Are you tired of worrying about what would happen if you were injured in a car accident? Well, fear not! Personal Injury Protection (PIP) is here to save the day.

PIP coverage provides financial protection for medical expenses and lost wages in case of an accident. But do you really need it?

In this article, we’ll explore the ins and outs of PIP insurance, compare it to other types of coverage, and help you make an informed decision.

So buckle up and let’s dive into the world of PIP!

Key Takeaways

- PIP coverage provides immediate medical payments and covers lost wages, offering peace of mind and protecting your bank account.

- PIP coverage ensures necessary support and protection in case of a car accident, covering medical expenses, lost wages, and more.

- PIP coverage is beneficial in situations where health insurance may not cover all costs related to accidents or injuries.

- Understanding PIP limits and exclusions is essential for ensuring adequate coverage and making an informed decision about the necessity of PIP coverage.

The Basics of Personal Injury Protection (PIP

If you’re wondering about the basics of personal injury protection (PIP), let me break it down for you. PIP is a type of insurance coverage that helps pay for medical expenses and other costs resulting from an accident, regardless of who was at fault. It’s like having a safety net to catch you if something unexpected happens.

Now, let’s talk about understanding PIP limits. Each state has its own requirements for minimum PIP coverage, so it’s important to know what your state mandates. These limits determine the maximum amount of money your insurance will pay out in case of an accident. Think of it as a cap on how much protection you have.

However, it’s crucial to be aware of PIP coverage exclusions. While PIP generally covers medical expenses and lost wages, there are certain situations where it may not apply. For example, if you were driving under the influence or participating in illegal activities at the time of the accident, your PIP coverage might not kick in.

Understanding these limits and exclusions is essential for mastering PIP. You want to make sure you have enough coverage to protect yourself financially but also understand what circumstances may not be covered.

Understanding the Purpose of PIP Coverage

So, you’re driving down the road, jamming out to your favorite tunes, when BAM! You get rear-ended by a distracted driver. Sucks, right?

Well, lucky for you, PIP coverage is here to save the day! In this discussion, we’ll dive into the benefits of having PIP coverage and compare it to other options out there.

Get ready for some insurance knowledge that’s as exciting as a high-speed chase (minus the danger)!

PIP Coverage Benefits

The benefits of PIP coverage include providing immediate medical payments and covering lost wages.

So, let’s talk about the perks, shall we?

Picture this: you’re cruising down the road, singing along to your favorite tunes, when bam! A reckless driver decides to crash into you. Ouch!

But fear not, my knowledgeable friend, because with PIP coverage on your side, you can breathe a little easier. Not only will it take care of those pesky medical bills that seem to multiply like rabbits, but it’ll also ensure that your bank account doesn’t go into hiding by covering your lost wages.

And here’s the icing on the cake—PIP coverage comes in different limits and at varying costs. So, you can customize it to fit your needs and budget.

Now that’s what I call peace of mind!

PIP Vs. Other Options

Let’s compare PIP coverage to other options available to you. When it comes to protecting yourself against personal injuries, there are a few alternatives to consider. To help you make an informed decision, here’s a handy comparison table:

| Options | Pros | Cons |

|---|---|---|

| PIP Coverage | Covers medical expenses, lost wages, and more. | Can be costly and may not be necessary if you have good health insurance. |

| Health Insurance | Comprehensive coverage for medical expenses. | May not cover all costs related to accidents or injuries outside of health concerns. |

| MedPay Insurance | No-fault coverage for medical expenses regardless of fault in an accident. | Limited coverage and may not include lost wages or other benefits like PIP does. |

| Liability Insurance | Protects against legal claims from others involved in an accident caused by your negligence. | Does not cover your own medical expenses or damages. |

Ultimately, the choice between these options depends on your specific needs and circumstances. Consider the pros and cons of each before making a decision that best suits you!

Key Benefits of Having PIP Insurance

So, you’ve got PIP insurance, but you’re wondering if it’s enough to cover your medical expenses. Well, let’s dive into the comparison of PIP vs. health insurance and see how they stack up.

