Did you know that adding bonds to your stock-dominated portfolio can actually increase your chances of financial success? It’s true! Bonds provide a stable and reliable source of income, while also reducing the overall risk in your investment strategy.

So if you’re looking to diversify, hedge against market volatility, and balance risk with return, incorporating bonds into your portfolio is a smart move. In this article, we’ll explore the fascinating world of bonds and uncover their hidden benefits for mastering the art of investing.

Key Takeaways

- Bonds provide stability and act as a cushion during turbulent times.

- Including bonds in a stock-dominated portfolio spreads out risk across different asset classes, adding layers of protection.

- Bonds offer dependable returns and lower volatility compared to stocks, cushioning the portfolio from extreme fluctuations.

- Including bonds in the portfolio helps spread out risk and protect against potential threats.

The Basics of Bonds

Bonds are a popular investment choice for individuals looking to diversify their stock-dominated portfolios. Now, let’s dive into the whimsical world of bond investing!

Picture this: you’re walking through a mystical forest where bonds grow on trees. Each bond is like a magical leaf that can bring stability and balance to your portfolio.

But how do you know which bonds to pick? Well, my dear master of investments, it all comes down to two important concepts: bond pricing and bond yield.

Bond pricing is like the face value of a magical potion – it tells you how much the bond will pay you back when it matures. The higher the price, the lower the return. It’s like finding an enchanted treasure chest – sometimes you strike gold, other times it’s just a bunch of old socks.

On the other hand, bond yield is like the potency of that potion. It shows you how much interest or income your bond will generate each year as a percentage of its price. Higher yields mean more power in your portfolio! Just imagine wielding a wand that can multiply your money while you sleep.

Now that we’ve uncovered these secrets of the forest, let’s take our newfound knowledge and venture forth into understanding stock-dominated portfolios. Don’t worry; we’ll navigate those treacherous stock market waters with ease now that we have our trusty bonds by our side.

Understanding Stock-Dominated Portfolios

Although stocks are the primary focus, it is important to understand the composition of a stock-dominated portfolio. After all, you wouldn’t want your portfolio to be as lopsided as a one-legged flamingo on an ice-skating rink! So, let’s dive into the world of stock-dominated portfolios and unravel their secrets.

-

Maintaining the Balance: Picture yourself walking on a tightrope above a sea of financial uncertainty. Just like how you need balance and agility to stay on that rope, a stock-dominated portfolio needs careful balancing too. It requires diversification across different sectors and asset classes to mitigate risks and increase the chances of success.

-

Riding the Rollercoaster: Investing in stocks can feel like riding a rollercoaster with both thrilling highs and stomach-churning lows. But fear not, my friend! A stock-dominated portfolio allows you to ride these waves of market volatility with optimism and patience. Keep calm, hold onto your metaphorical safety bar, and remember that over time, history has shown us that stocks tend to outperform other asset classes.

-

Adapting with Strategies: Just like chameleons change colors depending on their surroundings, successful investors adapt their strategies based on stock market performance. They blend growth stocks for potential capital appreciation with value stocks for stability and income generation. They also keep an eye on emerging markets or sectors that show promising growth potential.

Diversification Benefits of Bonds

When it comes to diversifying your investments, you’ll be pleased to discover the benefits that bonds bring to the table. Picture this: you’re at a lavish dinner party with a wide array of delectable dishes spread before you. You’ve got your succulent stocks and your tantalizing treasury bills, but there’s something missing from this feast of financial cuisine. Enter the bond, stage left.

Bonds have long been hailed as the knight in shining armor when it comes to diversification benefits and risk management. Just like adding a dash of seasoning to a dish, bonds add flavor and balance to your investment portfolio. They provide stability and act as a cushion during turbulent times in the market.

Think of bonds as the calm and collected counterpart to their wilder stock siblings. When stocks are bouncing up and down like kangaroos on trampolines, bonds remain steady as an oak tree swaying gently in the breeze.

By including bonds in your investment mix, you can protect yourself from dramatic losses if one asset class takes a tumble. It’s like having an umbrella handy when unexpected rain clouds roll in – it keeps you dry even when everything else is getting wet.

Historical Performance of Bonds

So you’re curious about the performance of bonds compared to stocks, huh? Well, let me tell you a little something.

Bonds may not be as flashy as stocks, but they’ve got some tricks up their sleeves. Not only do they provide diversification benefits in a stock-dominated portfolio, but they also have a history of holding their ground when stocks go on roller coaster rides.

