Are you ready for a roller coaster ride through life’s twists and turns? Buckle up, because we’re about to explore the life events that trigger a need for life insurance.

Like a compass guiding you through uncharted territory, these events serve as signposts, reminding you to protect what matters most.

From the joyful chaos of marriage to the thrilling adventure of starting your own business, each milestone brings both excitement and responsibility.

So grab your pen and let’s map out a plan that ensures your loved ones are always taken care of.

Key Takeaways

- Marriage, birth or adoption of a child, purchase of a new home, and starting a business are life events that often trigger a need for life insurance.

- Significant increase in income, divorce or separation, death of a spouse or partner, and retirement planning are financial planning and stability situations that may require reassessing life insurance coverage.

- Declining physical condition, new medical diagnosis, chronic health conditions, and caring for aging parents are health-related considerations that may necessitate life insurance for peace of mind and financial protection.

- Estate planning, change in employment status, change in financial responsibilities, and buying a home or starting a business are situations where life insurance can play a crucial role in providing financial security and protecting against risks.

Marriage

When you get married, it’s important to consider purchasing life insurance to protect your spouse financially. Marriage is a beautiful union of two souls, but it also comes with responsibilities – and financial stability is one of them. You want to ensure that if anything were to happen to you, your partner would be taken care of.

Life insurance plays a crucial role in marriage and financial stability. Imagine this: you and your spouse have built a life together, shared dreams, and made plans for the future. But what if you were suddenly gone? Without life insurance, your spouse could find themselves struggling financially. They might have to sell the house or make significant adjustments to their lifestyle just to make ends meet.

By having life insurance, you can provide peace of mind knowing that even in your absence, your partner will be financially secure. It can help cover debts such as mortgages or outstanding loans while allowing them time to grieve without worrying about money matters.

Moreover, marriage often involves estate planning as well. Life insurance can play a vital role in ensuring that your assets are distributed according to your wishes after you’re gone. It provides an opportunity for both partners to plan for the future together while protecting each other’s interests.

As we move on from discussing the importance of life insurance in marriage and financial stability, let’s explore another significant milestone – the birth or adoption of a child…

Birth or Adoption of a Child

Congratulations on becoming a parent through birth or adoption of a child; now is the time to consider securing coverage to protect your growing family. As you embark on this incredible journey, there are a few things you should know about how life insurance can help safeguard your little one’s future.

-

Peace of Mind: Life insurance provides financial security for your child in case something unexpected happens to you or your partner. It ensures that they will be taken care of, no matter what.

-

Childcare Expenses: Raising a child comes with its fair share of expenses, including childcare costs. Life insurance can help cover these expenses and ensure that your child receives quality care while you’re at work or taking some well-deserved parental leave.

-

Parental Leave: Speaking of parental leave, it’s important to have enough coverage to sustain your family during this precious time together. Life insurance can provide the financial support needed to take an extended leave and bond with your new addition without worrying about income loss.

-

Future Planning: As parents, we always want what’s best for our children. Life insurance allows you to plan for their future by providing funds for their education or any other endeavors they may choose later in life.

Purchase of a New Home

Securing a new home means taking on additional financial responsibilities, and finding the right insurance coverage is essential. Congratulations on your new abode! It’s time to make it your own, with all the quirks and personal touches that define you.

But before you dive headfirst into picking out paint colors and debating whether to install that fancy chandelier, let’s talk about something equally exciting: insurance.

Now, I know what you’re thinking – insurance sounds about as thrilling as watching paint dry. But trust me, it’s an important step in protecting your investment.

First things first, consider getting renovation expenses coverage. Because let’s face it, accidents happen. You don’t want to be stuck with a hefty bill if you accidentally knock down a wall or spill paint all over the pristine hardwood floors.

And speaking of protection, mortgage protection is another type of insurance to consider. Life can be unpredictable, and while we hope for sunny days filled with unicorns and rainbows, sometimes storms roll in unexpectedly. Mortgage protection ensures that if something were to happen to you or your partner (fingers crossed it doesn’t!), the remaining balance on your mortgage would be covered.

So now that you’ve got your home sweetly insured from top to bottom – both literally and figuratively – let’s move on to another exciting chapter: starting a business! Who knows? Maybe one day those renovation skills will come in handy when designing the office space of your dreams!

