Are you ready to uncover the hidden risks that lurk on the roads? Brace yourself, dear reader, for a wild ride through the treacherous world of uninsured motorists.

Picture this: you’re cruising down the highway, wind in your hair, when BAM! Out of nowhere, a reckless driver smacks into you. But wait! There’s a twist. They don’t have insurance. gasp

Fear not, intrepid adventurer! In this article, we shall guide you through the perils of driving without protection and teach you how to shield yourself from these road warriors.

Let’s embark on this journey together and master the art of safeguarding against uninsured motorists!

Key Takeaways

- Uninsured motorists are becoming increasingly common on the roads, with around 13% of drivers being uninsured.

- Driving without proper insurance coverage can have serious financial repercussions, including fines, license suspension, and out-of-pocket expenses for damages and injuries.

- Uninsured motorist coverage is crucial for financial protection in accidents, as it can help cover medical expenses and avoid out-of-pocket expenses for property damage.

- Dealing with an uninsured motorist claim can be challenging, but following the proper steps, documenting the accident scene, and contacting your insurance company is crucial to ensure proper assistance and compensation for damages.

The Prevalence of Uninsured Motorists

Uninsured motorists are becoming increasingly common on the roads, and it’s a problem that can make even the most serene driver lose their cool. You know the feeling – you’re cruising down the street, singing along to your favorite tunes, when suddenly, out of nowhere, BAM! An uninsured motorist smashes into your precious vehicle like a bull in a china shop. It’s enough to make you want to pull out your hair or scream at the top of your lungs.

But before you let frustration get the best of you, let’s take a look at some prevalence statistics. Did you know that according to recent studies, around 13% of drivers on the road are uninsured? That’s like playing Russian roulette with every commute! And if that isn’t enough to send shivers down your spine, consider this: uninsured motorist accidents account for nearly 20% of all car accidents in some states. Yikes!

Now that we’ve established just how prevalent these uninsured motorist incidents are, it’s time to arm yourself with knowledge and protect yourself from potential disaster. The first line of defense is making sure you have adequate insurance coverage. Don’t skimp on this one; it could mean the difference between getting back on track quickly or having to dip into your savings.

Remember folks, while we can’t control what other drivers do (unfortunately), we can control how prepared we are for whatever comes our way. So buckle up and stay vigilant out there!

Understanding the Financial Consequences

Understanding the potential financial consequences is essential when it comes to driving without proper insurance coverage. We get it, insurance can be a drag. Who wants to spend their hard-earned money on something they might never use? But let’s face it, life is full of surprises, and not all of them are pleasant.

Imagine this: you’re cruising down the road, wind in your hair (or through your open window if you prefer), when suddenly BAM! You find yourself in a fender bender with another car. Now here’s the kicker – you don’t have insurance. Yikes! Not only do you have to deal with the headache of fixing your car, but now you’re also facing some serious financial repercussions.

First off, let’s talk about the consequences of driving without insurance. Depending on where you live, it could be illegal and result in fines or even license suspension. And those are just the legal consequences! Think about how much you’ll have to pay out-of-pocket for any damages or injuries caused by the accident. Trust us, it won’t be cheap.

Now let’s delve into the impact on your personal finances. Without insurance, you’ll have to foot the bill for repairs to your own vehicle as well as any medical expenses for yourself or others involved in the accident. And let’s not forget about potential lawsuits that could drain your bank account faster than a kid at an ice cream shop.

Uninsured Motorist Coverage Explained

Now let’s take a closer look at how having uninsured motorist coverage can provide you with added protection on the road. Don’t worry, I won’t bore you with all the nitty-gritty details, but understanding exclusions and evaluating coverage options is crucial. So buckle up and get ready for a wild ride through the world of uninsured motorist coverage!