It’s like having a reliable friend who always keeps your investments in check while the stock market throws tantrums.

Bond Vs. Stock Returns

Investors may find that bond returns are lower compared to stock returns in a stock-dominated portfolio. But fear not, dear investor, for there is much more to this tale of bonds versus stocks! Let us embark on an adventure through the whimsical world of financial mastery.

-

Bonds: The Steady Sailors �

Bonds may not offer the dazzling highs of the stock market, but they provide stability and tranquility amidst stormy economic seas. Their predictable performance can be like a warm cup of tea on a rainy day – comforting and soothing. -

Stocks: The Wild Wanderers �️

Ah, stocks! These wild wanderers dance with volatility and flirt with risk. Their returns can soar to great heights or plummet into deep valleys. Every day is an adrenaline-fueled rollercoaster ride that keeps you on your toes! -

Finding Balance: Yin and Yang ☯️

In a stock-dominated portfolio, bonds act as the calming yin to the fiery yang of stocks. They provide diversification, reducing overall risk while still offering some growth potential. It’s all about finding that perfect harmony between stability and excitement!

Diversification Benefits of Bonds

In a well-balanced investment strategy, adding bonds to the mix can provide diversification benefits and reduce overall risk.

Picture this: your investment portfolio is like a colorful garden, bursting with different types of flowers. Each flower represents an asset class, and just like in a garden, you wouldn’t want all your flowers to be the same type or color.

That’s where bonds come in! Bonds bring diversity and balance to your portfolio, acting as the calming presence amidst the volatility of stocks. They offer stability and steady income streams that can help mitigate risks during market downturns.

Bonds are like the reliable friend who always has your back when things get rough. So why not invite them into your investment garden? Let them work their magic and watch as your portfolio flourishes with diversification advantages and risk mitigation!

Bonds as a Hedge Against Stock Market Volatility

Hey there, fellow investor! Let’s delve into the exciting world of bonds and discover how they can help you navigate the wild rollercoaster ride of the stock market.

First up, we have volatility reduction with bonds. These trusty assets can provide a much-needed stabilizing force when stocks start to go bonkers.

Next on our agenda is the diversification benefits from bonds. Think of them as your sidekick that adds some flavor to your investment mix and helps spread out the risk.

Last but certainly not least, we’ll explore how bonds can be a superhero when it comes to risk management. They swoop in to save the day by providing a cushion against potential losses in your portfolio.

Volatility Reduction With Bonds

One way to reduce volatility in a stock-dominated portfolio is by including bonds. Bonds can be your knight in shining armor, protecting you from the whims and fancies of the stock market. Here are three magical benefits that bonds bring to your portfolio:

-

Stability: Like a steady ship sailing through turbulent waters, bonds provide stability when stocks go haywire. They offer predictable interest payments and return of principal, keeping your heart rate at a comfortable pace.

-

Diversification: Picture a colorful bouquet of flowers – each bond adds its unique fragrance to your portfolio, diversifying it beyond just stocks. This helps spread the risk like fairy dust, ensuring no single investment dominates your dreams.

-

Income Generation: Bonds are like little money-making elves working tirelessly for you behind the scenes. With their regular interest payments, they can provide a consistent stream of income even when stocks are dancing chaotically.

Diversification Benefits From Bonds

Imagine the fragrance of a colorful bouquet as you add diverse bonds to your investment mix, spreading risk and protecting against stock market volatility.

Ah, the wonders of diversification benefits! Like a magician’s trick, bonds can help manage risk in your portfolio and keep those pesky market fluctuations at bay.

They come in all shapes and sizes, just like the different flowers in that dreamy bouquet. Some bonds are government-issued, while others are corporate or municipal. Each one brings its own unique scent to the table, offering stability and income potential.

By including these various bonds in your investment mix, you create a harmonious symphony of financial security.

Risk Management Through Bonds

Hey there, master of bonds! Now that we’ve explored the magical world of diversification benefits from bonds, it’s time to dive into the next enchanting topic: risk management through bonds. Brace yourself for an adventure!

-

Interest Rate Risk: Picture this – your bond is like a delicate flower in a storm. Changes in interest rates can cause its value to flutter and sway. But fear not! By understanding interest rate risk, you can protect yourself from unexpected surprises.