We’ll explore the coverage they offer for those unexpected medical bills and help you make an informed decision on whether you need that extra layer of protection.

Get ready to uncover the secrets of these insurance titans!

PIP Vs. Health Insurance

Health insurance may provide coverage for medical expenses, but PIP can offer additional benefits in case of an accident. When it comes to choosing between PIP and health insurance, here are some things you should consider:

- PIP Coverage Advantages:

- PIP covers not only medical expenses but also lost wages and even funeral costs.

-

PIP provides coverage regardless of who is at fault in the accident.

-

Choosing Between PIP and Health Insurance:

- If you have comprehensive health insurance with high deductibles or limited coverage, PIP can fill in the gaps.

- PIP can provide immediate financial assistance after an accident, while health insurance may take longer to process claims.

Coverage for Medical Expenses?

Considering your medical expenses, it’s important to evaluate the coverage provided by both your health insurance and PIP.

When it comes to uninsured motorists, having PIP coverage becomes even more crucial. Accidents happen, and if you find yourself in a collision with an uninsured driver, you don’t want to be left footing the bill for medical expenses.

With PIP coverage, you can have peace of mind knowing that your medical expenses will be taken care of, regardless of who is at fault. It’s essential to understand the limits and options for PIP coverage when it comes to medical expenses. Make sure you choose a policy that provides adequate coverage for your needs.

Now let’s delve into how PIP compares to other types of auto insurance coverage.

PIP Vs. Other Types of Auto Insurance Coverage

If you’re looking for alternatives to PIP, have you considered other types of auto insurance coverage? While Personal Injury Protection (PIP) is a commonly chosen option, it’s not the only one out there. Let’s explore some alternatives and see how they stack up against PIP:

-

Bodily Injury Coverage: This type of coverage helps protect you if you cause an accident that results in injury or death to another person. With bodily injury coverage, your insurance company will pay for the medical expenses and legal fees of the injured party. Compared to PIP, which covers your own medical expenses regardless of fault, bodily injury coverage focuses on protecting others involved in the accident.

-

Uninsured/Underinsured Motorist Coverage: This type of coverage steps in if you’re involved in an accident with someone who doesn’t have enough insurance or no insurance at all. If you sustain injuries due to their negligence and they can’t cover your medical expenses, uninsured/underinsured motorist coverage will help take care of those costs. It acts as a safety net when the other driver is unable to fulfill their financial obligations.

When comparing PIP to bodily injury coverage and uninsured/underinsured motorist coverage, it’s important to consider what kind of protection you value most. If safeguarding yourself against high medical bills is your priority, then PIP might be more suitable. On the other hand, if ensuring others are protected from your actions or finding a safety net for accidents involving uninsured drivers concerns you more, then bodily injury or uninsured/underinsured motorist coverage could be better options.

Now that we’ve explored some alternatives to PIP, let’s dive into whether this type of insurance is mandatory in your state.

Is PIP Mandatory in Your State

Hey there! So, you’re curious about PIP and whether it’s mandatory in your state. Well, let me break it down for you.

In this discussion, we’ll dive into the State PIP Requirements, because hey, who doesn’t love some good ol’ legal stuff?

We’ll also explore the juicy benefits of having PIP coverage and even check out some alternative options if you’re feeling a little rebellious.

Let’s get started and unravel the mysteries of PIP together!