-

Peace of Mind: Picture this – you’re cruising down the highway, wind in your hair, when out of nowhere, BAM! An uninsured driver decides to crash into your car like it’s a demolition derby. With uninsured motorist coverage, you can relax knowing that even if Mr. Crash-and-Dash doesn’t have insurance to pay for your repairs or medical bills, your own policy has got your back.

-

Hit-and-Run Protection: We’ve all seen those heart-stopping moments on TV where a driver smashes into another car and then speeds off into the sunset like a fugitive in an action movie. Well, guess what? If you have uninsured motorist coverage, that hit-and-run jerk won’t leave you high and dry. Your policy will kick in to cover the damages so you don’t end up paying for someone else’s reckless driving.

-

Supplemental Coverage: Let’s say you’re involved in an accident caused by an insured driver who only has minimal liability limits – not enough to cover all your expenses. Fear not! Uninsured motorist coverage can swoop in like a superhero sidekick and make up the difference between what their insurance pays and what it actually costs to fix your ride or heal your wounds.

-

Family Protection: Your loved ones deserve protection too! With uninsured motorist coverage, not only are YOU covered if some scofflaw smashes into YOUR car but also if they crash into one driven by your spouse or children (who hopefully aren’t driving toy cars…).

State Requirements for Uninsured Motorist Coverage

So, you’ve learned about the risks of driving without uninsured motorist coverage. But now let’s talk about the nitty-gritty: minimum coverage requirements.

Brace yourself, my friend, because each state has its own set of rules and regulations when it comes to how much coverage you need. And here’s a little word of advice: if you don’t comply with these requirements, you could be facing some not-so-fun legal consequences.

Yikes!

Minimum Coverage Requirements

The minimum coverage requirements vary by state, so it’s important to familiarize yourself with your specific state’s regulations. You don’t want to be caught off guard when you’re cruising down the highway, only to find out that your coverage is as thin as a slice of cheese on a cracker.

To help you navigate this insurance maze, here are four things you should know about minimum coverage options:

-

It’s like going to a buffet and only being able to fill one tiny plate. Minimum coverage might save you some money upfront, but if an accident happens, you could end up paying dearly out of pocket.

-

Think of comprehensive coverage as the superhero cape for your car. It protects you from all sorts of mishaps – theft, vandalism, natural disasters – everything except alien abductions (sorry).

-

Don’t be fooled by the term ‘minimum.’ Just because it’s the bare minimum required doesn’t mean it’s enough. Always aim for more than what’s expected because accidents have no regard for expectations.

-

Remember that insurance isn’t just about protecting your vehicle; it’s also about safeguarding yourself financially in case of injuries or damages caused by uninsured motorists who think they’re invincible.

Legal Consequences for Non-Compliance

Make sure you understand the legal consequences for not complying with the minimum coverage requirements in your state. They can have a significant impact on your finances and driving privileges. Let me tell you, my friend, it’s not a pretty sight.

Picture this: you’re cruising down the road, wind in your hair, tunes blaring from the speakers when BAM! You rear-end someone and find yourself knee-deep in legal troubles. Not only will you be facing hefty fines and potential license suspension, but you’ll also be stuck with a massive financial burden.

Without proper insurance coverage, you could end up shelling out loads of cash to cover damages and medical expenses. So do yourself a favor and don’t mess around with those minimum coverage requirements. They may seem like a hassle now, but trust me, it’s way better than dealing with the aftermath of non-compliance.

The Dangers of Driving Without Insurance

So, you think you can save a few bucks by driving without insurance? Well, let me tell you, my friend, that’s a risky game to play.

Not only could you face some serious legal consequences if caught, but imagine the financial burden of being in an accident without any coverage. Trust me, it’s not a situation you want to find yourself in.

That’s why having uninsured motorist coverage is so important – it provides that extra layer of protection when the unexpected happens.

Legal Consequences of Uninsured

If you don’t have insurance, you could face severe legal consequences. And trust me, you don’t want to mess with the law. So, let’s dive into the world of uninsured driving and explore the wild ride that awaits those who dare to go without coverage.