-

Bond Duration: Imagine your bond as a graceful dancer on a tightrope. Its duration determines how long it will take to recoup its initial investment through coupon payments and principal repayment. Knowing this can help you assess potential risks and rewards.

-

Peace of Mind: Ahh, the sweet serenity of knowing you’ve managed your risk well with bonds in your portfolio. It’s like having a trusty shield against market turbulence, keeping your investments safe and sound.

Role of Bonds in Risk Management

If you’re looking to manage risk in your stock-dominated portfolio, bonds can play a crucial role.

Picture this: you’re standing on a tightrope, balancing your investments precariously on either side. On one end, you have the wild and unpredictable world of stocks, where fortunes can be made or lost with a flicker of news. On the other end, there’s the steady and reliable realm of bonds, offering stability and safety like an old friend.

When it comes to asset allocation, bonds are like the calm anchor amidst the stormy sea of stocks. They provide balance and diversification to your portfolio, ensuring that if one investment falters, another will step in to save the day. It’s like having a trusty sidekick who always has your back – even when things get rough.

The importance of risk diversification cannot be overstated in the world of investing. By including bonds in your portfolio, you spread out your risk across different asset classes. Think of it as building a castle with multiple layers of defense – each layer adds an extra level of protection against potential threats.

Bonds offer stability not only through their dependable returns but also through their lower volatility compared to stocks. They act as a buffer when market turbulence strikes – cushioning your portfolio from extreme fluctuations and helping you sleep more soundly at night.

Impact of Interest Rates on Bond Investments

Hey there, curious investor!

Let’s dive into the fascinating world of interest rate fluctuations and how they can impact your bond investments.

Prepare to be enchanted as we explore the magical dance between interest rates and bond prices, and discover some whimsical strategies that can help you navigate this ever-changing landscape.

Interest Rate Fluctuations

Interest rate fluctuations can significantly impact the performance of bonds in a stock-dominated portfolio. It’s like riding a roller coaster with your money, except instead of screaming and throwing your hands up in the air, you’re watching numbers on a screen go up and down. So buckle up and get ready for the wild ride!

Here are three ways interest rate fluctuations can make your heart skip a beat:

-

Interest Rate Risk: When rates rise, bond prices fall. It’s like seeing your favorite dessert suddenly double in price – you just can’t afford it anymore!

-

Bond Market Dynamics: The bond market is like a bustling marketplace where buyers and sellers interact. Fluctuating interest rates can cause turbulence in this market, making it difficult to find good deals.

-

Timing is Everything: Trying to predict interest rate movements is as tricky as trying to catch a falling star. One wrong move and you could miss out on potential gains or end up with losses.

Bond Investment Strategies

When it comes to bond investment strategies, diversification is key.

You see, dear investor, just like having a variety of ice cream flavors in your freezer brings joy to your taste buds, having a diversified bond portfolio brings stability and peace of mind to your investment journey.

Bond selection is an art, my friend. It’s about finding the perfect balance between risk and reward.

Stay up-to-date with bond market trends, for they can guide you towards opportunities or warn you of potential pitfalls.

Remember, investing in bonds is like dancing the waltz – it requires grace and rhythm.

Different Types of Bonds to Consider

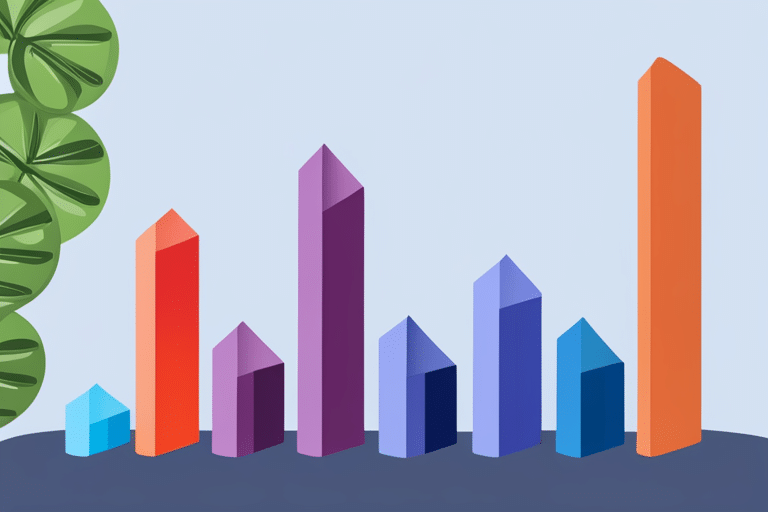

You should consider adding different types of bonds to your stock-dominated portfolio. Why, you may ask? Well, my curious friend, let me enlighten you with a list of three delightful advantages of bond diversification:

1) Stability in the Storm: Picture this – a storm is raging in the financial markets, causing stocks to tumble and investors to panic. Ah, but fear not! By including different types of bonds in your portfolio, you can create a sturdy shelter amidst the chaos. Bonds have a reputation for being more stable than their stock counterparts, providing a soothing sense of security when the tempests are brewing.

