Are you ready to make your golden years truly shine?

In this article, we’ll reveal the top tips for seamless retirement planning that will help you navigate this exciting phase of life with ease.

Evaluating your financial situation, setting retirement goals, and creating a budget are just a few steps to get started.

With our guidance, you’ll maximize your savings, explore investment options, and develop a long-term care plan.

Get ready to embark on this journey towards a fulfilling and active lifestyle!

Key Takeaways

- Gather all financial documents and assess retirement income sources.

- Envision the lifestyle you desire during retirement and set tangible goals based on your financial needs.

- Create a budget for retirement and allocate funds specifically for building up a retirement nest egg.

- Develop a long-term care plan, explore investment options, and diversify investments to protect against market fluctuations.

Evaluating Your Financial Situation

Before you can begin retirement planning, it’s important to start by evaluating your current financial situation.

Picture this: you’re sitting on a cozy couch surrounded by stacks of colorful bills and an abacus in hand. Okay, maybe not the abacus part, but evaluating your retirement readiness is crucial for a smooth transition into those golden years.

First things first, let’s assess where you stand financially. Take a deep breath and gather all your financial documents – bank statements, investment portfolios and that dusty piggy bank hidden somewhere in the attic. Pour yourself a cup of coffee, put on some relaxing tunes, and dive into the exciting world of number crunching.

Now that you have everything laid out before you, let’s take stock of your retirement income sources. Will Social Security be enough to cover your expenses? What about any pensions or annuities? Don’t forget to account for any additional income streams like rental properties or part-time jobs during retirement. Remember, this is your time to shine!

As you evaluate your financial situation, keep in mind that retirement planning is not just about numbers; it’s about envisioning the life you want to live after leaving the workforce. Will you be traveling the world or indulging in hobbies? Perhaps starting a second career or volunteering for causes close to your heart? Whatever it may be, make sure your finances align with these dreams.

Setting Retirement Goals

When it comes to setting retirement goals, you’ll want to make sure they align with your desired lifestyle and financial needs. After all, your golden years should be just that – golden! So let’s dive into the world of retirement dreams and aspirations.

First things first, it’s important to understand what kind of lifestyle you envision for yourself during those well-deserved days of relaxation. Do you see yourself traveling the globe or enjoying a quiet life in the countryside? Maybe you have a passion project in mind, like opening up a cozy bookstore or starting a nonprofit organization. Whatever your vision may be, take some time to really think about what brings you joy and fulfillment.

Once you have a clear picture of your dream retirement lifestyle, it’s time to set some tangible goals. This is where retirement savings targets come into play. Think about how much money you’ll need to support your desired lifestyle – from daily living expenses to any big-ticket items or experiences on your bucket list. Consider factors like inflation and healthcare costs as well.

Now that you have an idea of what you’re aiming for financially, it’s time to create a budget for retirement. This will help ensure that you stay on track with saving and spending once the time comes. In the next section, we’ll explore practical strategies for creating a budget that works for you.

Creating a Budget for Retirement

To create a budget for retirement, start by assessing your current expenses and income to determine how much you can allocate towards savings.

Retirement is like embarking on an exciting adventure—a journey to a land of relaxation, exploration, and endless cups of tea. But to make this dream a reality, you need to ensure that your finances are as sturdy as the ship that will carry you through these golden years.

First things first, let’s take a look at your income. What sources do you have? Social security benefits? Pension plans? Investments? Calculate the total amount flowing into your treasure chest each month.

Now it’s time for expense management—how much booty are you spending each month? Be honest with yourself about where your coins are going: entertainment, dining out, travel escapades?

Once you’ve gathered all this information, it’s time to chart your course towards financial stability in retirement. Start by trimming unnecessary expenses from your list. Do you really need those gold-plated socks or diamond-studded dog collars? Probably not.

Next comes the fun part—allocating funds towards savings! Set aside a portion of your retirement income specifically for building up a nest egg. This way, when stormy weather strikes or unexpected expenses arise (like accidentally hiring pirates instead of plumbers), you’ll be prepared.

Maximizing Your Retirement Savings

It’s important to explore various strategies for maximizing your retirement savings. After all, you want those golden years to shine as bright as possible! So let’s dive into some creative and imaginative ways to make the most of your retirement investment.