-

Fines that make your wallet cry: Picture this – you’re pulled over by a stern-faced police officer, and instead of a warning, they hit you with a hefty fine for driving uninsured. Ouch!

-

License suspension limbo: Say goodbye to your precious driver’s license because driving without insurance can lead to having it suspended. No license means no more late-night McFlurry runs!

-

The dreaded SR-22 form: Brace yourself for the bureaucratic nightmare known as the SR-22 form. It’s like filling out your taxes on steroids – time-consuming, confusing, and just plain annoying.

-

Lawsuits lurking around every corner: Without insurance, you become an easy target for lawsuits if you cause an accident. Your bank account might be emptier than a desert highway in no time.

Financial Burden After Accident

After an accident, the financial burden can be overwhelming for drivers who lack insurance coverage. Let’s face it – accidents are bad enough already without having to worry about emptying your pockets.

But fear not, my friend! There are actually some financial assistance programs out there to help you out in these sticky situations. Yep, you heard me right! These programs can provide some much-needed relief and help ease the strain on your wallet.

And trust me, you’re not alone in this predicament. Uninsured motorist statistics show that there are plenty of people out there facing the same problem.

Importance of Uninsured Motorist Coverage

Let me tell you, having uninsured motorist coverage is absolutely crucial in protecting yourself financially in case of an accident. Not convinced? Well, here are four reasons why you should seriously consider getting this type of coverage:

-

State requirements: Many states actually require drivers to have some form of minimum coverage for uninsured motorists. So, if you want to stay on the right side of the law, it’s best not to skimp on this.

-

Peace of mind: Knowing that you’re protected even if someone without insurance hits you can give you a sense of security. And trust me, peace of mind is priceless!

-

Medical expenses: If you do get into an accident with an uninsured driver and sustain injuries, your own health insurance may not cover all the costs. Uninsured motorist coverage can help fill in those gaps.

-

Property damage: It’s not just your medical bills that can add up after an accident; repairs to your car or any other property damaged in the crash can be expensive too! Having uninsured motorist coverage can save you from paying out of pocket.

Common Scenarios Involving Uninsured Motorists

When driving on the road, you should be aware of common scenarios involving uninsured motorists and take steps to protect yourself. Because let’s face it, there are some people out there who think car insurance is just a suggestion.

But don’t worry, we’ve got your back with some hilarious (and slightly terrifying) stories about these uninsured daredevils.

First off, let’s talk about the prevalence statistics. Did you know that around 13% of drivers in the United States are uninsured? That means there’s a one in eight chance that if someone crashes into you, they won’t have insurance to cover the damages. It’s like playing a real-life game of Russian roulette, but instead of bullets, it’s reckless drivers without insurance!

Now let’s dive into the uninsured motorist claim process. Picture this: you’re cruising down the highway when suddenly an uninsured driver cuts you off and causes a major fender bender. You exchange information only to find out that they don’t have any insurance. Cue the dramatic music! Now what do you do?

Well, first things first – stay calm and call your insurance company. They will guide you through the process of filing an uninsured motorist claim. Don’t forget to document everything – take pictures of the accident scene and get witness statements if possible (bonus points for finding witnesses who can juggle at the same time). Your insurer will then investigate the claim and hopefully provide compensation for your damages.