Starting a Business

Now that you’ve insured your new home, it’s time to dive into the exciting world of starting a business. Congratulations! You’re about to embark on a journey filled with endless possibilities and thrilling adventures.

But before you set sail, it’s important to navigate the waters of financial planning. Here are four essential steps to help you chart your course towards entrepreneurial success:

-

Create a budget: Financial planning is like having a treasure map for your business. Start by outlining your income and expenses, so you can keep track of where your doubloons are being spent. It may not sound glamorous, but trust me, it’s the key to long-term prosperity.

-

Set realistic goals: Just like searching for buried treasure, starting a business requires patience and perseverance. Take some time to establish achievable milestones along the way. Whether it’s doubling your revenue or expanding into new markets, these goals will keep you focused on reaching those hidden riches.

-

Build an emergency fund: Every pirate needs a stash of gold in case rough seas come their way. As an entrepreneur, unexpected challenges are bound to arise – from stormy economic climates to unforeseen expenses. Having an emergency fund will ensure that you’re prepared for any storms that may come your way.

-

Seek professional guidance: Even seasoned captains need advisors they can trust when navigating uncharted territories. Consider enlisting the help of financial experts who specialize in small businesses – they’ll be able to provide valuable insights and steer you towards smooth sailing.

Starting a business is like embarking on a grand adventure filled with excitement and unknown treasures waiting to be discovered. With proper financial planning at the helm, there’s no doubt that you’ll conquer new horizons and find success beyond your wildest dreams!

Significant Increase in Income

When you experience a significant increase in income, it’s important to reassess your financial goals and adjust your budget accordingly. Congratulations on that raise or promotion! It’s like finding a pot of gold at the end of a rainbow. With this increase in salary, you have unlocked new possibilities and opportunities.

But before you start splurging on extravagant vacations or filling your closet with designer clothes, take a moment to consider the importance of financial stability.

Financial stability is like having a safety net beneath you when life throws unexpected curveballs. It allows you to sleep peacefully at night knowing that you are prepared for any financial storm that may come your way.

So, what should you do with this newfound wealth? First things first, revisit your financial goals. Are there any long-term dreams or aspirations that were previously out of reach? Maybe it’s finally time to save up for that dream house or start investing for retirement.

Next, it’s time to adjust your budget accordingly. While treating yourself occasionally is well-deserved, make sure not to fall into the trap of lifestyle inflation. Instead of instantly upgrading everything in your life, focus on building a solid foundation for the future. Set aside an emergency fund for those unexpected expenses and increase contributions towards retirement accounts.

Divorce or Separation

Going through a divorce or separation can be emotionally challenging, but it’s important to also consider the financial implications that come with this major life change. While your heart might feel heavy right now, it’s time to put on your money-savvy hat and take control of your finances. Here are four things to keep in mind as you navigate this new chapter:

-

Rebuilding Finances: Divorce or separation often means dividing assets and starting anew financially. Take stock of your current situation and create a budget that reflects your new reality. It may not be glamorous, but it will give you a clear roadmap for rebuilding your finances.

-

Emotional Impact: The end of a relationship can bring a whirlwind of emotions – sadness, anger, confusion – you name it! These emotions can sometimes cloud our judgment when it comes to making financial decisions. Take time for self-care and seek support from loved ones or professionals who can help you stay focused during this emotional rollercoaster.

-

Protecting Your Assets: Update your estate planning documents like wills and trusts to reflect the changes in your circumstances. This ensures that your assets go where you want them to go in case something happens to you.

-

Seeking Professional Guidance: Consider consulting with a financial advisor who specializes in divorce or separation cases. They can provide valuable insights into tax implications, property division strategies, and long-term financial planning.

As you begin the process of rebuilding both emotionally and financially after a divorce or separation, remember that brighter days lie ahead.

Now let’s transition into discussing another life event that necessitates careful consideration – the death of a spouse or partner…

Death of a Spouse or Partner

Losing a spouse or partner can be emotionally devastating, but it’s important to also consider the financial implications that come with this significant loss. While grief counseling and emotional support are crucial during this time, taking steps to ensure your financial stability is equally important.

