of fine print and dodged the pitfalls of hidden fees.

With every click, you’ve uncovered the secrets of coverage and exclusions, ensuring that no unexpected disaster will catch you off guard.

So go forth, my friend, armed with knowledge and humor, and conquer the realm of insurance like a legend in their own time!