First off, have you considered automating your savings? By setting up automatic transfers from your checking account to a retirement savings account, you can ensure that a portion of your paycheck is put away before you even have a chance to spend it on those tempting impulse buys. It’s like having a personal assistant who knows exactly how much you need for your future.

Another strategy to consider is diversifying your investments. While it may be tempting to put all your eggs in one basket, spreading out your investments across different asset classes can help protect against market fluctuations and potential losses. Think of it as creating a retirement portfolio that’s as diverse and exciting as an art collection!

And don’t forget about taking advantage of any employer matching programs. If your company offers a matching contribution to your retirement savings plan, make sure you’re contributing enough to maximize their match. It’s like getting free money towards building that nest egg!

Now that we’ve explored some strategies for maximizing your retirement savings, let’s move on to exploring investment options. Because once you have the funds set aside, it’s time to start thinking about how best to grow them over time.

Exploring Investment Options

If you’re ready to explore investment options, consider researching different asset classes that align with your risk tolerance and financial goals. Retirement is on the horizon, and it’s time to make your money work harder for you.

But where do you start? Well, fear not! We’re here to guide you through the exciting world of investment strategies and risk assessment.

First things first, let’s talk about investment strategies. These are like roadmaps that lead you towards your financial goals. There are various approaches to choose from, each with its own advantages and disadvantages. You could opt for a conservative strategy that focuses on preserving your capital or go all-in with an aggressive approach that aims for high returns but comes with increased risks. Whatever path you choose, remember to diversify your investments across different asset classes such as stocks, bonds, real estate, or even commodities like gold.

Speaking of risks, assessing them is crucial in making informed investment decisions. It’s like playing chess – anticipate the moves before they happen! Take a good look at your risk tolerance – how comfortable are you with potential losses? Are you willing to take some calculated risks for potentially higher returns? Understanding your risk appetite will help you determine which asset classes suit you best.

Understanding Social Security Benefits

Understanding Social Security benefits is essential for securing your financial future, so let’s delve into the details and explore how this program can provide you with a stable income during retirement.

You might be wondering if you are eligible to receive these benefits. Well, good news! Almost everyone who has worked and paid Social Security taxes is eligible. Whether you’ve been employed in the traditional workforce or have been self-employed, as long as you’ve contributed to the system, you’re likely eligible.

Now that we know eligibility isn’t an issue, let’s talk about how your benefit amount is calculated. The Social Security Administration uses a formula that takes into account your average earnings over your working years. They adjust these earnings for inflation and calculate what they call your Primary Insurance Amount (PIA). Your PIA determines the monthly benefit you’ll receive once you start claiming.

But wait, there’s more! If you want to maximize your benefits and ensure a comfortable retirement lifestyle, it’s crucial to understand how timing affects your payments. You can begin claiming as early as age 62 but keep in mind that starting early will reduce your monthly benefit amount. On the other hand, if you delay claiming until after your full retirement age (which varies based on when you were born), your monthly benefit will increase by a certain percentage each year until age 70.

Considering Healthcare and Insurance

So, you’ve got your retirement all planned out and now it’s time to dive into the world of healthcare and insurance. Don’t worry, we’re here to guide you through the maze of options!

From health coverage choices that suit your needs, to the eternal battle between Medicare and private plans, and even the importance of long-term care insurance – we’ve got you covered (pun intended).

Let’s embark on this adventure together and make sure you’re well-equipped for whatever comes your way in the realm of healthcare.

Health Coverage Options

Medicare is a popular health coverage option for retirees. But did you know there are other ways to keep those retirement healthcare costs in check?

One option to consider is opening a health savings account (HSA). Picture this: your golden years gleaming with the satisfaction of having an account specifically dedicated to covering medical expenses.

With an HSA, you can contribute pre-tax dollars and watch them grow tax-free. It’s like planting seeds of financial security that sprout into peace of mind. Plus, any unused funds roll over year after year, so you can save up for those unexpected health hiccups.

Medicare Vs. Private Plans

Did you know there are alternatives to Medicare that offer different coverage options? It’s true! When it comes to health coverage, you have choices beyond the traditional Medicare plan.