Let’s take a moment to visualize the different aspects of financial stability after the death of a spouse or partner. Consider the following table:

| Financial Implications | Actions to Take |

|---|---|

| Review Insurance Policies | Contact insurance companies and update beneficiary information |

| Assess Cash Flow | Create a budget and determine if any adjustments are needed |

| Evaluate Investments | Seek professional advice and make informed decisions about managing investments |

| Plan for Retirement | Reevaluate retirement plans and adjust accordingly |

Now, let’s delve into each aspect in more detail. First, reviewing insurance policies is essential. You’ll want to contact insurance companies and update beneficiary information to ensure that any payouts go directly to you.

Next, it’s vital to assess your cash flow. Creating a budget will help you understand your current expenses and determine if any adjustments are necessary.

When it comes to investments, seeking professional advice can provide valuable insights on how best to manage them moving forward.

Lastly, planning for retirement should be reevaluated. Adjustments may need to be made based on changes in income or long-term goals.

Retirement Planning

So, your partner has passed away and you’ve dealt with the emotional impact of that. Now it’s time to think about your future, specifically your retirement.

Retirement is a time to relax, enjoy life, and maybe even travel the world. But in order to do all that, you need to have some savings set aside.

Let’s dive into retirement planning and how it can affect your life insurance needs.

-

The Importance of Retirement Savings: It’s crucial to start saving for retirement early on so that you can build up a nest egg that will provide you with a comfortable lifestyle when you retire.

-

Calculating Your Retirement Income: You’ll need to determine how much money you’ll need each month during retirement and then figure out how much you’ll receive from sources like Social Security or pensions.

-

Choosing the Right Retirement Accounts: There are various retirement accounts available, such as 401(k)s or IRAs, each offering different tax advantages and withdrawal rules. It’s important to choose the right ones based on your financial situation and goals.

-

Evaluating Life Insurance Needs: As you plan for retirement income, it’s essential to reevaluate your life insurance coverage. You may find that as your financial responsibilities decrease in retirement, you may not need as much coverage as before.

Now that we’ve covered retirement planning and its impact on life insurance needs, let’s move on to another significant life event – changes in health status.

Change in Health Status

So, it looks like life has thrown you a curveball, huh? Your once sprightly physical condition seems to be on the decline, and let’s not even get started on that new medical diagnosis.

But hey, chin up! With chronic health conditions now in the mix, you’ll have plenty of opportunities to show off your resilience and prove that you’re more than just a mere mortal.

Let’s dive into this discussion and find some ways to navigate this new chapter with grace and a touch of whimsy!

Declining Physical Condition

If you’re experiencing declining physical condition, it may be time to consider getting life insurance. Don’t worry, this isn’t a sign that you’re on the fast track to becoming a superhero or anything like that. But it is a reminder that life can take unexpected turns, and being prepared financially is always a good idea.

So, why should you consider getting life insurance when your physical health is declining? Let me break it down for you:

-

Peace of mind: Knowing that your loved ones will be taken care of financially after you’re gone can provide a sense of comfort in difficult times.

-

Medical expenses: Dealing with declining health often means increasing medical bills. Life insurance can help cover these costs and relieve some financial stress.

-

Legacy protection: Life insurance ensures that your family’s future is secured, allowing them to maintain their lifestyle and pursue their dreams even without you around.

-

Burial expenses: Unfortunately, funeral arrangements don’t come cheap. Life insurance can help alleviate this burden so your loved ones can focus on grieving without worrying about money.

New Medical Diagnosis

After receiving the new medical diagnosis, it’s important to explore your options for financial security. But don’t worry, my friend! Life has thrown you a curveball, but there are still ways to tackle it with style and grace. Take a deep breath and let’s dive into this whimsical journey together.

First things first, research all the new treatment options available to you. It’s like exploring a colorful candy store – except instead of sweets, you’re looking at potential paths to better health. These choices can have an emotional impact on you and your loved ones, so remember to lean on them for support during this time.

Now that we’ve got the medical side covered, let’s talk finances. Look into life insurance policies that will provide you with the financial security you need. It may not be as exciting as finding a golden ticket in a chocolate bar, but it can offer peace of mind knowing that your loved ones will be taken care of if anything were to happen.

Chronic Health Conditions

When it comes to managing chronic health conditions, developing a consistent routine is key. Here are four whimsical tips to help you navigate the world of long-term care options:

1) Embrace your inner superhero: Supercharge your self-care routine with healthy habits like exercise, meditation, and a nourishing diet. Remember, you have the power to take control of your health!