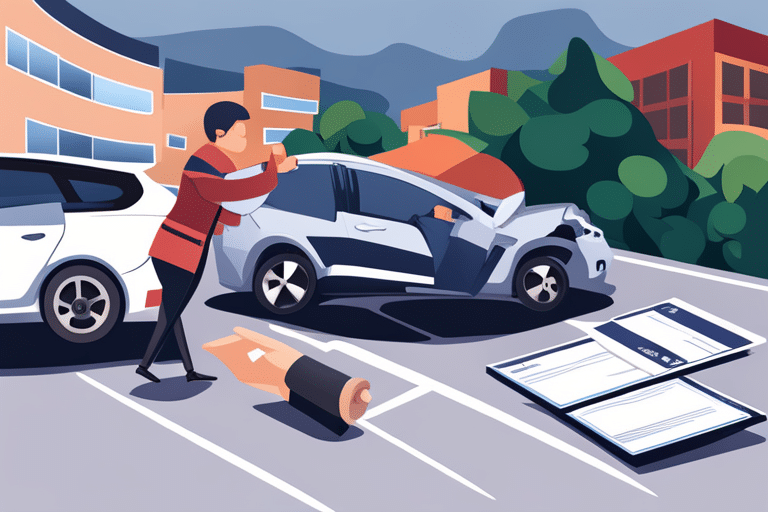

Steps to Take After an Accident With an Uninsured Motorist

If you find yourself in an accident with a driver who doesn’t have insurance, it’s important to take certain steps to ensure your protection. Don’t panic! Take a deep breath and follow these four simple steps:

-

Call the police: This is not the time for amateur detective work. Leave that to Sherlock Holmes and call the authorities. They will come to the scene, assess the situation, and file a report. Plus, they might even bring donuts if you’re lucky!

-

Gather evidence: Channel your inner CSI agent and collect as much evidence as possible. Take pictures of the damage (and maybe a selfie while you’re at it), exchange contact information with any witnesses, and make note of any skid marks or other details that could help your case.

-

File a police report: Once again, leave it to the professionals. Head down to the nearest police station and file a report about the accident. It’s like writing an action-packed memoir but without all the paparazzi.

-

Contact your insurance company: Time for some good old-fashioned phone tag! Call up your trusty insurance company and let them know what happened – they’ll guide you through the claims process faster than Superman can change into his cape.

Uninsured Motorist Bodily Injury Vs. Property Damage Coverage

So, you’ve found yourself in a pickle with an uninsured motorist. Not to worry, my friend! We’ve got your back.

Now that you know what steps to take after an accident, let’s dive into the nitty-gritty of uninsured motorist coverage.

First things first, let’s talk about the claims process. When it comes to filing a claim for an accident involving an uninsured motorist, it’s pretty straightforward. You’ll need to gather all the necessary information like police reports, witness statements, and any documentation of medical expenses or property damage. Then, simply contact your insurance company and provide them with all the juicy details. They’ll guide you through the rest of the process and help you get compensated for your losses.

Now let’s address the elephant in the room: cost. I know what you’re thinking – ‘How much is this going to set me back?’ Well, here’s some good news! Uninsured motorist coverage tends to be relatively affordable compared to other types of insurance policies. The exact cost will depend on several factors like your driving history, location, and desired coverage limits. But fear not! With a little research and negotiation skills, you can find a policy that fits both your needs and budget.

Alrighty then! Now that we’ve covered the claims process and cost considerations for uninsured motorist coverage, it’s time to tackle another intriguing topic: how this coverage works in hit-and-run accidents. Hang tight because we’re about to delve into some detective work!

But before we go full Sherlock Holmes mode…

How Uninsured Motorist Coverage Works in Hit-and-Run Accidents

So you’re cruising down the road, minding your own business, when out of nowhere, BAM! Some jerk slams into your car and speeds off like a getaway driver in a Hollywood movie. Talk about rude!

But fear not, my friend, because you’ve got coverage for hit-and-run accidents. That’s right, your insurance has your back even when the other driver disappears faster than a magician’s rabbit.

Now let me break it down for you: this nifty little thing called uninsured motorist coverage not only protects you from those sneaky drivers without insurance but also comes to the rescue in hit-and-run situations.

How does it work? Well, it’s like having a superhero on speed dial – when Mr. or Ms. Hit-And-Run tries to ruin your day and escape responsibility, your insurance swoops in to save the day and cover those damages.

It’s like having a trusty sidekick who always has your back (and bumper) no matter what happens on the road.