Here are a few things to consider:

- Public vs. Private Hospitals:

- Public hospitals: These are funded by the government and provide healthcare services at a lower cost.

-

Private hospitals: These are privately owned and offer more amenities and personalized care, but can be pricier.

-

Traditional vs. Alternative Medicine:

- Traditional medicine: This is the conventional approach to healthcare, using medications and surgery.

- Alternative medicine: This includes practices like acupuncture, herbal remedies, and yoga, focusing on natural healing methods.

So whether you prefer the affordability of public hospitals or the luxury of private ones, or if you’re interested in exploring alternative medicine alongside traditional treatments, there’s a health coverage option out there for you.

Take charge of your retirement planning by knowing all your choices!

Long-Term Care Insurance

Long-term care insurance provides coverage for services like nursing home care, assisted living, and in-home assistance. It’s like a safety net for your golden years, giving you peace of mind knowing that you’ll be taken care of when the time comes. But let’s face it, long-term care costs can be overwhelming. That’s why it’s essential to plan ahead and consider your options.

To help you understand the potential expenses associated with long-term care facilities, here’s a handy table:

| Long-Term Care Facility | Average Cost per Month |

|---|---|

| Nursing Home | $8,000 |

| Assisted Living | $4,500 |

| In-Home Assistance | $4,000 |

Developing a Long-Term Care Plan

So, you’re ready to dive into the nitty-gritty of developing a long-term care plan?

Well, buckle up because we’ve got some exciting topics to cover!

First up, let’s explore cost-effective care options that won’t break the bank but still provide top-notch care.

And don’t worry, we won’t leave your family out of the equation – we’ll also discuss how to involve them in the planning process for a truly collaborative and supportive approach.

Get ready for some serious brainstorming!

Cost-Effective Care Options

You’ll want to explore cost-effective care options that will help you maintain a comfortable and financially secure retirement. Retirement is the time to relax, enjoy life, and not worry about expenses.

Here are some strategies to save costs and find affordable housing options:

-

Downsizing: Consider moving to a smaller home or downsizing your current one. This can help reduce mortgage payments, property taxes, and maintenance costs.

-

Senior living communities: These communities offer a range of services tailored for retirees. They often provide amenities like housekeeping, meals, transportation, and healthcare assistance.

-

Independent living: Ideal for active individuals who want minimal assistance with daily activities.

-

Assisted living: Provides more support with personal care tasks while still promoting independence.

By implementing these cost-saving strategies and exploring affordable housing options like senior living communities, you can ensure a smooth transition into retirement without compromising on comfort or financial security.

Your golden years await!

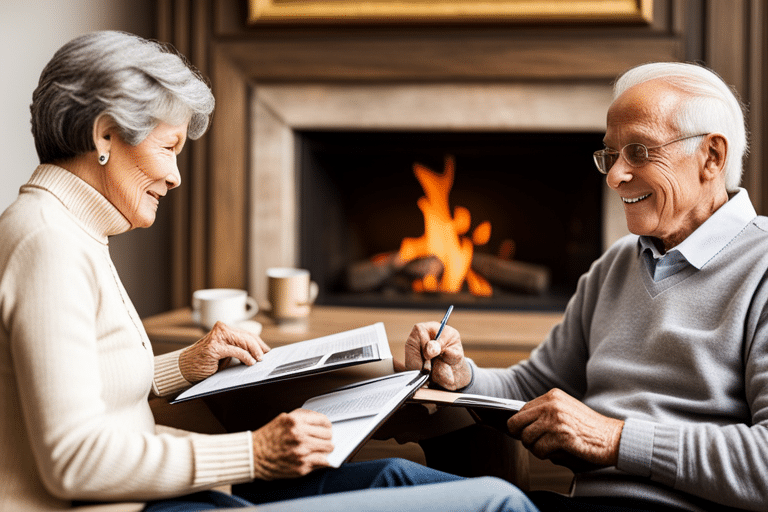

Family Involvement in Planning

When involving your family in planning, it’s important to consider their input and discuss their expectations for your retirement. After all, retirement isn’t just about you; it’s a time for the whole family to come together and celebrate the golden years.