2) Build a support squad: Surround yourself with friends, family, and healthcare professionals who can provide emotional support and guidance on navigating the challenges of living with a chronic condition.

3) Get organized: Keep track of appointments, medications, and treatment plans in a colorful planner or digital app. A little organization goes a long way in reducing stress and ensuring you stay on top of your care.

4) Explore alternative therapies: From acupuncture to art therapy, there’s a world of holistic approaches waiting for you. Don’t be afraid to step outside the box and try something new!

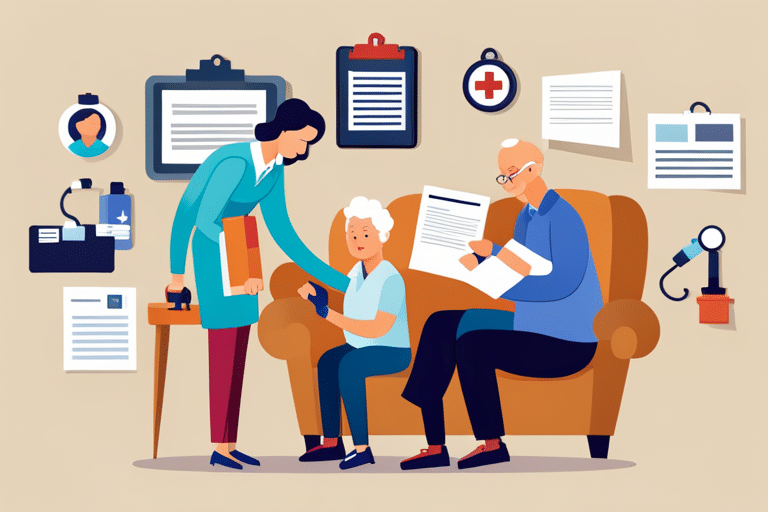

Caring for Aging Parents

As you navigate the challenges of caring for aging parents, life insurance can provide financial security and peace of mind. It’s no secret that taking care of elderly loved ones can be both emotionally and financially draining. The cost of medical expenses, assisted living facilities, and daily caregiving can quickly add up, leaving you feeling overwhelmed and unsure about the future.

But fear not! Life insurance is here to save the day – or at least ease the burden.

Imagine a magical table that could show you just how life insurance can help alleviate the financial strain of caring for your aging parents. Picture three columns: ‘Expenses,’ ‘Life Insurance Payout,’ and ‘Peace of Mind.’ In the first row stands the daunting figure of medical bills, followed by the reassuring amount in the second column, thanks to your life insurance policy. As you move down to row two, envision an assisted living facility fee staring back at you with its hefty price tag. But fear not! Your life insurance payout once again comes to your rescue in column two. Finally, in row three lies the weighty responsibility of daily caregiving costs – but wait! With life insurance by your side, that burden becomes lighter as well.

So there you have it – a whimsical glimpse into how life insurance can turn those financial worries into distant memories. By providing a safety net for your family’s future needs, it allows you to focus on what truly matters: creating lasting memories with your aging parents while cherishing every moment together.

Education Planning for Children

Planning for your child’s education can be overwhelming, but there are resources available to help you navigate the process. Don’t fret! With a little guidance and some careful consideration, you’ll be able to set your child up for success in their academic journey.

Here are four key steps to take when it comes to education planning:

-

Start early: It’s never too soon to begin thinking about college savings. The sooner you start putting money aside, the more time it has to grow and accumulate interest. Plus, it gives you peace of mind knowing that you’re taking proactive steps towards your child’s future.

-

Set realistic goals: Consider how much you can comfortably save each month and set realistic goals based on your financial stability. Remember, it’s not about being able to cover the entire cost of tuition upfront; rather, it’s about making consistent contributions over time.

-

Explore different options: There are various ways to save for college, such as 529 plans or Coverdell Education Savings Accounts (ESAs). Research these options and find one that aligns with your needs and preferences.

-

Seek professional advice: If navigating the world of college savings feels like trying to solve a Rubik’s Cube blindfolded, don’t hesitate to reach out for expert guidance. Financial advisors specialize in helping families plan for their children’s education and can provide valuable insights tailored to your specific situation.