2) Dancing with Diversity: Variety is indeed the spice of life, and it holds true for investment portfolios too! Just like a well-balanced meal satisfies your taste buds, diversifying your bonds can tantalize your financial senses. With different types of bonds such as government bonds, corporate bonds, or municipal bonds swaying harmoniously together, you get to enjoy a diverse array of income streams and potential returns.

3) Playing Hide-and-Seek with Risk: Oh joy! By adding various types of bonds to your portfolio mix, you can play an exciting game called risk mitigation. Bonds often behave differently from stocks during market fluctuations; sometimes they even move in opposite directions (how cheeky!). This lovely dance helps reduce the overall risk exposure within your portfolio.

Now that we’ve explored these enchanting advantages of bond diversification together, let’s take a gentle step into the next section about ‘bond market vs. stock market: a comparison’. So grab hold of that whimsical umbrella and let’s continue our journey through the magical world of investment knowledge!

Bond Market Vs. Stock Market: a Comparison

So you’ve learned about the different types of bonds and now it’s time to compare the bond market with the stock market. It’s like comparing apples to oranges, but hey, who doesn’t love a good fruit salad?

Let’s start with bond market efficiency. You see, in the land of bonds, things tend to be a bit more predictable. Bond prices are influenced by interest rates and credit ratings. This means that when interest rates go down, bond prices go up (and vice versa). It’s like playing a game of ‘Simon Says’ – you know what move to make next.

On the other hand, we have the stock market volatility. Oh boy, strap on your seatbelts because things can get wild! Stock prices can swing up and down like a monkey on a trapeze. One minute you’re riding high on a wave of profits, and the next minute you’re gripping onto your portfolio for dear life.

But fear not! Bonds are here to save the day (or at least help stabilize your investment portfolio). When stocks are bouncing around like kangaroos on spring break, bonds provide a nice cushion of stability. They act as an anchor in stormy seas or an oasis in a desert filled with crazy stock swings.

Balancing Risk and Return With Bonds

To achieve a balance between risk and return, it’s important to consider the stability and predictability that bonds can bring to your investment strategy. Bonds are like little anchors in your portfolio, keeping you steady when the stock market gets a little too wild. So let’s dive into the magical world of bonds and discover how they can help you sail through the stormy seas of investment.

-

Peace of Mind: Picture this – you’re sitting on a sandy beach, sipping a piña colada, with not a care in the world. That’s what bonds can do for you! They provide stability and predictability, giving you peace of mind even when stocks are going crazy.

-

Diversification Dance: Think of your investment portfolio as a dance party. You don’t want everyone doing the same moves; it would be boring! Bonds add some fancy footwork to your routine by diversifying your investments. They twirl around with stocks and other assets, reducing risk while still keeping things exciting.

-

Reliable Returns: Imagine waking up every day to find money magically appearing in your bank account – that’s what bond returns can feel like! Unlike stocks that go up and down like roller coasters, bonds offer consistent income through interest payments or coupon payments.

Bonds for Income Generation in a Portfolio

Imagine waking up every day to find your bank account growing, thanks to the steady income generated by incorporating bonds into your investment strategy. It’s like having a magical money tree that never stops giving! Bonds are not only a great way to diversify your portfolio but also provide a reliable source of income. They are like the responsible older sibling in the investing world, always there to support you when stocks get too rowdy.

When it comes to income generation, bonds are the unsung heroes. They offer regular interest payments, just like receiving allowance from a generous aunt or uncle. These payments can be reinvested or used as extra cash flow for those little luxuries in life (hello, fancy coffee!). With bonds in your arsenal, you can sleep soundly knowing that even if stock prices fluctuate wildly, you’ll still have a stable source of income.

But wait, there’s more! Bonds also play an important role in portfolio diversification. Think of them as the cool sidekick who complements your flashy stock investments. By adding bonds to your mix, you reduce the overall risk of your portfolio because they tend to move differently than stocks. It’s like balancing on a tightrope with an umbrella for extra stability – you’re less likely to fall if one element wobbles.