Coverage for Hit-And-Run

It’s important to have uninsured motorist coverage to protect yourself in the event of a hit-and-run incident. You never know when some reckless driver might crash into your car and then disappear like a magician leaving you with a pile of metal and frustration. Here are four reasons why uninsured motorist coverage is your secret weapon:

-

Hit and run statistics: Did you know that according to recent studies, there were over 737,100 hit-and-run crashes reported in the US last year? That’s enough to make Houdini jealous!

-

Peace of mind: With uninsured motorist coverage, you can rest easy knowing that even if the person who smashes into your car runs away faster than Usain Bolt, you’re still covered.

-

No penalties for the innocent: Unlike those sneaky hit-and-run drivers who face hefty fines and potential jail time if caught, having uninsured motorist coverage means you won’t be penalized for someone else’s bad behavior.

-

Financial protection: Dealing with repairs or medical bills after a hit-and-run can be as pleasant as getting a root canal without anesthesia. But with uninsured motorist coverage, your insurance company will swoop in like Batman and cover those expenses.

Protection From Uninsured Drivers

So, you’ve managed to escape the clutches of hit-and-run accidents. Phew! But what about those sneaky uninsured drivers? They’re like ninjas in the night, ready to pounce on your hard-earned cash. Well, fear not! State laws have got your back when it comes to protecting yourself from these cunning culprits.

Let’s talk statistics, shall we? Did you know that roughly one in eight drivers in the United States is uninsured? That’s right, it’s like playing a game of Russian roulette every time you hit the road. But hey, don’t let these numbers get you down. There are ways to shield yourself from financial disaster.

Now that we’ve got you on high alert about the risks of uninsured drivers, let’s dive into how this whole protection thing works. Get ready for some mind-blowing information that will leave you feeling more secure than ever before!

How Does It Work?

Let’s dive into how this whole protection thing actually works, shall we? Understanding the process of uninsured motorist claims can be a bit like deciphering ancient hieroglyphics. But fear not, intrepid learner! Here are four key points to demystify the process:

-

Report the accident: As soon as you find yourself in a fender bender with an uninsured driver, contact your insurance company faster than you can say ‘collision coverage.’

-

Gather evidence: Play detective and gather all relevant information about the accident. Photos, witness statements, and police reports will be your trusty sidekicks.

-

File a claim: Let your insurance company know about the incident and provide them with all the evidence you’ve gathered. They’ll guide you through the claims process like a superhero sidekick.

-

Get compensated: If your claim is approved (fingers crossed!), your insurance company will cover damages up to your policy limits for bodily injury and property damage caused by that pesky uninsured driver.

Now that you understand how uninsured motorist claims work, let’s move on to ensuring adequate coverage limits and deductibles so you can sleep soundly at night knowing you’re protected against those sneaky drivers without insurance coverage.

Ensuring Adequate Coverage Limits and Deductibles

To ensure you have adequate coverage limits and deductibles, it’s important to review your insurance policy regularly. I know, reading through all that fine print can be about as exciting as watching paint dry. But trust me, it’s worth the effort to protect yourself from any unexpected financial surprises.

Let’s start with understanding deductibles. Think of it as the amount you have to pay out of pocket before your insurance kicks in. It’s like a mini obstacle course on the road to getting your claim approved. But don’t worry, once you reach that deductible finish line, your insurance will swoop in like a superhero and cover the rest.

Now, let’s talk about adequate coverage options. Picture this: You’re cruising down the highway when suddenly a rogue shopping cart appears out of nowhere and dents your car door. Without enough coverage, you’d be stuck paying for those repairs yourself. But with adequate coverage limits, you can breathe easy knowing that your insurance has got your back.

To make things easier for you visual learners out there (myself included), here’s a handy-dandy table to help illustrate the importance of reviewing and understanding your insurance policy:

| Inadequate Coverage | Adequate Coverage |

|---|---|

| Constant anxiety | Peace of mind |

| Sleepless nights | Restful sleep |

| Empty pockets | Financial security |

| Regret | Confidence |

Filing a Claim With Your Insurance Company

When filing a claim with your insurance company, it’s important to provide all the necessary documentation and information. Trust me, they won’t just take your word for it that you had an encounter with a rogue shopping cart in the grocery store parking lot.