State PIP Requirements

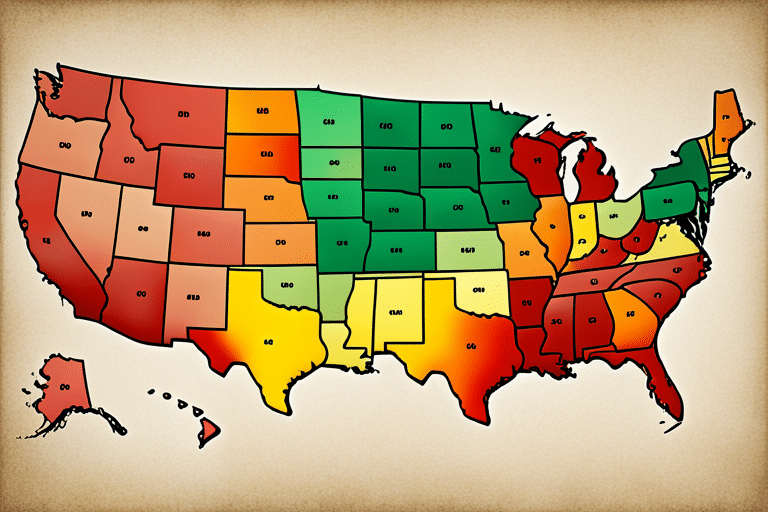

To meet your state’s requirements, you’ll need to have personal injury protection (PIP) coverage. But what exactly are these state PIP requirements? Let’s dive in and find out!

Here are some key things you should know about state PIP requirements:

-

Minimum Coverage Limits: Each state sets its own minimum coverage limits for PIP. Make sure to check the specific limits mandated by your state.

-

Mandatory or Optional: While some states make PIP coverage mandatory, others give you the option to purchase it. Be sure to research whether it is required in your state.

Now that you know a bit more about state PIP requirements, let’s explore some alternatives to traditional PIP coverage. Remember, having adequate protection for yourself and others on the road is crucial. So take a deep breath, buckle up, and let’s navigate through these insurance waters together!

PIP Coverage Benefits

Now that you know all about the requirements for PIP coverage in your state, let’s dive into the juicy benefits it offers.

Personal Injury Protection, or PIP, can be a lifesaver when it comes to covering medical expenses and lost wages after an accident. But what exactly are the limits of this coverage? Well, that depends on your insurance policy.

PIP coverage limits vary from state to state and even from policy to policy. Some states have mandatory minimums for PIP coverage, while others allow you to choose how much coverage you want. The cost of PIP coverage will also depend on the limits you select. Generally speaking, higher limits mean more protection but come with a slightly higher price tag.

When considering PIP coverage, it’s important to weigh the potential costs against the peace of mind it provides. After all, accidents happen when we least expect them! So take a moment to review your options and find a balance that suits both your budget and your need for protection.

PIP Alternatives Available

If you’re looking for alternatives to PIP coverage, it’s important to explore other insurance options that can provide similar benefits. Don’t worry, there are plenty of choices out there! Here are a couple of options worth considering:

-

Medical Payments Coverage (MedPay): Similar to PIP, MedPay covers medical expenses regardless of fault. It can help pay for hospital visits, surgeries, and even chiropractic treatments.

-

Uninsured/Underinsured Motorist Coverage (UM/UIM): This type of coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage. It can cover medical bills and lost wages.

With these alternatives, you can still enjoy the peace of mind that comes from having financial protection after an accident.

Now let’s dive into some factors to consider when deciding on PIP coverage…

Factors to Consider When Deciding on PIP Coverage

When deciding on PIP coverage, there are several factors to consider. Personal Injury Protection, or PIP, is an important type of insurance that can provide coverage for medical expenses and lost wages in case of an accident. But how do you know if it’s the right choice for you? Well, here are a few things to keep in mind.

First and foremost, think about your health insurance coverage. If you already have a comprehensive health insurance plan that covers any injuries sustained in an accident, then PIP coverage may not be necessary. However, if your health insurance has limited coverage or high deductibles, having PIP can provide an extra layer of protection.

Another factor to consider is the cost of PIP coverage itself. While it may seem like an additional expense, it can actually save you money in the long run. Without PIP, you could be responsible for paying out-of-pocket for medical bills and lost wages if you’re injured in an accident. With PIP coverage, these costs are generally covered up to a certain limit.

Additionally, think about your personal circumstances and risk tolerance. Are you more prone to accidents due to your lifestyle or occupation? Do you have dependents who rely on your income? These factors can help determine the level of PIP coverage that is right for you.

In conclusion, when considering whether or not to get PIP coverage, it’s important to weigh the factors mentioned above: your existing health insurance coverage, the cost of the policy itself, and your personal circumstances. By doing so, you can make an informed decision that provides peace of mind and financial security.