Strategies for Incorporating Bonds Into a Stock-Dominated Portfolio

When incorporating bonds into a portfolio heavily focused on stocks, there are several strategies that can be employed. Here are three whimsical approaches to help you master the art of bond allocation and bond selection:

-

The ‘Balancing Act’ Strategy: Imagine your stock-dominated portfolio as a circus performer on a tightrope, juggling different investments with grace and finesse. In this strategy, you allocate a certain percentage of your portfolio to bonds based on your risk tolerance and financial goals. By adding bonds, you create stability and reduce volatility in your overall performance, like the trusty balancing pole that keeps our acrobat from tumbling down.

-

The ‘Yin-Yang’ Strategy: Picture your portfolio as a harmonious dance between stocks and bonds – two opposing forces interwoven in perfect balance. With this strategy, you adjust your bond allocation based on market conditions and economic outlooks. When stocks are soaring high like kites in the wind, you may decrease your bond allocation to seize growth opportunities. Conversely, when storms approach the market landscape, increasing your bond allocation acts as an umbrella shielding you from potential losses.

-

The ‘Bond Whisperer’ Strategy: Embrace your inner investment psychic by selecting individual bonds that align with your financial aspirations and values. Just like whispering sweet nothings to a horse calms it down, carefully choosing specific types of bonds can provide comfort to even the most skeptical investor. Whether it’s government bonds for stability or corporate bonds for higher yields, becoming a bonafide bond whisperer allows you to handpick investments tailored to suit both risk appetite and personal beliefs.

Long-Term Benefits of Including Bonds in a Portfolio

Including bonds in your investment mix provides stability and diversification, helping to mitigate risk and potentially increase long-term returns. Bonds are like the calm and collected friend in your group who always knows how to keep things balanced. They may not be as flashy as stocks, but they have their own unique charm.

One of the key benefits of bond diversification is that it acts as a capital preservation tool. Imagine you’re on a roller coaster ride with stocks, experiencing all the highs and lows. Now imagine that there’s a soft cushion waiting for you at the end of each drop – that’s what bonds can do for your portfolio. They provide a safety net when stock markets take a nosedive, helping to preserve your hard-earned capital.

But bonds don’t just sit there idly, waiting for trouble to strike. Oh no! They also work behind the scenes to reduce volatility and smooth out any rough patches in your investment journey. Think of them as the conductor of an orchestra, harmonizing all the different instruments together.

By adding bonds to your portfolio, you create a beautiful symphony of investments that can weather storms while still providing opportunities for growth. Bonds offer stability when stock markets go haywire, allowing you to sleep soundly at night knowing that your money is safe.

Frequently Asked Questions

What Are Some Common Risks Associated With Bond Investments?

When it comes to bond investments, there are a couple of common risks you should be aware of. Interest rate risk and credit risk can both have an impact on the value of your bonds. So stay vigilant!

How Do Bond Ratings Affect the Value and Risk of a Bond?

Bond ratings can greatly impact the value and risk of a bond. They provide a helpful assessment of bond risk, ensuring you make informed decisions. So pay attention to those ratings, my friend!

Can Bonds Provide a Stable Income Stream in a Stock-Dominated Portfolio?

Yes, bonds can provide a stable income stream in a stock-dominated portfolio. They offer diversification benefits and act as a cushion against market volatility. So, go ahead and add some stability to your investment mix!

Are There Any Tax Advantages to Investing in Bonds?

Did you know that investing in bonds can offer some sweet tax advantages? Not only do they provide a stable income stream, but Uncle Sam might just give you a little break too!

How Do Bond Mutual Funds Differ From Individual Bond Investments?

When it comes to bond investments, there’s a choice between bond mutual funds and individual bonds. Bond mutual funds offer diversification and professional management, while individual bonds give you more control. It’s like choosing between a team of experts or going solo!

Conclusion

So there you have it, my friend! Bonds may seem like the shy cousins in a stock-dominated portfolio, but they play a crucial role.

They bring balance and stability to your investment journey, like a trusty sidekick guiding you through the ups and downs of the market.

With their diversification benefits and ability to act as a hedge against volatility, bonds add that extra layer of protection to keep your portfolio sailing smoothly.

So embrace these financial superheroes and let them work their magic in your investment world!