By taking these steps towards education planning, you’ll be well on your way to ensuring a bright future for your child academically and financially stable.

Now that we’ve covered education planning for your children, let’s move on to another important aspect of securing their future—estate planning.

Estate Planning

So you’ve spent your whole life amassing a collection of quirky trinkets, vintage vinyl records, and rare comic books. But have you ever stopped to think about what will happen to your beloved possessions after you shuffle off this mortal coil?

Well, my friend, that’s where inheritance and taxes come into play. Brace yourself for a whimsical journey through the world of estate planning and find out how your assets can be distributed after death.

Inheritance and Taxes

If you don’t want your loved ones to be burdened with inheritance taxes, it’s important to consider getting life insurance. Not only will this ensure that your beneficiaries receive the financial support they need, but it can also help minimize the tax implications associated with passing on your assets.

Here are four key reasons why life insurance is a wise choice for inheritance planning:

-

Tax efficiency: Life insurance proceeds are generally tax-free, meaning your beneficiaries won’t have to worry about paying hefty taxes on their inheritance.

-

Immediate liquidity: Life insurance provides immediate cash to cover any estate taxes or other expenses that may arise upon your passing, ensuring a smooth transition of wealth.

-

Equal distribution: With life insurance, you can designate specific beneficiaries and control how your assets are distributed, avoiding potential family disputes over inheritance.

-

Peace of mind: Knowing that your loved ones won’t be saddled with unnecessary financial burdens allows you to enjoy life without worrying about the future.

Asset Distribution After Death

When it comes to distributing your assets after death, it’s important to have a clear and legally binding will in place. You don’t want your loved ones left scratching their heads, trying to figure out who gets what. Plus, you definitely don’t want the taxman swooping in and taking a big chunk of what you’ve worked so hard for! So let’s talk about asset distribution after death, inheritance, and taxes.

To help you understand how these things work together, let me break it down for you in a nifty little table:

| Assets | Inheritance | Taxes |

|---|---|---|

| House | Kids | Estate Tax |

| Car | Spouse | Gift Tax |

| Investments | Siblings | Income Tax |

See? Easy peasy lemon squeezy! Now go forth and plan your asset distribution like the master of inheritance and taxes that you are!

Change in Employment Status

Losing your job can be a pivotal moment that prompts the need for life insurance. It’s not just about financial security but also about ensuring your loved ones are taken care of during uncertain times.

So, if you find yourself in a career switch or facing unemployment, here’s why life insurance should be on your radar:

-

Protection for the Unexpected: Life insurance provides a safety net when unexpected events occur, like losing your job. It acts as a cushion to help cover expenses and maintain financial stability while you navigate through this transition.

-

Peace of Mind: In times of uncertainty, having life insurance can bring peace of mind knowing that even if things aren’t going according to plan right now, you have a backup plan in place.

-

Support for Your Loved Ones: Life insurance ensures that your family is protected financially in case something happens to you. They won’t have to worry about the bills piling up or making ends meet while dealing with the stress of unemployment.

-

Building Future Security: Investing in life insurance during a career switch or period of unemployment can also help build future security. By starting early and maintaining coverage, you’re ensuring that you have protection throughout different stages of your professional journey.

Change in Financial Responsibilities

So you’ve found the one and decided to tie the knot, huh?

Well, get ready for some financial responsibilities! From joint bank accounts to shared bills, marriage means combining your money matters.

And if that’s not enough, throw in a couple of dependents, buying a home together, and maybe even starting a business – because why not?

It’s like a whirlwind of financial adventures waiting to happen!

Marriage and Dependents

Getting married and starting a family often prompts individuals to consider the importance of life insurance. As you embark on this new chapter of your life, it’s essential to protect your loved ones financially in case anything unexpected happens. Here are four reasons why life insurance is crucial for marriage and dependents:

-

Peace of Mind: Life insurance provides financial security and peace of mind knowing that your spouse and children will be taken care of even if you’re no longer around.

-

Income Replacement: In the event of your untimely passing, life insurance ensures that your family can maintain their standard of living by replacing lost income.

-

Debt Coverage: It helps cover any outstanding debts such as mortgages, student loans, or credit card bills so that these burdens don’t fall on your loved ones.

-

Future Planning: Life insurance can also help fund future expenses like college tuition or retirement savings, ensuring a secure future for your dependents.