So, here are some tips to make the filing process as smooth as freshly churned ice cream:

-

Be thorough: Gather all the evidence you can find. Take pictures of the damage, collect witness statements (if any), and keep any relevant receipts or repair estimates. Remember, more is always better when it comes to supporting your claim.

-

Fill out those forms: Don’t underestimate the power of paperwork! Fill out all the required claim forms accurately and double-check for any missing information. You don’t want to accidentally list ‘space alien’ as the cause of your fender bender.

-

Play detective: Investigate your policy thoroughly before submitting your claim. Familiarize yourself with its coverage limits, deductibles, and exclusions so that there are no surprises during the claim settlement process. Who knows? You might even discover some hidden benefits along the way!

-

Stay on top of things: Follow up regularly with your insurance company to ensure that everything is progressing smoothly. It’s like nurturing a delicate houseplant – give it too much attention, and you’ll drown it; neglect it too much, and it’ll wither away.

Legal Options for Recovering Damages

So, you’ve been in an accident and now you’re knee-deep in paperwork and insurance jargon. Don’t worry, we’ve got your back!

In this discussion, we’ll tackle three important topics:

- Insurance Coverage Requirements (yawn)

- Seeking Legal Representation (cue the dramatic music)

- Compensation for Medical Expenses (cha-ching!)

Get ready to navigate the legal waters with a smile on your face and a witty comeback at the ready.

Insurance Coverage Requirements

Insurance coverage requirements vary by state, and it’s important to understand the specific rules in your area. So buckle up, my friend, and let’s dive into the wild world of insurance! Here are four things you need to know:

-

Liability Insurance: This is like having a superhero sidekick that protects you if you cause an accident. It pays for the other person’s damages and medical bills.

-

Uninsured Motorist Coverage: Picture yourself as a ninja warrior equipped with this coverage. It kicks in when someone without insurance crashes into you. Trust me, you don’t want to be left high and dry.

-

Underinsured Motorist Coverage: Think of this as your trusty shield against drivers who have insurance but not enough to cover all the damages they’ve caused.

-

Consequences of Driving Without Insurance: Oh boy, this is like jumping off a cliff without a parachute! You could face hefty fines, license suspension, or even legal trouble.

Seeking Legal Representation

Hiring a lawyer can be crucial when dealing with legal matters related to accidents. Let’s face it, you’re not exactly Perry Mason over here. And when it comes to seeking compensation for your injuries or protecting your legal rights, you want someone who knows the ins and outs of the law better than Judge Judy.

A good lawyer can navigate through the maze of paperwork and negotiations faster than you can say objection! They’ll fight tooth and nail to make sure you get what you deserve, while you sit back and relax like a boss.

Compensation for Medical Expenses

When it comes to compensation for medical expenses, it’s important to understand your rights and options. So, let’s dive into the wild world of insurance claims and explore your fabulous choices:

-

The Negotiator: Channel your inner smooth talker and negotiate directly with the insurance company. Show them who’s boss and fight for that sweet compensation.

-

The Legal Eagle: If things get tricky, don’t be afraid to call in reinforcements. Seek legal representation from a badass attorney who knows their way around the insurance claim process.

-

The Document Wizard: Gather all your medical records, bills, and receipts like a pro magician pulling rabbits out of a hat. Organize everything neatly to strengthen your case.

-

The Time Traveller: Okay, maybe not an actual time traveller, but be prepared to wait patiently for resolution. Insurance claims can take time, so pack some snacks and settle in for the long haul.

Resources for Finding Legal Assistance

If you’re unsure of where to turn for legal assistance, don’t fret! There are online directories out there that can help you find experienced attorneys who won’t break the bank. Finding affordable lawyers doesn’t have to be a daunting task. Let me guide you through some free legal aid options that will save your wallet from taking a hit.