Now let’s move on to debunking some common misconceptions about PIP insurance…

Common Misconceptions About PIP Insurance

One misconception about PIP insurance is that it only covers medical expenses. Oh, how wrong you are! PIP coverage is like a superhero cape that swoops in to save the day when you least expect it. Let’s debunk some common myths about PIP coverage and uncover the truth:

- Myth 1: PIP only covers medical bills

-

Truth: While medical expenses are indeed covered by PIP, this superpower goes beyond just doctor visits. It also takes care of lost wages due to injury, rehabilitation costs, and even funeral expenses if the unthinkable happens.

-

Myth 2: PIP is only for major accidents

- Truth: Don’t underestimate the power of PIP! It’s there for you no matter how big or small the accident may be. Whether it’s a fender bender or a full-blown collision, PIP has got your back.

Now that we’ve cleared up these misconceptions, let’s dive into how exactly PIP coverage works in case of an accident. But first, take a moment to appreciate its versatility and breadth of protection. With PIP by your side, you can focus on healing and recovery without worrying about financial burdens.

How PIP Coverage Works in Case of an Accident

To understand how PIP coverage works in case of an accident, let’s dive into the details and explore its specific benefits.

Picture this: you’re cruising down the highway, singing along to your favorite tunes, when suddenly, BAM! An unexpected collision sends your heart racing and your car spinning. In times like these, having PIP coverage can be a lifesaver.

So what exactly are the benefits of PIP coverage? Well, my friend, unlike health insurance which primarily focuses on medical expenses related to illness or injury outside of accidents, PIP coverage steps up to the plate when you find yourself tangled in a fender-bender. It helps cover not only your own medical bills but also those of your passengers – even if they aren’t family members! Plus, it can assist with lost wages due to time off work for recovery.

But wait, there’s more! Unlike health insurance that may require deductibles or co-pays before kicking in (ugh), PIP coverage often takes care of things right away without any out-of-pocket expenses from you. Think of it as a helpful sidekick that swoops in to save the day without asking for anything in return. Now that’s what I call peace of mind!

Now you might be wondering: why bother with PIP when I have health insurance? Well my curious learner, while health insurance certainly plays an important role in keeping us healthy overall (cue apple-a-day reference), it may not cover all accident-related expenses like ambulance rides or rehabilitation services. That’s where our trusty sidekick PIP comes in handy again – bridging those gaps and ensuring you get the care you need after an unfortunate event.

Does Your Health Insurance Cover Personal Injuries

Did you know that your health insurance may not fully cover all the expenses related to personal injuries? It’s true! While health insurance is an essential safety net, it does have its limitations when it comes to covering the costs of personal injuries.

So, before you assume that you’re fully protected, let’s take a closer look at the coverage limits and potential gaps in your health insurance policy.

Here are some things to consider:

- Health Insurance Limitations:

- Deductibles: Just like car insurance, health insurance often comes with deductibles. This means that you will have to pay a certain amount out of pocket before your coverage kicks in.

-

Co-pays and Co-insurance: Even after meeting your deductible, you may still be responsible for additional costs such as co-pays or co-insurance. These can add up quickly, especially if you require ongoing treatments or therapies.

-

Personal Injury Coverage Limits:

- Out-of-Network Providers: Your health insurance may only cover treatment from certain doctors or hospitals within their network. If you need care from an out-of-network provider, it could result in higher out-of-pocket expenses.

- Non-Medical Expenses: Health insurance typically focuses on medical expenses but may not cover other costs associated with personal injuries, such as lost wages or transportation to medical appointments.

Understanding these limitations and possible gaps in your health insurance coverage is important for maintaining financial stability during times of personal injury. To ensure comprehensive protection, it might be worth considering additional coverage options like personal injury protection (PIP) or supplemental accident policies.

PIP Claims Process: What You Need to Know

Alright, now that you know whether your health insurance covers personal injuries or not, let’s dive into the nitty-gritty of the PIP claims process. Buckle up and get ready for a wild ride!