So gather everyone around the table, pop open a bottle of bubbly (non-alcoholic if you prefer), and let the intergenerational conversations flow! Ask your kids what they envision for your retirement – maybe they want to take you on exotic vacations or plan epic family reunions. And don’t forget about the grandkids! They have wild imaginations and might have some quirky ideas that could add a touch of whimsy to your retirement plans.

Estate Planning and Asset Protection

Take a moment to consider how estate planning and asset protection can secure your financial future during retirement. It may not be the most exciting topic, but it’s essential for ensuring that all your hard-earned money doesn’t slip through your fingers like sand at the beach. Let’s dive into some tips and tricks to help you navigate the world of inheritance planning and wealth preservation:

-

Create a comprehensive estate plan: This involves drafting a will, establishing trusts, and designating beneficiaries for your assets. By having a clear plan in place, you’ll have peace of mind knowing that your loved ones will be taken care of after you’re gone.

-

Consult with professionals: Seek guidance from experienced estate planners or attorneys who specialize in this area. They can help you navigate complex legalities and ensure that your wishes are carried out accurately.

-

Consider tax implications: Estate taxes can significantly impact the value of an inheritance. Look into strategies like gifting assets during your lifetime or setting up charitable trusts to minimize tax burdens on both you and your beneficiaries.

-

Protecting your assets: As retirement approaches, safeguarding what you’ve accumulated becomes crucial. Here are some ways to do it:

-

Insurance coverage: Make sure you have adequate coverage for health, long-term care, property, and liability insurance. It’ll save you from unexpected financial setbacks down the road.

-

Asset diversification: Don’t put all your eggs in one basket—diversify investments across various asset classes like stocks, bonds, real estate, or even alternative investments such as artwork or collectibles.

Transitioning Into Retirement

So you’ve finally reached retirement, and now it’s time to kick back, relax, and enjoy the fruits of your labor.

But wait! Before you start planning that around-the-world cruise or take up knitting as a new hobby, there are a few key points to consider.

First off, let’s talk about financial stability after retirement – because no one wants to be eating ramen noodles for every meal.

Next up is health and wellness – because what good is all that free time if you’re not feeling your best?

And last but certainly not least, finding purpose and fulfillment – because retirement shouldn’t just be about lounging on a beach somewhere (although that does sound pretty nice).

Let’s dive in and explore these topics together!

Financial Stability After Retirement

Ensure you have enough savings to maintain financial stability after retirement by creating a detailed budget and sticking to it. Here are some tips to help you evaluate your retirement income and implement effective savings strategies:

- Explore different sources of retirement income:

- Assess your pension plans, Social Security benefits, and any other employer-sponsored plans.

-

Consider additional sources like investments, annuities, or rental properties.

-

Develop a comprehensive retirement savings strategy:

- Set clear goals for how much you want to save before retiring.

- Determine the best investment options based on your risk tolerance and timeline.

By carefully evaluating your retirement income options and implementing sound savings strategies, you can ensure a financially stable future.

Now that your finances are in order, let’s move on to the next section about health and wellness. Remember, taking care of yourself is just as important as managing your money!

Health and Wellness

Now that you have your finances in order, let’s focus on taking care of yourself and prioritizing your health and wellness.

You’ve worked hard all these years, and it’s time to enjoy the golden years with a healthy body and mind.

When it comes to healthcare options, explore what suits you best. Look into Medicare plans that offer comprehensive coverage for your medical needs.

Don’t forget to schedule regular check-ups, screenings, and vaccinations to ensure early detection of any potential health issues.

Embrace healthy aging by staying active through hobbies or exercise routines tailored to your abilities.

Maintain a balanced diet filled with nutritious foods that will fuel your body for optimal function.

Remember, self-care is essential at this stage of life, so take time for relaxation and indulge in activities that bring you joy.

Your wellbeing matters as much as financial stability during retirement!

Finding Purpose and Fulfillment

Finding purpose and fulfillment in retirement can be achieved by exploring new hobbies, volunteering, or pursuing lifelong passions.