But before we dive in, let’s visualize our options with a nifty little table:

| Legal Aid Option | Pros | Cons |

|---|---|---|

| Pro Bono Services | Free of charge | Limited availability |

| Legal Clinics | Low-cost or sliding scale fees | Long wait times |

| Online Directories | Easy access to many attorneys | Can be overwhelming with so many choices |

Now, let’s unpack these options like a pro. Pro bono services are like finding a unicorn – they exist, but they’re hard to come by. While they offer free legal assistance, their availability may be limited due to high demand. So if you manage to snag one, consider yourself lucky!

Legal clinics are another great option for those on a budget. They usually offer low-cost or sliding scale fees based on your income level. However, be prepared for long wait times because everyone loves a good deal!

Finally, we have online directories at our fingertips. These digital wonders provide easy access to countless attorneys without even leaving your couch! Just make sure you do your homework and read reviews before committing.

Tips for Preventing Accidents With Uninsured Motorists

Before you hit the road, it’s important to be aware of potential dangers and take precautions to stay safe. When it comes to dealing with uninsured motorists, defensive driving is your best friend.

Here are some humorous and lighthearted tips to help you prevent accidents and protect yourself from these sneaky road warriors:

-

Keep your eyes peeled: Uninsured drivers can appear out of nowhere like a magician pulling a rabbit out of a hat. Stay alert and watch out for any signs of erratic behavior or questionable bumper stickers.

-

Maintain a safe distance: Give those uninsured motorists some extra breathing room on the road. You never know when they might decide that stop signs are mere suggestions or that turn signals are purely decorative.

-

Avoid confrontation: If you encounter an uninsured driver who seems as unpredictable as a squirrel on caffeine, don’t engage in any unnecessary back-and-forth banter or attempts at educating them about insurance policies.

-

Invest in comprehensive coverage: Protect yourself by making sure your own insurance policy includes coverage for accidents involving uninsured drivers. It may feel like wearing three seatbelts at once, but it’s better to be safe than sorry!

Frequently Asked Questions

What Are the Penalties for Driving Without Insurance?

Driving without insurance can lead to serious consequences. If you get caught, expect hefty fines and penalties. It’s like playing a risky game of hide and seek with the law. Don’t take chances, protect yourself!

Can Uninsured Motorist Coverage Be Used for Hit-And-Run Accidents?

Hit and run incidents: How uninsured motorist coverage can help. You’ll be relieved to know that if you’re a victim of a hit and run, your uninsured motorist coverage can come to the rescue. But there are limitations, so don’t rely on it completely!

How Can I Ensure That My Uninsured Motorist Coverage Limits Are Adequate?

To ensure your uninsured motorist coverage limits are adequate, start by determining how much protection you need. Evaluate insurance policies carefully, comparing prices and benefits. Don’t let the hidden risks catch you off guard!

What Steps Should I Take After an Accident With an Uninsured Motorist?

After a collision with an uninsured driver, take these steps to protect yourself: gather evidence like a detective, then file a claim with your insurance company. It’s like playing Sherlock Holmes, but without the fancy hat.

What Legal Options Are Available for Recovering Damages From an Uninsured Motorist?

Well, if you find yourself in a pickle with an uninsured motorist, don’t fret! You have legal options to recover damages. First and foremost, check your uninsured motorist coverage. It could save the day!

Conclusion

So, now you know all about the risks and repercussions of driving without insurance. It’s like playing a game of Russian roulette with your bank account!

But fear not, my friend, for there is a way to protect yourself from these uninsured bandits lurking on the roads. Uninsured motorist coverage is your knight in shining armor, ready to swoop in and save the day.

So don’t be a fool, get that coverage and rest easy knowing that you’re covered in case one of those sneaky drivers crosses your path.

Stay safe out there!