When it comes to filing a PIP claim, there are certain documentation requirements you need to keep in mind. Don’t worry, I’ve got your back! Check out this handy-dandy table below that outlines what you’ll need:

| Documentation | Description |

|---|---|

| Accident Report | A detailed report of the accident from law enforcement or any other relevant authority. |

| Medical Records | All medical bills, records, and reports related to your injuries sustained in the accident. |

| Lost Wages Verification | Proof of income verification from your employer to support your claim for lost wages due to the accident. |

| Proof of Expenses | Receipts and invoices for any out-of-pocket expenses incurred as a result of the accident (e.g., medication costs). |

| Witness Statements | Statements from witnesses who can attest to the details of the accident and support your claim. |

Now that you know what documents you need, let’s talk about the PIP claim settlement process itself. It typically involves submitting all necessary documentation along with your claim form to your insurance company. They will then review everything and determine the amount they’re willing to pay out for your medical expenses, lost wages, and other qualifying expenses.

But wait! Before we jump into making an informed decision about whether you really need PIP coverage or not, let’s take a closer look at some important factors that can help guide us in our decision-making process.

Making an Informed Decision: Do You Really Need PIP Coverage?

Before diving into the decision-making process, let’s explore some key factors that can help you determine if PIP coverage is necessary for you.

Making an informed decision about personal injury protection (PIP) means considering your specific needs and circumstances. Here are a few things to consider:

- PIP Coverage vs. Uninsured Motorist Coverage:

- PIP coverage provides medical expenses and lost wages regardless of who is at fault in an accident.

-

Uninsured motorist coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance.

-

PIP Coverage for Pedestrians and Cyclists:

- If you frequently walk or cycle, PIP coverage may be beneficial as it can provide financial assistance if you’re injured by a vehicle.

- Keep in mind that PIP usually extends to household members, so even if you’re not driving, your family members could still benefit from this coverage.

When deciding whether PIP coverage is right for you, it’s essential to weigh the potential benefits against your individual circumstances. Consider factors such as your health insurance coverage, overall risk tolerance, and budget. Remember that accidents can happen anytime and anywhere, so having adequate protection is crucial.

Ultimately, the choice between PIP coverage and uninsured motorist coverage depends on your priorities and what risks you want to mitigate. By understanding these key factors and carefully evaluating your situation, you’ll be better equipped to make an informed decision about whether or not PIP coverage is necessary for you.

Frequently Asked Questions

How Much Does PIP Coverage Typically Cost?

You might be wondering how much PIP coverage typically costs. Well, factors like your driving history and location can affect the price. But don’t worry, understanding the benefits of PIP insurance makes it worth considering!

Are There Any Specific Requirements or Qualifications to Be Eligible for PIP Coverage?

To be eligible for PIP coverage, you’ll need to meet certain requirements. These include having a valid driver’s license, owning a registered vehicle, and being involved in a covered accident that requires medical treatment. PIP helps cover your medical bills in such situations.

Can PIP Coverage Be Used for Injuries Sustained Outside of a Car Accident?

Yes, PIP coverage can be used for injuries sustained outside of a car accident. It provides injury coverage in non-automotive accidents too. So go ahead and enjoy those roller coasters with peace of mind!

Does PIP Coverage Provide Compensation for Lost Wages Due to Injuries?

You might wonder if PIP coverage compensates for lost wages due to injuries. Well, the good news is that it does! In addition to covering medical expenses, PIP also helps with non-car accident injuries.

Are There Any Limits or Caps on the Amount of Coverage Provided by PIP Insurance?

Are there any limits or caps on the amount of coverage provided by PIP insurance? Well, let me tell you, PIP coverage benefits can vary depending on your policy. Some have higher limits, while others may have certain caps. It’s important to check and understand your specific PIP coverage limits!

Conclusion

So, after diving into the world of Personal Injury Protection (PIP), you’ve gained a wealth of knowledge.

You now understand the purpose and benefits of having PIP insurance, as well as how it differs from other types of auto coverage.

You’ve even learned about the claims process and whether your health insurance covers personal injuries.

Now it’s decision time – do you really need PIP?

Like a detective weighing the evidence, only you can decide what’s best for you.

But remember, when life throws unexpected curveballs your way, having that extra layer of protection might just be the secret weapon that saves the day!