As you navigate through the benefits of life insurance for marriage and dependents, it’s important to consider other significant milestones such as buying a home…

Buying a Home

When you decide to purchase a home, it’s important to consider the financial implications and responsibilities that come with homeownership. But fret not, dear homeowner-to-be! For within these challenges lie hidden treasures of benefits just waiting to be discovered.

First, let’s talk about the joys of homeownership. Picture yourself lounging in your very own backyard oasis, sipping lemonade on a sunny day. Ah, bliss! And don’t forget the pride that comes from saying goodbye to pesky landlords and hello to your castle!

Of course, challenges may arise along the way. From unexpected repairs to juggling mortgage payments, there will be moments where you’ll need a little extra patience and resourcefulness. But fear not! Tackling these challenges head-on will only make you stronger and more resilient.

Starting a Business

Starting a business can be an exciting and challenging endeavor, but with careful planning and determination, you have the potential to turn your dreams into a successful reality. As an aspiring entrepreneur, you are about to embark on a thrilling adventure that will test your skills and push you beyond your limits. But fear not! Here are four whimsical tips to help you navigate the challenges of business expansion and overcome any entrepreneurship hurdles:

- Embrace failure as a stepping stone to success – every setback is an opportunity for growth.

- Surround yourself with a supportive network of mentors who can offer guidance and wisdom.

- Stay adaptable and embrace change – the business world is constantly evolving.

- Never lose sight of your passion and purpose – let them be the driving force behind your entrepreneurial journey.

Reevaluation of Long-Term Goals

Reevaluating your long-term goals can help you determine if life insurance is necessary to protect your future plans. Life is full of surprises, and sometimes those surprises can make us rethink our career paths and financial plans. Perhaps you’ve been working in the same industry for years, but lately, you find yourself daydreaming about a different line of work. Maybe you’ve always dreamed of opening a bakery or becoming a professional dog walker. Now is the time to take a step back and evaluate whether these new aspirations align with your long-term goals.

Financial planning plays a crucial role in making any career change successful. As you embark on this journey of self-discovery, it’s important to consider how your new career path may impact your finances. Will you be earning less initially? Will there be periods of instability before your business takes off? These are all factors that need careful consideration.

Life insurance can provide peace of mind during times of uncertainty. It acts as a safety net, ensuring that even if something unexpected happens, your loved ones will be taken care of financially. In the midst of reevaluating your long-term goals, it’s easy to overlook the importance of protecting yourself and those who depend on you.

Frequently Asked Questions

How Does the Birth or Adoption of a Child Impact the Need for Life Insurance?

When you welcome a new child into your life through childbirth or adoption, it’s time to consider life insurance. It provides financial security for your growing family and ensures their future is protected.

What Factors Should Be Considered When Purchasing Life Insurance After Starting a Business?

When starting a business, purchasing life insurance is crucial for business owners like yourself. Consider factors such as the value of your business assets, potential liabilities, and the financial security of your loved ones. Protect what matters most with life insurance for entrepreneurs.

How Does a Significant Increase in Income Affect the Amount of Life Insurance Coverage Needed?

When your income skyrockets, you might think you don’t need more life insurance coverage. But remember, with a bigger paycheck comes bigger responsibilities. Protect your loved ones and secure their future.

What Are the Implications of a Divorce or Separation on Existing Life Insurance Policies?

Divorce or separation can have implications on your existing life insurance policies. Remarriage may impact coverage, so it’s important to review and update beneficiaries accordingly. Don’t let life changes catch you off guard!

How Does a Change in Health Status Impact the Ability to Secure Life Insurance Coverage?

If your health takes a turn for the worse, it can affect your ability to get life insurance. Insurers may view you as a higher risk and charge higher premiums. Stay healthy and financially stable!

Conclusion

Congratulations on reaching the end of this whimsical journey through life events that trigger a need for life insurance.

Remember, life is full of unexpected twists and turns, so it’s important to be prepared.

Here’s an interesting statistic to ponder: Did you know that 40% of Americans don’t have any life insurance coverage?

Don’t let yourself be part of that statistic! Take the leap and protect your loved ones from the uncertainties of tomorrow.

Life may be unpredictable, but with life insurance, you can add a little sprinkle of security to your story.