Retirement is not just about kicking back and relaxing; it’s a time to discover new avenues that bring joy and satisfaction to your life. Here are some ideas to get you started on your purposeful retirement journey:

- Explore New Hobbies:

- Take up painting or pottery classes

-

Learn a musical instrument

-

Volunteer Opportunities:

- Help out at a local animal shelter

- Mentor young individuals in your community

By engaging in these activities, you not only fill your days with meaningful experiences but also create connections with others who share similar interests. These pursuits will give you a sense of accomplishment and contribute positively to society.

Now that you have found ways to find purpose and fulfillment in retirement, let’s shift our focus to maintaining a fulfilling and active lifestyle as we delve into the next section.

Maintaining a Fulfilling and Active Lifestyle

Don’t let retirement slow you down – keep up an active and fulfilling lifestyle! Retirement is a new chapter in your life, filled with endless possibilities and opportunities for growth. It’s important to stay active and pursue your hobbies to ensure that you make the most of this exciting phase. So, put on your adventure hat and get ready to explore!

One great way to maintain an active lifestyle during retirement is by engaging in physical activities that bring you joy. Whether it’s taking daily walks in nature, joining a senior fitness class, or trying out a new sport like golf or pickleball, staying physically active will not only keep you fit but also boost your mood and overall well-being.

Another way to keep yourself engaged is by pursuing hobbies that ignite your passion. Retirement gives you the freedom to dive into activities that you’ve always wanted to try but never had the time for. From painting and gardening to cooking and playing a musical instrument, there’s no limit to what you can explore. Hobbies not only provide a sense of purpose but also serve as a creative outlet for self-expression.

To help you visualize the myriad of options available, here’s a table showcasing some popular hobbies among retirees:

| Hobby | Description | Benefits |

|---|---|---|

| Gardening | Cultivating plants and flowers | Physical exercise, stress relief |

| Painting | Creating art on canvas | Enhances creativity, reduces anxiety |

| Photography | Capturing moments with a camera | Encourages exploration, preserves memories |

| Cooking | Preparing delicious meals | Nurtures creativity, brings people together |

| Dancing | Moving rhythmically | Improves flexibility, boosts confidence |

Frequently Asked Questions

How Can I Plan for Unexpected Expenses During Retirement?

Planning for unexpected expenses during retirement is essential. Start by creating an emergency fund to cover any unforeseen costs. Additionally, consider long-term care insurance to help protect your savings and ensure a seamless retirement journey.

What Steps Should I Take to Protect My Assets and Ensure They Are Passed on to My Loved Ones?

To protect your assets and ensure they go to your loved ones, start with estate planning. Craft a will, establish trusts, and consider gifting strategies. Preserve your legacy for generations to come!

Is It Possible to Retire Early Without Compromising My Financial Stability?

Want to retire early without jeopardizing your financial stability? Start by focusing on retirement savings and creating a solid early retirement plan. With careful planning and smart investments, you can enjoy your golden years stress-free!

How Can I Ensure That My Healthcare Needs Are Adequately Covered During Retirement?

Worried about healthcare coverage during retirement? Fear not! Picture your healthcare needs as a beautiful garden, and long term care as the diligent gardener. Explore Medicare options to ensure your blossoms are well-taken care of.

What Strategies Can I Employ to Minimize Taxes During Retirement?

Want to keep more money in your pocket during retirement? Maximize your income and create a diverse portfolio with these tax-minimizing strategies. It’s time to make those golden years gleam!

Conclusion

Congratulations, you savvy retirement planner! Your golden years are about to shine brighter than the sun itself.

With careful evaluation of your financial situation and setting clear retirement goals, you’ve laid a solid foundation for an exciting future. By creating a budget and maximizing your savings, you’ve built a fortress of financial security.

Exploring investment options has added a touch of magic to your portfolio, while developing a long-term care plan ensures peace of mind. With estate planning and asset protection as your trusty sidekicks, you’re ready to gracefully transition into retirement.

And don’t forget to keep that fulfilling and active lifestyle alive – it’s the secret ingredient that will make these years truly unforgettable! So go forth, my friend, and let the juxtaposition of freedom and responsibility guide you on this incredible journey ahead.

The world is waiting for you to spread your wings and soar into retirement bliss!